Best Utah Car Insurance (2025)

The top-rated car insurance companies in Utah include The Hartford and State Farm. Utah car insurance rates are $73 per month. Utah car insurance laws require 25/65/15 of bodily injury and property damage coverage, but the law allows a grace period of 2-30 days for new car owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

UPDATED: Mar 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Some of the best Utah auto insurance companies are The Hartford and State Farm

- Utah car insurance laws require all drivers to carry at least 25/65/15 of bodily injury and property damage

- Car insurance quotes in Utah start at $73 per month

| Utah Statistics Summary | Details |

|---|---|

| Annual Road Miles | Total in State: 46,153 Vehicle Miles Driven: 27,554 Million |

| Vehicles | Registered: 2,076,482 Total Stolen: 7,298 |

| State Population | 3,161,105 |

| Most Popular Vehicle | Ford F-150 |

| Percentage of Motorists Uninsured | 8.20% State Rank: 39th |

| Driving Deaths | 2008-2017 Speeding: 851 Drunk Driving: 468 |

| Average Premiums (Annual) | Liability: $497.53 Collision: $265.90 Comprehensive: $109.50 |

| Cheapest Provider | USAA and Geico |

Early Utahns moved around a lot, and that roaming spirit of freedom lives on along its highways and rugged terrain, where cars populate the roads. As part of your right to drive in Utah, you must buy car insurance, and the process isn’t always easy. Car insurance in Utah is required by law, but fortunately, there are a lot of car insurance companies in Utah to choose from.

The best Utah car insurance review is here to help. Along our journey, we’ll explore state-required minimum insurance, the cost of average car insurance in Utah, company rankings, and much more. You’ll find everything you need to help you compare car insurance rates in Utah and find the best car insurance coverage. If you’re ready to roll, we’ve reserved a spot in the front seat just for you.

But, before you learn more about the best auto insurance in Utah, you can enter your ZIP code for a FREE Utah car insurance quote.

Utah Car Insurance Coverage & Rates

Shopping for car insurance can be frustrating, especially with all the different companies and rates available, and a mountain of information at your fingertips. Just how do you find time to sort through the clutter?

You’ll find everything you need here. We’ve gathered everything you must know to find out if the state-required minimum insurance coverage will protect you, learn about additional liability, and other coverage options in one place.

Utah Minimum Car Insurance Coverage

Drivers in Utah must have car insurance; however, the state follows “no-fault” laws regarding damages and bodily injuries from an accident. That means that if you cause an accident that involves another driver, you’re not required to pay for property damage.

Your Personal Injury Protection (PIP) coverage will pay for any medical treatment and out-of-pocket losses covered under the policy up to coverage limits, regardless of who’s responsible. But you can’t get compensation for “pain and suffering” and other non-monetary damages from a crash.

You may file a claim for damage to, or total loss of, a vehicle against the driver responsible for an accident, without limits. You can also file a third-party insurance claim or lawsuit against the at-fault driver for “pain and suffering” and other non-economic losses if your injuries meet certain thresholds:

Read more: What is the difference between a first-party claim and a third-party claim?

- You must have sustained at least $3,000 worth of medical expenses due to the collision, OR

- You must have suffered a qualifying injury: dismemberment, permanent disfigurement, permanent impairment, or permanent disability

Liability insurance covers the costs of bodily injury and property damage. Below are Utah’s minimum liability requirements:

| Insurance Required | Coverages |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $65,000 per accident |

| Property Damage Liability Coverage | $15,000 minimum |

| Personal Injury Protection (PIP) Coverage | $3,000 minimum |

Here’s a further explanation of the coverages outlined above:

- 25,000 bodily injury liability coverage per person: to cover the costs of injuries to an individual from a collision you caused

- $65,000 bodily injury liability coverage per accident: to cover the total costs of bodily injuries to more than one individual from a collision you caused

- $15,000 property damage liability coverage: to cover property damage to other parties from a collision you caused

- $3,000 “no-fault”/Personal Injury Protection (PIP) coverage: to cover medical expenses and other losses you incurred from an accident, regardless of who is at fault

Despite the state requirements, these coverage amounts might not cover all of the costs from an accident. That’s why we suggest you buy coverage beyond the minimum required amounts.

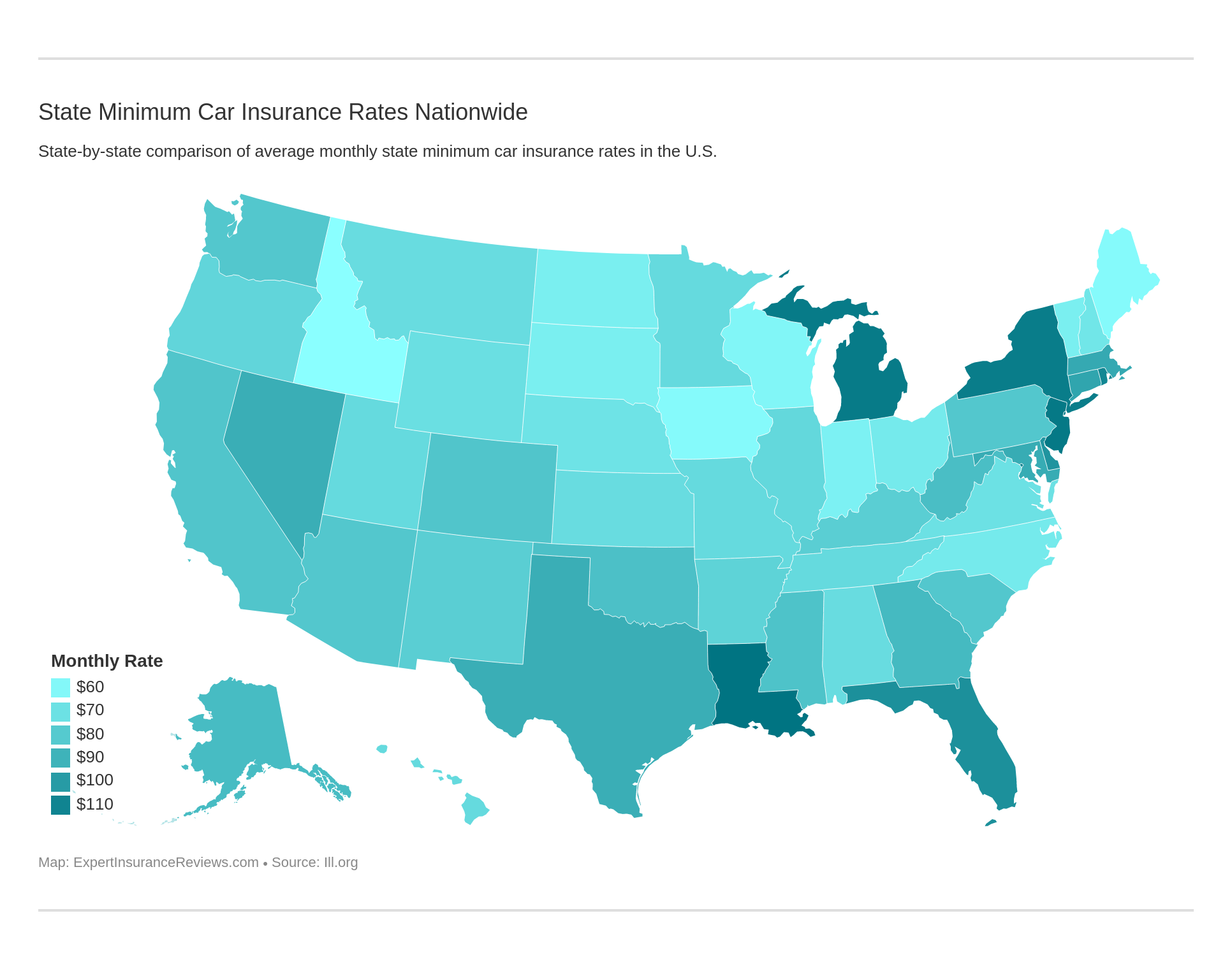

Minimum coverage costs vary from state to state.

Forms of Financial Responsibility

Minimum liability coverage under Utah car insurance laws serves as proof of insurance or evidence of your financial responsibility for damages from an accident. You must provide proof of insurance when a law enforcement officer requests it.

Acceptable forms of proof of insurance are:

- Valid liability insurance ID cards

- A copy of your current car’s insurance policy

- A valid insurance binder (a temporary form of car insurance)

- Electronic proof of insurance or a picture of your insurance card on your mobile device

The Utah State Legislature has enacted an insurance monitoring system to verify whether drivers are currently insured. If it shows a driver’s policy has lapsed, the Utah Division of Motor Vehicles will notify them that they have 15 days to provide proof of insurance.

Drivers who fail to provide proof of insurance must pay a $400 fine and a $50 surcharge for their first offense. They must pay $1,000 and a $50 surcharge for second and later offenses. A second offense could result in a license suspension.

Alternate forms of proof of insurance or financial responsibility in place of a car insurance policy include:

- A certificate of deposit confirming you’ve deposited $170,000 in cash with the Utah State Treasurer in the event you are responsible for a collision

- A surety bond for at least $80,000 provided by a licensed Utah surety company listing the Utah Department of Public Safety (DPS) as the legal creditor

- A certificate of self-funded coverage if you have more than 24 cars registered in your name and have deposited $200,000 and an additional $100 in an account for each car to be insured

As you can see, it’s vital to have a current car insurance policy or proof of financial responsibility to avoid fines and penalties. Don’t leave home without it.

Premiums as a Percentage of Income

In 2014, Utah’s average per capita disposable income (DPI), or earnings after taxes, was $33,566. That means that Utahns have about $2,700 to spend on groceries, living expenses, and insurance every month.

On average, in 2014, a full coverage car insurance policy in Utah cost each driver $852.66 yearly, or 2.54 percent of their income. However, nationwide, Americans had an average DPI of $40,859 and spent $981.77 annually for full coverage car insurance.

The table below details the data regarding Utahns’ incomes and how much they paid for car insurance from 2012 – 2014:

| Year | Full Coverage | Disposable Income | Insurance as Percentage of Income |

|---|---|---|---|

| 2012 | $805.32 | $31,991.00 | 2.52% |

| 2013 | $820.92 | $32,176.00 | 2.55% |

| 2014 | $852.66 | $33,566.00 | 2.54% |

During those three years, Utah residents saw an average income increase of about $1,500, while insurance rates rose nearly $50.

Neighboring states Colorado and Idaho showed disparities in their DPI and insurance costs from 2012 – 2014. Coloradans had a higher DPI of $43,609, and drivers there paid an average of $939.52 yearly for car insurance. Idahoans, on the other hand, had a much lower per capita income of $33,600 and paid an average of $673.13 yearly for car insurance.

Want to find out how much of your income goes to car insurance? Try our free tool below.

CalculatorPro

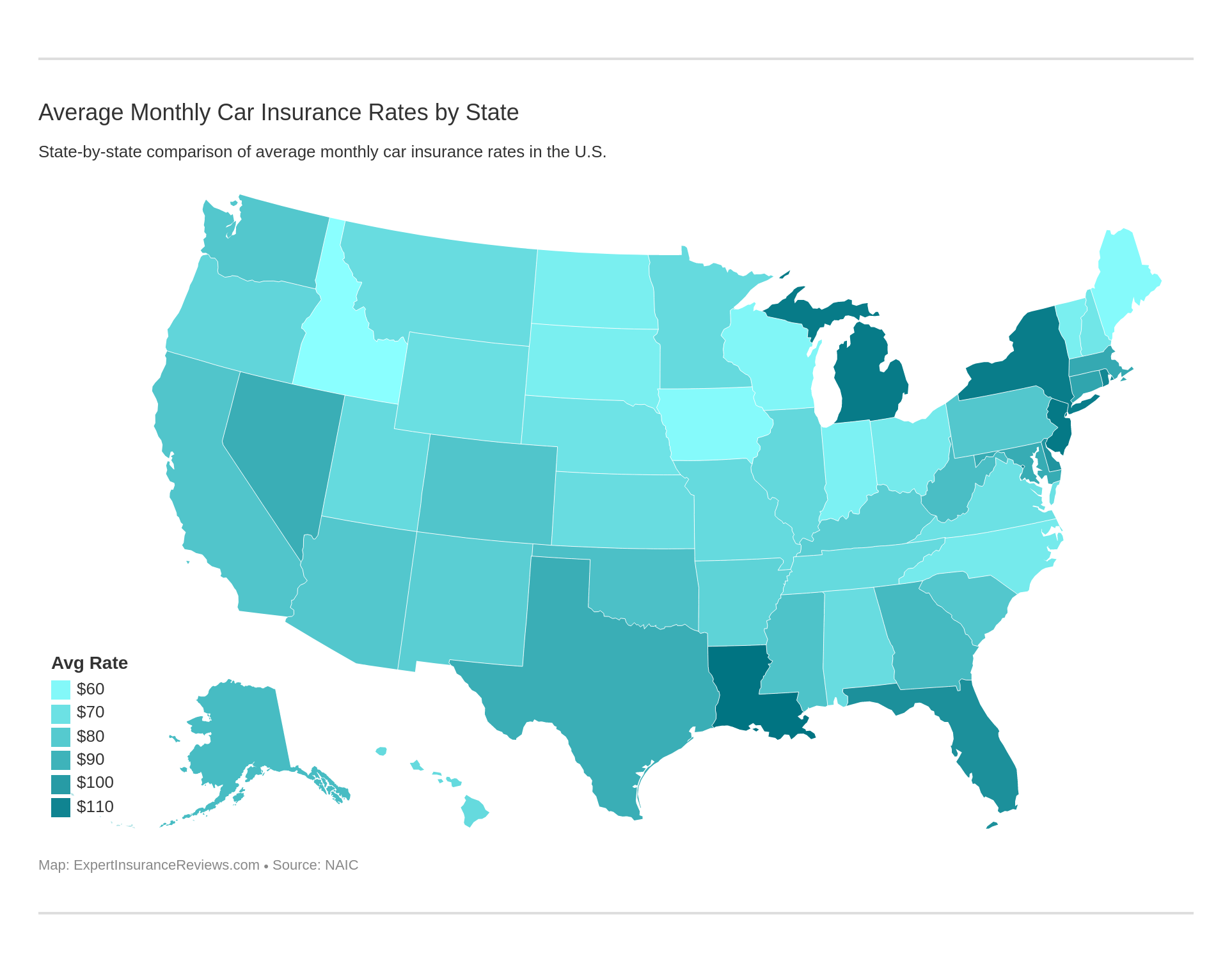

What is the average cost of auto insurance in Utah?

Three different types of car insuranc coverage make up full or core coverage: liability, collision, and comprehensive. The below data from the National Association of Insurance Commissioners (NAIC) shows the average rates for core coverage in Utah and across the U.S..

| Coverage Type | Annual Cost (2015) |

|---|---|

| Liability | $497.53 |

| Collision | $265.90 |

| Comprehensive | $109.50 |

| Combined | $872.93 |

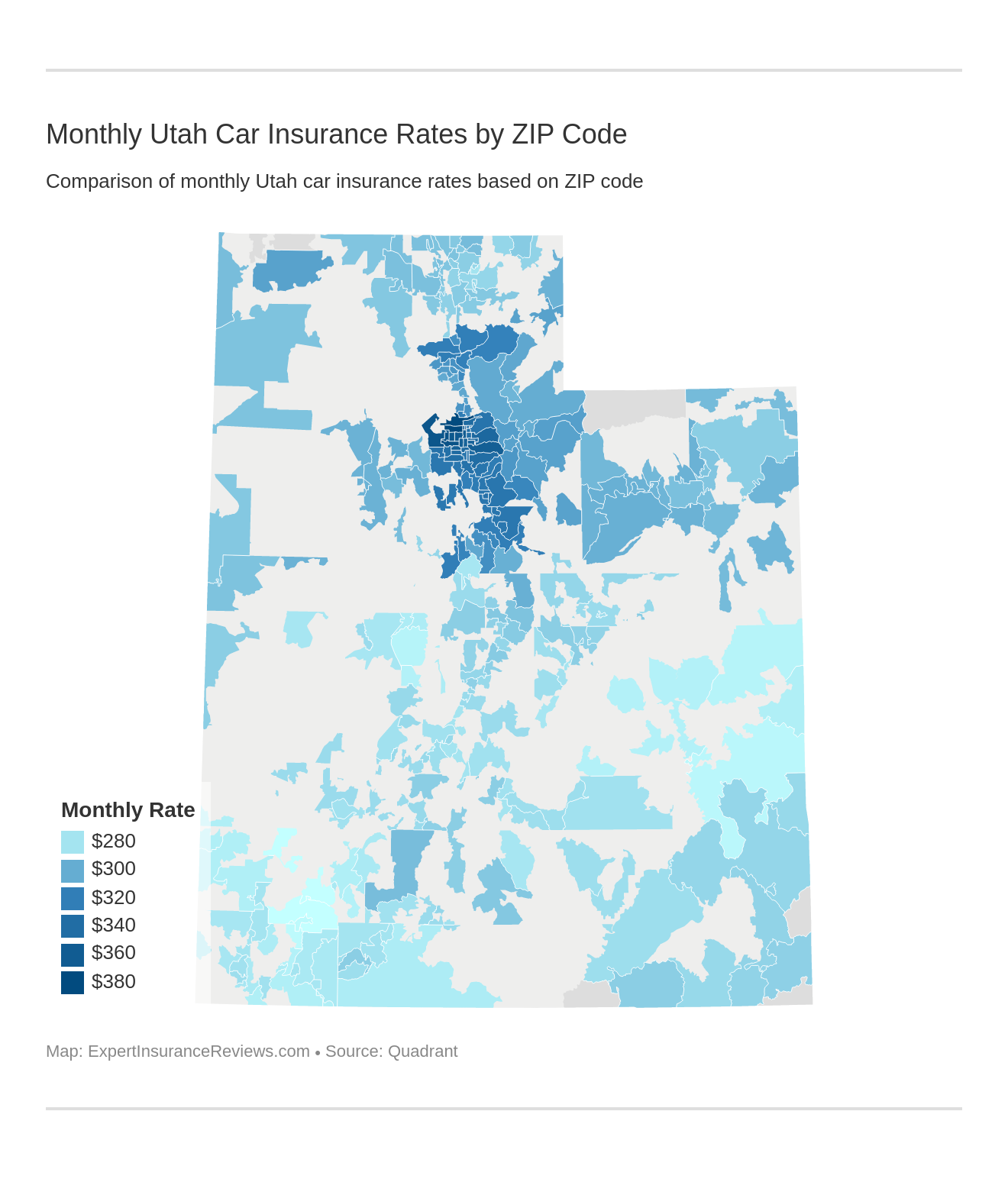

Let’s take a closer look at Utah and see what the average rates by ZIP code.

As one might expect, rates go up as you get closer to big cities like Salt Lake City and Ogden. This is simply due to the fact that driving in the city poses more hazards, such as accidents and theft.

Expect rates to continue to rise in 2019 and beyond.

We recommend you buy more than the state-required minimum coverage, which may be more affordable than you think. We’ll cover the cost differences among different carriers later.

For now, let’s go over more liability coverage you can add to a policy.

Additional Liability

Additional liability will cover expenses beyond a standard policy. It includes the following:

- Personal injury protection – It helps cover medical expenses for anyone involved in an accident, regardless of who is at fault.

- Medical payments (MedPay) coverage – It pays for medical expenses for you and anyone else listed on your policy, regardless of who is responsible.

- Uninsured/underinsured motorist coverage – It pays if you’re in an accident with an uninsured or underinsured driver.

The below data from NAIC shows the average insurer’s loss ratio in Utah. A company’s loss ratio reveals how much it earns compared to the premiums it writes. A loss ratio higher than 100 percent means the company pays more in premiums and is taking losses on them. If it’s well below 100 percent, the company pays few claims.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 74.22 | 69.28 | 68.56 |

| Medical Payments (MedPay) | 110.60 | 99.16 | 120.63 |

| Uninsured/Underinsured Motorist Coverage | 86.69 | 76.45 | 73.65 |

The loss ratios above show that for PIP and uninsured/underinsured motorist coverage, the best car insurance companies in Utah have a good profit versus loss ratio. But, for MedPay claims, the companies have lost revenue.

It’s wise to buy these optional coverages. Do you know why?

Eight percent of Utah drivers aren’t insured, which ranks the state 39th in the U.S. for uninsured drivers.

With so many uninsured drivers on the road, unfortunately, you never know what can happen. To protect yourself, your loved ones, and those around you, we recommend you buy uninsured/underinsured motorist and additional liability coverage.

Add-Ons, Endorsements, & Riders

The following are more types of coverage you can add to a basic car insurance policy in Utah:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Car Insurance

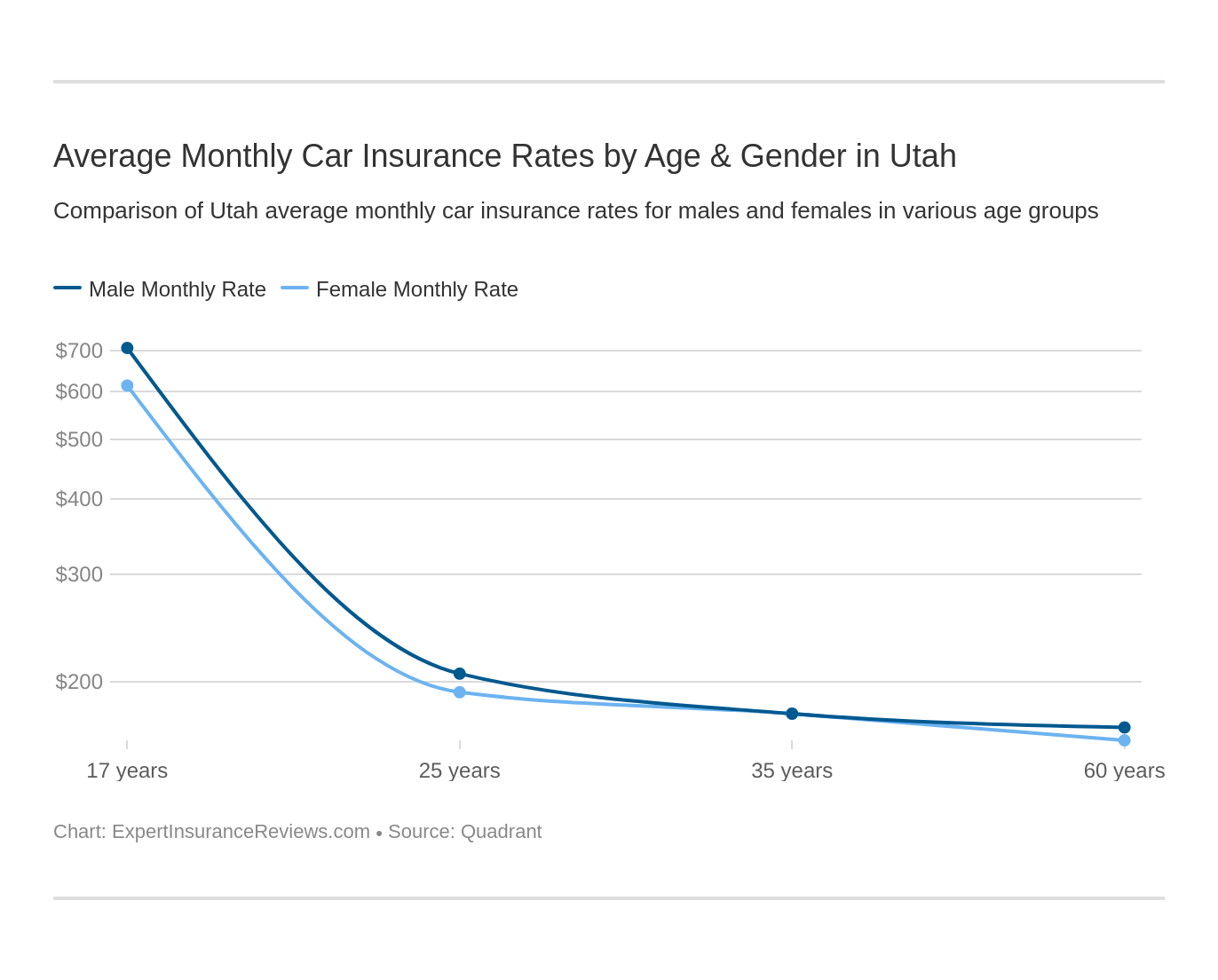

Average Car Insurance Costs in Utah by Age & Gender

We’ve partnered with Quadrant to bring you the following data. It’s based on coverage the state population has purchased and includes rates for high-risk drivers and those who choose to buy more than the state minimum. It also includes other types of insurance the state doesn’t require.

Gender and age affect your car insurance rates in Utah. Let’s see how much it amounts to among the different carriers:

| Company | Married 35-Year Old Female Annual Rates | Married 35-Year Old Male Annual Rates | Married 60-Year Old Female Annual Rates | Married 60-Year Old Male Annual Rates | Single 17-Year Old Female Annual Rates | Single 17-Year Old Male Annual Rates | Single 25-Year Old Female Annual Rates | Single 25-Year Old Male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,291.16 | $2,124.28 | $2,080.31 | $2,080.58 | $7,131.66 | $7,968.85 | $2,433.88 | $2,420.66 |

| American Family Mutual | $2,061.52 | $2,061.52 | $1,895.69 | $1,895.69 | $7,447.08 | $9,734.69 | $2,061.52 | $2,432.42 |

| Mid-Century Ins Co | $2,122.25 | $2,096.76 | $1,874.89 | $1,996.87 | $9,007.70 | $9,276.70 | $2,403.87 | $2,484.88 |

| Geico Cas | $1,913.89 | $2,132.40 | $2,102.55 | $2,444.23 | $5,712.14 | $6,093.85 | $1,659.40 | $1,666.10 |

| SAFECO Ins Co of IL | $2,424.16 | $2,609.54 | $2,009.88 | $2,240.08 | $9,510.32 | $10,560.25 | $2,555.09 | $2,712.73 |

| Depositors Insurance | $1,925.73 | $1,948.00 | $1,721.22 | $1,812.40 | $5,226.02 | $6,649.99 | $2,224.59 | $2,384.61 |

| Progressive Classic | $2,097.59 | $1,950.05 | $1,716.07 | $1,829.17 | $8,562.83 | $9,521.67 | $2,421.45 | $2,541.96 |

| State Farm Mutual Auto | $2,831.94 | $2,831.94 | $2,574.96 | $2,574.96 | $8,675.15 | $10,787.39 | $3,211.87 | $3,678.46 |

| USAA CIC | $1,429.68 | $1,404.80 | $1,283.35 | $1,282.42 | $5,021.49 | $5,867.34 | $1,738.92 | $1,900.76 |

The cost differences in Utah between the sexes, whether they’re married or single, often add up to less than $500.

Regarding age, it’s not too surprising that the youngest, least experienced drivers — those age 17 — pay as much as $5,000 – 6,000 more than their older counterparts. By age 25, for both genders, rates decrease significantly and continue to decline through age 60.

Best Utah Car Insurance Companies

Lots of companies offer car insurance. It can be hard to find the one that provides the coverage you need.

This section is here to save you from that struggle. We’ve gathered the most crucial information you need, including the financial strength of the top carriers, reviews, and even some complaints, to help you make an informed decision.

Are you ready to learn more? Let’s get started.

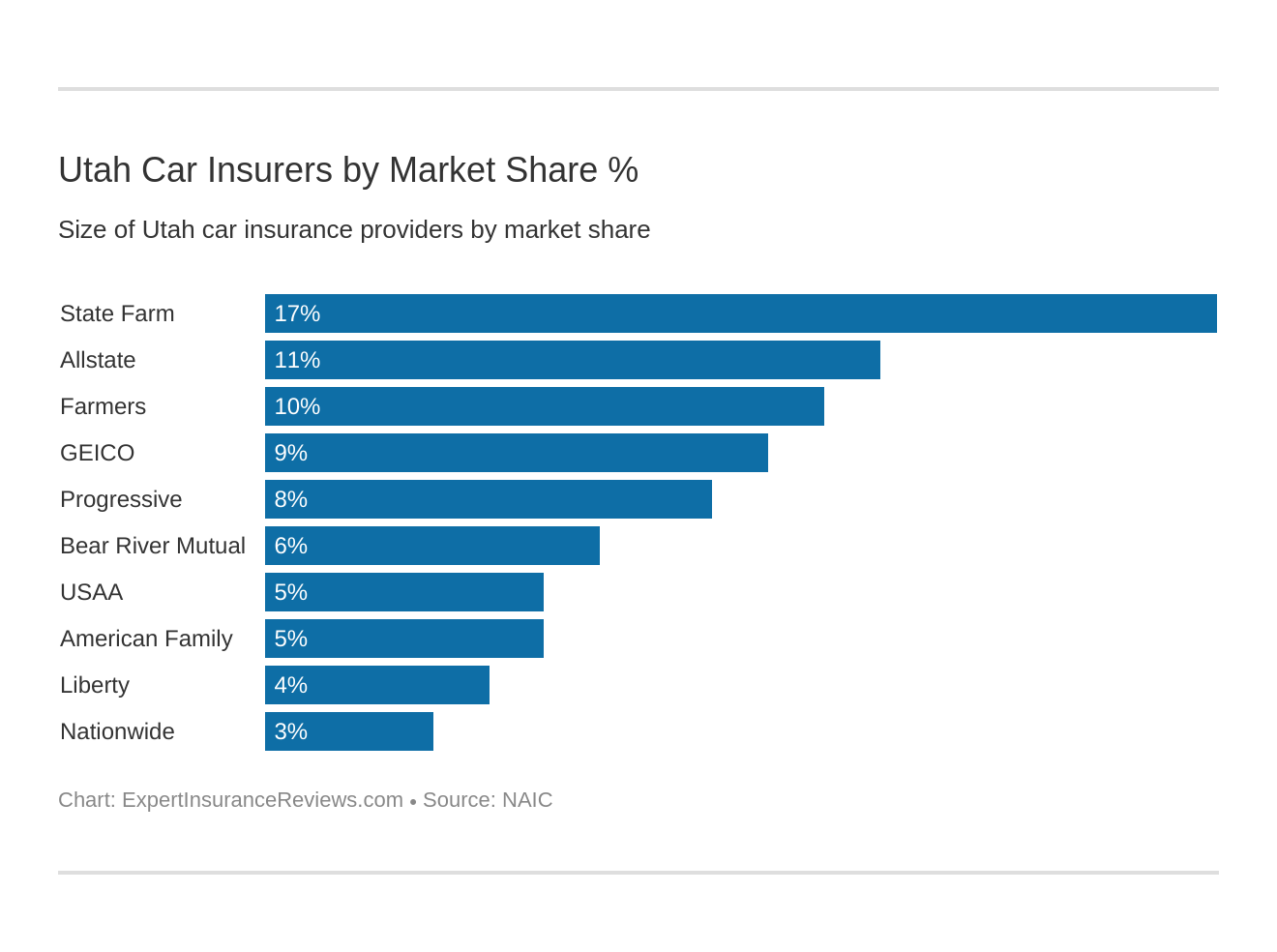

The Largest Companies’ Financial Rating

A.M. Best evaluates insurance companies and ranks them based on their financial stability.

Larger companies are generally more financially stable, which makes sense considering they’re more capable of paying out claims.

Companies with a good score are more likely to be able to pay customers’ claims. These are A.M. Best’s ratings for the ten largest insurers in Utah.

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $323,026 | 64.11% | 16.71% |

| Allstate Insurance Group | A+ | $217,324 | 57.30% | 11.24% |

| Farmers Insurance Group | NR | $183,973 | 54.43% | 9.52% |

| Geico | A++ | $169,933 | 77.67% | 8.79% |

| Progressive Group | A+ | $160,684 | 65.16% | 8.31% |

| Bear River Mutual Insurance Co | A- | $117,031 | 81.12% | 6.05% |

| USAA Group | A++ | $91,547 | 73.34% | 4.74% |

| American Family Insurance Group | A | $87,583 | 82.77% | 4.53% |

| Liberty Mutual Group | A | $86,034 | 66.67% | 4.45% |

| Nationwide Corp Group | A+ | $52,126 | 70.19% | 2.70% |

The State Farm group, United Services Automobile Association (USAA), and Geico have a solid lock on their “A++” status. They’re financially stable over the long-term, with a high amount of claims written and decent loss ratios and market share.

Companies with Best Ratings

J.D. Power’s Auto Insurance Study rates the best insurance companies based on their overall customer satisfaction. These are their rankings for insurers in the Southwest Region based on a 1,000-point scale.

| Insurer | Points | Power Circles |

|---|---|---|

| The Hartford | 832 | five |

| State Farm | 831 | five |

| Allstate | 826 | three |

| American Family | 826 | three |

| Southwest Average | 823 | three |

| Safeco | 821 | three |

| CSAA Insurance Group | 818 | three |

| GEICO | 818 | three |

| Liberty Mutual | 813 | three |

| Farmers | 812 | three |

| Progressive | 807 | two |

| Travelers | 789 | two |

| Nationwide | 775 | two |

| USAA* | 887 | five |

“Power Circle” legend:

- five = among the best

- four = better than most

- three = above average

- two = the rest

The Hartford and State Farm topped J.D. Power’s survey through earning five “Power Circles” that show they’re “among the best” insurers in the region.

*USAA is an insurance provider open only to U.S. military and their families, and therefore, J.D. Power didn’t include it in their rankings.

Companies with Most Complaints in Utah

Based on NAIC data, let’s see how well the top insurers handle negative responses to their service in the Beehive State.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| State Farm Group | 1 | 0.44 | 1482 |

| Allstate Insurance Group | 1 | 0.5 | 163 |

| Farmers Insurance Group | 1 | 0 | 0 |

| Geico | N/A | 0.007 | 6 |

| Progressive Group | 1 | 0.75 | 120 |

| Bear River Mutual Insurance Co | 1 | 0 | 0 |

| USAA Group | N/A | 0 | 2 |

| American Family Insurance Group | 1 | 0.79 | 73 |

| Liberty Mutual Group | 1 | 5.95 | 222 |

| Nationwide Corp Group | 1 | 0.28 | 25 |

At one time or another, every company is bound to get a complaint, but if there’s a pattern, it’s a sign of something serious. When you consider the information above, also take into account each company’s market share in Utah.

For instance, Liberty Mutual’s complaint ratio is nearly six times the national average of “one,” yet it makes up less than 5 percent of the market in Utah.

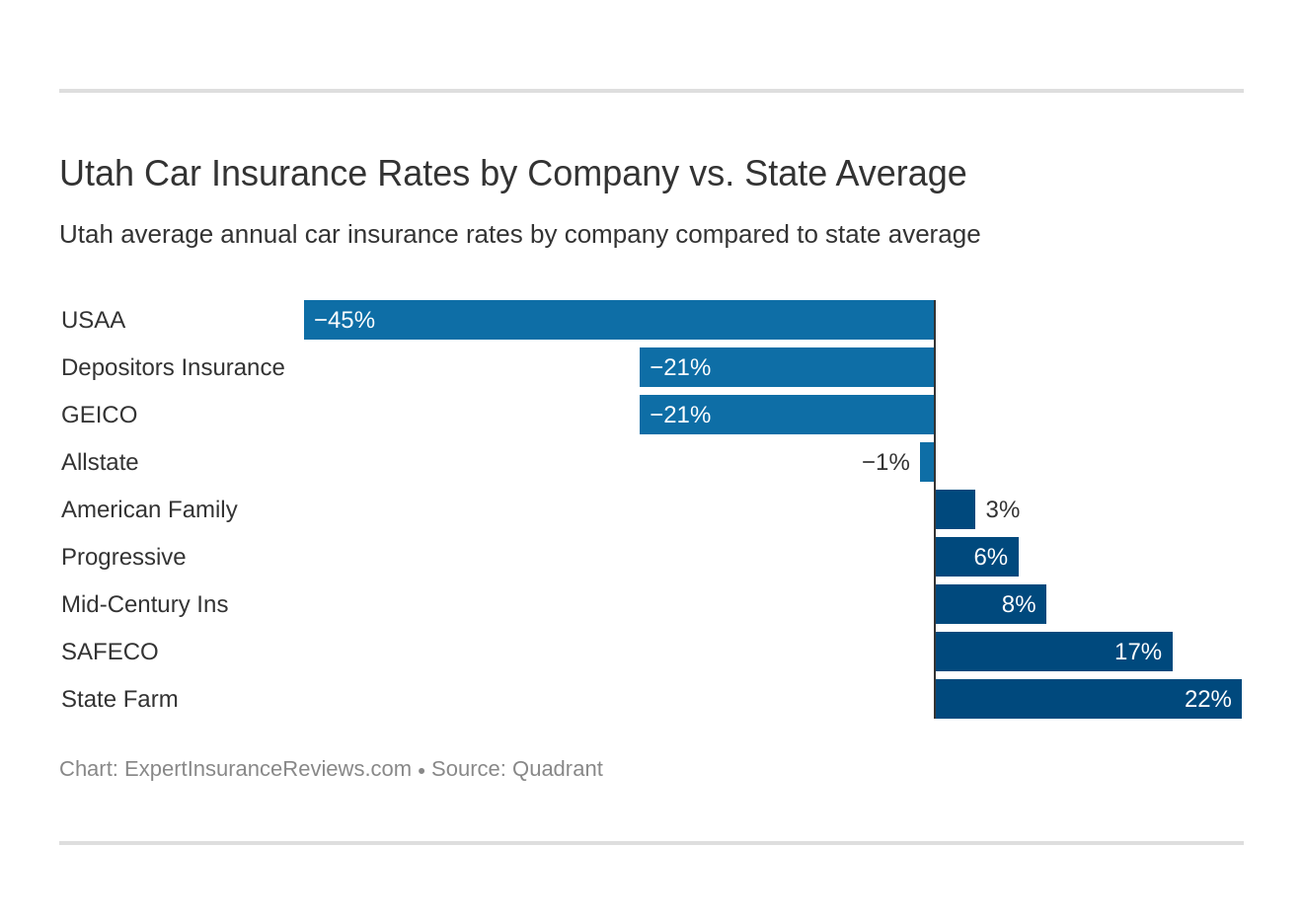

Cheapest Companies in Utah

Now we’re going to explore which carriers, on average, offer cheap car insurance in Utah.

| Company | Average Annual Rates | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate F&C | $3,566.42 | -$35.81 | -1.00% |

| American Family Mutual | $3,698.77 | $96.53 | 2.61% |

| Mid-Century Ins Co | $3,907.99 | $305.76 | 7.82% |

| Geico Cas | $2,965.57 | -$636.66 | -21.47% |

| SAFECO Ins Co of IL | $4,327.76 | $725.52 | 16.76% |

| Depositors Insurance | $2,986.57 | -$615.66 | -20.61% |

| Progressive Classic | $3,830.10 | $227.87 | 5.95% |

| State Farm Mutual Auto | $4,645.83 | $1,043.60 | 22.46% |

| USAA CIC | $2,491.10 | -$1,111.14 | -44.60% |

Compared to the average annual cost of a full coverage car insurance policy in Utah ($3,602.23), USAA, The Government Employees Insurance Company (Geico) and Depositors have the lowest rates. Read more about GEICO in our GEICO insurance review & complaints.

Commute Rates by Companies

How far you drive regularly also factors into your car insurance rates. Here’s how the top carriers in Utah compare for average commute distances.

| Group | 10 miles commute, 6000 annual mileage | 25 miles commute, 12000 annual mileage |

|---|---|---|

| Allstate | $3,566.42 | $3,566.42 |

| American Family | $3,696.47 | $3,701.06 |

| Farmers | $3,907.99 | $3,907.99 |

| Geico | $2,915.00 | $3,016.15 |

| Liberty Mutual | $4,257.17 | $4,398.34 |

| Nationwide | $2,986.57 | $2,986.57 |

| Progressive | $3,830.10 | $3,830.10 |

| State Farm | $4,527.85 | $4,763.81 |

| USAA | $2,463.59 | $2,518.60 |

Not every insurer factors distance into their rates. As shown, Allstate, Nationwide, Farmers, and Progressive don’t change their prices for 10- versus 25-mile commutes. Among those who do, Geico had the lowest price increase of $101.15 between the different mileages.

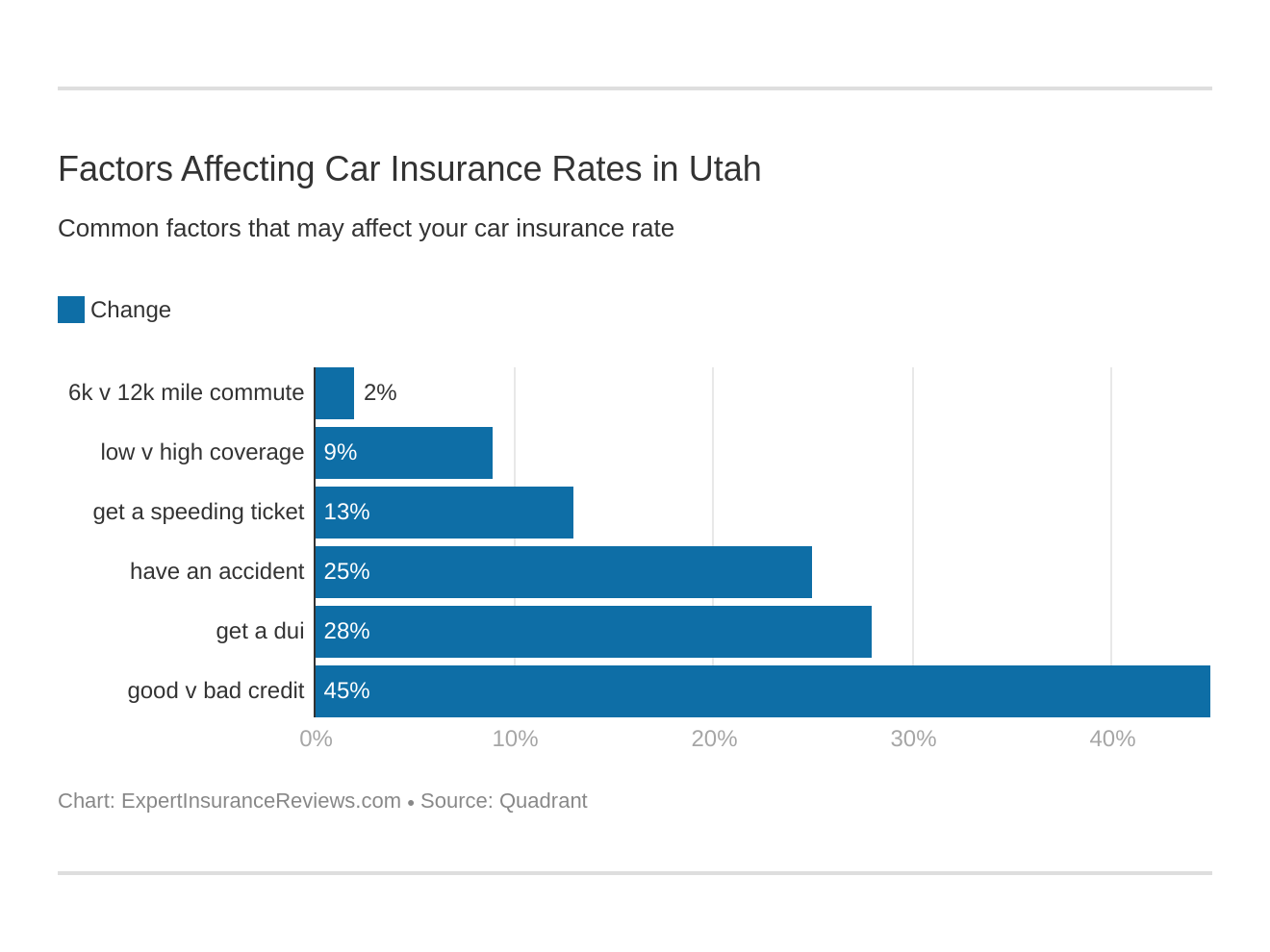

Commute distance is not the only factor that affects your rates. Take a look!

Coverage Level Rates by Companies

How much insurance you buy also affects how much you pay for coverage. Let’s see how much is car insurance in Utah with each insurance level. Generally, the highest level is full coverage.

| Group | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $3,404.92 | $3,559.01 | $3,735.35 |

| American Family | $3,596.17 | $3,747.39 | $3,752.75 |

| Farmers | $3,573.93 | $3,852.63 | $4,297.41 |

| Geico | $2,754.34 | $2,953.94 | $3,188.43 |

| Liberty Mutual | $4,110.94 | $4,310.56 | $4,561.77 |

| Nationwide | $3,272.27 | $2,837.83 | $2,849.61 |

| Progressive | $3,509.42 | $3,697.49 | $4,283.39 |

| State Farm | $4,356.81 | $4,658.86 | $4,921.83 |

| USAA | $2,381.51 | $2,492.87 | $2,598.91 |

Among the top insurers listed, only Nationwide offers drivers a discount if they buy high coverage versus low coverage. Drivers who buy full coverage pay an average of $2,849.61 yearly with them versus $3,272.27 for the lowest coverage. Read Nationwide insurance review & complaints to learn more.

Credit History Rates by Companies

Your credit score is another major influence on car insurance costs. Let’s see how much rates can change with poor, fair, or good credit.

| Group | Annual Rates with Poor Credit | Annual Rates with Fair Credit | Annual Rates with Good Credit |

|---|---|---|---|

| Allstate | $4,771.61 | $3,199.61 | $2,728.04 |

| American Family | $4,648.73 | $3,486.39 | $2,961.19 |

| Farmers | $4,470.84 | $3,719.82 | $3,533.31 |

| Geico | $4,519.94 | $2,503.04 | $1,873.73 |

| Liberty Mutual | $6,171.64 | $3,807.29 | $3,004.33 |

| Nationwide | $3,696.25 | $2,796.09 | $2,467.37 |

| Progressive | $4,330.83 | $3,709.85 | $3,449.62 |

| State Farm | $7,561.42 | $3,805.27 | $2,570.80 |

| USAA | $3,572.35 | $2,276.89 | $1,624.05 |

Experian reports that the average credit score in Utah in 2017 was 683. The average Utahns’ credit score was about eight points higher than the national average score of 675.

Among the insurers listed, State Farm emphasizes credit scores the most in its rates. The insurer charged the highest price difference for drivers with poor to good credit scores, which averaged $5,000. Check out our State Farm insurance review to learn more.

Driving Record Rates by Companies

Even one violation on your driving record can raise your insurance rates by thousands of dollars. Here’s how they can change with some common driving penalties.

| Group | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,010.26 | $3,393.73 | $3,629.16 | $4,232.55 |

| American Family | $3,050.91 | $3,429.99 | $3,808.97 | $4,505.19 |

| Farmers | $3,324.89 | $3,779.88 | $4,326.75 | $4,200.44 |

| Geico | $2,146.67 | $2,493.28 | $3,340.13 | $3,882.19 |

| Liberty Mutual | $3,390.93 | $4,262.72 | $4,650.33 | $5,007.04 |

| Nationwide | $2,369.61 | $2,644.32 | $3,191.57 | $3,740.78 |

| Progressive | $3,241.33 | $3,793.05 | $4,895.50 | $3,390.52 |

| State Farm | $4,222.84 | $4,645.83 | $5,068.82 | $4,645.83 |

| USAA | $1,957.81 | $2,193.89 | $2,476.70 | $3,335.98 |

For one speeding ticket, USAA increased rates the least, by only $200. But with the same insurer, one accident can raise your rates by $500, and a DUI can increase them by $1,400. For more information about USAA, check out USAA insurance review & complaints.

Number of Insurers by State

Foreign companies were formed in other states but are licensed to operate in Utah, while domestic insurers were incorporated in the Beehive State.

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 9 | 878 | 887 |

As shown, out of 887 total licensed insurers, only nine of them were founded in Utah.

Next, let’s look at some of the driving and insurance laws in the state.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Utah Laws

With all of the laws that have been enacted, you may be confused about the ones that apply to driving and insurance. Don’t worry — there’s no need to feel overwhelmed.

To simplify things, we’ll cover only the most important ones that can affect your driving life. That includes car insurance laws, license renewal procedures, teen driving laws, penalties for driving without insurance, and more.

Keep reading to learn more about them.

Utah Car Insurance Laws

Before we get into the “nitty-gritty” of car insurance laws, we’ll cover how Utah determines them.

Read more: Utah Car Insurance Laws

How State Laws for Insurance are Determined

Each state determines the type of tort law and threshold (if any) that applies, the type and amount of liability insurance to require, and the system they use to approve insurer rates and forms.

Insurance companies in Utah must meet the regulations the state insurance commissioner sets per the fair competition standards of the National Association of Insurance Commissioners (NAIC).

To set rates and file forms, insurers in the Beehive State must follow the Utah Department of Administrative Service’s “use and file” system. It requires insurers to make their rate filings within 30 days.

The state insurance commissioner has 90 days after submission to approve or disapprove them. They may also specify that insurers file rates 30 days before they become effective.

Windshield Coverage

According to CarWindshields.Info, Utah lets insurers use “aftermarket crash parts” (“nonmechanical sheet metal or plastic parts”) for repairs, and they must disclose when they do so.

Consumers also have the right to choose the repair vendor, but they may have to pay for any price differences themselves.

You might be able to get a zero-deductible with windshield coverage under a comprehensive car insurance policy. Not every carrier offers this coverage, but you may be able to find the right policy for you. While you research plans, look at how the different insurance providers handle windshield claims.

High-Risk Insurance

High-risk insurance helps drivers with a history of accidents or traffic violations and can’t buy coverage through a standard insurance carrier.

To help “high-risk” drivers, the Utah Automobile Insurance Plan (UT AIP) offers them coverage, but they must meet the following requirements to qualify:

- Submit an application stating that they have tried to get insurance through the voluntary insurance market during the past 60 days

- Provide a valid driver’s license

- Have a vehicle registered in Utah

This state-administered program lets insurance companies share the risk associated with your policy among a pool of other insurers. You may, however, end up paying more for insurance compared to standard premiums.

Companies in the plan can decide whether to insure a driver. When the cost of premiums isn’t government-mandated, it’s usually based on an insurance actuary’s statistical data calculations regarding risk factors that can affect the cost of future claims.

Drivers in the UT AIP plan have different payment options. They can choose to deposit 40 percent of their annual premiums when they send their applications and pay the remaining 60 percent within 30 days of when their policy was issued.

Low-Cost Insurance

Though Utah has a program to help high-risk drivers, it doesn’t have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

Automobile Insurance Fraud in Utah

Insurance fraud is the second-largest economic crime in America. It affects premium rates and the prices consumers pay for goods and services. If those fraud numbers continue to rise, it’s more likely insurers will pass some of the costs in investigating them on to you in higher premiums.

There are two types of fraud: hard and soft.

- Hard Fraud – A purposefully fabricated claim or accident

- Soft Fraud – A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurers about one of the following:

- The number of annual miles driven

- The number of drivers in the household

- How they will use the vehicle

Even the little white lie you tell to get a lower rate has consequences. That intentional misrepresentation of facts is known as “rate evasion” and costs auto insurers $16 billion annually according to the Insurance Information Institute. They pass those costs onto consumers in the form of higher premiums.

Auto insurance fraud is a crime in Utah and includes the following penalties:

- A Class B misdemeanor if the sought or secured benefits amount to less than $500 total

- A Class A misdemeanor with penalties including up to one year’s imprisonment and fines up to $2,500 if the secured or sought benefits are over $500, but under $1,500

- A third-degree felony with penalties including up to five year’s imprisonment and fines up to $5,000 if the secured or sought benefit is $1,500 or above, but under $5,000

- A second-degree felony with penalties including up to 15 years’ imprisonment and fines up to $10,000 if the secured or sought benefit is $5,000 or above

In 2018, the Utah Insurance Department Insurance Fraud Division filed criminal charges against 88 defendants who were involved in more than 92 insurance fraud incidents. They filed a total of 131 charges. In many cases, they charged the perpetrators with multiple counts based on their criminal actions.

To report fraud to the Division, you may call (844) 373-0233 or (801) 468-0233, fax (801) 468-0003, or email Director Armand Glick at aglick@utah.gov. You can also complete an online form.

Statute of Limitations

The statute of limitations is the time you have left to file a legal claim. In Utah, drivers have four years from the time of an accident to file a lawsuit for personal injury and three years for property damage claims.

Evidence can degrade, and witnesses can be hard to keep track of over time, so it’s best to file sooner rather than later.

State-Specific Laws

According to AAA, when Utah drivers approach a railroad crossing, they must stop within 50 feet, but no less than 15 feet from the nearest rail. They must also stop in the following situations:

- when a clearly visible electric or mechanical signal device warns a train is coming

- when a crossing gate is lowered, or a human flagman signals that a train is approaching

- when a railroad train approaching within about 1,500 feet of the highway crossing emits a signal audible from that distance and the train because of its speed or nearness to the crossing is an immediate hazard

- when an approaching train is plainly visible and is in hazardous proximity to the crossing

- when any other condition makes it unsafe to continue through the crossing

- at a railroad grade crossing gate or barrier that is closed or is being opened or closed

- when warning lights are flashing

- when audible warning devices are sounded

- when any other traffic control devices signal a train is coming

Remember to slow down around railroad crossings to stay safe.

As this news report reveals, drivers and pedestrians have been ignoring these warning signs in Utah:

Vehicle Licensing Laws

Here, we’ll go over Beehive State laws for getting and renewing a driver’s license and Utah’s “points” system for penalties.

REAL ID

Utah is among the states that comply with the federal REAL ID program of verified identity protection for driver’s licenses and state IDs.

The proposed federal program slated to go into effect on Oct. 1, 2020, lets REAL ID holders enter federal buildings and board domestic flights. The program stems from national security measures and federal identification standards adopted after the Sept. 11, 2001, terrorist attacks in the U.S.

To get a REAL ID–compliant license, visit your local Driver License Division office and bring the following documents:

- Proof of your social security number, such as your social security card, W-2, or paystub with full SSN. Original or certified copies only.

- Proof of identity, such as an original or certified copy of a U.S. birth certificate, U.S. passport, employment authorization, permanent resident card, or unexpired foreign passport with valid U.S. visa and approved I-94 form.

- Proof of any name changes (if applicable), such as a marriage or divorce court order

- Proof of residency from within the past 90 days, if your address has changed, such as a utility bill, rental agreement, mortgage, or medical document. Photocopies accepted.

- For a first Utah driver’s license, proof of driving experience, such as a driver training course certificate or driving privilege issued in another state or country.

Once you have your first REAL ID–compliant license, if you’re eligible, you may renew it online.

This Utah Department of Public Safety video explains more about the ID program:

Penalties for Driving Without Insurance

As we mentioned earlier, you must carry an acceptable form of proof of insurance in case of a car accident or whenever law enforcement pulls you over.

According to the Utah Division of Motor Vehicles (DMV), drivers who aren’t insured face the following penalties:

| Penalities for Driving Without Insurance in Utah | Details |

|---|---|

| First Offense | - Fine: $400 - license suspension until proof of insurance (maintained for three years) - $100 reinstatement fee |

| Second Offense | - Fine: $1000 - three years; license suspension until proof of insurance (maintained for three years) - $100 reinstatement fee |

You must provide proof of insurance any time you are pulled over, register a car, or are in an accident. Law enforcement can also check your car insurance status electronically.

If you’re caught driving without insurance during a traffic stop, the DMV will suspend your license until you can provide proof of insurance. If you’re convicted for driving without insurance after an auto accident, the DMV will suspend your license for one year.

You also must maintain an SR-22 proof of financial responsibility for three years. To have your license reinstated, you will need to satisfy all fines and pay the reinstatement fee.

Teen Driver Laws

Teen drivers in Utah may apply for a driving permit at age 15. Drivers younger than age 19 must enroll in driver’s education. Per the Insurance Institute for Highway Safety (IIHS), below are the state requirements for getting a license.

| Requirements for Getting a License in Utah | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 40 hours, 10 of which must be at night |

| Minimum Age | 16 years old |

According to the IIHS, permit holders younger than 18 may only drive under the supervision of a driving instructor, a parent or guardian, or a responsible adult who has accepted liability for the permit holder’s driving.

Supervised driving in the learner stage may include up to five hours in a driving simulator.

These are the limits for drivers with restricted licenses:

| Requirements for Getting a License in Utah | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 40 hours, 10 of which must be at night |

| Minimum Age | 16 years old |

Next, we’ll cover license renewal procedures for everyone.

Driver License Renewal Procedures

According to the Insurance Institute for Highway Safety, these are Utah’s license renewal procedures for older drivers and the general public:

- Renewal Cycle: every five years; effective January 1, 2020, every eight years

- Proof of Adequate Vision: required at every renewal for those 65-years and older; for the general population, only for those who renew in-person

- Mail/Online Renewal: online permitted at every other renewal

Now, we’ll go over the licensing requirements for New Utah residents.

Read More: What is the process for renewing my car insurance policy?

New Residents

New residents should visit their local driver’s license office or schedule an appointment there to apply for a Utah license.

As part of the process, applicants will have their pictures taken. They will also need to pay a nonrefundable fee of $32 if they’re 21 and older or $39 for a provisional license (age 20 and younger). They must pass a vision test and a written knowledge test, and possibly also a driving skills test.

They must also bring the following documents with them to the DMV:

- Proof of a valid driver’s license from another state or country or of driver education to avoid having to carry a learner’s permit for 90 days and complete the online Traffic Safety and Trends Exam.

- Proof of identity (name and date of birth)

- Proof of Social Security number

- Two proofs of Utah residency, such as a utility bill or a rental or mortgage agreement

If the name on your driver’s license or identity card is different than the one on your identity document (birth certificate, passport, etc.), you must also bring legal documentation authorizing the name change. These include a certified state marriage certificate, divorce decree, adoption, citizenship, guardianship, or court documents that show the name change. (For more information, read our “Life Insurance and Adoption: What to Know“).

New residents who meet all of these requirements will get a temporary driver’s license the same day and will receive a completed license in the mail in about eight to 10 weeks.

Negligent Operator Treatment System (NOTS)

The Utah Driver’s License Division assigns points for driving offenses, which can ultimately lead to a driver’s license suspension or revocation. These are some of the points the state assigns for common driving offenses:

- Reckless driving: 80

- Careless driving: 50

- Speeding:

-

- 1-10 (over 35 mph)

- 11-20 (over 55 mph)

- 21 (over 75 mph)

- Failing to stop at a red light: 50

- Negligent collision: 50

- Texting while driving: 50

- Other moving violations: 40

Points may vary plus or minus 10 percent, depending upon the severity of the record. The Utah Driver’s Licensing Division (DLD) requires mandatory suspension or revocation for certain serious violations, such as drunk driving, and they don’t include them in the point system.

Under the provision points system, a driver under 21 years of age who accumulates 70 or more points in three years, may have their license suspended or denied for one month to a year, depending upon the severity of the offense. In the adult points system, drivers who earn 200 or more points in three years may have their licenses suspended for three months to a year, depending on the severity of their records.

As a safety incentive, the point system provides that when you drive one full year without a moving violation conviction, the DLD will remove half the points you acquired from your record. If you drive two years back-to-back without a conviction, they will delete all points.

They automatically remove points for individual convictions from your record three years after the date of the violation. As a further incentive, you may have 50 points removed from your record for completing a driver improvement course a division hearing officer has recommended.

Rules of the Road

These are some of the laws you should obey for safe driving and to avoid severe penalties.

Fault vs. No-Fault

As we mentioned earlier, Utah follows “no-fault” laws regarding damages and bodily injuries from an accident. That means if you cause an accident that involves another driver, you’re not required to pay for property damage.

Your Personal Injury Protection (PIP) coverage will pay for any medical treatment and out-of-pocket losses covered under the policy up to coverage limits, regardless of who’s responsible. But, you can’t get compensation for “pain and suffering” and other non-monetary damages from a crash.

Regarding filing accident claims or lawsuits, Utah follows a law of modified comparative negligence in assigning a percentage of blame for damage awards. The state uses a “50 percent rule.”

Under this rule, an accident victim may only collect damages if a judge or jury determines that the plaintiff’s fault for the injury is 49 percent or below. If they find the plaintiff’s percentage of liability is 50 percent or more, they won’t receive an award.

This law firm video further explains the law in Utah:

Seat Belt & Car Seat Laws

According to the IIHS, Utah’s seat belt laws are as follows:

| Safety Belt Laws in Utah | Details |

|---|---|

| Effective Since | April 28, 1986 |

| Primary Enforcement | yes; effective since 05/12/15 |

| Age/Seats Applicable | 16+ years in all seats |

| 1st Offense Max Fine | $45 |

These are the car seat and child-seating laws:

| Type of Car Seat Required | Details |

|---|---|

| Must be in child safety seat | Seven years and younger and shorter than 57 inches |

| Preference for rear seat | law states no preference for rear seat |

| Maximum base fine 1st offense, additional fees may apply | $45 |

| Adult Belt Permissible | Eight through 15 years; all children 57 inches or taller |

Drivers who break one of these laws will pay a fine of $45 and fees. Because Utah’s child seat laws aren’t very specific, we suggest you follow manufacturers’ age and weight guidelines on car seats and booster seats.

The state prohibits riding in the cargo area of a pickup truck except for employees on duty, off-highway operations, and people riding in a vehicle space intended for any load.

Keep Right & Move Over Laws

Utah law requires drivers who block traffic in the left lane to stay in the right lane and remain there if they drive slower than the traffic around them.

According to AAA, drivers must reduce their speeds or move to the closest lane when they approach the following types of vehicles:

- stationary authorized emergency vehicles

- tow trucks or highway maintenance vehicles displaying flashing lights and traveling in the same direction

Obey these laws to keep yourself and everyone else around you safe.

Speed Limits

Courtesy of the IIHS, these are the speed limits in Utah:

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75; 80 on specified segments of road |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 75 mph |

| Other Roads | 65 mph |

On freeways or limited access highways that have passed engineering and traffic tests, the posted speed limit may be up to 80 mph.

Ridesharing

In Utah, drivers who work for rideshare companies such as Uber and Lyft must meet certain car insurance requirements.

Rideshare drivers in the Beehive State must carry a minimum of one million dollars in commercial liability coverage. Failure to comply will result in fines of up to $500. They can find rideshare coverage through the following carriers:

- Allstate

- Farmer’s

- American Family

- State Farm

Only Allstate and Farmer’s offer full rideshare coverage.

Automation on the Road

Utah recently allowed autonomous vehicles on its roads. The operator needs to be licensed and carry liability insurance but doesn’t have to occupy the vehicle.

Safety Laws

In this section, we’ll go over more regulations controlling safe driving in Utah: DUI laws, marijuana laws, and distracted driving laws.

DUI Laws

Responsibility.org reports that in 2017, 53 people died from alcohol-related accidents in Utah.

Drinking and driving remain a problem nationwide, and in the Beehive State, which is a major reason why Utah recently reduced its blood-alcohol content (BAC) limit from 0.08 to 0.05. The BAC law is the strictest in the U.S., per the below NBC News report:

These are the state’s DUI laws:

| Name for Offense | Driving Under the Influence (DUI) |

|---|---|

| BAC Limit | 0.05 |

| High BAC Limit | 0.16 |

| Criminal Status | 1st-2nd class B misdemeanors, 3rd+ in 10 years third-degree felonies |

| Look Back Period | 10 years |

Here are the penalties for drinking and driving:

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 120 days; alcohol restricted driving privilege 2 years | min 48 consecutive hours OR 48 hours community service OR home confinement | $1,310 min | IID 18 months |

| 2nd Offense | 2 years; alcohol restricted driving privilege 10 years | min 240 consecutive hours OR 240 hours community service OR home confinement | $1,560 min | |

| 3rd Offense | 2 years, alcohol restricted driving privilege for life | 62 days up to 5 years | $2,850 up to $5000 | IID 18 months |

| 4th Offense | Same as third | |||

A fourth DUI offense carries the same penalties as a third one. With all of the penalties involved and the harm drunk driving can cause, in the end, it’s best not to risk a DUI offense.

Marijuana-Impaired Driving Laws

According to DISA Global Solutions, Utah allows marijuana use for medicinal purposes and hasn’t decriminalized it.

The state has a zero-tolerance law for THC and metabolites (the chemicals that cause a “high”). If you test positive for marijuana use, you could face a Class B misdemeanor months or even weeks later because THC and metabolites will stay in your bloodstream long afterward.

Penalties include fines up to $1,000, up to six months in jail, and a 120-day license suspension.

Distracted Driving Laws

Especially with the popularity of the cell phone, distracted driving has become another major road hazard. These are Utah’s distracted driving laws:

| Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement |

|---|---|---|---|

| No | Drivers younger than 18 | All drivers | Primary |

Read more: Does my car insurance cover damage caused by a road hazard?

The state doesn’t prohibit handheld use, but if a law enforcement officer catches a driver dialing on a handheld phone, they can pay a maximum fine of $100 for a first offense provided the offender inflicted no bodily harm.

The Utah Department of Transportation (DOT) and the Utah Department of Public Safety encourage drivers to resist driving while distracted:

Driving in Utah

Driving in the Beehive State comes with its share of risks. When a major news report about an accident airs, we may think about the dangers every time we get behind the wheel.

This section is here to remind everyone of the hazards involved and the importance of driving safely. We’ll cover facts and statistics about vehicle thefts and fatal accidents.

They can be startling, yet enlightening. Read on to find out more.

Vehicle Theft in Utah

The table below shows the top 10 stolen vehicles in Utah as of 2016, together with the most popular model year.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Accord | 1997 | 938 |

| Honda Civic | 1998 | 915 |

| Subaru Legacy | 1996 | 262 |

| Ford Pickup (Full Size) | 2006 | 238 |

| Chevrolet Pickup (Full Size) | 2004 | 225 |

| Dodge Pickup (Full Size) | 2012 | 117 |

| Subaru Impreza | 1997 | 106 |

| Acura Integra | 1995 | 103 |

| Jeep Cherokee/Grand Cherokee | 1996 | 102 |

| Nissan Altima | 1997 | 97 |

The Honda Accord at the Honda Civic topped the list.

Vehicle Theft by City

Let’s see where vehicle thefts occur most often in Utah. The following Federal Bureau of Investigation (FBI) data from 2017 shows the number of vehicles stolen in various towns and cities across the state.

| City | Motor Vehicle Theft |

|---|---|

| American Fork/Cedar Hills | 40 |

| Big Water | 0 |

| Blanding | 3 |

| Bluffdale | 17 |

| Bountiful | 60 |

| Brian Head | 0 |

| Brigham City | 18 |

| Cedar City | 37 |

| Centerville | 35 |

| Clearfield | 50 |

| Clinton | 16 |

| Cottonwood Heights | 48 |

| Draper | 260 |

| Enoch | 6 |

| Fairview | 2 |

| Farmington | 28 |

| Fountain Green | 1 |

| Garland | 2 |

| Grantsville | 34 |

| Harrisville | 22 |

| Heber | 15 |

| Helper | 0 |

| Hurricane | 22 |

| Kanab | 2 |

| Kaysville | 24 |

| La Verkin | 10 |

| Layton | 83 |

| Lehi | 56 |

| Lindon | 19 |

| Logan | 37 |

| Lone Peak | 17 |

| Mapleton | 3 |

| Moab | 7 |

| Monticello | 1 |

| Mount Pleasant6 | 4 |

| Murray | 472 |

| Naples | 1 |

| Nephi | 7 |

| North Ogden | 24 |

| North Park | 13 |

| North Salt Lake | 50 |

| Ogden | 468 |

| Orem | 129 |

| Park City | 6 |

| Payson | 18 |

| Perry | 2 |

| Pleasant Grove | 4 |

| Pleasant View | 13 |

| Price | 4 |

| Provo | 117 |

| Richfield | 18 |

| Riverdale | 28 |

| Roosevelt | 57 |

| Roy | 38 |

| Salem | 2 |

| Salina | 6 |

| Salt Lake City | 1,886 |

| Sandy | 270 |

| Santa Clara/Ivins | 13 |

| Santaquin/Genola | 8 |

| Saratoga Springs | 11 |

| Smithfield | 6 |

| South Jordan | 156 |

| South Ogden | 36 |

| South Salt Lake | 397 |

| Spanish Fork | 15 |

| Spring City | 1 |

| Springdale | 0 |

| Springville | 30 |

| Stockton | 0 |

| Sunset | 3 |

| Syracuse | 14 |

| Tooele6 | 74 |

| Tremonton | 9 |

| Vernal | 9 |

| Washington | 21 |

| West Bountiful | 27 |

| West Jordan | 384 |

| West Valley | 1,146 |

| Willard | 1 |

| Woods Cross | 10 |

Salt Lake City, Ogden, and other highly populated areas saw the most vehicle thefts.

Road Fatalities in Utah

Weather, light condition, impaired drivers, and speed are among the biggest causes of deaths on Utah highways.

Let’s look at how many have occurred throughout the Beehive State.

Most Fatal Highway in Utah

According to Geotab, in the past decade, over 112 fatal crashes have occurred on U.S. Route 89, which also happens to run through several national parks.

To determine the most dangerous highway in each state, Geotab calculates a fatal crash rate based on the annual number of NHTSA road fatality and fatal crash statistics. They adjust them for the average daily traffic counts the Federal Highway Administration provides.

Fatal Crashes by Weather Condition & Light Condition

Let’s see how weather and light conditions can affect fatal crashes.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 127 | 24 | 53 | 11 | 0 | 215 |

| Rain | 7 | 5 | 4 | 0 | 0 | 16 |

| Snow/Sleet | 6 | 0 | 2 | 0 | 0 | 8 |

| Other | 1 | 1 | 1 | 1 | 0 | 4 |

| Unknown | 0 | 0 | 0 | 3 | 1 | 4 |

| TOTAL | 141 | 30 | 60 | 15 | 1 | 247 |

Most deaths occurred under normal daylight conditions.

Fatalities (All Crashes) by County

Below is the National Highway Traffic Safety Administration (NHTSA) Crash Report data on road fatalities in Utah by county from 2013 – 2017.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Beaver County | 4 | 2 | 5 | 0 | 1 | 61.9 | 31.12 | 78.81 | 0 | 15.66 |

| Box Elder County | 5 | 13 | 16 | 10 | 12 | 9.86 | 25.34 | 30.88 | 18.88 | 22.19 |

| Cache County | 10 | 12 | 4 | 12 | 21 | 8.54 | 10.18 | 3.34 | 9.81 | 16.88 |

| Carbon County | 4 | 4 | 8 | 3 | 4 | 19.13 | 19.4 | 39.28 | 14.73 | 19.71 |

| Daggett County | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 90.42 | 92.51 | 97.18 |

| Davis County | 12 | 11 | 11 | 27 | 11 | 3.72 | 3.35 | 3.29 | 7.91 | 3.16 |

| Duchesne County | 4 | 9 | 2 | 1 | 3 | 20.03 | 44.52 | 9.63 | 4.92 | 14.98 |

| Emery County | 6 | 2 | 6 | 9 | 4 | 55.77 | 18.8 | 57.94 | 88.05 | 39.69 |

| Garfield County | 2 | 4 | 0 | 5 | 1 | 39.74 | 79.81 | 0 | 100 | 19.69 |

| Grand County | 3 | 7 | 6 | 4 | 11 | 32 | 73.93 | 62.85 | 41.43 | 113.71 |

| Iron County | 8 | 3 | 2 | 4 | 11 | 17.19 | 6.38 | 4.15 | 8.03 | 21.57 |

| Juab County | 3 | 2 | 0 | 5 | 7 | 29.23 | 19.21 | 0 | 45.44 | 62.22 |

| Kane County | 2 | 3 | 5 | 2 | 1 | 28.08 | 41.85 | 70.96 | 27.3 | 13.22 |

| Millard County | 7 | 4 | 9 | 5 | 8 | 55.79 | 31.91 | 71.27 | 39.43 | 62.19 |

| Morgan County | 0 | 4 | 2 | 1 | 3 | 0 | 37.77 | 18.13 | 8.79 | 25.27 |

| Piute County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 68.35 | 0 |

| Rich County | 0 | 2 | 0 | 0 | 2 | 0 | 87.95 | 0 | 0 | 83.65 |

| Salt Lake County | 53 | 66 | 76 | 69 | 69 | 4.9 | 6.05 | 6.88 | 6.15 | 6.08 |

| San Juan County | 7 | 8 | 5 | 10 | 12 | 46.7 | 53.15 | 32.81 | 65.24 | 78.15 |

| Sanpete County | 9 | 3 | 4 | 4 | 3 | 32 | 10.6 | 13.94 | 13.65 | 9.99 |

| Sevier County | 8 | 2 | 3 | 9 | 3 | 38.55 | 9.65 | 14.38 | 42.56 | 14.07 |

| Summit County | 4 | 6 | 7 | 4 | 5 | 10.4 | 15.35 | 17.68 | 9.9 | 12.16 |

| Tooele County | 8 | 15 | 14 | 20 | 9 | 13.19 | 24.41 | 22.35 | 30.96 | 13.34 |

| Uintah County | 2 | 8 | 5 | 3 | 6 | 5.6 | 21.68 | 13.24 | 8.29 | 17.07 |

| Utah County | 21 | 24 | 39 | 31 | 25 | 3.81 | 4.28 | 6.81 | 5.25 | 4.12 |

| Wasatch County | 3 | 5 | 9 | 7 | 10 | 11.25 | 17.92 | 30.75 | 22.9 | 31.15 |

| Washington County | 14 | 18 | 17 | 15 | 15 | 9.52 | 11.91 | 10.99 | 9.42 | 9.05 |

| Wayne County | 3 | 3 | 1 | 0 | 0 | 110.42 | 111.32 | 37.26 | 0 | 0 |

| Weber County | 18 | 16 | 21 | 19 | 15 | 7.56 | 6.66 | 8.64 | 7.68 | 5.96 |

Salt Lake and Utah Counties had the most crash deaths in the five years, and they also increased during that timeframe.

Traffic Fatalities

Below are the number of urban and rural traffic fatalities in Utah from 2008 – 2017.

| Area | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 176 | 141 | 131 | 117 | 95 | 107 | 125 | 127 | 121 | 116 |

| Urban | 100 | 103 | 122 | 126 | 122 | 113 | 131 | 151 | 160 | 156 |

| Total | 276 | 244 | 253 | 243 | 217 | 220 | 256 | 278 | 281 | 273 |

Most of the fatal crashes occurred in urban areas. Rural areas saw a decrease over the nine-year timeframe, while crash deaths rose in urban areas.

Fatalities by Person Type

These are the number of fatalities for 2013 – 2017 based on the type of person and vehicle.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 69 | 89 | 95 | 85 | 89 |

| Light Truck - Pickup | 40 | 27 | 38 | 38 | 32 | |

| Light Truck - Utility | 24 | 29 | 30 | 43 | 41 | |

| Light Truck - Van | 7 | 11 | 12 | 8 | 5 | |

| Large Truck | 5 | 4 | 6 | 4 | 8 | |

| Bus | 2 | 0 | 0 | 0 | 1 | |

| Other/Unknown Occupants | 5 | 5 | 7 | 18 | 7 | |

| Total Occupants | 152 | 165 | 188 | 196 | 185 | |

| Light Truck - Other | 0 | 0 | 0 | 0 | 2 | |

| Motorcyclists | Total Motorcyclists | 31 | 45 | 36 | 41 | 39 |

| Nonoccupants | Pedestrian | 28 | 32 | 47 | 35 | 42 |

| Bicyclist and Other Cyclist | 6 | 9 | 5 | 5 | 6 | |

| Other/Unknown Nonoccupants | 3 | 5 | 2 | 4 | 1 | |

| Total Nonoccupants | 37 | 46 | 54 | 44 | 49 | |

| Total | Total | 220 | 256 | 278 | 281 | 273 |

Motor vehicle occupant deaths — primarily in passenger cars — occurred the most.

Fatalities by Crash Type

Here is more information about the types of vehicles and the accidents that led to fatalities from 2013 – 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 220 | 256 | 278 | 281 | 273 |

| (1) Single Vehicle | 141 | 146 | 150 | 161 | 146 |

| (2) Involving a Large Truck | 20 | 18 | 39 | 20 | 36 |

| (3) Involving Speeding | 75 | 90 | 64 | 72 | 78 |

| (4) Involving a Rollover | 79 | 80 | 82 | 93 | 79 |

| (5) Involving a Roadway Departure | 126 | 128 | 118 | 137 | 142 |

| (6) Involving an Intersection (or Intersection Related) | 36 | 72 | 62 | 78 | 58 |

Most of the crash deaths involved single vehicles and roadway departures.

Five-Year Trend for the Top 10 Counties

These are the numbers of fatalities in the most populated Utah counties from 2013 to 2017.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Salt Lake County | 53 | 66 | 76 | 69 | 69 |

| Utah County | 21 | 24 | 39 | 31 | 25 |

| Cache County | 10 | 12 | 4 | 12 | 21 |

| Washington County | 14 | 18 | 17 | 15 | 15 |

| Weber County | 18 | 16 | 21 | 19 | 15 |

| Box Elder County | 5 | 13 | 16 | 10 | 12 |

| San Juan County | 7 | 8 | 5 | 10 | 12 |

| Davis County | 12 | 11 | 11 | 27 | 11 |

| Grand County | 3 | 7 | 6 | 4 | 11 |

| Iron County | 8 | 3 | 2 | 4 | 11 |

Salt Lake County, the most populated, had the highest crash fatalities. They also rose in the five-year timeframe.

Fatalities Involving Speeding by County

These stats highlight where you should pay the most attention to speeders.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Beaver County | 0 | 1 | 1 | 0 | 1 | 0 | 15.56 | 15.76 | 0 | 15.66 |

| Box Elder County | 1 | 1 | 6 | 3 | 2 | 1.97 | 1.95 | 11.58 | 5.66 | 3.7 |

| Cache County | 5 | 4 | 0 | 4 | 5 | 4.27 | 3.39 | 0 | 3.27 | 4.02 |

| Carbon County | 0 | 3 | 3 | 2 | 0 | 0 | 14.55 | 14.73 | 9.82 | 0 |

| Daggett County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 92.51 | 0 |

| Davis County | 7 | 4 | 2 | 7 | 3 | 2.17 | 1.22 | 0.6 | 2.05 | 0.86 |

| Duchesne County | 1 | 3 | 0 | 0 | 0 | 5.01 | 14.84 | 0 | 0 | 0 |

| Emery County | 2 | 2 | 0 | 2 | 0 | 18.59 | 18.8 | 0 | 19.57 | 0 |

| Garfield County | 0 | 2 | 0 | 2 | 0 | 0 | 39.9 | 0 | 40 | 0 |

| Grand County | 1 | 1 | 1 | 1 | 3 | 10.67 | 10.56 | 10.47 | 10.36 | 31.01 |

| Iron County | 3 | 1 | 2 | 1 | 0 | 6.45 | 2.13 | 4.15 | 2.01 | 0 |

| Juab County | 1 | 0 | 0 | 2 | 4 | 9.74 | 0 | 0 | 18.18 | 35.56 |

| Kane County | 1 | 0 | 0 | 0 | 0 | 14.04 | 0 | 0 | 0 | 0 |

| Millard County | 3 | 0 | 1 | 1 | 4 | 23.91 | 0 | 7.92 | 7.89 | 31.1 |

| Morgan County | 0 | 3 | 1 | 1 | 3 | 0 | 28.33 | 9.07 | 8.79 | 25.27 |

| Piute County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Rich County | 0 | 1 | 0 | 0 | 1 | 0 | 43.98 | 0 | 0 | 41.82 |

| Salt Lake County | 16 | 23 | 16 | 13 | 17 | 1.48 | 2.11 | 1.45 | 1.16 | 1.5 |

| San Juan County | 1 | 7 | 0 | 1 | 3 | 6.67 | 46.51 | 0 | 6.52 | 19.54 |

| Sanpete County | 2 | 0 | 1 | 2 | 2 | 7.11 | 0 | 3.49 | 6.83 | 6.66 |

| Sevier County | 1 | 0 | 0 | 0 | 0 | 4.82 | 0 | 0 | 0 | 0 |

| Summit County | 1 | 0 | 1 | 3 | 0 | 2.6 | 0 | 2.53 | 7.43 | 0 |

| Tooele County | 3 | 6 | 6 | 5 | 1 | 4.95 | 9.76 | 9.58 | 7.74 | 1.48 |

| Uintah County | 1 | 6 | 2 | 2 | 6 | 2.8 | 16.26 | 5.29 | 5.53 | 17.07 |

| Utah County | 11 | 10 | 9 | 6 | 5 | 1.99 | 1.78 | 1.57 | 1.02 | 0.82 |

| Wasatch County | 1 | 2 | 3 | 1 | 6 | 3.75 | 7.17 | 10.25 | 3.27 | 18.69 |

| Washington County | 5 | 6 | 7 | 6 | 7 | 3.4 | 3.97 | 4.52 | 3.77 | 4.23 |

| Wayne County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Weber County | 8 | 4 | 2 | 6 | 5 | 3.36 | 1.67 | 0.82 | 2.43 | 1.99 |

Again, Salt Lake County had the most accident fatalities, but they were lower than other types of accidents. Still, it’s best to be cautious about speed and the dangers involved.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

These figures reveal just how deadly drunk driving can be, as it doesn’t affect just you, but those around you.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Beaver County | 1 | 0 | 0 | 0 | 0 | 15.48 | 0 | 0 | 0 | 0 |

| Box Elder County | 0 | 2 | 2 | 1 | 5 | 0 | 3.9 | 3.86 | 1.89 | 9.25 |

| Cache County | 2 | 2 | 0 | 1 | 1 | 1.71 | 1.7 | 0 | 0.82 | 0.8 |

| Carbon County | 1 | 2 | 1 | 1 | 0 | 4.78 | 9.7 | 4.91 | 4.91 | 0 |

| Daggett County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 97.18 |

| Davis County | 3 | 2 | 1 | 4 | 2 | 0.93 | 0.61 | 0.3 | 1.17 | 0.58 |

| Duchesne County | 3 | 2 | 0 | 0 | 0 | 15.02 | 9.89 | 0 | 0 | 0 |

| Emery County | 0 | 0 | 2 | 1 | 2 | 0 | 0 | 19.31 | 9.78 | 19.85 |

| Garfield County | 1 | 0 | 0 | 1 | 0 | 19.87 | 0 | 0 | 20 | 0 |

| Grand County | 1 | 0 | 3 | 0 | 3 | 10.67 | 0 | 31.42 | 0 | 31.01 |

| Iron County | 2 | 0 | 0 | 0 | 0 | 4.3 | 0 | 0 | 0 | 0 |

| Juab County | 1 | 0 | 0 | 1 | 2 | 9.74 | 0 | 0 | 9.09 | 17.78 |

| Kane County | 0 | 1 | 0 | 2 | 0 | 0 | 13.95 | 0 | 27.3 | 0 |

| Millard County | 1 | 2 | 4 | 1 | 0 | 7.97 | 15.95 | 31.68 | 7.89 | 0 |

| Morgan County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Piute County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 68.35 | 0 |

| Rich County | 0 | 1 | 0 | 0 | 1 | 0 | 43.98 | 0 | 0 | 41.82 |

| Salt Lake County | 6 | 24 | 13 | 11 | 20 | 0.56 | 2.2 | 1.18 | 0.98 | 1.76 |

| San Juan County | 2 | 1 | 3 | 6 | 3 | 13.34 | 6.64 | 19.69 | 39.14 | 19.54 |

| Sanpete County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 3.41 | 3.33 |

| Sevier County | 1 | 0 | 0 | 1 | 0 | 4.82 | 0 | 0 | 4.73 | 0 |

| Summit County | 0 | 0 | 3 | 2 | 0 | 0 | 0 | 7.58 | 4.95 | 0 |

| Tooele County | 2 | 4 | 1 | 7 | 0 | 3.3 | 6.51 | 1.6 | 10.84 | 0 |

| Uintah County | 0 | 5 | 2 | 0 | 3 | 0 | 13.55 | 5.29 | 0 | 8.53 |

| Utah County | 4 | 3 | 5 | 5 | 4 | 0.73 | 0.53 | 0.87 | 0.85 | 0.66 |

| Wasatch County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 3.42 | 0 | 6.23 |

| Washington County | 2 | 2 | 2 | 3 | 2 | 1.36 | 1.32 | 1.29 | 1.88 | 1.21 |

| Wayne County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 37.26 | 0 | 0 |

| Weber County | 2 | 3 | 3 | 2 | 1 | 0.84 | 1.25 | 1.23 | 0.81 | 0.4 |

Salt Lake County topped the list yet again.

Teen Drinking & Driving

Responsibility.org reports that Utah’s average number of under-21 driving fatalities involving alcohol is 0.5 deaths per 100,000 people. The national average is higher, at 1.2.

Below is more data about the state’s drunk driving arrests and fatalities:

| DUI Arrest (Under 18 years old) | DUI Arrests (Under 18 years old) Total Per Million People | Rank |

|---|---|---|

| 196 | 212.63 | 3 |

Utah ranks third nationwide in the number of underage DUI arrests. With the low fatality rate and strict BAC limit of 0.5, it’s a positive sign that efforts to keep drunk drivers off the road there are effective.

EMS Response Time

These are the EMS response times for crashes in Utah’s rural and urban areas.

| Area | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 6.7 mins | 20.16 mins | 39.52 mins | 50.51 mins | 97 |

| Urban | 2.23 mins | 6.85 mins | 24.61 mins | 34.2 mins | 149 |

As shown, the response time in urban areas is less than half that of rural areas. The difficulties first-responders may have in finding and getting to rural addresses can affect response times.

Transportation in Utah

Below, using information from Data USA, we’ll look at the state of transportation in Utah, from car ownership to traffic congestion and commuter transportation.

Read on to find out more about the transportation situation in the Beehive State.

Car Ownership

Data USA reports that 39 percent of Utah households own two cars, which is a couple of points below the national average. By contrast, 25 percent of households in the state own three cars, which is slightly higher than the U.S. average.

Commute Time

According to Data USA, Utah residents have a shorter commute time (20.5 minutes) than the normal U.S. worker (25.5 minutes). Also, 1.44 percent of Utahns face “super commutes” longer than 90 minutes.

Commuter Transportation

Now, let’s explore the most popular forms of commuter transportation in the Beehive State.

Per Data USA figures, in 2017, most Utah commuters drove alone — an overwhelming majority of 76 percent, followed by those who carpooled (11 percent).

Traffic Congestion

Data from Numbeo’s traffic research study below shows how much time commuters in Salt Lake City waste in traffic.

| City | Traffic Index | Time Index (in minutes) | Inefficiency Index |

|---|---|---|---|

| Salt Lake City | 155.28 | 34.72 | 190.28 |

The traffic index reveals commuters’ total time in traffic. The time index is the one-way commute time in minutes. The inefficiency index is the estimation of traffic inefficiencies, which include sitting in traffic jams or driving alone versus taking public transportation or carpooling.

As a reminder of the toll traffic takes on commuters, this information can inspire us to think about ways to make our routes easier.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Utah Car Insurance: The Bottom Line

Utah was founded on the concept of a hard work ethic that leads to success, with everyone contributing to the effort like bees in a hive.

The state nickname, the Beehive State, comes from the Mormon name “Deseret,” which means “honeybee.” The early Mormon settlers proposed the ambitious State of Deseret, which would have comprised not just modern-day Utah and Nevada, but also parts of other states spanning from Wyoming and Idaho to California and Oregon.

When the U.S. Congress made Utah a territory in 1850, and then later when it became a state, the pioneering dream stayed alive, though on a smaller scale. If you’re a proud Utah resident, you want to follow the state’s car insurance laws.

Did you find this guide helpful? We aim to please by giving you all the data you need to make an informed decision about auto insurance in Utah.

If you’re ready, start comparing car insurance rates today. Get auto insurance quotes in Utah now by entering your ZIP code below.

Frequently Asked Questions

What are the car insurance requirements in Utah?

Utah car insurance laws require 25/65/15 of bodily injury and property damage coverage.

Is there a grace period for new car owners in Utah?

Yes, Utah car insurance laws allow a grace period of 2-30 days for new car owners.

Which are the top-rated car insurance companies in Utah?

The top-rated Utah car insurance companies include:

- Hartford

- State Farm

- Allstate

How can I find the best car insurance rates in Utah?

To find the best car insurance in Utah by city, it is recommended to compare quotes using a free tool available.

What is the minimum car insurance coverage required in Utah?

The minimum car insurance coverage required in Utah includes:

- Bodily Injury Liability Coverage: $25,000 per person, $65,000 per accident

- Property Damage Liability Coverage: $15,000 minimum

- Personal Injury Protection (PIP) Coverage: $3,000 minimum

What are the average monthly car insurance rates in Utah for liability, collision, and comprehensive coverage?

The average annual car insurance rates in Utah for liability, collision, and comprehensive coverage are as follows:

- Liability: $497.53

- Collision: $265.90

- Comprehensive: $109.50

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.