Best Hawaii Car Insurance (2025)

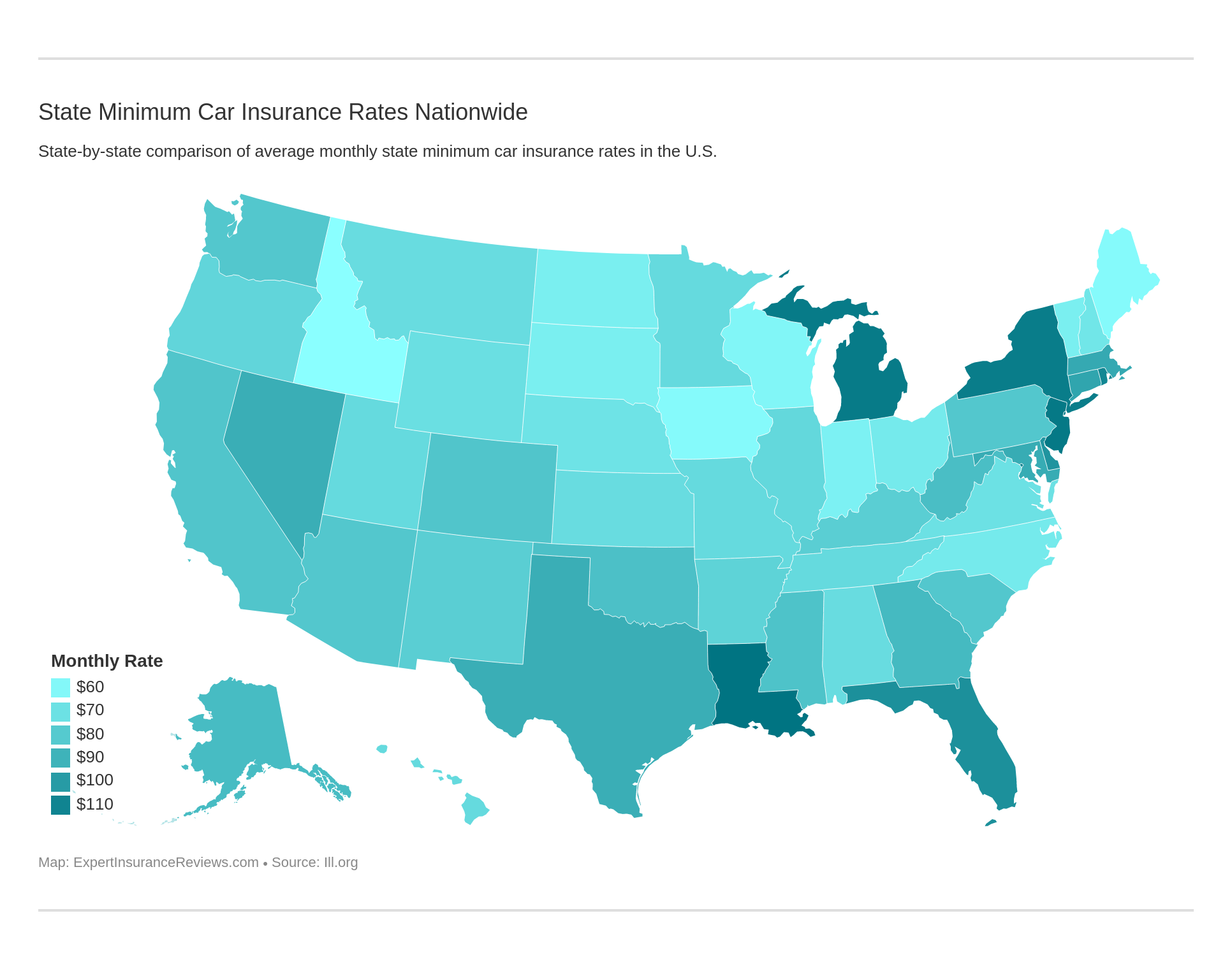

Hawaii auto insurance rates average $46 per month for liability coverage and $73 per month for full coverage. Hawaii minimum car insurance requirements are 20/40/10 for bodily injury and property damage. The cheapest Hawaii car insurance companies are State Farm and USAA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

UPDATED: Feb 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

| HAWAII STATISTICS SUMMARY | STATS |

|---|---|

| Miles of Roadway | 4,455 |

| Vehicles Registered in State | 1,208,515 |

| State Population | 1,420,491 |

| Most Popular Vehicle | Tacoma |

| Uninsured Motorists | 10.60% State Rank: 30 |

| Driving Fatalities in 2018 | Speeding: 51 DUI: 35 Total: 156 |

| Annual Insurance Costs | Liability: $458.54 Collision: $313.17 Comprehensive: $101.56 Full Coverage: $873.28 |

| Cheapest Provider | GEICO |

Let’s take a drive through the paradise of Hawaii, where urban life still pays homage to the native culture and the state’s famous beach life. It’s almost rare not to see a surfboard or canoe out on the clear waters as thousands of tourists flood the state’s islands annually.

If you are traveling through Hawaii’s rich islands, whether you’re a local or tourist, there’s something essential you’ll always need: Hawaii car insurance. We all need it, right? Whether we’re driving down the street or embarking on a long road trip, being covered is state-mandated.

But we know it can get confusing at times, reading about all the various scenarios and companies promising you the best deals. How in the world do you sift through all of that information? That’s where we come in. Imagine having a one-stop place for everything beneficial to know. We’re talking coverage types, rates, and more in this Hawaii auto insurance review.

Well, look no further. We’ve compiled a list of the cheapest companies, various types of coverage, state laws, and data like weather conditions and road fatalities that could be useful when traveling on the road daily.

And what better place to begin our adventure than the gorgeous islands of Hawaii?

Enter your ZIP code above to get a FREE quote today.

Aloha.

Table of Contents

Does Hawaii require car insurance?

So let’s get started.

Because again, we all know that reviewing insurance coverage on your own, and rates to obtain that coverage, can be, well, a tad overwhelming. So first, we’ll learn about Hawaii’s roadways and types of coverage needed to embark on those roadways. Then, we’ll get acquainted with some rates.

Minimum Auto Insurance Coverage in Hawaii

Every state except New Hampshire and Virginia requires individuals to have a certain level of minimum insurance coverage, and the minimum is different in each state. For the state of Hawaii, insurance minimum requirements are:

| COVERAGE | REQUIRED AMOUNT |

|---|---|

| Bodily Injury Liability | $20,000 per person $40,000 per accident |

| Property Damage Liability | $10,000 per accident |

| Personal Injury Protection (PIP) | $10,000 per person |

Bodily injury covers an individual or persons in the event of an accident. Property damage insurance is also required and covers fixtures and structures damaged by the driver in the event of a collision.

As seen in the chart, Hawaii’s minimum coverage for bodily injury is $20,000 per person and $40,000 per accident, while the minimum for property damage is $10,000 per accident. Most states have these two basic types of liability coverage.

Hawaii is special in that it also requires individuals to have Personal Injury Insurance or PIP. PIP helps cover the costs of one’s personal medical bills and sometimes wage losses in the event of an accident. The minimum required PIP coverage in Hawaii is $10,000 per person. These types of coverage are required by the state in order for one to legally be on the road in Hawaii.

One must also carry proof of this coverage with them at all times. These forms of Financial Responsibility inform the state that the individual has the basic required insurance. What documents are acceptable?

Let’s take a look.

Forms of Financial Responsibility

Under Hawaii’s Compulsory Liability Insurance Law, all individuals in possession of a vehicle are required to maintain liability coverage at all times.

But what are the proofs of insurance beyond an insurance card issued by the policymaker?

The Financial Responsibility law is enforced through the SR-22 Certificate or posting of securities in the amount of $25,000. As a result of crashes, the SR-21 Certificate or acceptable proof of settlement for damages or body injuries is required.

Let’s break this down a bit.

An SR-22 certificate is an acceptable form of insurance and is usually required to restore one’s license after a major violation. Thus, if you lose your initial insurance, an SR-22 certificate is future proof of responsibility that you’ll meet the state’s minimal coverage.

We’ll get to securities in a minute.

An SR-21, on the other hand, is a form that proves that you were insured at the time of an accident and is also a form of financial responsibility. This form certifies that the motorist was indeed covered at the time of a collision. So both an SR-22 and an SR-21 are acceptable forms of financial responsibility in the state of Hawaii.

But what about securities? Here’s a video that elaborates in detail.

As stated in the video, security is simply any financial asset that can be traded. Thus, securities in the form of $25,000 are acceptable as proof of automobile insurance in the state of Hawaii also.

Let’s dive in a bit further.

Premiums as a Percentage of Income

So what do you do with your finances after taxes? Shopping? Vacations? Investments?

Well, if you own a vehicle, your disposable income or income per capita—that is, the amount of money you have after taxes to either save or spend—will be impacted by your insurance premium.

But by how much?

| Year | Average Disposable Income | Average Full Coverage | Percent of Disposable Income |

|---|---|---|---|

| 2012 | $40,339.00 | $844.12 | 2.09% |

| 2013 | $40,094.00 | $844.16 | 2.11% |

| 2014 | $41,801.00 | $858.16 | 2.05% |

Looking at the chart, the average disposable income for an individual living in Hawaii was $41,801 in 2014. On average they paid roughly $858.16 for insurance, which was 2.05 percent of their disposable income.

This is a tad below the median rate for the rest of the nation. And despite a peak in 2013, Hawaii still managed to stay below the national average of disposable income for all three years. This is something to consider if you’re a local or plan to reside in the Aloha state in the future.

Premiums, however, have probably increased since then.

Want to find out how much of your income is going toward your insurance premium? Simply enter your data in the calculator tool below to get started.

CalculatorPro

How much is car insurance in Hawaii per month?

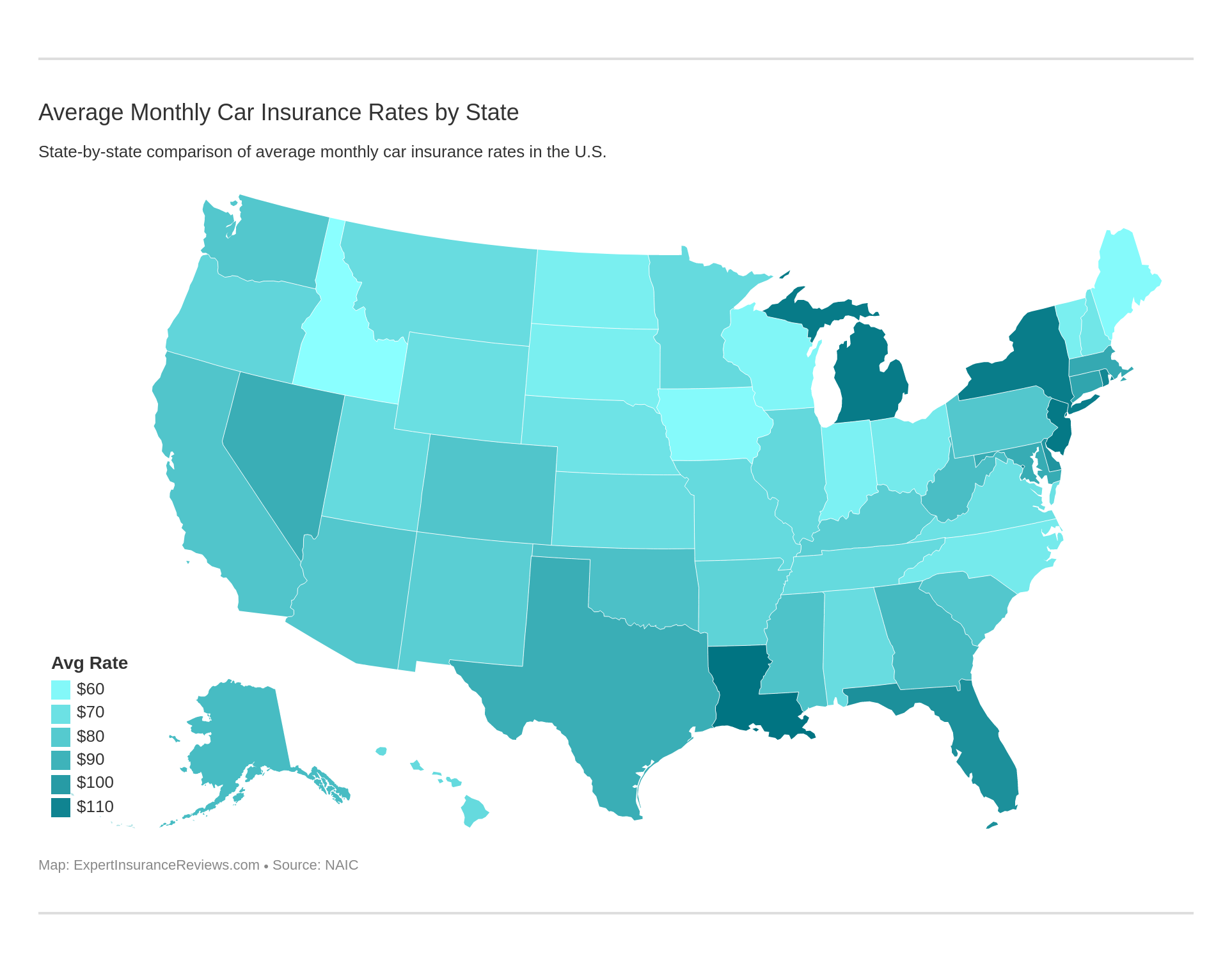

When we discuss core coverage, we’re talking about the essential parts of what is outlined as a full coverage car insurance policy. This data, based on the National Association of Insurance Commissioners (NAIC), displays the average cost of each component as it relates to the national average.

| Coverage Type | Average Rate in Hawaii (2015) | Average Cost Nationwide (2015) |

|---|---|---|

| Liability | $458.54 | $538.73 |

| Collison | $313.17 | $322.61 |

| Comprehensive | $101.56 | $148.04 |

| Total | $873.28 | $1,009.38 |

As you can see from the data, on average, Hawaiians paid below the nationwide cost for liability, collision, and comprehensive coverage.

This is extremely good news, as some states end up on the other side of the spectrum, paying more than the average nationwide cost annually.

Additional Liability

Now that we’ve talked core coverage, we’ll discuss a few extra insurance coverages that people tend to use to bulk up their policy in Hawaii. Let’s look at the chart. And don’t worry, we’ll talk about loss ratios in a second. First, let’s break down a few terms.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| MedPay | 126.12 | 231.68 | 78.70 |

| PIP | 62.73 | 62.01 | 60.90 |

| Uninsured/Underinsured Motorist Coverage | 42.90 | 42.57 | 40.47 |

No matter who is at fault, PIP is a type of car insurance that will cover one’s medical bills, and often lost wages, as we covered earlier.

MedPay is like PIP in that it negates the driver at fault. This type of coverage pays for medical expenses for you or other persons injured during a traffic incident.

And lastly, we have UM/UIM. This insurance pays for the victim’s injuries caused by the opposing party if they are uninsured or underinsured.

Now that we’ve got those terms out of the way, let’s discuss loss ratios. A loss ratio represents a company’s losses to premiums earned and displays a company’s strength or lack thereof.

A high loss ratio, for example, could indicate that that company is in distress or losing money–a loss ratio of 100 would be an example. That means they are paying out more than they’re taking in. An acute loss ratio indicates a company is making money but not paying out their claims as often. A loss ratio of 60-70 is considered a “safe zone” of sorts.

Hawaii’s loss ratios for PIP indicate that the companies in the state are doing well managing their claims. Since this type of coverage is required, it’s good to know that the companies offering this coverage are not in distress.

Its ratios for UM/UIM are a bit below an ideal situation; thus, as iterated before, the companies in the state offering this type of coverage are not in financial distress, but they’re not paying out their claims either. Furthermore, Hawaii’s loss ratio for MedPay displays 126.12 for 2015–this loss ratio was nearly double the rate from 2014.

So while the companies in the state figured out how to manage their claims better, the state was still losing money by paying out more claims than they ideally should have been.

While some of this data may not be fascinating, it is important to bulk up on your insurance policy, as 10.6 percent of drivers in Hawaii are uninsured, ranking 30th in the 50 states. While this exceeds the halfway mark for the rest of the nation, anything can happen, so being covered is extremely important.

Add-ons, Endorsements, and Riders

Don’t be overwhelmed. We’ll get to rates soon; however, we want to make sure you are informed about additional types of coverage that may be beneficial for you and your family. We’ve listed some of them below.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance (check for state-specific laws)

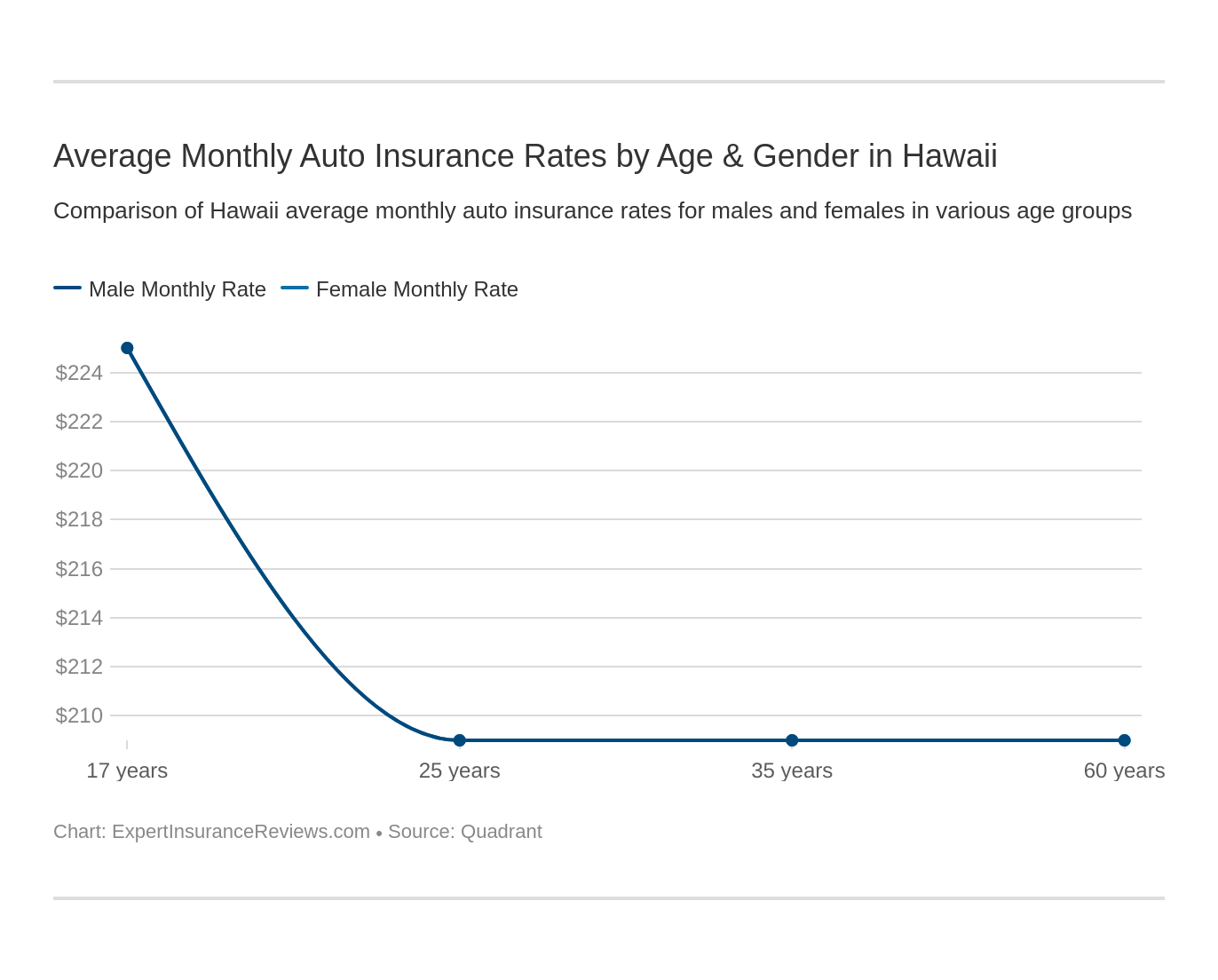

Average Car Insurance Rates by Age & Gender in HI

Who pays more for car insurance–women or men?

Nationwide, women get into fewer car accidents than men and have fewer DUIs. But does gender play a role in the state of Hawaii? Let’s take a look.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 |

| Farmers | $5,077.15 | $5,077.15 | $4,659.38 | $4,659.38 | $4,659.38 | $4,659.38 | $4,659.38 | $4,659.38 |

| GEICO | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 |

| Liberty Mutual | $3,218.54 | $3,218.54 | $3,179.89 | $3,179.89 | $3,179.89 | $3,179.89 | $3,179.89 | $3,179.89 |

| Progressive | $2,781.14 | $2,781.14 | $1,976.86 | $1,976.86 | $1,976.86 | $1,976.86 | $1,976.86 | $1,976.86 |

| State Farm | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 |

| USAA | $1,228.38 | $1,228.38 | $1,176.35 | $1,176.35 | $1,176.35 | $1,176.35 | $1,176.35 | $1,176.35 |

In Hawaii, women and men pay the same rates across all spectrums. This is because the state has outlawed gender discrimination in auto rates.

Sometimes states drop their prices when an individual who is 17 turns 25, as younger drivers are considered to be a liability–all companies, except for State Farm, Geico, and Allstate, keep their rates the same.

States will often sometimes give older drivers leeway, as they have more experience on the road, but in the case of Hawaii, 35-year-old couples and 60-year-old couples have the same rates.

Interesting, isn’t it?

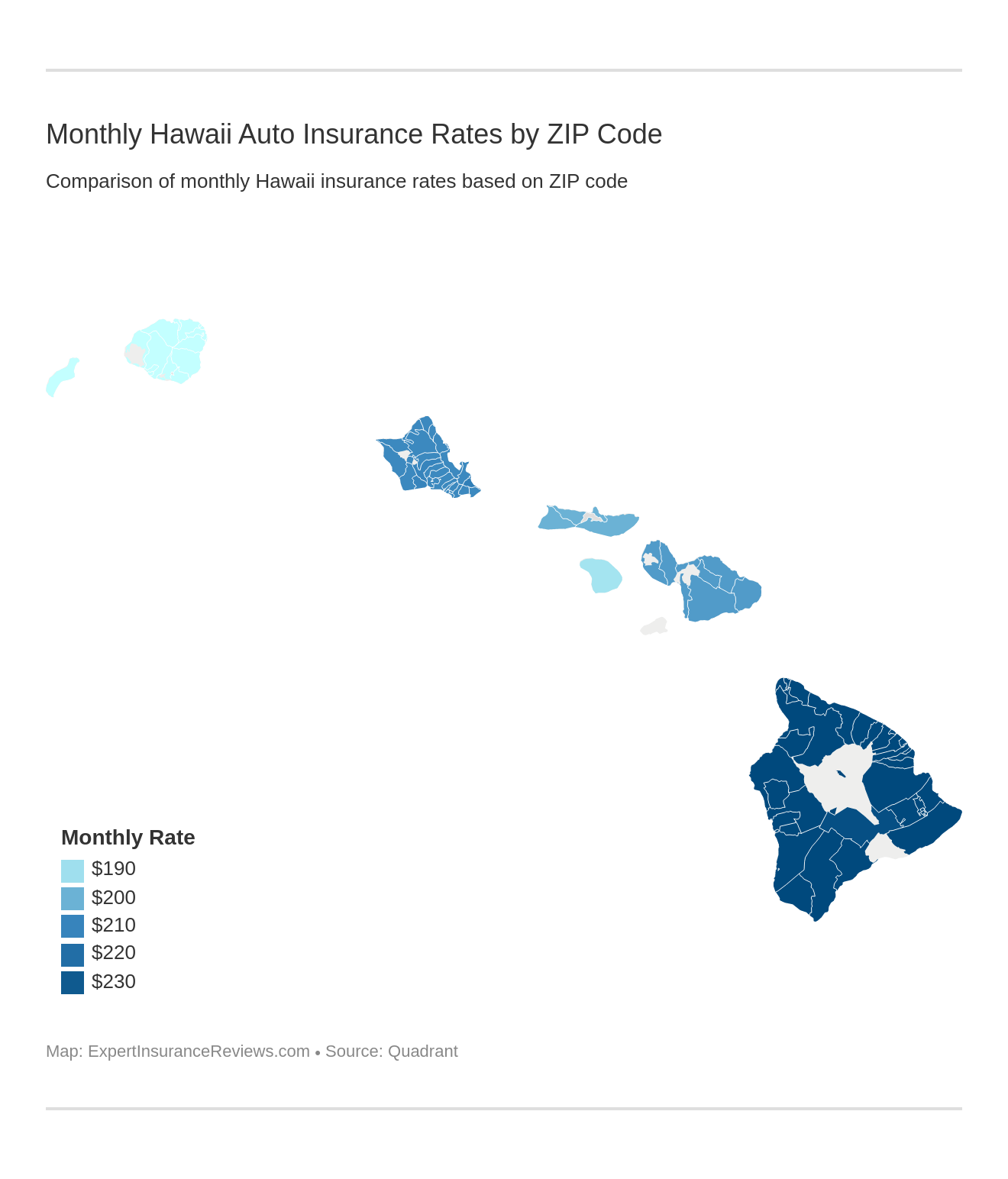

What is the cheapest car insurance in Hawaii?

Location can also play a major factor in the rates you pay for your insurance; some regional areas are more expensive than others.

Feel free to enter your ZIP code to see your rates.

| Zipcode | Annual Average | Allstate | Farmers | GEICO | Liberty Mutual | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|---|

| 96704 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96710 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96718 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96719 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96720 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96725 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96726 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96727 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96728 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96737 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96738 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96739 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96740 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96743 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96749 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96750 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96755 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96760 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96764 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96771 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96772 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96773 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96774 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96776 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96777 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96778 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96780 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96781 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96783 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96785 | $2,814.68 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,104.66 | $1,083.14 | $1,222.56 |

| 96795 | $2,544.50 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,415.64 | $1,049.86 | $1,272.36 |

| 96706 | $2,520.31 | $2,212.33 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96797 | $2,520.31 | $2,212.33 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96813 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96814 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96815 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96816 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96817 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96818 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96819 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96821 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96822 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96825 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96826 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96844 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96850 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96853 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96854 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96857 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96858 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96859 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96860 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96861 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96863 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96898 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96701 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96707 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96712 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96717 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96730 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96731 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96734 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96744 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96759 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96762 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96782 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96786 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96789 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96791 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96792 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96708 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96713 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96732 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96753 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96761 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96768 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96779 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96784 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96790 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96793 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96729 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96742 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96748 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96770 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96763 | $2,263.39 | $2,116.77 | $3,397.27 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96703 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96705 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96714 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96716 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96722 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96741 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96746 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96747 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96751 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96752 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96754 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96756 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96766 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96769 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96796 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

The top five cheapest rates by ZIP codes in Hawaii are 96703, 96705, 96714, 96716, and 96722.

And the highest? 96704, 96710, 96718, 95719, and 96720 respectively.

Cheapest Rates by City

The city you live in may also play a role in your insurance rates.

Feel free to enter your city to see how you fare.

| City | Annual Average |

|---|---|

| ANAHOLA | $2,198.62 |

| ELEELE | $2,198.62 |

| HANALEI | $2,198.62 |

| HANAPEPE | $2,198.62 |

| KALAHEO | $2,198.62 |

| KAPAA | $2,198.62 |

| KAUMAKANI | $2,198.62 |

| KEALIA | $2,198.62 |

| KEKAHA | $2,198.62 |

| KILAUEA | $2,198.62 |

| KOLOA | $2,198.62 |

| LIHUE | $2,198.62 |

| MAKAWELI | $2,198.62 |

| PRINCEVILLE | $2,198.62 |

| WAIMEA | $2,198.62 |

| LANAI CITY | $2,263.39 |

| HOOLEHUA | $2,397.78 |

| KALAUPAPA | $2,397.78 |

| KAUNAKAKAI | $2,397.78 |

| MAUNALOA | $2,397.78 |

| HAIKU | $2,459.60 |

| HANA | $2,459.60 |

| KAHULUI | $2,459.60 |

| KIHEI | $2,459.60 |

| KULA | $2,459.60 |

| LAHAINA | $2,459.60 |

| MAKAWAO | $2,459.60 |

| PAIA | $2,459.60 |

| PUUNENE | $2,459.60 |

| WAILUKU | $2,459.60 |

| AIEA | $2,508.57 |

| HALEIWA | $2,508.57 |

| HAUULA | $2,508.57 |

| KAAAWA | $2,508.57 |

| KAHUKU | $2,508.57 |

| KAILUA | $2,508.57 |

| KANEOHE | $2,508.57 |

| KAPOLEI | $2,508.57 |

| KUNIA | $2,508.57 |

| LAIE | $2,508.57 |

| MILILANI | $2,508.57 |

| PEARL CITY | $2,508.57 |

| WAHIAWA | $2,508.57 |

| WAIALUA | $2,508.57 |

| WAIANAE | $2,508.57 |

| CAMP H M SMITH | $2,511.19 |

| FORT SHAFTER | $2,511.19 |

| HICKAM AFB | $2,511.19 |

| HONOLULU | $2,511.19 |

| M C B H KANEOHE BAY | $2,511.19 |

| PEARL HARBOR | $2,511.19 |

| SCHOFIELD BARRACKS | $2,511.19 |

| TRIPLER ARMY MEDICAL CENTER | $2,511.19 |

| WAKE ISLAND | $2,511.19 |

| WHEELER ARMY AIRFIELD | $2,511.19 |

| EWA BEACH | $2,520.31 |

| WAIPAHU | $2,520.31 |

| WAIMANALO | $2,544.50 |

| VOLCANO | $2,814.68 |

| CAPTAIN COOK | $2,859.11 |

| HAKALAU | $2,859.11 |

| HAWAII NATIONAL PARK | $2,859.11 |

| HAWI | $2,859.11 |

| HILO | $2,859.11 |

| HOLUALOA | $2,859.11 |

| HONAUNAU | $2,859.11 |

| HONOKAA | $2,859.11 |

| HONOMU | $2,859.11 |

| KAILUA KONA | $2,859.11 |

| KAMUELA | $2,859.11 |

| KAPAAU | $2,859.11 |

| KEAAU | $2,859.11 |

| KEALAKEKUA | $2,859.11 |

| KEAUHOU | $2,859.11 |

| KURTISTOWN | $2,859.11 |

| LAUPAHOEHOE | $2,859.11 |

| MOUNTAIN VIEW | $2,859.11 |

| NAALEHU | $2,859.11 |

| NINOLE | $2,859.11 |

| OCEAN VIEW | $2,859.11 |

| OOKALA | $2,859.11 |

| PAAUILO | $2,859.11 |

| PAHALA | $2,859.11 |

| PAHOA | $2,859.11 |

| PAPAALOA | $2,859.11 |

| PAPAIKOU | $2,859.11 |

| PEPEEKEO | $2,859.11 |

| WAIKOLOA | $2,859.11 |

The cheapest cities in this scenario are Anahola, Eleele, Hanalei, Hanapepe, and Kalaheo. And in case you were wondering about the most expensive, those are Captin Cook, Hakalau, Hawaii National Park, Hawi, and Hilo.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Hawaii

What factors go into determining the best car insurance company? Because let’s face it, they’ve all promised great customer satisfaction and cheaper rates than their competitors. And while we know that’s just the name of the game, we truly want to know which companies offer the best car insurance.

That’s what this section will be about.

We’ll look at some of the big household names in Hawaii and see how they compare to one another. And this is about more than just price. We’re checking rates from various angles, based on commute times, driving records, and more.

You don’t want to miss this.

We’ll also cover ratings from trusted sources and customer reviews to see just how these different companies are performing.

Let’s begin.

The Largest Companies’ Financial Rating

AM Best grades companies based on their strength, or lack thereof. And this is extremely important, just as important as a skilled instructor giving out grades based on one’s performance on a test. So how do the largest companies in Hawaii fare?

| Company | AM Best Rating |

|---|---|

| Allstate | A+ |

| Farmers | A |

| GEICO | A++ |

| Island Insurance | A |

| Liberty Mutual | A |

| MS & AD Insurance | A+ |

| Progressive | A+ |

| State Farm | A++ |

| Tokio Marine | A+ |

| USAA | A++ |

As you can see from the chart above, all companies in Hawaii have exceptional ratings and above. Talk about an “A++”-GEICO, Statefarm, and USAA car insurance head up this category.

Companies with the Most Complaints in Hawaii

Reviews and complaints are highly significant when it comes to insurance companies. They give you an additional aspect to consider before choosing to do business with someone. Let’s take a look at how some of the biggest car insurance companies faired in Hawaii.

| Company | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| Allstate | 0.5 | 163 |

| Farmers | 0 | 0 |

| GEICO | 0.68 | 333 |

| Island Insurance | 0 | 0 |

| Liberty Mutual | 5.95 | 222 |

| MS & AD | 0 | 0 |

| Progressive | 0.75 | 120 |

| State Farm | 0.44 | 1482 |

| Tokio Marine | 0.71 | 1 |

| USAA | 0.74 | 296 |

We’ve talked about loss ratios-remember, they measure the number of complaints to one’s share of the business. While State Farm had the most complaints by far, its loss ratio was fairly low compared to the rest of the bunch. Subsequently, the highest loss ratio went to Liberty Mutual, although they had only 222 complaints compared to State Farm’s 1,482 complaints, it’s something to keep in mind.

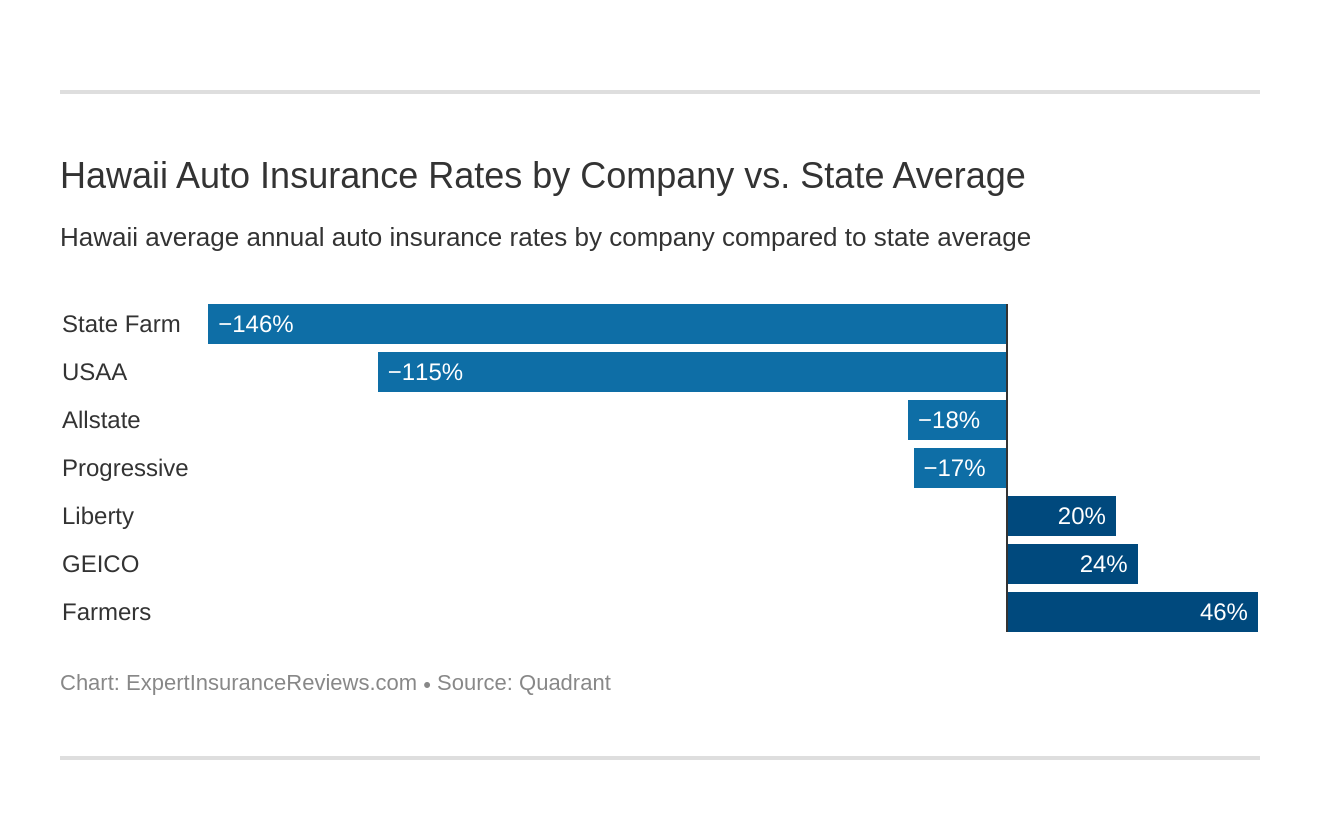

Cheapest Insurance Companies in Hawaii

You’ve probably been wondering, what is the cheapest car insurance in Hawaii? Well, we have the answer for you. Take a look at the chart below.

| Company | Annual Average | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate | $2,173.49 | -$382.70 | -17.61% |

| Farmers | $4,763.82 | $2,207.64 | 46.34% |

| GEICO | $3,358.86 | $802.68 | 23.90% |

| Liberty Mutual | $3,189.55 | $633.37 | 19.86% |

| Progressive | $2,177.93 | -$378.25 | -17.37% |

| State Farm | $1,040.28 | -$1,515.90 | -145.72% |

| USAA | $1,189.35 | -$1,366.83 | -114.92% |

Compared to the state average, both State Farm and USAA had the lowest rates. Among the highest were Farmers and GEICO.

Commute Rates by Companies

Your commute times can also affect the rates you pay for your car insurance. Let’s see which companies give their customers a break for longer commutes, and which are a tad bit little less forgiving.

| Company | 10 miles commute, 6000 annual mileage | 25 miles commute, 12000 annual mileage |

|---|---|---|

| Allstate | $2,035.52 | $2,311.46 |

| GEICO | $3,358.86 | $3,358.86 |

| Liberty Mutual | $3,189.55 | $3,189.55 |

| Progressive | $2,177.93 | $2,177.93 |

| State Farm | $1,040.28 | $1,040.28 |

| USAA | $1,189.35 | $1,189.35 |

Out of all the companies listed, Allstate is the only one that raises its rates for longer commutes. No other company takes commute times into account when determining rates.

Coverage Level Rates by Companies

Every individual starts with the basic amount of coverage for car insurance. But what if you’re looking for more than the standard level of coverage? Let’s take a look.

| Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $2,020.68 | $2,178.85 | $2,320.93 |

| Farmers | $4,573.64 | $4,799.09 | $4,918.73 |

| GEICO | $3,199.86 | $3,383.08 | $3,493.66 |

| Liberty Mutual | $3,193.05 | $3,009.99 | $3,365.61 |

| Progressive | $1,988.28 | $2,176.37 | $2,369.14 |

| State Farm | $969.68 | $1,042.97 | $1,108.19 |

| USAA | $1,123.14 | $1,188.96 | $1,255.96 |

Liberty Mutual had the lowest change rate at 5.40 percent, as they rarely penalized their customers for wanting to extend their coverage. Progressive, on the other hand, upped their rates by 19.16 percent for customers who wanted more coverage. Again, this is all useful information when selecting an insurance company.

Credit History Rates by Companies

Your credit history could have a dramatic impact on your rates in some states. Fortunately, Hawaii is one of the states that bans insurance companies from basing rates on a person’s credit score.

You heard it right. In Hawaii, it is illegal for insurance companies to factor in one’s credit when generating rates. Good news for those who may have fair to poor credit. But what about your driving record? We’ll get to that next.

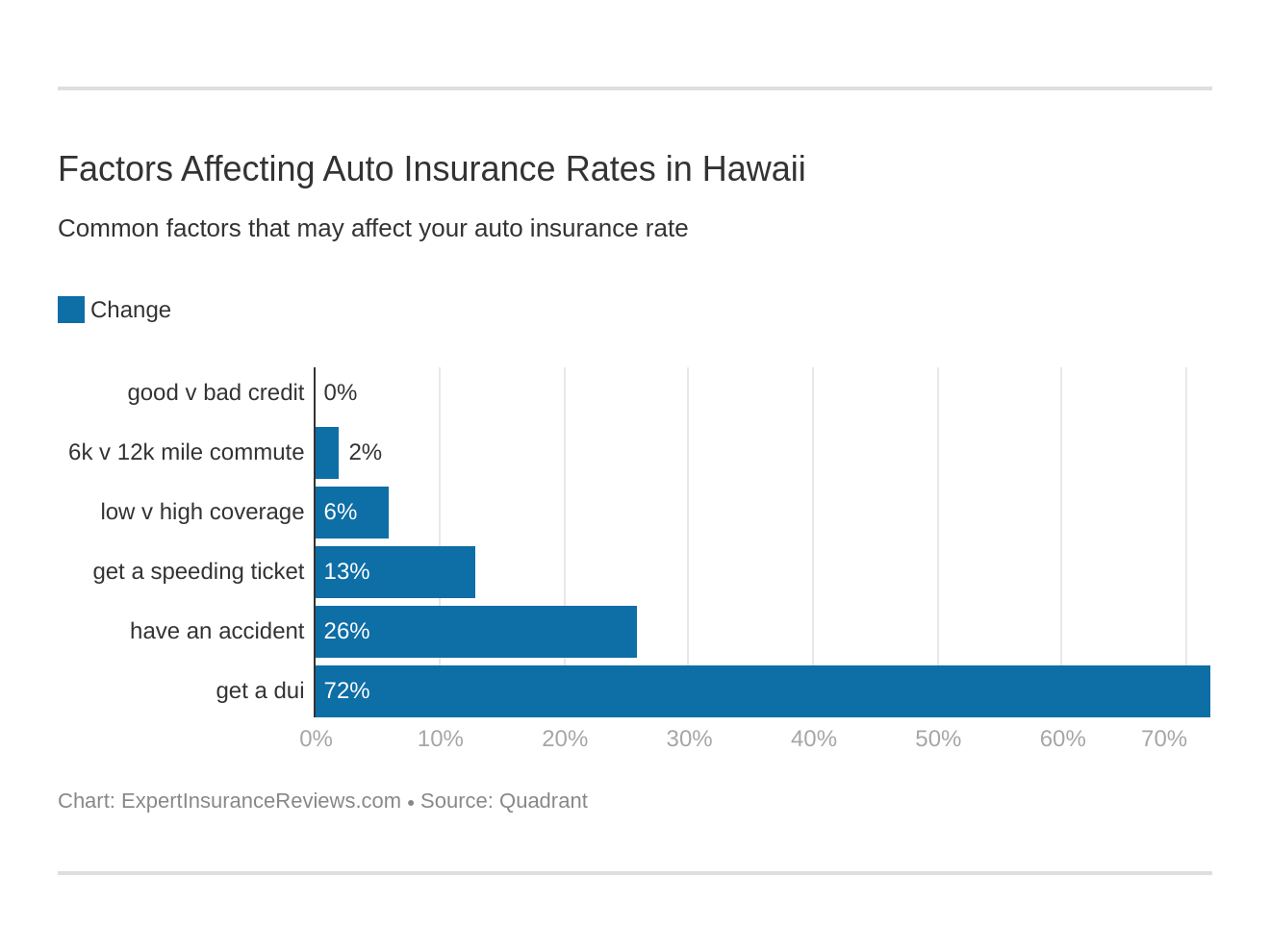

Driving Record Rates by Companies

Do you have a good driving record? Or have you had some bumps and bruises along the way? Well, insurance companies also factor this in when they are determining car insurance rates.

Check out the chart below.

| Company | Clean Record | With 1 Speeding | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $1,293.11 | $1,774.29 | $1,904.18 | $3,722.37 |

| Farmers | $2,290.51 | $2,290.51 | $3,419.86 | $11,054.40 |

| GEICO | $1,414.01 | $1,414.01 | $1,834.57 | $8,772.86 |

| Liberty Mutual | $1,697.57 | $2,124.22 | $2,124.22 | $6,812.19 |

| Progressive | $1,649.25 | $2,137.29 | $2,322.92 | $2,602.26 |

| State Farm | $950.44 | $1,040.29 | $1,130.10 | $1,040.29 |

| USAA | $901.19 | $942.77 | $1,109.67 | $1,803.79 |

In the State of Hawaii, State Farm is most forgiving, only upping their rates 9.45 percent if you get a DUI with a previously clean record.

That’s not the case for other companies. Let’s take a look at rate changes–GEICO comes in at the highest rate with 520.42 percent, Famers at second highest with 382.62, followed by

Liberty Mutual with 301.29 percent.

If you are living in the state of Hawaii or planning to move there soon, this information is good to know, as you’d want to have a clean driving record while traveling along the luscious green roads in the Aloha State.

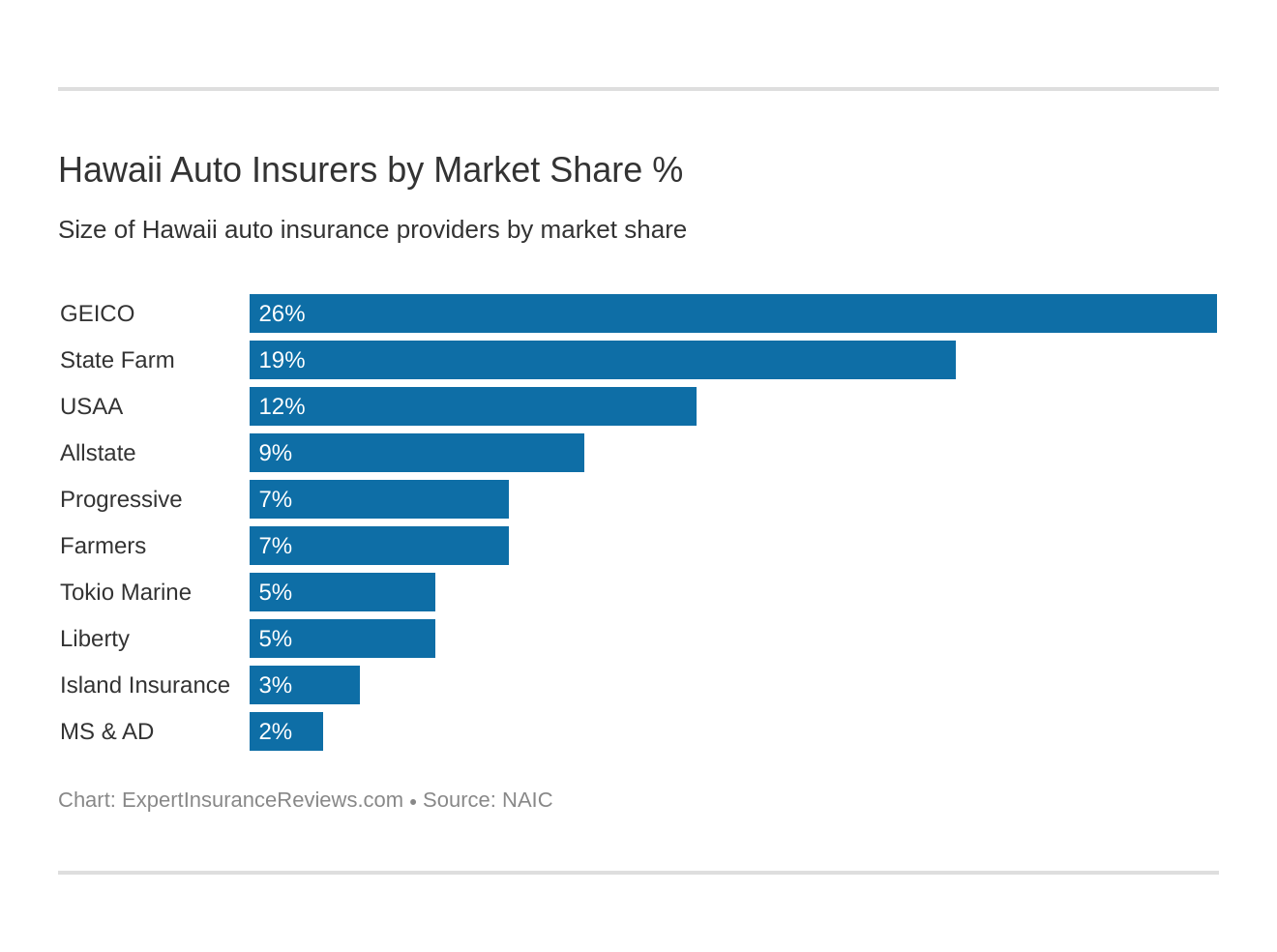

Largest Car Insurance Companies in Hawaii

A company’s market share represents the percentage of the car insurance industry that is owned by that company for a given period of time.

Let’s take a look at the chart and see the largest companies in the state of Hawaii.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| GEICO | $198,986 | 26.45% |

| State Farm Group | $139,679 | 18.56% |

| USAA Group | $90,542 | 12.03% |

| Allstate Insurance Group | $67,866 | 9.02% |

| Progressive Group | $53,397 | 7.10% |

| Farmers Insurance Group | $51,498 | 6.84% |

| Tokio Marine Holdings Inc Group | $38,833 | 5.16% |

| Liberty Mutual Group | $34,387 | 4.57% |

| Island Insurance Co Group | $24,127 | 3.21% |

| MS & AD Insurance Group | $17,932 | 2.38% |

GEICO holds the largest market share with 26.45 percent, followed by State Farm with 18.56 percent.

Number of Insurers by State

A domestic insurer conducts its business in the company’s home country, while foreign insurers are based outside the company’s predominant country of business.

In Hawaii there are 17 domestic insurers and 608 foreign insurers, for a total of 625 insurers–a lot of options to choose from for a relatively small state.

Hawaii State Laws

It would be helpful to know the laws on and off the road to ensure a safe and informed journey. How can you get to know these laws when there are so many and some have multiple stipulations.

Don’t worry, we’ve got you. In this next section, we’ll be discussing laws off and on the road. We’re talking about insurance laws, vehicle and safety laws, as well as the rules of the road. So buckle up, let’s continue our journey through paradise.

Hawaii Car Insurance Laws

Car insurance laws vary from state-to-state. Whether you’re a local in Hawaii or someone traveling through the state, being aware of these laws is extremely important. (For more information, read our “Hawaii Car Insurance Laws“).

Let’s take a look at the legislation of car insurance in the state of Hawaii.

How State Laws for Insurance are Determined

How do insurance laws work in Hawaii?

Hawaii is currently under Prior-Approval law. This simply means that before an insurer can choose rates, they must get approval beforehand from the state.

In instances where the insurer has not heard from the state over a given time period, they may assume the rates have been approved already–for example, if an insurer hasn’t heard from the state in 90 days, they may assume (in some states only) that their rates have been approved.

Windshield Coverage

Driving with a cracked windshield is against the law. And let’s face it, accidents do happen. In the state of Hawaii, however, there are no insurance regulations regarding car windshields.

You can, however, check with your insurer to see if your policy offers some type of coverage or discount at auto repair locations.

High-Risk Insurance

Drivers who’ve had a bad record on the road are considered high-risk drivers for insurers.

Thankfully, Hawaii has a program that gives those drivers a second chance to drive the roads of the Aloha state. This program is called the Hawaii Joint Underwriting Plan, or HJUP.

The HJUP program secures drivers who’ve had bad luck getting covered at a licensed insurance company due to their bad driving record. All insurers in the state must participate and offer at least the minimum amount of coverage required by the state.

Customers can apply through any agent at any insurance company, and one of the three servicing companies in the plan–First Insurance, Island Insurance, or State Farm Insurance–will be chosen based on the customer’s preference.

Low-Cost Insurance

Only a handful of states currently offer affordable car insurance for low-income individuals–California, New Jersey, and, you guessed it, Hawaii.

This low-cost insurance is available for individuals who are currently receiving help through Hawaii’s Assistance to the Aged, Blind, and Disabled (AABD) program.

This program provides cash aid, food aid, shelter, and other resources including low-cost insurance. This is great news, especially for low-income individuals and people with special needs. Visit the AABD website linked above to see if you qualify.

Read more: Best Car Insurance for Disabled Drivers

Automobile Insurance Fraud in Hawaii

With insurance laws come laws to protect against erroneous use. Insurance fraud is serious and is considered a crime in the state of Hawaii.

Reporting insurance fraud is easy. Simply call the Insurance Fraud Investigation Branch hotline at (808) 587-7416.

You can also visit the Hawaii Department of Commerce and Consumer Affairs website to fill out a Suspected Fraudulent Claim Referral form and send it to the branch by mail at:

Hawaii Insurance Division

Insurance Fraud Investigation Branch

P.O. Box 3614

Honolulu, Hawaii 96811

No fraud on our watch. Enter your ZIP code to find the cheapest rates for you and your family.

Statute of Limitations

A statute of limitations is the period of time one has to bring a legal matter to court.

With insurance laws, a person has two years to file a complaint regarding bodily injury and property damage.

Two years isn’t a lot of time, and often the agency’s process will take a while, as they are helping hundreds to thousands of people, so be sure to put in a claim as soon as the incident occurs.

State Specific Laws

One law worth noting is that it is illegal to smoke with a child in the car. This law applies to both tobacco products and e-cigarettes.

It is also illegal to ride in the back seat of a vehicle without a seatbelt in Hawaii. However, if all other seats are taken, it’s permissible to ride in the bed of a pickup truck without a seatbelt.

Vehicle Licensing Laws

Now that we’re good on insurance laws, we’ll investigate laws relating to the administering of vehicle and driver permits in Hawaii.

REAL ID

According to Homeland Security, the REAL ID Act was established so that the government could set higher standards for the issuance of sources of identification, including driving licenses.

Examples of occasions where REAL ID-compliant documentation would be relevant would be if you were preparing to board a domestic flight or to enter a federal building.

And since many individuals fly in Hawaii, it’s worth the investment to obtain the newer IDs, for both state IDs and driver’s licenses.

Penalties for Driving Without Insurance

Get covered.

In Hawaii, it’s illegal to drive without insurance. If you’re caught, the following penalties will apply:

- First Offense: $500 fine or community service granted by a judge; either license suspension for three months or a required nonrefundable insurance policy enforced for six months.

- Second Offense: $1500 minimum fine paid within five years; either license suspension for one year or a required non-refundable insurance policy enforced for six months.

And we don’t want that.

Teen Driver Laws

According to the Insurance Institute for Highway Safety (IIHS), Hawaii’s approach to driver’s education is a three-tiered program that equips teens with the necessary tools and experience to drive safely on the road in the Aloha state.

Learner Stage:

- Minimum Entry Age: 15 years and six months old

- Mandatory Holding Period: Six months

- Minimum Amount of Supervised Driving: 50 hours, 10 of which must be at night

- Minimum Age to Enter Next Stage: 16 years old

Intermediate Stage (Restrictions on Driving While Unsupervised):

- Unsupervised driving prohibited: 11 p.m.-5 a.m.

- Restrictions on passengers (family members excepted unless otherwise noted): No more than one passenger younger than 18 (household members excepted)

- Nighttime restrictions: Last for six months and until age 17

Unrestricted State (When Restrictions May Be Lifted):

- Passenger Restrictions: Last for six months and until age 17

Older Driver’s License Renewal Procedures

In the state of Hawaii, drivers must get their licenses renewed every two years if they are 72 or older. This can be done by mail, limited to two consecutive renewals, but the driver must appear in person at least once every 16 years.

Any elder driver younger than 72 must get their license renewed every eight years. Again, this can be done by mail, limited to two consecutive renewals, and the individual must appear in person at least once every 16 years.

New Residents

Once you become a resident of Hawaii, you must apply for a Hawaii driver’s license within 30 days.

The state of Hawaii has prepared an online guide that provides new residents with the information needed to apply for their Hawaiian license.

License renewal procedures

In Hawaii, one must renew their license six months before its expiration date. You’ll want to make an appointment to get started.

Negligent Operator Treatment System (NOTS)

While states like California have a point system for drivers with bad records, Hawaii does not.

Hawaii demerit points are no longer applied by the Department of Motor Vehicles (DMV) to your driving record, so that’s one thing you don’t need to worry about.

This does not mean that you don’t have to drive responsibly. In fact, roadway violations are recorded and can be viewed by your employer or insurance agent if requested.

Hawaii is a gorgeous and scenic place to drive, but be sure to do so responsibly.

Rules of the Road

Now we’re on the road, literally.

Let’s check out the rules of the road in the Aloha State. Knowledge of these will be beneficial for all drivers, whether you’re a local just brushing up or an out-of-state visitor completely unaware of the specific regulations for driving in Hawaii.

Let’s begin.

Fault vs. No-Fault

Hawaii is considered a “no-fault” state. This simply means that the claimant must turn to their own insurance policy for damages and medical expenses, whereas in a “fault” state, the driver at fault for the accident would be responsible for damages.

The good thing about Hawaii, however, is that it has PIP protection; as stated earlier, this will pay for your personal bills in the event of a collision. PIP insurance policies kick in regardless of who was at fault for the car accident.

Seat belt and car seat laws

Seat belt laws are extremely important, as they are one of the major defenses in preventing an injury during an accident. In the state of Hawaii, there are seat belt regulations for individuals of all ages.

According to IIHS, seat belt laws have been in effect since 12/16/85. Seat belt laws apply to those who are 8+. Failure to comply could result in a maximum base fine of $45. Things differ, however, when it comes to smaller children.

As stated in the video, children under four years old need to be in a safety seat; children 4-7 years old must be in a child restraint or booster seat.

Children that are older than seven and are taller than 4’9″ are permitted to sit in an adult seat; they should be seated in a rear seat and their seat belt must be secured. Failure to comply could result in a maximum base fee of $100.

Placing children in a rear seat is not a legal requirement, just a safety suggestion.

Keep Right and Move Over Laws

This video outlines the move over laws in the state of Hawaii. Take a look.

If a driver is approaching a vehicle in distress, they are required to move over to the next lane, or slow their speed when approaching if the former isn’t an option.

Speed Limits

In Hawaii, the maximum speed limit is established by county ordinance or by the director of transportation. Generally speaking, here are the speed limits for driving in the Aloha state:

Rural interstates: 60 MPH

Urban interstates: 60 MPH

Other limited-access roads: 55 MPH

Other roads: 45 MPH

Be sure to always use your discretion when you are out on the road.

Ridesharing

In the state of Hawaii, transportation network companies, or TNCs, like Uber and Lyft are very popular, especially in heavily-populated areas like Honolulu, Kaneohe, Maui, and Waipahu. TNC drivers are required to carry the minimum amount of insurance coverage for the state in which they are driving.

Automation on the Road

“Automation” refers to computerized operations that were previously done by humans.

Currently, in the state of Hawaii, there is testing of automation on the road, though there are no laws specifically regulating it as of yet.

Safety Laws

Still with me?

Let’s check out safety laws in Hawaii pertaining to DUIs, marijuana impairment, and distracted driving.

DUI Laws

Every state recognizes that driving under the influence is a serious crime that claims the lives of individuals daily. Check out these DUI facts regarding the Aloha State.

| DUI LAW IN HAWAII | DETAILS |

|---|---|

| Name of Offense | Driving Under the Influence (DUI) / Operating a Vehicle Under the Influence of an Intoxicant (OVUII) |

| BAC Limit | 0.08 |

| High BAC Limit | NA |

| Criminal Status by Offense | 1st-3rd petty misdemeanors, 4th+ class C felony |

| Look Back Period | 5 years |

And what if those laws are broken? Below we’ve listed a series of consequences for driving while under the influence of alcohol.

| OFFENSE NUMBER | ALS OR REVOCATION | IMPRISONMENT | FINE | OTHER |

|---|---|---|---|---|

| 1st | 1 year | 48 hours-5 days | $150-$1000 +$25 to neurotrama special fund +$25 to trauma system special fund if court ordered | 14 hour min rehab program; may require 72 hours community service; IID for 1 year |

| 2nd | 2nd offense in 5 years: 18 months-2 years | min 240 community service hours OR 5-30 with 48 consecutive hours | $500-$1500+$25 to neurotrama special fund+$50 to trauma system fund if court ordered; additional $500 if child in vehicle | abuse and education program required; IID during revocation period |

| 3rd | in 5 years of prior two convictions, 2 year revocation | 10-30 days, 48 hours served consecutively | $500-$2500+$25 to neurotrama special fund+$50 to trauma system fund if court ordered; additional $500 if child in vehicle | 240 min community service; abuse and education program required, IID required during revocation period |

We certainly wouldn’t want that. And alcohol isn’t the only potential impairment one might have while traveling on the road. Let’s talk about marijuana-impaired driving next.

Marijuana-Impaired Driving Laws

We all know that marijuana has been a hot topic in recent years. How much is too much in the system while driving? What levels could cause major mishaps on the road?

Unfortunately, Hawaii doesn’t have any laws in place specific to driving while impaired from marijuana use.

And although marijuana has been decriminalized in Hawaii, you could still get in trouble for using any substance that affects your ability to drive safely. This is definitely something to keep in mind.

Distracted Driving Laws

Distracted driving laws center around an individual’s potential lack of focus while driving on the road. Eating while driving is one example, but the most infamous is texting and driving.

Hawaii’s distracted driving laws prohibit all motorists from using a handheld mobile electronic device while driving. And for certain drivers, even hands-free device use is prohibited.

There are restrictions on teenagers as well.

Drivers under 18 years old are completely prohibited from using an electronic device while operating a vehicle, even with hands-free or voice-operated technology.

Driving Safely in Hawaii

Wow, we’ve covered a lot.

From Hawaii’s roadway laws and expectations to automation and a look at the future of distracted driving laws. What a journey. Hopefully, you now feel a bit more comfortable with Hawaii’s laws and can drive through the islands of paradise secure, informed, and safe.

Hang in there.

This next section will deal with dangers that you could face while on the road, including the potential for fatalities due to speeding, weather conditions, and more. We’re even covering which areas are more prone to accidents and danger. This data is simply meant to inform you so that you can be prepared at all times while on the road.

Let’s begin.

Vehicle Theft in Hawaii

Here’s a look at the top 10 most stolen vehicles in Hawaii, according to the National Insurance Crime Bureau.

| Make/Model | Year | Thefts |

|---|---|---|

| Honda Civic | 2000 | 250 |

| Honda Accord | 1994 | 180 |

| Ford Pickup (Full Size) | 2006 | 154 |

| Toyota Tacoma | 2003 | 86 |

| Toyota Corolla | 2004 | 64 |

| Toyota Camry | 2000 | 55 |

| Toyota 4Runner | 1997 | 45 |

| Nissan Frontier | 2004 | 44 |

| Nissan Altima | 2004 | 42 |

| Dodge Pickup (Full Size) | 2001 | 37 |

According to the list, the Honda Civic was the most frequently stolen car in Hawaii in 2016 with 250 thefts. This was followed by the Honda Accord and the Ford Pickup (full size), with 180 thefts and 154 thefts respectively.

Below you will find the FBI’s vehicle theft statistics for 2017. While Hawaii is made up of multiple islands, data is only available for Hawaii’s capital city, Honolulu.

| City | Motor Vehicle Theft (2017) |

|---|---|

| Honolulu | 3,606 |

The population in Hawaii at the time was 359,870, so that would’ve been roughly 1 theft for every 100 individuals.

Road Fatalities in Hawaii

Now we’ll be delving into the most common causes of accidents using state-by-state statistics. NHTSA’s Traffic Safety Facts will also give us insight into some important information related to EMS response times.

If you’re driving daily in Hawaii, these statistics are something to keep in mind.

Most Fatal Highway in Hawaii

Route 11 is considered Hawaii’s most dangerous highway. It is located on the island of Hawai’i and has roughly six fatal crashes per year.

Fatal Crashes by Weather Condition and Light Condition

We’ve also got data that displays what factors—like weather, for instance—can cause fatal accidents. Let’s take a look.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 37 | 26 | 14 | 2 | 0 | 79 |

| Rain | 5 | 6 | 1 | 0 | 0 | 12 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 1 | 1 | 0 | 0 | 2 | 4 |

| TOTAL | 43 | 33 | 16 | 2 | 2 | 96 |

Most of the accidents caused in Hawaii occurred under normal conditions, mainly during daylight hours. Weather was not a major factor in most road fatalities.

Fatalities (All Crashes) by County

Knowing fatalities by county can also put things into perspective, especially if you or your family members live in a county with a high rate, as this may mean you should use extra caution.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Hawaii County | 13 | 21 | 32 | 35 | 32 |

| Honolulu County | 53 | 48 | 59 | 49 | 62 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 |

| Kauai County | 8 | 3 | 8 | 6 | 6 |

| Maui County | 21 | 21 | 21 | 17 | 17 |

In all five years, Honolulu had the most fatalities, followed by Hawaii County, and then Maui. This isn’t much of a surprise, however, as these hot spots are heavily populated and thriving throughout the year–which could ultimately mean more accidents.

Traffic Fatalities

Did you know there’s even data that provides the number of accidents based on urban and rural settings?

| Road Types | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Rural | 30 | 13 | 25 | 25 | 26 |

| Urban | 65 | 80 | 94 | 82 | 91 |

| Total | 95 | 93 | 120 | 107 | 117 |

Over the past three years, urban settings have had a higher number of accidents by far compared to rural settings.

Fatalities by Person Type

This is important information, as knowing which individuals are more prone to accidents can give you a heightened level of awareness while on the road.

Let’s take a look.

| Passenger Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Bicyclist and Other Cyclist | 4 | 2 | 0 | 6 | 2 |

| Large Truck | 0 | 0 | 1 | 0 | 0 |

| Light Truck - Other | 0 | 0 | 5 | 0 | 0 |

| Light Truck - Pickup | 15 | 9 | 8 | 10 | 15 |

| Light Truck - Utility | 7 | 7 | 7 | 12 | 3 |

| Light Truck - Van | 0 | 1 | 3 | 3 | 3 |

| Motorcyclists | 25 | 26 | 24 | 25 | 34 |

| Passenger Car | 16 | 20 | 40 | 34 | 16 |

| Pedestrian | 24 | 25 | 29 | 14 | 42 |

| Other/Unknown Nonoccupants | 4 | 2 | 3 | 1 | 2 |

| Other/Unknown Occupants | 0 | 1 | 0 | 2 | 0 |

According to the data, both motorcyclists and pedestrians tie for the number of accidents caused leading up to 2018. Passenger cars and light pickup trucks follow, respectively.

Fatalities by Crash Type

Knowing the different types of common accidents can also be informative, as one might want to exercise extra caution, for instance, when going through an intersection or a roadway departure. Let’s look at the crash types for Hawaii from 2014-2018.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Single Vehicle | 68 | 54 | 75 | 59 | 75 |

| Involving a Large Truck | 4 | 5 | 6 | 9 | 7 |

| Involving Speeding | 36 | 41 | 54 | 51 | 51 |

| Involving a Rollover | 10 | 14 | 16 | 26 | 9 |

| Involving a Roadway Departure | 44 | 42 | 65 | 60 | 49 |

| Involving an Intersection (or Intersection Related) | 30 | 26 | 31 | 30 | 35 |

Most accidents were single-vehicle, followed by accidents involving a roadway departure, and lastly, accidents involving speeding. Again, this data is something to consider when you’re on the road, both in terms of how you approach your own driving and how you monitor other drivers.

Five-Year Trend For the Top 10 Counties

How do the top counties fare when it comes to automobile fatalities?

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Hawaii County | 13 | 21 | 32 | 35 | 32 |

| Honolulu County | 53 | 48 | 59 | 49 | 62 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 |

| Kauai County | 8 | 3 | 8 | 6 | 6 |

| Maui County | 21 | 21 | 21 | 17 | 17 |

Again, Honolulu comes in at the top with the highest number of fatalities in all five years. It is a popular attraction site for tourists, being the state capital and known for its nightlife and all sorts of other activities–perhaps the tourists have a harder time navigating the roads than the locals.

The counties of Hawaii and Maui followed respectively, and these are also well-known hot spots on the island chain.

Fatalities Involving Speeding by County

Speeding plays a major role in car accidents. Every year we gather statistics on how speeding caused fatal situations. According to the data below, certain counties have more incidents involving speeding than others.

Let’s take a look.

| County Name | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Hawaii County | 4 | 9 | 12 | 19 | 12 |

| Honolulu County | 19 | 21 | 30 | 26 | 32 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 |

| Kauai County | 3 | 1 | 4 | 1 | 1 |

| Maui County | 10 | 10 | 8 | 5 | 6 |

Once again we have popular Honolulu leading the pack all five years for the county with the most speeding, followed by Hawaii and Maui respectively. Kalawoa and Kaui are among the safest counties regarding fatal speeding incidents.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

And what about alcohol-impaired fatalities? There’s even data that displays which counties are more susceptible to fatal incidents involving alcohol impairment.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Hawaii County | 3 | 7 | 8 | 9 | 9 |

| Honolulu County | 17 | 17 | 18 | 19 | 18 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 |

| Kauai County | 2 | 1 | 4 | 1 | 2 |

| Maui County | 7 | 12 | 7 | 13 | 7 |

There have consistently been more impaired driving accidents in the populous Honalulu than any other county, while others, like Kalawao County, have been consistently safe.

Teen Drinking and Driving

Not only is there data for alcohol-impaired drivers, but there’s a subset specific to teen DUIs.

| TEEN DRINKING AND DRIVING | HAWAII | NATIONAL |

|---|---|---|

| DUI Arrest (Under 18 years old) | 23 | 102.82 |

| DUI Arrests (Under 18 years old) Total Per Million People | 74.67 | 94.84 |

| Under 21 DUI fatalities for 100,000 population | 1.4 | 1.2 |

Hawaii falls below the national average number of DUI arrests for individuals under 18 years old, ranking 28th in the nation.

Unfortunately, however, Hawaii is above the national average when it comes to DUI fatalities for individuals under 21, according to Responsibility.org

EMS Response Time

Lastly, here’s a look at the average EMS response times in Hawaii.

| EMS Response Time | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 4.00 | 16.32 | 40.71 | 62 |

| Urban | 3.69 | 8.49 | 31.18 | 43.82 |

In Hawaii, the response to urban emergencies was quicker than the response in rural areas.

Transportation in Hawaii

Lastly, we’ll take a look at transportation in Hawaii. We’ll learn about car ownership, commute time, and more.

Car Ownership

According to DataUSA, most households in the Aloha state own two cars, with one car being the second most popular response.

Commute Time

And when it comes to commute times, workers in Hawaii have only a slightly longer commute at 25.8 minutes than the national average, which is 25.5 minutes.

Commuter Transportation

How do Hawaiians get to work? Well, in 2017, most people reported driving alone (67.6 percent), followed by those who carpooled (13.3 percent), and then those who rode public transit (6.15 percent).

Traffic Congestion

And last but not least, traffic congestion.

| City | Hours Lost in Congestion | Cost of Congestion Per Driver | Inner City Travel Time (Minutes) | Inner City Last Mile Speed (mph) |

|---|---|---|---|---|

| Honolulu | 92 | $1,282 | 5 | 12 |

It shouldn’t come as any surprise that Honolulu ranks as the top city in the Aloha State for traffic congestion, according to data gathered from INRIX’s 2018 Global Traffic Scorecard.

Honolulu’s congestion is increasingly problematic, as it earned the 10th spot on the list of cities with the most traffic in 2016, and the time spent in congestion since then has nearly doubled.

And there you have it. Our ultimate guide for the state of Hawaii, from car insurance rates, the best companies, state and road laws, and statistics for your everyday driving experience.

Before we part ways, we wanted you to know what we’ve compiled the best insurance rates from different companies for you to consider. Check it out below, and again, Aloha.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum car insurance requirements in Hawaii?

In Hawaii, the minimum car insurance requirements are $20,000 per person and $40,000 per accident for bodily injury liability coverage, as well as $10,000 for property damage liability coverage.

What additional types of car insurance coverage should I consider in Hawaii?

In addition to the minimum coverage requirements, you may want to consider adding collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP) coverage to your car insurance policy in Hawaii.

Does Hawaii require uninsured/underinsured motorist coverage?

Uninsured/underinsured motorist coverage is not required in Hawaii, but it is a good idea to consider adding it to your policy to protect yourself in the event of an accident with a driver who does not have enough insurance to cover your damages.

How can I find the best car insurance rates in Hawaii?

To find the best car insurance rates in Hawaii, you can compare quotes from multiple insurance companies and consider factors such as coverage options, deductibles, discounts, and customer reviews. Working with an independent insurance agent can also help you find the best coverage at the most affordable price.

What discounts are available for car insurance in Hawaii?

Car insurance discounts that may be available in Hawaii include safe driver discounts, multi-policy discounts, multi-vehicle discounts, good student discounts, and discounts for anti-theft devices or safety features on your vehicle.

Can my car insurance rates be increased in Hawaii if I get into an accident?

Your car insurance rates may increase in Hawaii if you get into an accident, particularly if you are found to be at fault for the accident. However, some insurance companies offer accident forgiveness programs that may help mitigate the impact of a single accident on your rates.

What should I do if I have a car insurance claim in Hawaii?

If you have a car insurance claim in Hawaii, you should contact your insurance company as soon as possible to report the incident and provide any necessary information. Your insurance company will guide you through the claims process and help you get the coverage you need to repair or replace your vehicle.