Allstate Home Insurance Review & Complaints: Home Insurance (2025)

The average Allstate home insurance rates are $377.75/mo. Allstate is the number two insurance provider in the nation and makes an effort to give back to the community, and homeowners are easily covered with affordable rates that are slightly below competitors.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

UPDATED: Feb 2, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 2, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Allstate Insurance Overview | Details |

|---|---|

| Year Founded | 1931 |

| Current Executives | President & CEO - Tom Wilson |

| Number of Employees | 10,000 Agency Owners & 24,000+ Licensed Sales Professionals |

| Total Sales/Assets | $112.2 billion (2018) |

| HQ Address | 2775 Sanders Road, Northbrook, IL, 60062 |

| Phone Number | 1-847-402-5000 |

| Company Website | www.allstate.com |

| Premiums Written | 8,262,445 |

| Loss Ratio | 65.55% |

| Best For | Discounts, first time homebuyers, homesharing hosts, young parents, cheap rates |

Your home and the belongings within that home are often the most important investments in your life. That is not to say a person is made-up of the things they own, but in the real world, a home is a significant financial investment not just in the present for safety and shelter but also your future, both in living conditions and financial well-being.

As with any investment, you need to be prepared for unexpected loss or damage by safeguarding that investment with an insurance policy that is affordable and fits your needs as a homeowner. The good hands of Allstate, now the number two insurance provider in the nation with its wide range insurance policies, have got you covered on this front.

The people who live in your home are not seen as a tangible investment, but they are just as important to you. You have invested your time, love, and appreciation in them you want to protect them. Allstate understands the importance of safeguarding your family by providing homeowners insurance as well as multiple additional coverage options to protect those you hold most dear.

When it comes to personal property coverage and the many other types of insurance you may need, Allstate has more than enough options to protect your valuable items. They have been covering America for over 80 years with an ever-changing business model placing consumer needs front and center. They offer just about any insurance you could possibly need. And with that wide list of insurance lines comes a series of bundling discounts as well as the convenience of keeping all of your insurance under the same roof.

From their start as a mail-order insurance provider that transitioned into a more personal agent-based business model and now is pivoting again taking full advantage of online capabilities, they have shown an ability to adapt to the needs of the consumer in an ever-changing market. Their home insurance policies offer coverage for a variety of living situations including standard homeowners, condos, renters, and landlords, and every Allstate agent is dedicated to working with you to find the right policy to fit your home and life plan.

How can you tell if Allstate is right for you? We can help. We’ve provided a detailed run-down of Allstate as the nation’s number two insurance provider. Below you will find our full review of Allstate’s credit ratings and financial stability, market share data, customer reviews, and the ease/difficulty of their claims process. The information will help you better understand Allstate as a company but more importantly if their policies will meet your home insurance needs.

If you’d like to start comparing rates now from multiple homeowners insurance companies, try out our free online quote option above. Get a head start on planning for the safety and well-being of your financial investment of today and tomorrow.

What Are Allstate Ratings?

As a top ten ranked insurance provider, it may be easier to just assume that, as their slogan appropriately implies, you will be in good hands if you take out a home insurance policy with Allstate. However, the easy way hardly ever affords you the trust and security you need when it comes to safeguarding your home investment. A customer satisfaction rating review will give you a general idea of how a company performs, but a more in-depth look provides the good faith that you are not just in good hands, but the right hands to meet your needs as a homeowner. What good is the most affordable policy that meets your needs as a homeowner if poor customer service fails to match those same standards making the entire claims process a nightmare?

Since we are never ones to assume when it comes to securing one of your biggest investments not just for today but for the future as well, we have taken the liberty to check further into Allstate’s background diving deep into their credit rankings, industry reports, and customer satisfaction reviews. All things considered, Allstate may be a safe-bet as the number two home insurance provider for multiple perils, but wouldn’t you rather hedge your bets with some insider information making it a true sure thing when it comes to a payout on your investment.

The chart below lists a quick overview, or scorecard if you will, showing just how Allstate stacks up as a fiscally responsible company that services its policyholders well.

| Ratings Agency | Rating |

|---|---|

| A.M. Best | A+ |

| Better Business Bureau | A+ |

| Moody's Rating | Aa3 |

| S&P Rating | AA- |

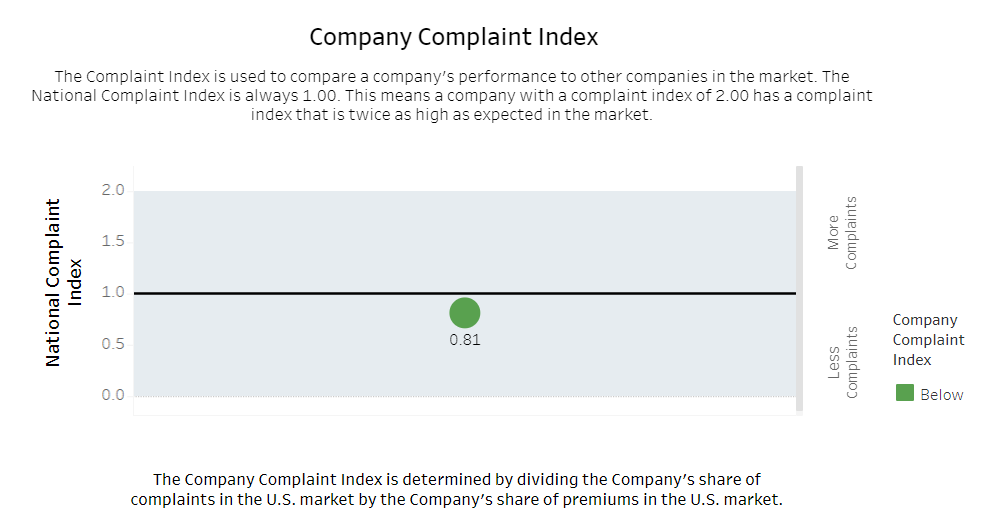

| NAIC Complaint Index | 0.81 |

| Fitch Rating | A+ |

| J.D. Power | 3/5-3/5 |

If we are going by grade school rules, then Allstate appears to have an honor roll report card, and that assumption is not too far off. The snapshot above attests that Allstate has an above-average credit ranking with a very stable outlook of continued growth in the future. It also suggests that their customer service is a little more than adequate since they remain below the national average of measured complaints in the insurance industry.

At this point, you may have started asking yourself the big three questions. What are these watchdog agencies? How do they rate each company? And more importantly, why do their opinions matter? When it comes to picking the right homeowners policy that meets your needs, you need to make sure that your insurance provider can back you up financially in the here and now but also in the years to come. You also want to make sure that they’re capable of servicing your claims in the customer service department.

We have gone ahead and answered those big 3 below with a detailed rundown of each of these rating agencies to give a better understanding of how Allstate operates as a company in the past, present, and future.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

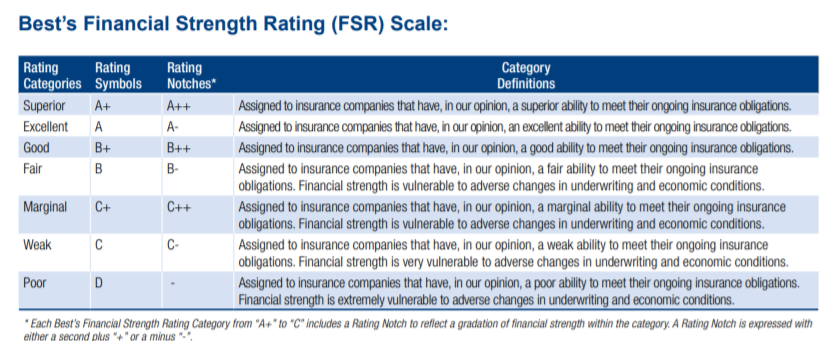

What Are the Ratings from A.M. Best?

Operating as a financial watchdog for the insurance industry since 1899, A.M. Best has reviewed over 100 years of insurance policy work bringing with them a high measure of clout, a wealth of experience, and industry knowledge. A.M. Best remains one of the major credit ranking agencies that round out the majority of opinions and facts for the financial solvency of insurance providers; out of the other credit ranking agencies, A.M. Best earns our top of the list spot for focusing solely on the insurance industry.

Their ranking system measures not just the quantity but also the quality of the company as a financial investment with the bonus of projecting the potential future outlook of operating performance as well. Below is a detailed chart of each letter grade on their scale what they mean for any given insurance provider.

A.M. Best awarded Allstate with top marks as they received an A++ rating. The review from Best states the assertion that Allstate is both financially stable now and poised for significant growth. They are in a superior, to use the ratings agency’s lingo, position as an insurance provider from the credit angle and even received extra + marks to reflect recent change and growth. Allstate is stable and experiencing significant growth in the financial sector which means they are a safe investment for your future.

What Are the Ratings from Better Business Bureau?

Think of the Better Business Bureau (BBB) as the nation’s complaint department. They field complaints on both a national and local level for any companies operating in the United States; BBB assigns ratings from A+ (highest) to F (lowest). They process these reviews to provide accountability, higher working standards, and positive feedback by giving the consumer a voice. And here we thought yelp was such a novel idea to provide feedback and hold restaurants to a higher standard when the BBB has been at it even longer.

The BBB’s rating system takes a systematic approach to measuring the number of complaints a business receives as well as a company’s efficiency in responding to those complaints. The ultimate goal is to provide everyday consumers with an inside look into how their local businesses operate, so these very same consumers can conduct transactions with a business they can trust.

A positive rating with the BBB goes a long way in explaining how a company operates daily with actual consumers. If an affordable policy fits your needs as a homeowner, but you can not easily file your claim, then what good are the savings or the policy for that matter? Customer service is just as important in our minds as the policy itself. They kind of go hand-in-hand, and the BBB is here to help consumers make more educated purchasing decisions.

Allstate received an A+ rating from the BBB. It is reassuring to know that not only will your policy be affordable while providing all the necessary coverage but the claims and any customer issues will be handled appropriately in a timely fashion as well.

What Are the Ratings from Moody’s?

Moody’s is the first of the big three credit rating agencies we will take a look at in determining the financial stability of Allstate. In operation since 1909, Moody’s provides informative surveys, reviews, and ratings that give an outlook on the fiscal solvency of corporations across the globe. Opinions and subsequent ratings are based on facts, market trends, and an even-handed measure of experience with the financial prospects of any given company.

Moody’s conducts a regular review process that takes place yearly and sometimes monthly providing updates on top corporations’ financial integrity or lack thereof.

Considering your home or in the least your investment in your home as a long term plan to promote a stable and thriving financial livelihood, you need a company that will be with you in the long term. You need an insurance provider with the capital and fiscal solvency to pay out claims given an unforeseen loss or damage to the property without hesitation. If you want to see how an insurance provider like Allstate stacks up against itself and the competition financially, look no further than Moody’s.

Moody’s currently ranks Allstate with an Aa3 rating, one of the highest, with minimal risk as far as investments are concerned. The 3 suggests they are also capable of repaying debt obligations in the short-term whereas the double-A depicts them being fiscally solvent with a positive outlook in the future years to come.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are the Ratings from Standard & Poor’s?

Standard & Poor’s (S&P) is the second of the top three credit ranking agencies, and although we are not getting to it first, S&P proves to be no slouch either when it comes to analyzing, reviewing, and presenting a clear understanding of the global financial market. S&P provides financial guidance in 28 countries with an over 150-year history of providing financial intelligence reports. These reports include but are not limited to credit ratings and research reports of financial institutions. The video below gives a brief overview of why a credit rating from S&P matters.

The company is divided into three factions, but the faction we are interested in is the rating department. Whereas A.M. Best favored the insurance industry and Moody’s operates on a global scale, S&P is more focused on providing an indexed outlook of the American stock market. They are the end-all when evaluating and determining an accurate review based on any company’s stock.

They have a particular rating section devoted to the current and future outlook of insurance providers. S&P has given Allstate an A- rating; S&P generally takes a more nuanced look into the business practices and considers all the factors. The slightly lower grading evinces that the insurance provider is a good investment but susceptible to changes due to issues such as weather, which are out of their control.

What’s NAIC Complaint Index?

The National Association of Insurance Commissioners (NAIC) is a national non-profit organization whose main responsibility is to protect the interests of insurance consumers. They measure and rate insurance providers with the priority of holding each company to the highest of standards. They operate primarily as a watchdog organization with the consumer’s best interest at heart.

The graph above displays Allstate’s complaint rating as compared to the national average in the insurance industry for 2018. The insurance provider is the second overall in the nation, so its no wonder they field more volume in the number of complaints; And their response time and rating, although not the best, is still commendable especially given the size of the insurance provider. Allstate is still measuring well below the national average which is set at one. This scoring shows that they may receive a high number of complaints, but they generally respond quickly and appropriately in resolving those high volumes of complaints issued.

What Are Fitch Ratings?

Fitch Ratings (Fitch) rounds out the top three credit ranking agencies and is a leading provider of credit ratings, commentary, and research. They are definitely on par with both Moody’s and S&P in their dedication to providing even-handed assessments of the financial stability and credit ranking of any given corporation. They maintain that their process is thorough, independently conductive, and always objectively given.

Fitch’s rating system takes into consideration what kind of debt a company holds and how sensitive it is to systemic changes like interest rates. The system operates on letter grades that code signify financial ranking on a global scale.

Fitch rates Allstate with an A- which asses it more in line with S&P’s ranking. It is still viewed as a minimal risk investment, and any hesitation generally has to do with the nature (or weather hazards) of the home insurance industry.

Fitch appears to be cautious in awarding it the highest marks, but this rating, in combination with the other credit agencies, depicts Allstate as a company that still has room for growth while its financial interests remain stable. There is potential for advancement in financial solvency opportunity which makes Allstate not just a safe bet for investing in a home insurance policy today but in the years to come as well.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are J.D. Power Rankings?

J.D. Power has become an American institution for financial reports and quality reviews of corporations and their products promoting the advocacy of consumer intelligence. Founded in 1968 by James David Power III, J.D. Power is not another legacy credit ranking institution and does not place in the top three, but they have become a respected source for information on company performance and product review.

They have primarily made their name in the auto industry, but have gradually taken the same practices to company interests even including home insurance.

In almost every category, Allstate ranks 3/5 in J.D. Power’s review for home insurance. Not the best but for a company their size, number two home insurance provider in the nation, an average score is a win in our book. This also suggests that they may have room for improvement; a slight increase could elevate service from average to great.

What’s Allstate History?

Like most insurance providers, Allstate began its storied career with the selling of auto insurance policies in the early 1900s. Unlike those other providers, Allstate was initially developed as a mail-order auto insurance service that eventually morphed into the more person-to-person agent service known today.

The mail-order service was the brainchild of Sears, Roebuck & Co.’s President and Board Chairman Robert E. Wood who after taking inspiration from the success of the Sears catalog realized an opportunity in combining the two businesses. So on April 17, 1931, Allstate opened its doors with the opportunity to purchase auto insurance policies, and by May, Allstate had sold its first insurance policy.

Allstate opened its first permanent sales office in a Chicago Sears store around 1934, and as the company gradually shifted to a more personal agent-driven approach, offices quickly sprang up eventually being opened in a vast majority of Sears department stores throughout the 30s.

The more prominent slogan that Allstate has come to be known by, “You’re In Good Hands With Allstate”, was first thought up by one of Allstate’s own general sales manager, a Mr. Davis W. Ellis. In the company’s first national print campaign, two hands holding a car illustrate the line.

Allstate has made significant strides in custom tailoring insurance policy to meet individual policyholders’ needs since their inception. Their auto insurance policies were some of the first to consider drivers’ needs, ages, and mileage when drafting rates and policies, and soon enough, the entire industry followed in suit. the 1947 introduction of the Illustrator Policy, which simplified the language of policies and added pictures to enhance customers’ understanding of their coverage, facilitated growth.

Allstate would go on to expand outside of the auto industry sphere including the likes of fire insurance, homeowners, and life insurance in the 1950s. The company did so well in the first 30 years at meeting the needs of American Consumers that Allstate decided to even expand globally by selling insurance to Canadians. Allstate Insurance Company of Canada was incorporated in 1964. The only limitations Allstate seemed to place on itself was bringing the business closer focus by selling insurance only by the 1970s.

The 70s also brought on the introduction of two new policies that would greatly benefit both Americans and Canadian citizens. Allstate saw the need and implemented what we know today as the Basic Homeowners Policy and the Healthy American Plan (life insurance).]

In 1991, Sears, Roebuck and Co., offering 20 percent of Allstate’s stock, went public before becoming completely independent of Sears in 1995. At the time, the stock offering was the largest public stock offering in the nation’s history, and today, Allstate has become the nation’s largest publicly held personal property and casualty insurance company.

The 1990s brought with it change; Allstate diversified its potential to offer great rated insurance policies by utilizing exclusive and independent agents, creating a network of call centers, and expanding their online presence as in their most recent acquisition of competitor Esurance. Allstate continues to be relevant after 80 years as an insurance provider competing in and occasionally creating markets that did not even exist at their onset.

After Allstate became independent of Sears, Allstate has continued to grow and prosper and is now the second-largest provider of property and casualty insurance in the nation servicing approximately 16 million households. The nation agrees that they are in good hands when it comes to Allstate, especially in providing the necessary insurance to promote the safety and security we all desire.

What is Allstate Insurance Market Share?

In any industry, market share figures for a single year are informative about a company’s degree of success, but it is the consecutive yearly figures that you should concern yourself with in terms of financial stability. The term itself is relatively self-explanatory; it is the percentage of sales earned (shares) by a company in a particular industry (market) over a specified period.

According to Investopedia, calculating the market share involves dividing company sales by total industry sales over the same period. As mentioned previously, it is the comparisons between companies through multiple years that provides a clear picture of that company’s overall projected performance. So how does Allstate’s market share affect you as the policyholder? Think of your policy as an investment not only in protecting your home but also an investment in the success of Allstate. You both operate hand-in-hand and benefits for the overall company extend down to the policyholders level as well.

| Company | 2016 - % Market Share | 2016 - Premiums Written | 2017 - % Market Share | 2017- Premiums Written | 2018 - % Market Share | 2018 - Premiums Written |

|---|---|---|---|---|---|---|

| Allstate | 8.64% | 7,903,530,000 | 8.44% | 7,957,403,000 | 8.36% | 8,262,445,000 |

Allstate’s Insurance market share has seen a continuous loss in the past three years but a minimal percentage. Gains continue to be made in the premiums written, so this shows that business has not grown stagnant. They remain steady and income is coming in so bankruptcy or a drastic fall from the number two position seems unlikely.

Businesses as old as Allstate go through cyclical periods of losses and gains, and these minimal dips are not anything to be concerned about for the immediate future.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is Allstate’s Position for the Future?

Allstate seems poised to continue to grow steadily in the immediate and far-reaching future. The income that Allstate continues to bring in through premiums written is impressive seeing initial steady growth and a nice jump between 2017-2018. Their loss ratio, amount of claims being paid out in comparison to premiums coming in, remains in a safe range.

This all suggests that Allstate remains a financially stable company and will continue to prosper in the years to come. The only concern we see at this moment is the potential to over-extend oneself as Allstate continues to expand from insurance policies to even the financial sector; but currently, all of this expansion seems like the healthy growth of a profitable company that services its customers well.

What is Allstate’s Online Presence?

Allstate was in early on the ground floor of the internet age having begun creating an online presence in 1996. They have adapted easily to online business having previously provided insurance through mail order; it seems like every trend is cyclical right about now. Online insurance offerings seem to be a similar trade-in style as the mail-order they once provided, and although this is a focus, Allstate continues to offer and push a more personable approach with agent offerings. Just as they transitioned in the past, they have integrated new tech even understanding the need pivoting to adapt and even acquiring rival all-online insurance providers like Esurance.

Aesthetically, the site appears a little crowded although the message projected is straight forward enough and the navigation is generally intuitive. When selecting options it does seem like you hop between too many pages to gather the necessary information. The front page does provide all their main offerings for insurance including home and immediately which is direct, and if you allow them permission to use your location, the site immediately presents local agent options complete with pictures, location, and contact information.

The site has an additional learning center that offers insurance advice on top of general tips for home repair as well as being generally informative about the company and its history. On the top navigation bar, Allstate also offers the option for submitting an online claim for those anxious folks who have difficulty in one-on-one interactions.

What are Allstate’s Commercials?

As has been the trend in recent years since the, an absurdist comedy angle to gain viewers’ attention in hopes they will remember when it comes time to find a provider of their own. In the commercial below, a comedic actor personifies potential mayhem and destruction that can happen to anyone with humorous results.

https://youtu.be/dHXL8A1dowo

To show they are with the times and constantly adapting their business model to the needs of the consumer, they also have commercials that bring to mind the current trend of homeowners renting out their homes through the likes of Airbnb.

https://youtu.be/h3a1VrDKnGg

All things considered, Allstate’s commercials provide depth to their coverage option, unique and genuinely funny while also offering ideas on coverage options you may not have considered in the past. Their coverage is surprisingly inclusive and affords options for many if not every possible consumer need.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Is Allstate Helping the Community?

As early as the 1950s, Allstate has understood the value of helping the community involving themselves in the lives of their policy holders through their Allstate Foundation. The Allstate Foundation is fully funded by donations from Allstate. It invests both nationally and in the local communities where we live and work. The current website even provides a nice feature displaying an interactive map that shows how Allstate is helping out in your local community.

Allstate touts a contribution of $42.2 million as their current figures for community donations in 2018. While the majority of this donated $42 million in community contributions is provided by the Allstate Foundation, additional funds have been provided to fund other corporate volunteer oriented work wich includes the hometown giving program, the Helping Hands staff volunteer initiative, the Allstate Officer Nonprofit Board Program, plus the Renewal Project and the Better Arguments Project.

All donated money is obviously given in the effort to prove that Allstate supports in communities in addition to providing the necessary insurance. Some of the recent highlights include $6.4 million raised by the 2018 Allstate Giving Campaign which matches employee donations dollar for dollar.

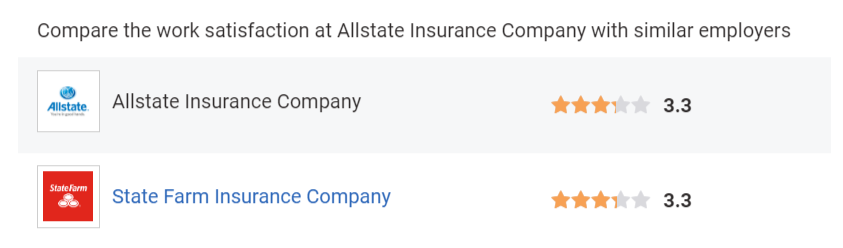

Allstate displays some impressive figures in community volunteerism and benefit; however, the message occasional comes across as slightly insincere or at least not as much of a priority as their top competitor, State Farm. The message received seems to be that they are a publicly traded business first and any donated contributions, although many, seem like an afterthought. This may seem like a negative swipe at Allstate but frankly in our opinion, we find comfort Allstate’s business in the front and volunteer party in the back approach.

What Do Allstate’s Employees Say About the Company?

A company is only as good as the employees who work there. We believe good management that treats employees with fairness offering equal opportunity and fare pay trickles down from the employer to employee and eventually the customer.A workforce is only as good as they are treated, and your policy, no matter how affordable or all inclusive the coverage, is worthless if you cannot get a claim serviced appropriately through online customer service agents.

On another note, if there are holes in the customer service department, there is probably mismanagement from the top down, and your policy may not be as good as you think it is. Trouble in one area generally spells out even more trouble across the board.

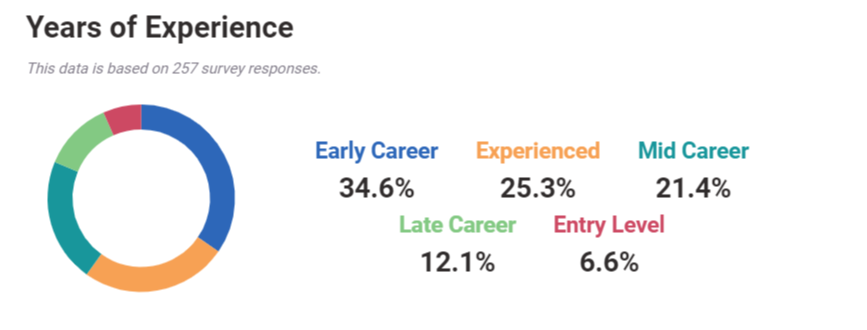

What’s the Age of Employees & Tenure?

According to Payscale, Allstate has a larger percentage of early career employees as well as experienced tenured positions. Always nice to have an experienced driver behind the wheel of your home insurance policy.

The data obviously depicts that their industry is more adept at providing long term job opportunities. It also shows the Allstate knows the importance of your home investment only letting experienced individuals handle your policy and filed claims. The median age is 35 years old for employees with those fresh faces holding down those jobs for about 2.9 years of tenure. The fresh outlook with young careers offers initially some nice go-getter attitude and the later year experienced staff measures out for confidence group. Generally, nice averages all around.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What’s the Employee Experience like?

Overall, Allstate scores well in this category. Payscale reports slightly above average results for employee experience.

Do They Have Awards and Accolades?

These are just a handful of Allstate’s proud moments spotlighting their industry leading standards that extend to more than the insurance industry including also how they operate as well. Their message continues to promote core values of honesty, caring and integrity.

Before we take you any further into Allstate’s rates and coverage options, why don’t you start this section off with an actual estimate by using our free online quote engine. You will have a better perspective with an estimated cost in front you while reading about all of Allstate’s coverage options. It is simple, just type in your zip code, and we will take care of the rest.

How to Get Allstate Cheap Home Insurance Rates

Eventually what it will all come down to is money. The best home insurance policy does you no good if your can not afford to cover it financially. Dollars and cents, dollar dollar bills y’all. We know you want an affordable home insurance policy with the lowest rates; but, you definitely do not want the discount version of coverage coming from your provider.

Allstate seems to hit that just right, Goldilocks sweet spot; as a leading provider of home insurance, number two in the nation, they are large enough to offer affordable rates across the board. On top of that, their size helps policyholders further save on their insurance rates by offering multiple insurance discounts through bundling a variety of insurance options. If your looking for home insurance, chances are you might need auto insurance as well. Allstate not only has you covered on both counts but will offer you premium discounts for multiple policies across various lines of insurance.

Allstate’s size benefits consumers as it is small enough to offer person-to-person agent experience where you feel heard and not lost in the shuffle but large enough to make those claims when unexpected property loss and damage occur. They have the fiscal stability to still be there after all the bills are paid and the rebuilding is finished. It is safe to say that even in a catastrophe, Allstate will keep you in good hands.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What’s Allstate Availability?

Allstate homeowners insurance policies are available in all 50 states and the District of Columbia.

Allstate Compared to the Top 10 Market Share

Allstate is more than competitive in its field as an insurance provider. Currently ranked second in the nation with massive potential for growth. Their expansion into multiple markets including the financial district affords them a wide birth to become a much larger insurance provider than most smaller companies. And then as a bonus for policyholders with multiple lines of insurance, you get discount bundles and payment options all under one roof.

| Rank | Company | Direct Premiums Written ($) | % Market Share | Loss Ratio |

|---|---|---|---|---|

| 1 | State Farm | 18,177,462 | 18.50% | 61.87% |

| 2 | Allstate | 8,262,445 | 8.36% | 65.55% |

| 3 | Liberty Mutual | 6,655,452 | 6.74% | 52.60% |

| 4 | USAA | 6,170,558 | 6.24% | 79.77% |

| 5 | Farmers Insurance Group | 5,795,044 | 5.86% | 78.80% |

| 6 | Travelers | 3,766,277 | 3.81% | 69.34% |

| 7 | American Family Insurance | 3,276,280 | 3.32% | 63.74% |

| 8 | Nationwide | 3,184,627 | 3.22% | 77.83% |

| 9 | Chubb Ltd Group | 2,832,082 | 2.87% | 91.87% |

| 10 | Erie Insurance Group | 1,675,976 | 1.70% | 66.03% |

Allstate has a clear lead in premiums written over the majority of the top ten, State Farm not being considered. And although they are a ways off, to be it politely, from State Farm, so is every competitor in the nation. They more than match up with their true contenders with only Liberty posing a remote if none at all threat to their positioning. Growth is the key factor to consider here, and Allstate shows no signs of slowing down.

How to Get Allstate Sample Rates

In order to give you a clearer perspective on the rates Allstate offers, we used the California Department of Insurance’s comparison tool that offers by estimated rates for cities and counties dependent on the desired amount of coverage. Selecting at random, we surveyed Pasadena, California to see some actual price-tags on rates from Allstate as well as how they pair up with the top ten leading competitors. The table below shows how Allstate pairs up to its competitors for home insurance coverage ranging from $200-500,000.

Average Home Insurance Rates of the Top 10 Home Insurance Companies by Dwelling Coverage – Pasadena, Los Angeles County, CA

| Companies | $200,000 | $350,000 | $500,000 |

|---|---|---|---|

| Travelers | $408 | $585 | $795 |

| Allstate | $421 | $734 | $1,047 |

| State Farm | $427 | $690 | $972 |

| Nationwide | $439 | $668 | $961 |

| USAA | $448 | $811 | $1,154 |

| Liberty Mutual (as Liberty Ins Corp) | $656 | $866 | $1,076 |

| Farmers | $899 | $1,386 | $1,869 |

| Chubb Ltd | $965 | $1,564 | $2,031 |

| American Family | N/A | N/A | N/A |

*CA rates based on home age of 1-3 years old, $1,000 deductible

This is by no means an exact figure, rates vary frequently by location, but Allstate clearly is a top competitor when it comes to affordable rates. In each category, Allstate offers some of the lowest rates across the board no matter the coverage cost. This shows that even as the premiums rise, Allstate can afford to keep their rates competitive and even below the national average in most instances when compared to some of their biggest competitors.

When you choose Allstate as your home insurance provider, you know you will get a fair and reasonable rate. The chart does show some added padding in dollar amounts as the coverage reaches the $500 thousand range, but frankly, this is reassuring in their continued ability to be able to payout claims of this size. Those insurance companies who drop their rates significantly as premiums go up should be cause for concern. The good hands of Allstate prove to be offering affordable rates with discounts whenever possible and a degree of trust that they know what their doing if the rate increases slightly.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is the Coverage Offered?

Allstate has a variety of insurance lines to pick from with responsibly priced rates and coverage that will be there when you need them. For homeowners insurance, Allstate provides the standard dwelling coverage as well as a litany of extras with the possibility of gaining discounts based on bundling with other lines of insurance options i.e. auto and home plus boat.

What Are Allstate’s Policy Types?

Allstate has policy holders covered no matter the living situation offering up homeowner, renters, condo, mobile home, and landlord insurance. They offer so many policies for home coverage you may just end up bundling within the same department line of home insurance.

Homeowners

Allstate offers policyholders a standard homeowner’s insurance with the actual physical structure being covered. Additional options include the belongings inside your home, liability insurance coverage, coverage if a third party injures themselves on your property, and guest medical covering the potential injured third party’s medical bills.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Condo

Allstate provides coverage for your unit and the belongings inside the unit for damage or loss. All of this, though, has to covered under the listed perils which include fire, theft, accidental water damage from your plumbing, and vandalism.

Renters

Allstate offers surprisingly affordable renters insurance that covers the cost of your belongings within a rental property.

https://youtu.be/llXiZrgAQ_A

As mentioned in the video, the renters insurance will cover liability, personal property, and additional living expenses that pay for hotel stays if your rental unit is uninhabitable. It does not protect the physical structure. Make sure to check your own rental insurance plan to see what exactly is covered and what is not.

Mobile Home

As technology advances so has the modern convenience of building a home. Manufactured or mobile homes are increasingly becoming a popular option considering the lower price-tag and surprising sustainability of these new models. Allstate’s mobile home policy generally covers the same multiple perils as a standard homeowners policy, which includes offering coverage for the home, liability, and personal property.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Rental Property

Rental property or landlord insurance is provided by Allstate to cover the physical dwelling against damage or loss while renting it out to a third party. Both flood insurance and personal umbrella policy (in case of lawsuits) are extra coverages but possibly more important given your landlord status.

Do They Have any Additional Policies?

Motor-home coverage is an additional policy from Allstate that lands somewhere between auto and home. The insurance leans closer to auto insurance, but it is important to make sure you are covered for liability and damages other than those caused on the road.

What Does Allstate’s Standard Homeowners Policy Include?

The standard type of homeowners insurance that Allstate offers includes coverage for the actual physical structure of your home, your personal property, liability protection, as well as guest medical.

The first two cover the home and the contents of your home. Whereas, the liability and guest medical almost go hand-in-hand addressing issues caused by an injury on your property. This type of coverage is necessary so you do not lose your home financially speaking over someone else’s accident.

https://youtu.be/_plcvNliXGQ

The video above details a variety of coverage options that Allstate offers for homeowners. The purpose of the video is to better inform homeowners of their coverage options, possible claims, and what exactly their policy may or may not cover. It provides a level of trust and strength in character for the good hands of Allstate.

If there is something not covered in the standard homeowner policy that you deem worthy of protecting, there are also optional coverages that you can add to an already purchased policy. Things like garden or shed insurance as well as high priced items that are stored in the house are just some of the examples for optional coverage.

On a final note, Allstate also offers personal umbrella insurance policy that covers liability for truly expensive lawsuits that exceed the standard cap. The need for this is rare, but it is nice to have the option if you feel like being especially cautious. As far as flood insurance, an Allstate agent can help you purchase one or you can on your own as this policy is only offered by the National Flood Insurance Program.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are Allstate’s Bundling Options?

One thing Allstate does not have a problem with is the variety of insurance lines. Seriously, almost like the flavors of the week with Allstate. As an insurance provider with multiple lines of insurance, they do tend to reward policyholders with discounts if they purchase multiple lines of insurance from Allstate. The most common saver being the bundling of auto and home which can save up to 25 percent. And that’s a 25 percent we all know can be well spent elsewhere for business or pleasure.

The other potential bundle benefit included in an Allstate package coverage is convenience and time saving; with almost every type of insurance, Allstate can provide multiple policies, many you probably already have, that you will pay at one convenient location.

Probably the option that provides the most in savings is the combining of home, life, and auto insurance under one package deal. You get 10 percent off alone with combining home and life and up 25 percent by combining home and auto. Just imagine the kind of savings with the trifecta. All of these policies are essential coverage’s as you get older so why not save and purchase them all from Allstate.

What Are Allstate’s Discounts?

Allstate offers a wide variety of homeowners discounts for both new and old policyholders. Even just for switching. The chart below lists just some of the discounts Allstate offers to each of the policyholders.

| Discount | Percentage Off (up to) | Details/Requirements |

|---|---|---|

| EZ Pay Plan | 5% | Set up automatic withdrawal of premium payments |

| eSmart | 10% | Sign up for online policy management |

| Full Pay | 10% | Pay full term premium up front |

| Early Signing Discount | 10% | Sign policy documents at least seven days before effective date |

| Responsible Payer | 5% | No cancellation notices for non-payment in past year |

| Auto and Home | 10% off auto 25% off home | Have both auto and home in force with Allstate |

| 55 and Retired | 10% | Homeowners over age 55 and who are retired |

| Claim Free | 25% | Homeowners save when they switch to Allstate without a recent home insurance claim |

| Welcome & Loyalty | 10% | Save on your home insurance premium just for switching to Allstate and continue to save each month as long as you're a customer |

As you can see from the table above, Allstate provides a multitude of discounts. Some of those discounts are even offered for just being an Allstate home policyholder. That is 10 percent right there for switching over, and that discount continues month to month throughout your time as a valued customer at Allstate.

What Security Discounts Does Allstate Offer?

The security discounts that Allstate offers are they typical fare which include installing/having theft or fire protection devices, a smoke-free homes, storm shutters, and hail-resistant roofs. These are just a few of the examples where Allstate rewards policyholders for being responsible homeowners. They provide incentives to further protect your home investment.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Kind of Bundling Discounts Do They Offer?

Allstate offers a variety of bundling options but what is best for homeowners is the package deal with auto and life. The auto and home bundle already offers up to 25 percent off rates and that is before the addition of life.

Do They Have Other Discounts?

Allstate is all about discounts, even adding a few options after the more traditional bundling. Some of these untraditional discounts that may apply to you are the 10 percent early signing discount, the 10 percent loyalty discount, the new home buyer discount, and the 55 and retired discount. Do not fret if none of these categories match your homeowning situation because Allstate’s rates are already some of the lowest in the insurance industry. Also, we are pretty sure Allstate will find some way to give you a discount.

What are Allstate’s Programs?

Allstate has its version of a learning center with articles conveniently laid out on each line of insurance’s web-page. The site-specific insurance articles actually provide some useful tips typically helpful for first time home buyers but may still offer tips or tidbits of information to veteran homeowners. (For more information, read our “Best Home Insurance for First-Time Buyers“)

Allstate’s tools include a homeowner vs renter calculator and an inclusive web service focused on planning your move. The site and feature is called the Moving Center and includes initial topics as buttons to further explore. The initial navigation buttons include house hunting, packing up, moving day, and settling in.

Allstate offers some informative features that really seem geared to helping the inexperienced and uninformed make better decisions when it comes to owning a home and purchasing insurance. The rest of the page following the links from the navigation buttons includes articles covering topics such as what an escrow insurance account is and what additional living expense coverage is as well as a homeowners insurance quiz.

Allstate does provide those trademark good hands in their informative easy to navigate website but at times it almost seems like too much information, and there are sometimes too many web-page redirects. You will definitely get the feeling that this is a large company.

The only potential worry that could arise from surveying Allstate’s site is about getting lost in the shuffle of such a large company. These worries are quickly alleviated with the online quote option which is quick and easy with responsive navigation. There is an informal questionnaire that gathers appropriate, home-related information, however, it never really feels like your filling out just another form. So well done on that angle.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Cancel Your Allstate Policy

Before entering a serious contract you should definitely gather an exit strategy just in case you do not like the fit of your insurance provider.

What’s the Cancellation Fee?

Allstate allows you to cancel your homeowners policy any time with no cost cancellation fees.

Is There a Refund?

You will get a pro-rated refund for the unused portion of your premium. The only phone call cancellation can be frustrating, but at least there will not be any hidden fees for canceling.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Cancel

You will find that canceling your policy is not as easy as signing up for one. In order to cancel your Allstate insurance policy, you must call your agent. And even then, the agent may ask you to fill out a written request for the cancellation of your policy.

When canceling your policy, you will need to have your policy number, social security number, and the date you would like the cancellation to take effect. The good news is your cancelation can take place on the same day.

When Can I Cancel?

Allstate allows you to cancel your homeowners policy any time; and unlike some providers, Allstate will even refund a pro-rated amount even if you cancel halfway through your month of coverage.

How to Make a Claim

The unexpected happens and it will happen to you and your home. You pay your monthly insurance rate, and you rightly expect your insurance provider to step up immediately when that unexpected does happen to facilitate a claims process that is both easy and hassle-free.

Luckily, Allstate makes the process just that easy and hassle-free; Allstate offers multiple options for making a claim, each just as effective as the last.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Ease of Making a Claim

Allstate makes claim to having the largest team of claims agents in the country, so the process should be no headache. And if the number of claims agents is anything like the number of filing options, then you are truly in good hands in the unfortunate case of property loss or damage.

You can file a claim online, through the app, over the phone with your agent, and in person with the very same agent. There is also the 1-800-7828 number you can call to file your claim in case your personal agent is unavailable.

What is the Number of Premiums Written?

Why should you be concerned with the number of premiums your insurance provider has written? Within a single year, the data is somewhat irrelevant; however, following the numbers across a three year period offers an insiders look into how Allstate is operating as a company financially speaking. You can gather a relatively accurate projection of potential growth which will give you an idea if the insurance provider is worth your investment. Can not file a claim if your insurance provider ends up bankrupt.

| Company | 2016 - % Market Share | 2016 - Premiums Written | 2017 - % Market Share | 2017- Premiums Written | 2018 - % Market Share | 2018 - Premiums Written |

|---|---|---|---|---|---|---|

| Allstate | 8.64% | 7,903,530,000 | 8.44% | 7,957,403,000 | 8.36% | 8,262,445,000 |

The table above shows steady growth each year with a general increase in the total number of premiums gained from year to year. 2016 to 2017 shows modest gains, but the 2018 numbers spike upwards reflecting the increasing acquisition of new business from policyholders.

Not only is Allstate’s a stable company with statistics suggesting they are fiscally solvent, but they are also growing each year, This all suggests that Allstate is operating at the top of its game. Policyholders are happy and homeowners insurance claims are being processed to the tune of striking up new business. The more they gain in premiums also keeps their loss ratio in check.

What’s the Loss Ratio?

What is a loss ratio and how does it relate to the number of premiums written. The loss ratio is a comparison of how much the insurance provider takes in with premiums written in contrast to the number of claims they are paying out. Basically, the amount of money coming in versus the amount of money going out.

A loss ratio under 40% is probably too low, and a loss ratio over 75% is too high. If a company’s loss ratio is too low, it suggests a company is not paying out claims as it should and simply pocketing the majority of the premiums. When a company’s loss ratio is too high, the insurance provider is running the risk of bankruptcy.

Too low and the company may be a cheat; too high and the company is mismanaged running itself into the ground. There is wiggle room on either end especially in the high loss ratio category; an insurance provider is clearly not running the risk of bankruptcy if these spikes do not occur in consecutive years. They more accurately reflect an oncoming rate increase which is not positive for the policyholder.

| Company | 2016 - Premiums Written | 2016 Loss Ratio | 2017- Premiums Written | 2017 Loss Ratio | 2018 - Premiums Written | 2018 Loss Ratio |

|---|---|---|---|---|---|---|

| State Farm | 17,613,109,000 | 54.25% | 17,556,871,000 | 80.93% | 18,177,462,000 | 61.87% |

| Allstate | 7,903,530,000 | 49.98% | 7,957,403,000 | 55.60% | 8,262,445,000 | 65.55% |

In comparison to the nation’s top contender, Allstate has handled itself in a more stable fashion than the number one provider Allstate; the figures suggest a higher degree of fiscal solvency. There is a bit of a jump particularly between 2017 and 2018, but there was also a significant jump in premiums written (collected income) to counterbalance the increase in claims paid out.

The numbers for Allstate remain well within the safe range each year projecting success in the years to come,

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Get a Quote Online

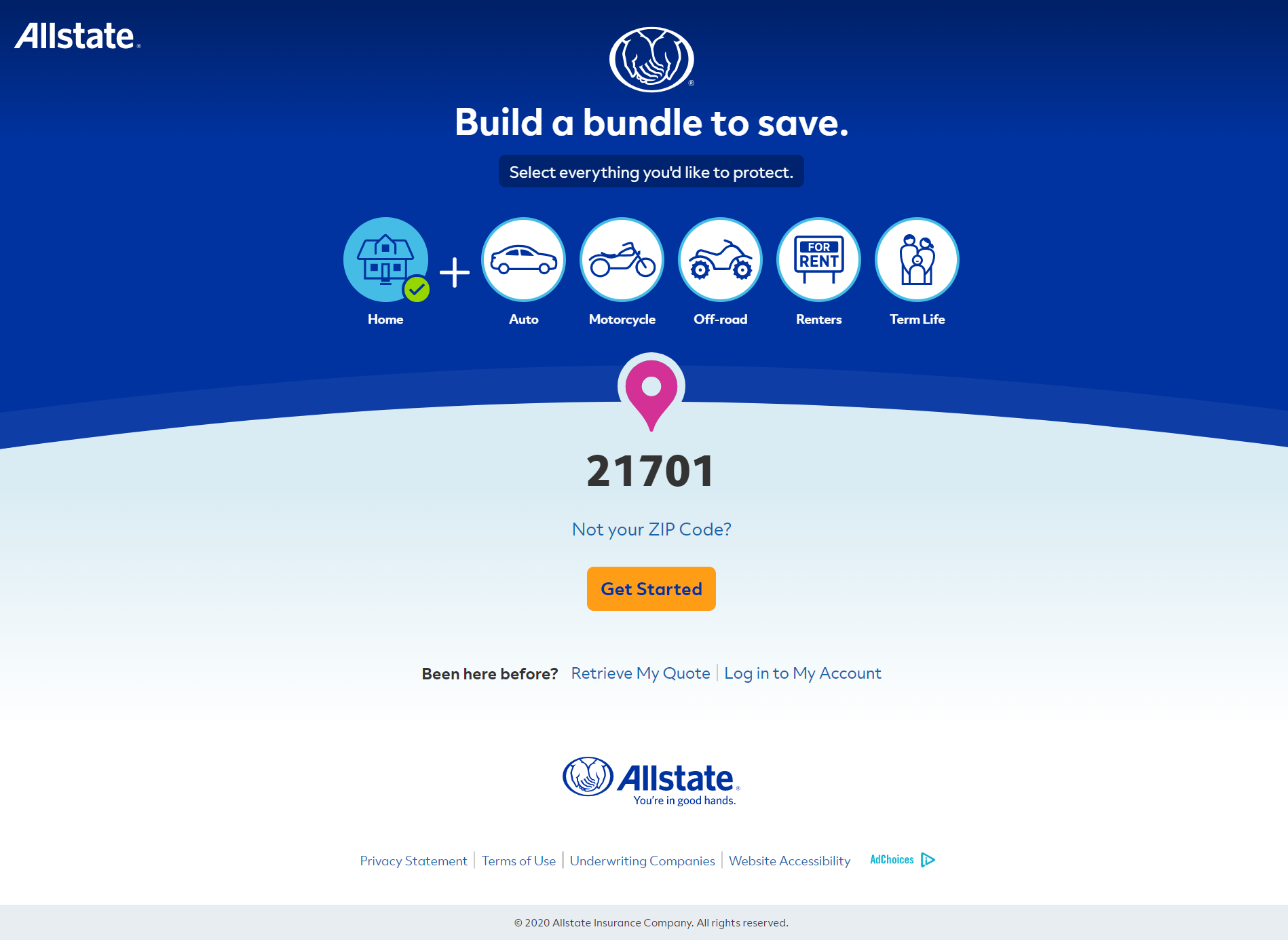

Getting a quote online through Allstate has never been easier. By visiting their website at www.allstate.com, there are several options for finding an online quote depending on the line of insurance you are interested in. The front page has an easy enough layout with each insurance option represented by an icon. After selecting home, you are redirected to the home insurance main page where you will type in your zip code. After your location is determined, it is on the next page where you are actually ready to begin.

Step One: Enter Your ZIP Code

With your ZIP code entered, Allstate conveniently offers you their bundling options at the start which includes auto, motorcycle, off-road, renters, and term life.

We went ahead with the single homeowners insurance option, but it is a nice feature to conveniently have these bundling options upfront instead of afterward with the best guesstimate of your savings.

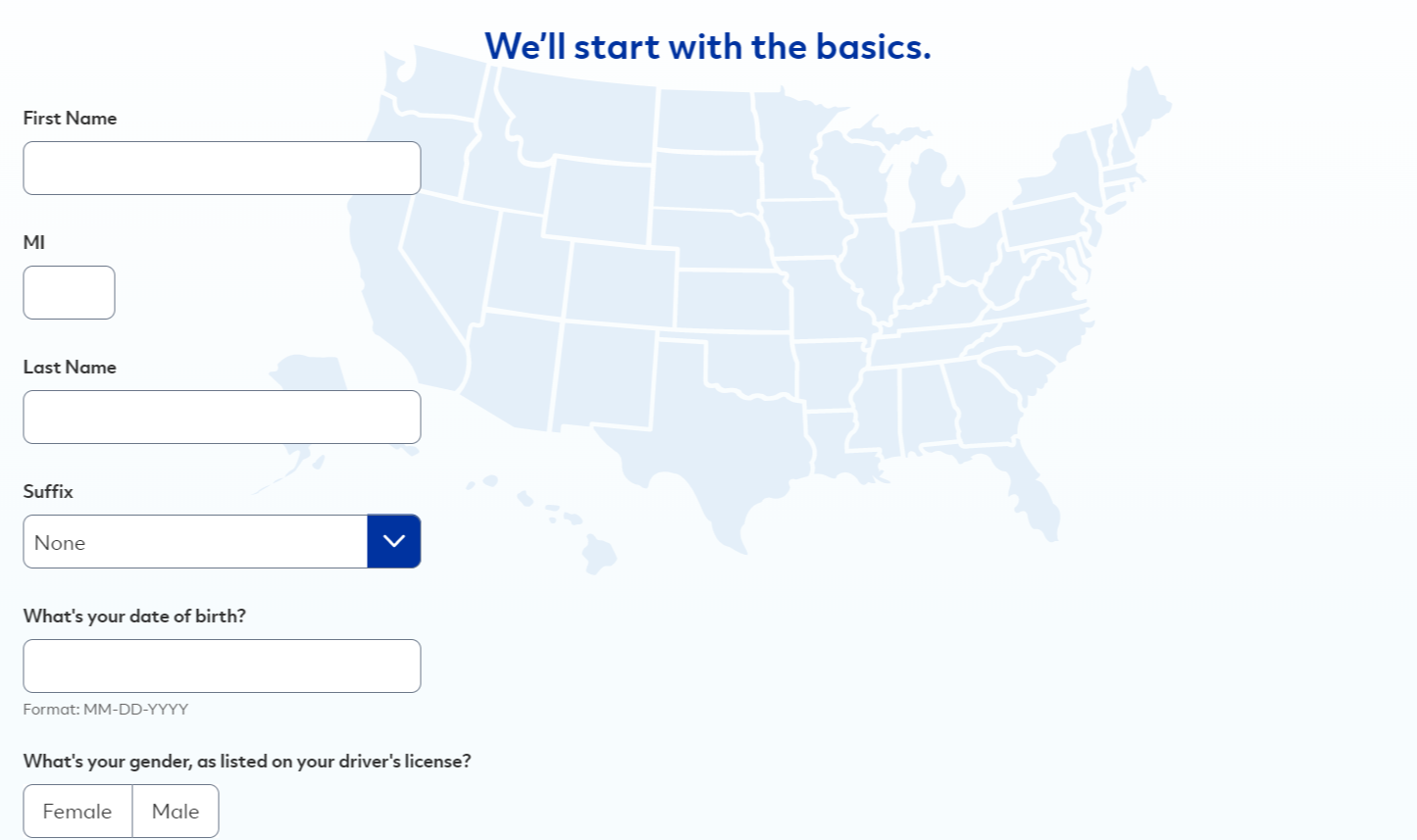

Step Two: Provide Basic Information About Yourself

A basic questionnaire follows where you provide your name, marital status, age, and sex.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

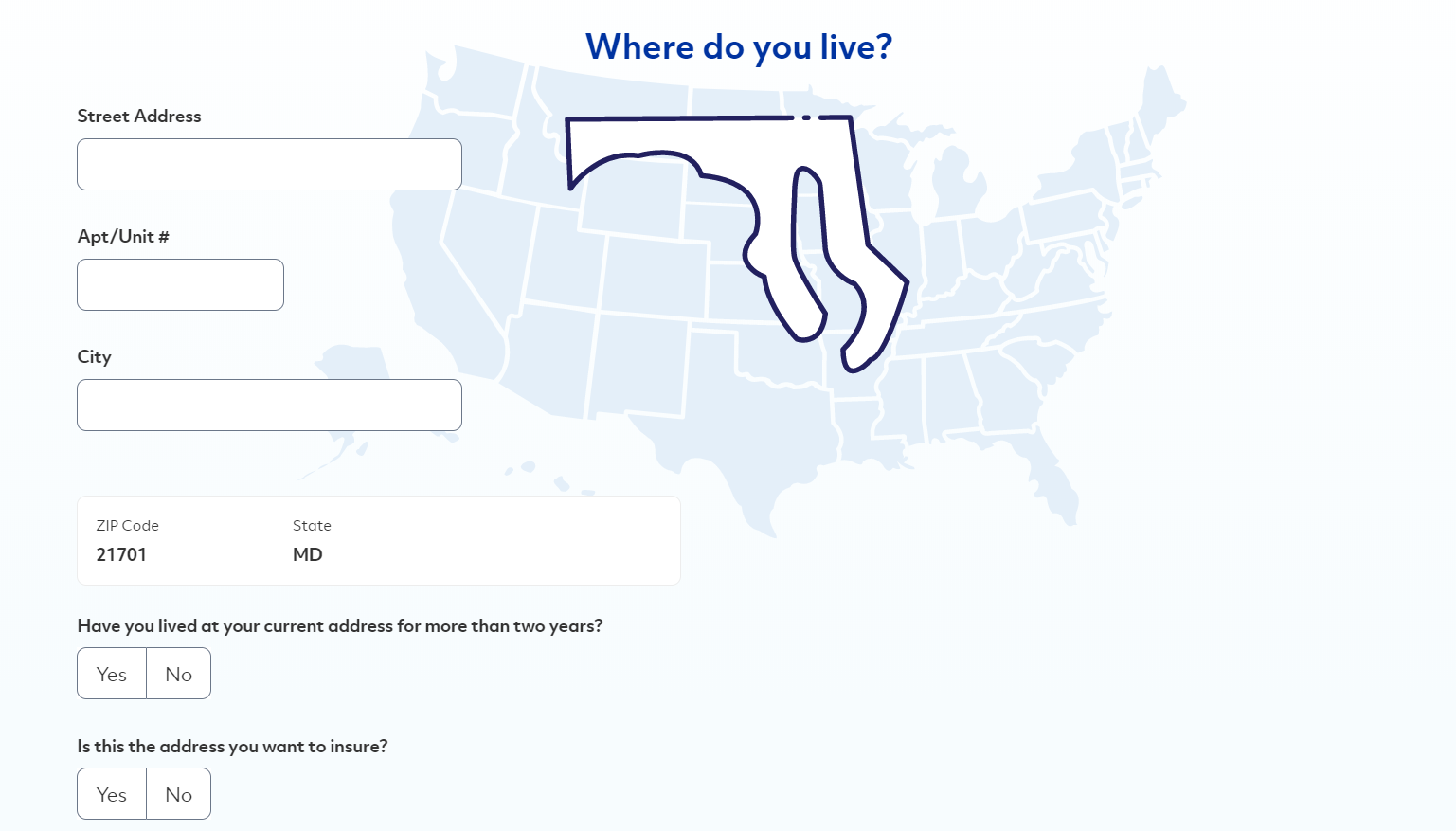

Step Two: Enter Your Home Address

After supplying Allstate with this general personal information, you will be redirected to the next page and prompted to give more information about the location of your home.

Step Three: Enter Contact Information

Your contact information is the next step.

You provide both your email and phone number with express permission for Allstate to contact you about this quote as well as an option to cancel this permission whenever you choose.

Step Four: Provide Property Details

Now it is time to provide some actual details about the home you want to insure. The more inclusive you are with your information the more accurate the quote will be in the end.

This whole section covers basic home info; the headers for the sections are exterior, interior, and safety.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Step Five: Provide Household Details

The next section involves informing about your household or the individuals residing in your home.

This section mainly is attempting to find out how much of a liability you may pose as a policyholder. Questions include how many in your household, if you smoke, if you have filed claims recently, automobiles, do you currently have insurance, and start date of your new insurance.

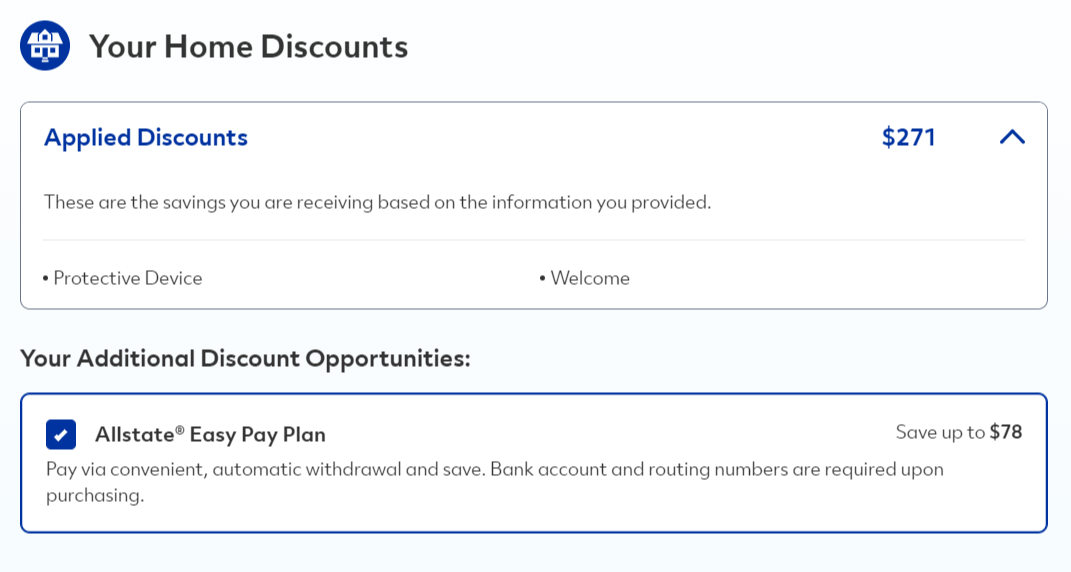

Step Six: Calculate Discounts

Savings, the best part is truly saved for last. Allstate calculates all the potential discounts you can take advantage of from the information you provided.

You have the option to include these discounts in your online quote offer or leave them out.

Step Seven: Get Your Quote

Not much of a step here as after the discount page, you are redirected to a detailed report of potential insurance options and their quoted cost.

The laundry list provided of coverage options along with quoted prices is impressive; the information ranges from standard dwelling coverage, personal property, other structures, additional expenses, to cyclones and weather patterns. The three big sections include property coverage, coverage for you and others, optional coverages including sewage issues, roof maintenance, and green enhancements.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How Does the Design of Website/App Look like?

The website provides a wealth of information with an intuitive navigation system that occasional gets bogged down with too much information. That being said, it runs smoothly, offers a very detailed and informative online quoting system, as well as a variety of articles to increase policyholder knowledge and awareness of potential insurance issues.

There seems to be a significant amount of clutter, and the whole site could use a whole less is more straightforward to it. The site is truly made for the modern youth consumer visually as it is constantly multitasking your options; the eye tends to darts too much back and forth causing the appearance of slight confusion.

The information is there but the layout could be much cleaner and the message more direct with fewer options.

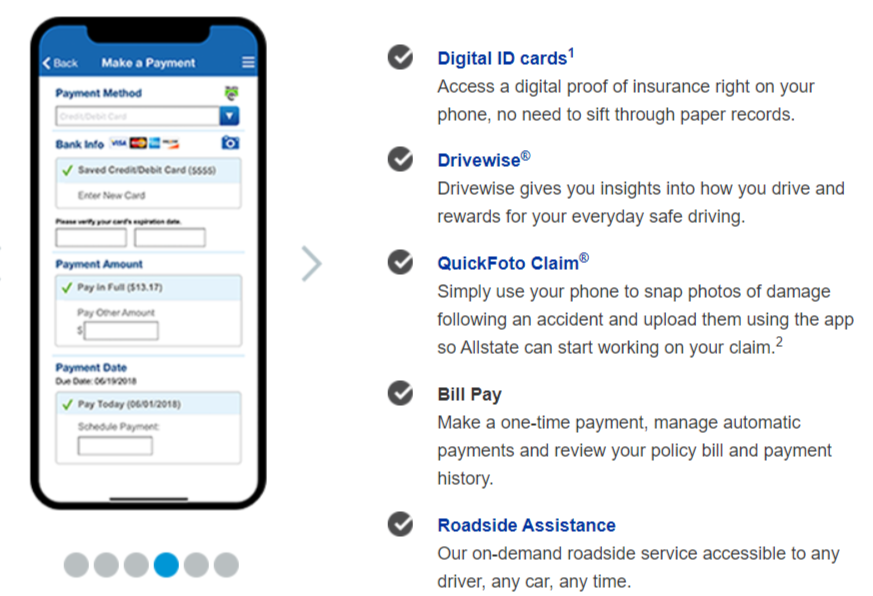

The Allstate Mobile app is primarily focused on automotive, but the inclusion of bill pay, policy search, and ID cards are a convenient addition to Allstate’s already option heavy features. Homeowners can now pay their monthly bills with the touch of a button on their phone.

Allstate has put a significant amount of time and effort into their online presence; all that money and effort does show on their mobile app, but it remains, as mentioned previously, auto-centric in its functions. Homeowners can take advantage of easy bill claims, photo-ready immediate claims filing, and digital ID cards though.

The app is a huge hit with policyholders and their on-the-go lifestyles.

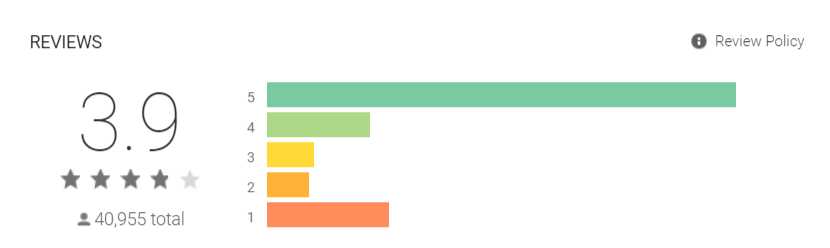

As you can see from the review graph above, the mobile app is one of the highest-rated insurance apps out there on the google play store. A nice average of positive reviews with feedback and actual response for fixing issues in the comments section. There are some issues with retrieving documents, but these petty gripes come from a desire to speed up even the immediacy of phone access to your policy. The Allstate mobile app is now available for android and iOS operating systems.

What Are the Pros and Cons?

| Pros | Cons |

|---|---|

| Allstate offers a variety of insurance line options including home ensuring that they can be the one stop shop for all your insurance needs | Allstate operates so many different lines of insurance that the departments can become confusing sparking fears of possibly getting information lost in the shuffle |

| Allstate has a significant online presence offering a detailed online quote and bill pay option through their website and app | An Allstate policy is not so easy to cancel forcing customers to call their agents and even then in some cases provide written notice of cancellation |

| Allstate offers several discounts on bundling options the biggest being a 25% discount on Home & Auto | The multitude of discounts often feel like a carrot held out front on a stick prompting questions like why not offer more of these values uprfront |

Allstate Home Insurance Claims Process

Ease of Filing a Claim

Allstate offers flexible claims filing, from online submissions on their website to phone claims and mobile app use. This variety accommodates both digital-savvy customers and those who prefer direct contact with a representative.

Average Claim Processing Time

One crucial aspect of the claims process is the speed at which claims are processed and resolved. Allstate aims to provide efficient claim processing to minimize disruptions in customers’ lives. While specific processing times may vary depending on the nature of the claim and other factors, Allstate strives to handle claims promptly to offer peace of mind to policyholders.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is an essential indicator of an insurance company’s performance during the claims process. Allstate’s commitment to customer satisfaction is reflected in its handling of claim resolutions and payouts. Policyholders’ experiences and satisfaction levels contribute to shaping Allstate’s reputation as an insurer that delivers on its promises.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Allstate Home Insurance Digital and Technological Features

Mobile App Features and Functionality

Allstate’s mobile apps provide policyholders with a range of features and functionality. These apps offer convenient tools for managing insurance policies, accessing digital ID cards, filing claims, and even obtaining roadside assistance. The mobile apps are designed to make it easier for customers to interact with Allstate and access important information on the go.

Online Account Management Capabilities

Online account management is a key component of Allstate’s digital offerings. Policyholders can log in to their accounts through the website to review policy details, make payments, update personal information, and track the progress of their claims. This online portal enhances the customer experience by providing self-service options and easy access to policy-related information.

Digital Tools and Resources

Allstate empowers policyholders with digital tools like online calculators, educational content, and informative articles, aiding them in making informed insurance decisions. This commitment to digital empowerment ensures policyholders have the information needed for confident coverage choices.

What’s the Bottom Line?

Allstate is the number two insurance provider in the nation and makes an effort to give back to the community.

Allstate is a publicly-traded insurance provider that relies on increased capital for profits and this is in no way a negative trait. And how have they increased the capital fueling their financial success? By constantly pivoting and changing to the needs of the market and their consumers. From the early days, Allstate has been open to change altering service from mail delivery to a more agent-driven business model and now by increasing their online presence. All of this success is caused by meeting the needs of their policyholders.

Their array of insurance options makes them a one-stop-shop for all lines of insurance. Homeowners are easily covered with affordable rates that are slightly below competitors. They’re also more than willing to provide discounts for the consumer especially when bundling

Allstate’s straight forward business approach is admirable which is represented by their above-average credit rating, and for individuals with the need for multiple policies, they sure are a great candidate.

Frequently Asked Questions

How can I pay my bill?

There are multiple options for paying your monthly bill. Probably the most convenient is online or through the mobile app both of which take direct payments. Otherwise, you can pay by phone calling 1-800-901-1732 24 hours a day, 7 days a week. Or, you could opt for the more traditional, old school method of mailing a check to the address on your policy statement.

Do You Handle Property Damage from Natural Disasters Differently?

The short answer is yes. Allstate covers natural disasters as listed by multiple perils in your policy. The long answer; Generally what occurs is first the natural disaster would be classified as a catastrophe. Then, a crew of claims adjusters known as the National Catastrophe Team will have boots on the ground within days to assist and provide detailed instructions about filing claims.

Will My Premium Increase If I File a Claim?

This all depends on the circumstances involved in the claim and the homeowner’s actual coverage as detailed in their policy, Every claim is unique, and it is best to review your options with your local Allstate agent. You would lose any discounts, such as the Allstate Claim Free Discount, and your premium could increase. Once again, your agent or a claims agent can look at your particular situation and detail your options.

What is Allstate Home Insurance?

Allstate Home Insurance is a type of insurance policy that provides coverage for your home and personal belongings in case of damage, theft, or other covered events. Allstate offers different types of home insurance policies, including standard homeowners insurance, condo insurance, renters insurance, and landlord insurance.

How much does Allstate Home Insurance cost?

The cost of Allstate Home Insurance depends on several factors, including the location and age of your home, the value of your personal belongings, and the coverage limits you choose. You can get a personalized quote from Allstate by contacting an agent or using their online quote tool.

What are some common complaints about Allstate Home Insurance?

Some common complaints about Allstate Home Insurance include delays in claims processing, difficulty getting in touch with customer service, and disputes over coverage and claim payouts. However, it’s worth noting that many customers are satisfied with their Allstate Home Insurance policies and the company’s customer service.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.