Does Nationwide cover medical bills after an accident? (2025)

Many readers may wonder, "Does Nationwide cover medical bills after an accident?" It does if you carry personal injury protection (PIP) or medical payments (MedPay) coverage. You'll usually pay between $30 to $70 monthly for these coverages, and some states require them as part of a no-fault insurance program.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

UPDATED: Mar 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Nationwide PIP and MedPay assist with your medical bills after an accident

- 12 states require PIP insurance, while only three states require MedPay

- Medical bills add up quickly, while PIP and MedPay only cost $5-$50 monthly

You may wonder, “Does Nationwide cover medical bills after an accident?” Yes, Nationwide insurance policyholders can buy medical payments coverage (MedPay) or personal injury protection (PIP) to cover medical expenses.

Read More: Nationwide Insurance Review

Some states require PIP or MedPay insurance as part of a no-fault auto insurance system where drivers use their own insurance to cover medical expenses. In addition, while PIP pays for medical bills, lost wages, and child care, MedPay only covers medical expenses.

You should also consider uninsured/underinsured motorist coverage to pay medical bills if you get hit by an uninsured driver. Enter your ZIP code into our free tool above to instantly compare PIP and MedPay insurance quotes.

Nationwide PIP Insurance vs. MedPay: Coverage for Medical Bills

Medical payments (MedPay) and personal injury protection (PIP) both cover medical bills after an accident. However, they both cover different things.

MedPay helps fill any gaps, such as the cost of dental work, for things not covered under your health insurance. MedPay also covers ambulance expenses, emergency room treatments, doctor visits, hospital stays, nursing care, and medical procedures needed to treat your injuries, but it does not cover lost wages.

Adding medical payments coverage to your Nationwide auto policy will increase your rates, but it pays medical costs for you and your passengers when injured in a covered auto accident.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Read More: Best Medical Payments (MedPay) Coverage Car Insurance Companies

No-fault insurance is another name for personal injury protection (PIP). Some states make all drivers get PIP insurance. In other states, this insurance is optional. Nationwide is on our list for consideration as one of the best personal injury protection (PIP) car insurance companies.

PIP pays medical bills for personal injuries, no matter who is at fault. Nationwide’s PIP covers more expenses than MedPay but comes with a deductible. It also covers personal injuries if you are hit by a car while walking or riding a bike. MedPay provides more car insurance coverage for passengers in your vehicle.

If you live in one of the 12 no-fault states, you must carry PIP or MedPay to cover medical bills for injuries sustained in an auto accident.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Comparing PIP vs. MedPay Insurance Rates

MedPay and PIP aren’t always part of full coverage car insurance, but some states do require them.

Check out the table below to see how much you could pay for PIP or MedPay:

Car Insurance Monthly Rates: Personal Injury Protection and Medical Payments

| Insurance Company | PIP Rates | MedPay Rates |

|---|---|---|

| Allstate | $65 | $45 |

| American Family | $63 | $43 |

| Farmers | $62 | $42 |

| Geico | $55 | $35 |

| Liberty Mutual | $70 | $50 |

| Nationwide | $50 | $30 |

| Progressive | $58 | $38 |

| State Farm | $60 | $40 |

| Travelers | $57 | $37 |

| USAA | $52 | $32 |

You probably don’t need to have both PIP and MedPay. They are slightly different but cover some of the same things.

Nationwide Uninsured/Underinsured Motorist Coverage

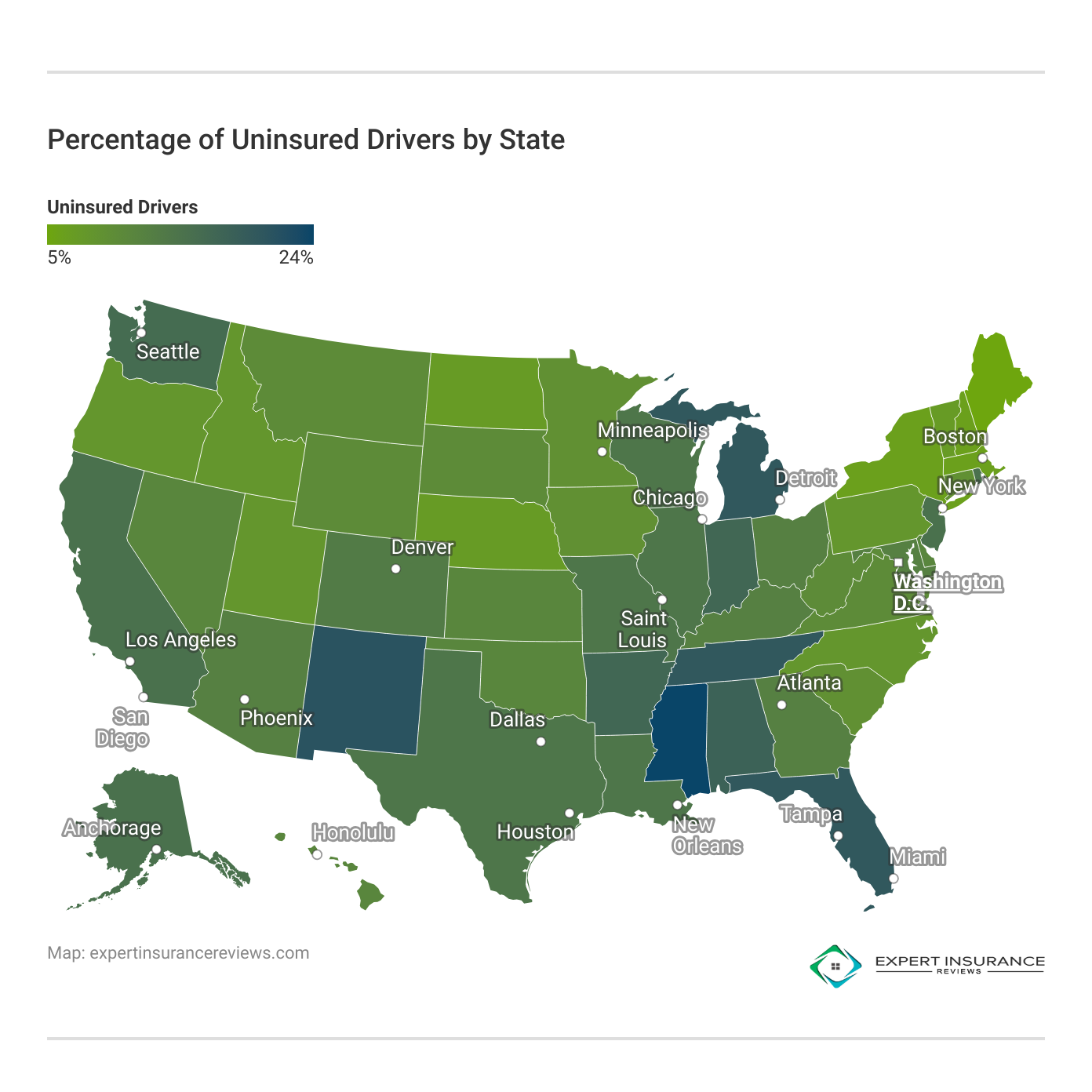

Whether you have MedPay or PIP insurance, you will want uninsured/underinsured motorist (UIM) coverage. According to Insurance Information Institute, one in eight drivers is uninsured.

UIM coverage is for personal injuries in an accident caused by a hit-and-run driver or someone without insurance or with insufficient insurance limits that cannot cover all your medical bills. UIM coverage may also apply to vehicle damage in some states, so check your policy terms.

Nationwide offers UM/UIM coverage, but compare rates from the best uninsured motorist (UM) coverage car insurance companies to get the cheapest price on your policy.

Buy Full Insurance Protection from Nationwide

To have full insurance protection from Nationwide for your auto policy, in addition to having liability, collision, and comprehensive coverage, you will want to add medical payments coverage (MedPay) or personal injury protection (PIP) and uninsured motorist coverage.

Compare cheap car insurance quotes for free today by entering your ZIP code into our comparison tool below.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.