Best Michigan Car Insurance (2025)

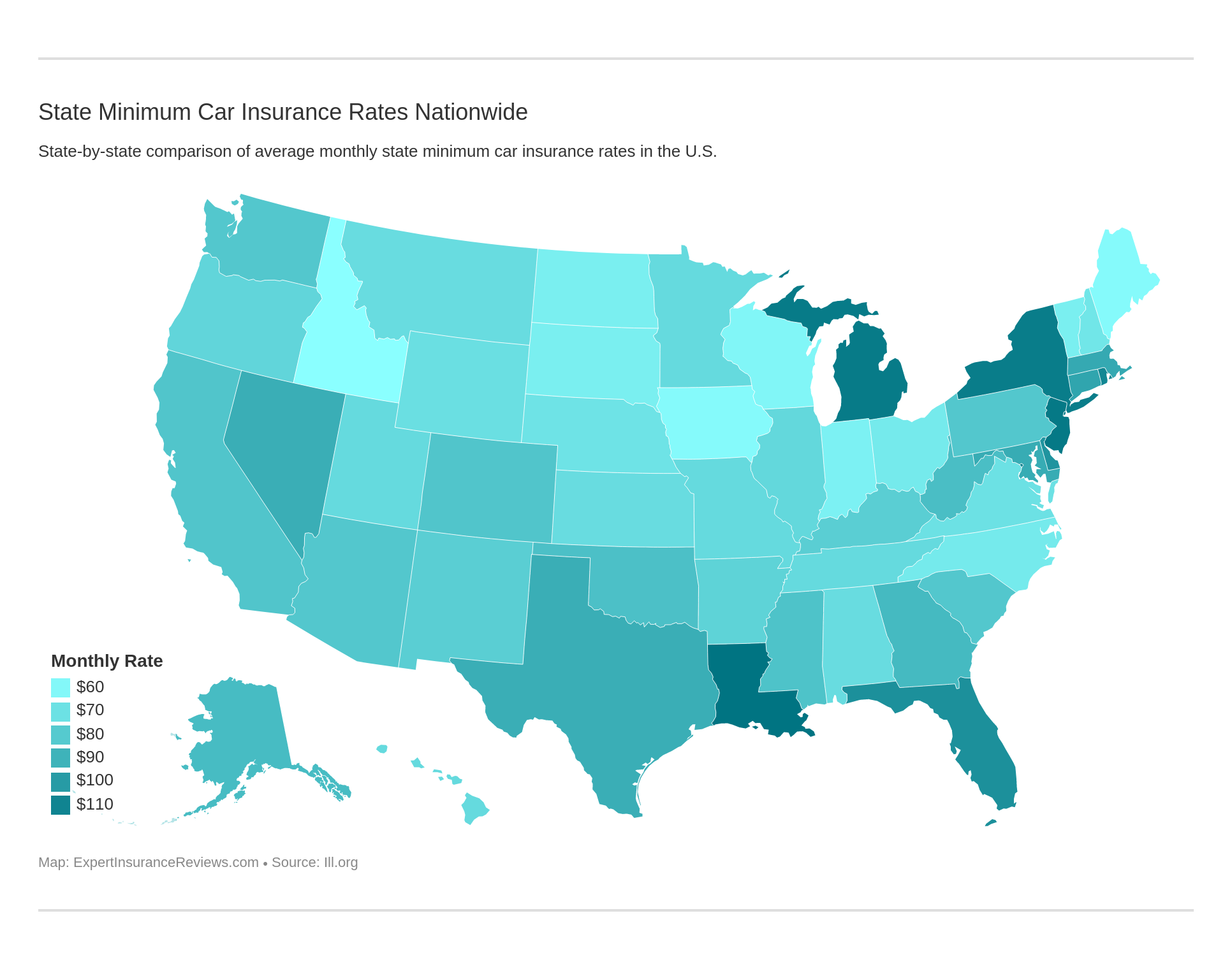

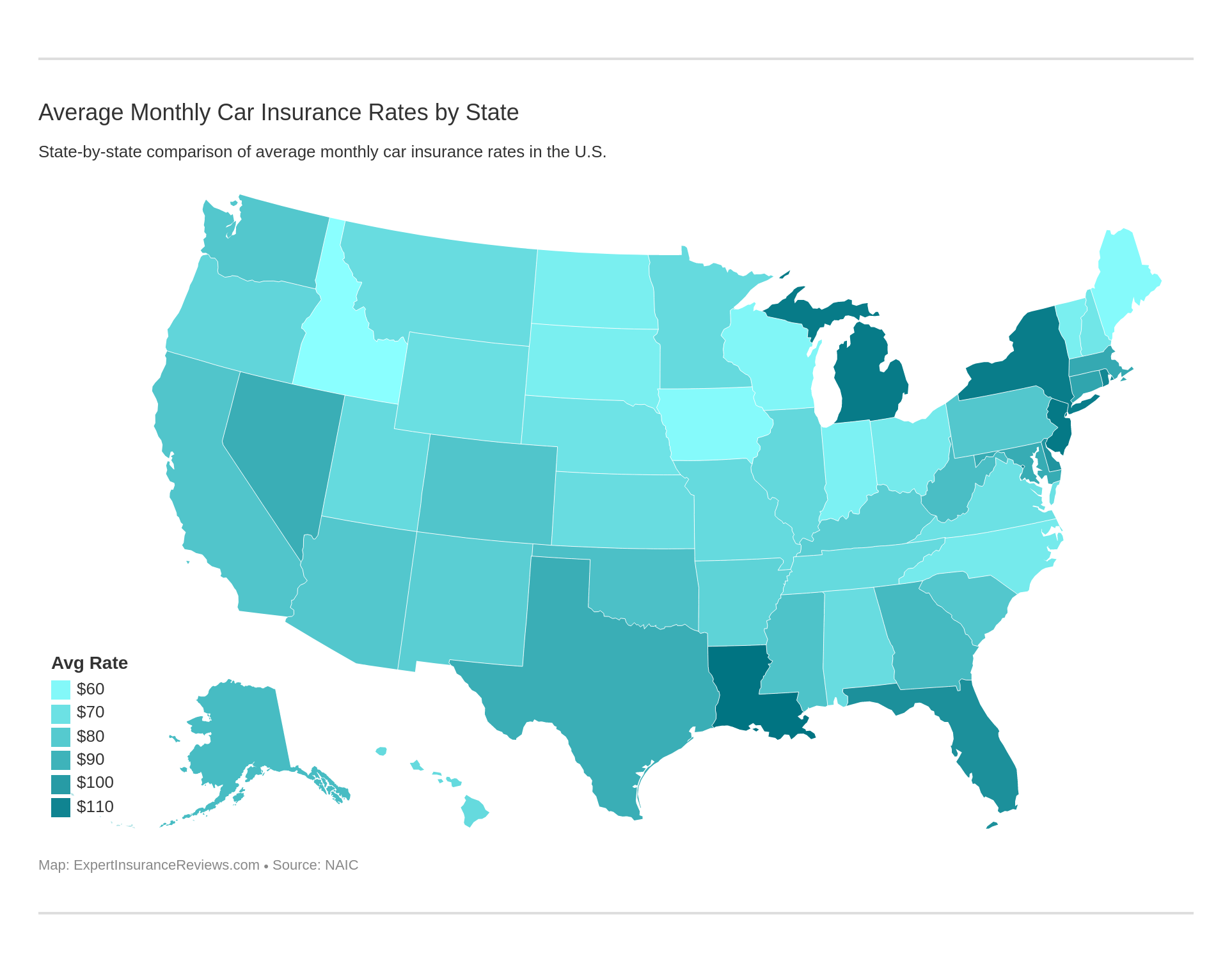

Primarily due to state insurance requirements, car insurance in Michigan’s monthly cost of $224 per month is higher than the national average. Geico and Progressive are typically the cheapest options for minimum coverage, but you might find the best Michigan car insurance for you at another company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

UPDATED: Mar 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Michigan Statistics Summary | Details |

|---|---|

| Road Miles | Total Miles: 122,284 Vehicle Miles Driven: 97.8 Million |

| Vehicles | Registered: 7.86 Million Total Stolen: 21,157 |

| State Population | 9.96 Million |

| Most Popular Vehicle | Ford Escape |

| Uninsured Motorists | 20.3% State Rank: 4th |

| Total Driving Fatalities | 2008-2017 Speeding: 2,397 Drunk Driving: 2,562 |

| Annual Average Premiums | Collision: $414 Comprehensive: $155 Liability: $795 |

| Cheapest Providers | Progressive & USAA |

- Michigan car insurance rates are some of the highest in the country, especially for drivers looking for a minimum coverage policy

- While rates are influenced by many factors, Michigan car insurance requirements are the primary cause of its expensive rates

- Some of the cheapest Michigan car insurance companies are Geico and Progressive, though the provider with the cheapest coverage for you depends on multiple factors

Although prices have decreased a little in recent years, Michigan car insurance laws keep quotes for the average driver higher than most other states. In fact, many Michigan drivers pay more for minimum insurance than what people in other states pay for full coverage.

However, that doesn’t mean it’s impossible to find affordable Michigan car insurance. Taking steps like looking for discounts, choosing the right coverage, and comparing quotes can help you save on your Michigan auto insurance, no matter how much coverage you want to purchase.

Read on to explore your options for the best Michigan car insurance, no matter what your needs are. Then, compare Michigan car insurance quotes from as many companies as possible to find the best prices.

Michigan Car Insurance Coverage and Rates

Michigan consistently ranks as one of the most expensive states for auto insurance, taking the number one spot for the fourth year in a row in 2017. The average annual rates in Michigan are about a thousand dollars more than the national average, which makes finding consistently affordable insurance an enormous challenge.

There are many different complicated reasons why Michigan is so unaffordable when it comes to car insurance, but the basics are as follows:

First, the state has a no-fault coverage law. This means that when it comes to an accident, no matter who is at fault, insurance provides personal injury protection with no maximum limit for any injuries that occur.

Instead of whoever is at fault paying for everything; drivers have insurance to cover their injuries and damage rather than insuring to pay out to the other person.

Secondly, Michigan has an extremely high rate of insurance fraud compared to other states. This leads companies to drive those prices up.

Finally, because the prices are so gouged, there is an unusually high number of uninsured motorists on the road. According to III, 20.3 percent of drivers in Michigan are uninsured.

This recipe is a complete disaster, but we’re here to do the dirty work and give you some help on figuring it all out.

Michigan Minimum Coverage

Michigan is a no-fault car insurance state, as mentioned previously. If you’re injured in an accident, you’ll need to be sure your own insurance coverage is appropriate to get compensation for your medical bills and other out-of-pocket expenses.

Drivers in the state are required to purchase no-fault insurance with the following minimum limits:

- $20,000 per person hurt or killed in an accident

- $40,000 per accident in which more than one person is hurt or killed, and

- $10,000 per accident for property damage for an accident that occurs in another state.

Also, residents must have residual liability insurance to protect from the limited situations in which the no-fault system does not apply. These situations include accidents causing death or serious injuries, out-of-state accidents, or accidents involving damage to a resident of another state.

Forms of Financial Responsibility

Financial responsibility rules and regulations refer to drivers being required to show some sort of proof of insurance. When this becomes tricky is when drivers are found uninsured. To avoid the uninsured driver from receiving no justice, different laws require them to be responsible for some if not all expenses.

With the no-fault coverage being required and the prices of insurance being so high, Michigan is notorious for its uninsured motorists.

If a person is operating a vehicle without insurance and is at-fault in an accident, the injured person can file a lawsuit against the uninsured motorist in court to sue for damages.

Electronic proof of insurance is now becoming popular. If you’re interested, Michigan does allow electronic forms of insurance to be accepted by officials.

Premiums as a Percentage of Income

Michigan is known for its high costs of auto insurance as we’ve covered. But how much of your annual income is spent on that expensive insurance?

| YEAR | AVERAGE DISPOSABLE INCOME | AVERAGE FULL COVERAGE RATES | PREMIUM AS PERCENTAGE OF INCOME |

|---|---|---|---|

| 2012 | $34,727.00 | $1,171.94 | 3.37% |

| 2013 | $34,854.00 | $1,264.20 | 3.63% |

| 2014 | $36,419.00 | $1,350.58 | 3.71% |

In the entire U.S. Michigan paid the most percentage of their income to their insurance policies than any other state between 2012 and 2014. In 2014, 3.71 percent of the average annual income went to auto insurance. That number is outrageous and continues to grow higher each year. It is well above the national average, which is 2.4 percent.

Overall, if you live in Michigan or you’re thinking of moving, the consensus is you will be paying a lot for auto insurance.

Average Monthly Car Insurance Rates in MI (Liability, Collision, Comprehensive)

| Coverage Type | Average Cost in Michigan (2015) | Average Cost Nationwide (2015) |

|---|---|---|

| Liability | $795.32 | $538.73 |

| Collision | $413.83 | $322.61 |

| Comprehensive | $154.85 | $148.04 |

| Total (Full Coverage) | $1364.00 | $1,009.38 |

Core coverage includes the parts of your policy coverage that is considered full coverage. These three parts are liability, collision, and comprehensive. Combined, the three make up full coverage auto insurance.

Above is the average costs of the three separate parts and full coverage in Michigan and the entire nation. This information is gathered based on data from the National Association of Insurance Commissioners (NAIC).

Liability and collision insurance are so high in Michigan that they make up most of the overall cost. The overall averages are only around $155 which is right around the average of the nation.

Additional Liability

There are different types of additional liability coverages. Personal injury protection or PIP is probably the most important. In Michigan, drivers are responsible for paying medical coverage up to $500,000. Michigan auto insurance policies have different levels of PIP available for your convenience.

| Coverage Type | Michigan Loss Ratio (2015) | National Average Loss Ratio (2015) |

|---|---|---|

| Personal Injury Protection | 112.06 | 85.76 |

| Medical Payments | 75.68 | 75.74 |

| Uninsured/Underinsured Motorist | 75.19 | 75.14 |

Loss ratios aren’t a well-known factor among insurance buyers, but if you know the facts, they can be pretty important.

A loss ratio that’s too high means that insurance companies are paying out too much in claims – if the rate climbs over 100 percent they are paying out more than they’re taking in. If the company’s loss ratio is too low, it means they aren’t paying out any claims.

Both of these are important to you knowing the inner workings of the auto insurance company you choose.

Add-ons, Endorsements, and Riders

There are many different types of extra insurance coverage that you can add to your core coverage in Michigan. These are meant to help you ease your mind on the road.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

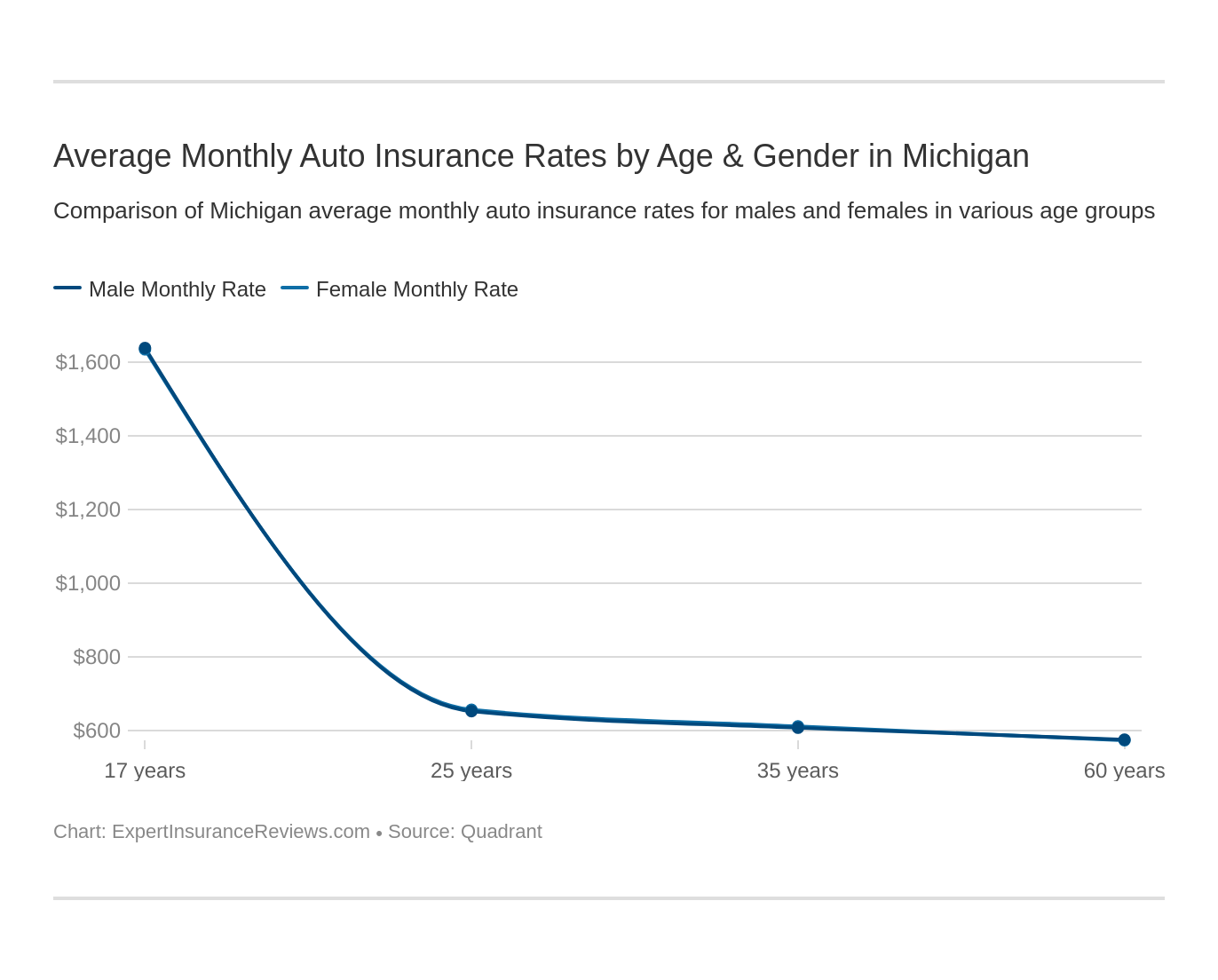

Average Car Insurance Rates by Age & Gender in MI

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $16,754.82 | $16,754.82 | $15,575.00 | $15,575.00 | $41,309.06 | $41,309.06 | $17,646.81 | $17,646.81 |

| Farmers | $6,307.90 | $6,307.90 | $5,856.52 | $5,856.52 | $13,831.87 | $13,831.87 | $7,104.64 | $7,104.64 |

| Geico | $4,453.35 | $4,453.35 | $4,533.10 | $4,533.10 | $12,291.51 | $12,291.51 | $4,252.21 | $4,252.21 |

| Liberty Mutual | $14,880.96 | $14,880.96 | $14,732.64 | $14,732.64 | $35,157.81 | $35,157.81 | $14,880.96 | $14,880.96 |

| Nationwide | $4,477.30 | $4,477.30 | $3,979.03 | $3,979.03 | $11,785.55 | $11,785.55 | $4,907.85 | $4,907.85 |

| Progressive | $3,156.54 | $2,932.15 | $2,785.12 | $3,113.99 | $11,516.82 | $12,259.07 | $3,676.55 | $3,393.23 |

| State Farm | $7,556.15 | $7,556.15 | $7,010.11 | $7,010.11 | $26,491.15 | $26,491.15 | $8,869.85 | $8,869.85 |

| Travelers | $5,839.83 | $5,839.83 | $5,012.52 | $5,012.52 | $17,631.16 | $17,631.16 | $6,344.88 | $6,344.88 |

| USAA | $2,649.82 | $2,508.37 | $2,491.74 | $2,352.36 | $6,472.15 | $6,145.20 | $3,229.01 | $3,095.85 |

Until August 1st, 2019, in almost every situation, women paid less than men did on auto insurance. It has now been outlawed to base rates by gender in Michigan. While it is outlawed and averages will all be the same no matter your gender;

Women are notoriously better drivers than men are and the statistics show. Also, women make much less money in their average annual income than men do. This is why insurance companies charged less to women in the first place.

Both genders below the age of 25 pay the most for car insurance. The facts on teen driving are skewed towards unsafe. The teenage age bracket speeds the most and gets caught in the most accidents. This is based on a simple lack of experience on the road.

In Michigan, auto insurance rates are enormous. For 17-year-olds, the average rate for Allstate is $41,309. This is $25,000 more a year than the next age bracket at 25 years old.

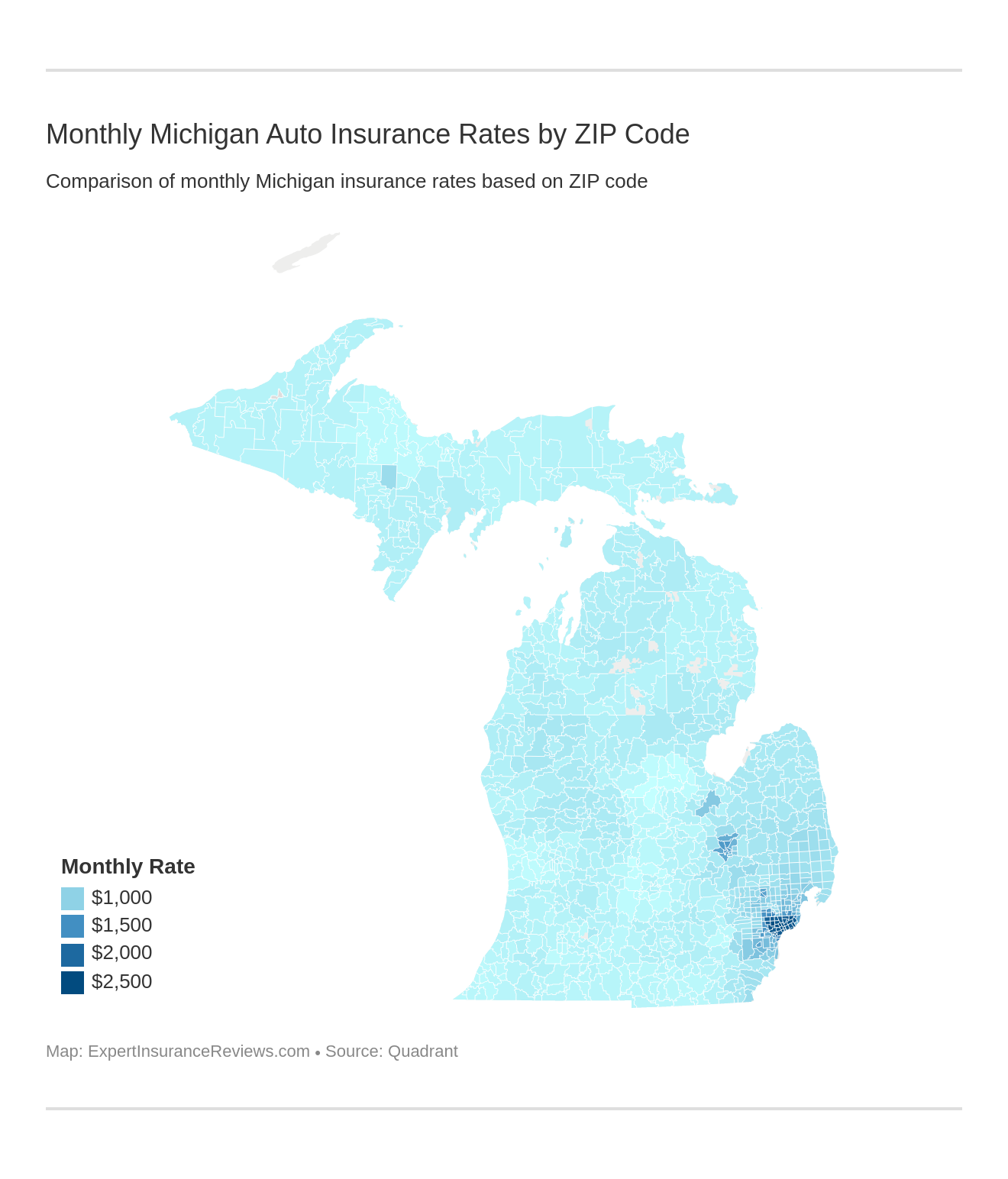

Cheapest Rates By Zip Code

Rates by zip code are a great statistic to discover the best places to buy auto insurance. Many different factors go into why each zip code is more or less expensive than the other.

Insurance companies look at the poverty line in each zip code, the amount of theft and vehicle theft, and the number of uninsured motorists are the top factors in determining rates in each zip code.

| Zipcode | Annual Average |

|---|---|

| 48201 | $30,350.09 |

| 48206 | $29,791.56 |

| 48227 | $29,374.46 |

| 48204 | $29,281.79 |

| 48202 | $28,946.15 |

| 48213 | $28,556.49 |

| 48210 | $28,417.19 |

| 48215 | $28,186.14 |

| 48238 | $28,148.98 |

| 48228 | $28,073.11 |

| 48216 | $28,040.22 |

| 48211 | $28,033.06 |

| 48205 | $27,952.29 |

| 48208 | $27,867.09 |

| 48226 | $27,767.57 |

| 48207 | $27,424.94 |

| 48212 | $26,925.66 |

| 48203 | $26,923.65 |

| 48224 | $26,758.51 |

| 48214 | $26,730.26 |

| 48209 | $26,710.78 |

| 48126 | $26,665.38 |

| 48234 | $26,566.42 |

| 48235 | $26,516.64 |

| 48223 | $26,031.27 |

| 48221 | $25,949.25 |

| 48219 | $25,711.89 |

| 48243 | $25,321.49 |

| 48120 | $25,271.87 |

| 48233 | $23,804.13 |

| 48217 | $22,744.30 |

| 48218 | $19,405.58 |

| 48225 | $19,225.22 |

| 48237 | $18,716.04 |

| 48075 | $18,279.98 |

| 48229 | $18,154.01 |

| 48089 | $17,832.12 |

| 48033 | $17,608.63 |

| 48034 | $17,435.93 |

| 48127 | $17,372.65 |

| 48503 | $17,141.70 |

| 48239 | $17,118.82 |

| 48505 | $16,992.77 |

| 48502 | $16,992.10 |

| 48504 | $16,991.84 |

| 48141 | $16,984.97 |

| 48091 | $16,810.09 |

| 48076 | $16,742.91 |

| 48341 | $16,728.63 |

| 48128 | $16,651.90 |

| 48122 | $16,544.22 |

| 48342 | $16,339.74 |

| 48242 | $16,014.67 |

| 48015 | $15,998.68 |

| 48532 | $15,891.56 |

| 48340 | $15,756.76 |

| 48507 | $15,754.53 |

| 48125 | $15,602.18 |

| 48236 | $15,596.70 |

| 48021 | $15,452.65 |

| 48458 | $15,267.00 |

| 48124 | $15,094.25 |

| 48030 | $14,956.77 |

| 48506 | $14,643.00 |

| 48193 | $14,530.95 |

| 48101 | $14,529.34 |

| 48437 | $14,524.70 |

| 48310 | $14,315.55 |

| 48092 | $14,312.59 |

| 48240 | $14,307.94 |

| 48146 | $14,234.31 |

| 48174 | $14,173.50 |

| 48195 | $14,149.43 |

| 48192 | $14,043.40 |

| 48230 | $14,026.37 |

| 48066 | $13,991.39 |

| 48180 | $13,914.92 |

| 48220 | $13,868.27 |

| 48093 | $13,797.44 |

| 48070 | $13,700.16 |

| 48082 | $13,583.02 |

| 48043 | $13,565.07 |

| 48312 | $13,552.23 |

| 48135 | $13,518.13 |

| 48036 | $13,464.42 |

| 48185 | $13,463.42 |

| 48164 | $13,393.48 |

| 48035 | $13,378.19 |

| 48184 | $13,349.33 |

| 48138 | $13,348.84 |

| 48080 | $13,326.09 |

| 48026 | $13,284.36 |

| 48045 | $13,262.93 |

| 48322 | $13,066.18 |

| 48313 | $13,011.22 |

| 48323 | $12,938.17 |

| 48186 | $12,894.38 |

| 48038 | $12,801.67 |

| 48519 | $12,735.43 |

| 48601 | $12,734.26 |

| 48529 | $12,727.92 |

| 48088 | $12,650.98 |

| 48111 | $12,605.17 |

| 48083 | $12,598.20 |

| 48051 | $12,557.67 |

| 48315 | $12,556.36 |

| 48183 | $12,535.40 |

| 48607 | $12,508.19 |

| 48302 | $12,503.86 |

| 48071 | $12,475.72 |

| 48081 | $12,453.34 |

| 48314 | $12,384.34 |

| 48134 | $12,355.30 |

| 48069 | $12,322.59 |

| 48317 | $12,273.53 |

| 48047 | $12,237.80 |

| 48509 | $12,168.69 |

| 48331 | $12,127.91 |

| 48301 | $12,123.77 |

| 48304 | $12,088.82 |

| 48067 | $11,979.89 |

| 48334 | $11,960.69 |

| 48044 | $11,842.93 |

| 48330 | $11,784.51 |

| 48098 | $11,759.54 |

| 48320 | $11,751.62 |

| 48377 | $11,691.55 |

| 48048 | $11,668.13 |

| 48326 | $11,641.07 |

| 48324 | $11,608.72 |

| 48042 | $11,602.01 |

| 48084 | $11,599.54 |

| 48152 | $11,578.47 |

| 48096 | $11,542.38 |

| 48374 | $11,510.59 |

| 48191 | $11,498.57 |

| 48094 | $11,491.31 |

| 48316 | $11,475.78 |

| 48336 | $11,468.49 |

| 48309 | $11,453.47 |

| 48327 | $11,438.28 |

| 48375 | $11,397.96 |

| 48328 | $11,369.01 |

| 48335 | $11,334.26 |

| 48085 | $11,270.21 |

| 48023 | $11,250.47 |

| 48095 | $11,244.86 |

| 48462 | $11,206.96 |

| 48025 | $11,197.34 |

| 48602 | $11,191.08 |

| 48150 | $11,189.70 |

| 48022 | $11,157.42 |

| 48097 | $11,147.61 |

| 48072 | $11,136.60 |

| 48065 | $11,129.87 |

| 48329 | $11,111.72 |

| 48480 | $11,103.28 |

| 48133 | $11,061.48 |

| 48387 | $11,046.10 |

| 49877 | $11,042.30 |

| 48197 | $11,032.40 |

| 48442 | $11,027.98 |

| 48420 | $11,011.74 |

| 48005 | $11,011.50 |

| 48382 | $11,009.11 |

| 48154 | $11,001.37 |

| 48190 | $10,982.92 |

| 48383 | $10,980.88 |

| 48027 | $10,965.72 |

| 48173 | $10,961.24 |

| 48006 | $10,925.79 |

| 48017 | $10,915.79 |

| 48390 | $10,907.94 |

| 48307 | $10,897.48 |

| 48050 | $10,889.02 |

| 48049 | $10,884.68 |

| 48032 | $10,872.94 |

| 48722 | $10,868.44 |

| 48064 | $10,832.68 |

| 48004 | $10,810.91 |

| 48198 | $10,790.84 |

| 48188 | $10,790.47 |

| 48162 | $10,780.86 |

| 48028 | $10,755.83 |

| 48073 | $10,750.05 |

| 48001 | $10,745.87 |

| 48433 | $10,735.55 |

| 48306 | $10,733.07 |

| 48062 | $10,714.39 |

| 48145 | $10,714.39 |

| 48367 | $10,670.95 |

| 48161 | $10,669.49 |

| 48366 | $10,667.69 |

| 48039 | $10,660.22 |

| 48187 | $10,660.06 |

| 48450 | $10,659.66 |

| 48463 | $10,658.56 |

| 48002 | $10,647.76 |

| 49634 | $10,640.77 |

| 48386 | $10,639.91 |

| 49673 | $10,636.17 |

| 48436 | $10,599.58 |

| 48393 | $10,595.09 |

| 48014 | $10,591.64 |

| 48177 | $10,589.21 |

| 48074 | $10,581.74 |

| 48428 | $10,573.67 |

| 48381 | $10,571.71 |

| 49611 | $10,565.41 |

| 48464 | $10,563.29 |

| 48370 | $10,558.67 |

| 48422 | $10,535.59 |

| 48059 | $10,534.36 |

| 48401 | $10,522.87 |

| 49263 | $10,521.16 |

| 49711 | $10,511.20 |

| 48444 | $10,508.66 |

| 48003 | $10,506.04 |

| 48041 | $10,493.02 |

| 48009 | $10,491.26 |

| 48461 | $10,489.29 |

| 48416 | $10,487.91 |

| 49737 | $10,485.93 |

| 48175 | $10,481.91 |

| 48168 | $10,473.59 |

| 49723 | $10,466.63 |

| 48165 | $10,463.25 |

| 48469 | $10,459.71 |

| 48412 | $10,449.65 |

| 48179 | $10,447.80 |

| 48063 | $10,446.94 |

| 48466 | $10,442.76 |

| 48419 | $10,433.11 |

| 48435 | $10,403.76 |

| 48439 | $10,397.89 |

| 48760 | $10,385.71 |

| 48167 | $10,378.34 |

| 48421 | $10,356.33 |

| 48054 | $10,355.23 |

| 48455 | $10,347.17 |

| 48727 | $10,326.56 |

| 48356 | $10,313.99 |

| 48451 | $10,303.86 |

| 48060 | $10,296.16 |

| 48079 | $10,291.39 |

| 48454 | $10,287.16 |

| 48438 | $10,284.84 |

| 48357 | $10,275.43 |

| 48380 | $10,257.48 |

| 48418 | $10,212.55 |

| 48446 | $10,211.71 |

| 48157 | $10,207.25 |

| 48359 | $10,199.29 |

| 49304 | $10,194.24 |

| 48746 | $10,193.35 |

| 48348 | $10,193.19 |

| 48887 | $10,181.74 |

| 48363 | $10,173.42 |

| 49942 | $10,169.21 |

| 48040 | $10,167.04 |

| 48350 | $10,164.44 |

| 48360 | $10,153.78 |

| 48371 | $10,153.00 |

| 49642 | $10,141.13 |

| 48178 | $10,139.79 |

| 48144 | $10,129.45 |

| 49644 | $10,116.14 |

| 48110 | $10,108.55 |

| 48166 | $10,102.22 |

| 48630 | $10,100.91 |

| 48453 | $10,090.39 |

| 48117 | $10,080.78 |

| 49270 | $10,078.61 |

| 49656 | $10,065.49 |

| 48182 | $10,059.71 |

| 48758 | $10,047.16 |

| 48744 | $10,047.02 |

| 48415 | $10,042.53 |

| 48362 | $10,041.84 |

| 48346 | $10,036.59 |

| 49655 | $10,035.30 |

| 48434 | $10,031.41 |

| 48610 | $10,030.90 |

| 49309 | $10,029.06 |

| 49688 | $10,023.48 |

| 48471 | $10,010.92 |

| 48427 | $10,008.40 |

| 48426 | $10,007.32 |

| 48729 | $10,005.99 |

| 49677 | $10,001.36 |

| 48465 | $10,000.31 |

| 48850 | $9,991.19 |

| 48767 | $9,988.75 |

| 48170 | $9,986.14 |

| 48432 | $9,981.73 |

| 48140 | $9,978.87 |

| 48456 | $9,976.69 |

| 48472 | $9,975.31 |

| 48741 | $9,970.85 |

| 48468 | $9,966.45 |

| 49329 | $9,962.00 |

| 48701 | $9,961.52 |

| 48726 | $9,957.81 |

| 48473 | $9,956.53 |

| 48723 | $9,955.61 |

| 48470 | $9,955.19 |

| 48725 | $9,952.61 |

| 48467 | $9,952.35 |

| 48768 | $9,950.51 |

| 49459 | $9,942.95 |

| 48475 | $9,941.22 |

| 48720 | $9,936.93 |

| 49339 | $9,936.26 |

| 48733 | $9,927.93 |

| 48754 | $9,927.01 |

| 48731 | $9,924.33 |

| 49332 | $9,921.44 |

| 48766 | $9,919.63 |

| 48445 | $9,914.92 |

| 48755 | $9,914.89 |

| 49327 | $9,913.77 |

| 48441 | $9,912.62 |

| 48759 | $9,912.04 |

| 48659 | $9,902.46 |

| 48624 | $9,899.46 |

| 48749 | $9,895.30 |

| 48658 | $9,892.35 |

| 49343 | $9,891.00 |

| 49322 | $9,886.56 |

| 49347 | $9,884.04 |

| 48735 | $9,877.99 |

| 49312 | $9,872.49 |

| 49336 | $9,870.12 |

| 49307 | $9,867.55 |

| 49463 | $9,863.66 |

| 49337 | $9,855.81 |

| 48413 | $9,855.26 |

| 48765 | $9,846.46 |

| 48609 | $9,839.70 |

| 48137 | $9,837.18 |

| 48423 | $9,834.79 |

| 48838 | $9,828.01 |

| 49330 | $9,824.89 |

| 48703 | $9,822.89 |

| 48884 | $9,816.19 |

| 48159 | $9,812.51 |

| 48886 | $9,806.76 |

| 48888 | $9,803.73 |

| 49037 | $9,801.05 |

| 49646 | $9,794.66 |

| 48430 | $9,773.75 |

| 49676 | $9,770.14 |

| 48449 | $9,760.79 |

| 49342 | $9,760.78 |

| 49346 | $9,753.71 |

| 49039 | $9,744.22 |

| 49759 | $9,741.61 |

| 48885 | $9,737.45 |

| 49610 | $9,734.96 |

| 48834 | $9,732.66 |

| 49319 | $9,727.77 |

| 48874 | $9,722.74 |

| 49797 | $9,722.04 |

| 48924 | $9,719.55 |

| 49074 | $9,713.93 |

| 49689 | $9,710.64 |

| 49612 | $9,709.76 |

| 48870 | $9,709.71 |

| 48654 | $9,704.40 |

| 49626 | $9,700.51 |

| 48915 | $9,698.64 |

| 48865 | $9,697.20 |

| 49674 | $9,681.65 |

| 49761 | $9,673.87 |

| 49625 | $9,671.56 |

| 48818 | $9,668.99 |

| 48661 | $9,655.31 |

| 49865 | $9,650.79 |

| 49628 | $9,648.44 |

| 48739 | $9,643.86 |

| 49410 | $9,635.52 |

| 48812 | $9,630.39 |

| 49733 | $9,629.81 |

| 49683 | $9,628.87 |

| 48852 | $9,624.54 |

| 49310 | $9,618.28 |

| 48829 | $9,615.96 |

| 48708 | $9,615.42 |

| 49627 | $9,614.13 |

| 48613 | $9,611.53 |

| 48756 | $9,606.33 |

| 48748 | $9,604.14 |

| 49659 | $9,603.78 |

| 49633 | $9,602.81 |

| 49751 | $9,600.26 |

| 49717 | $9,598.33 |

| 49617 | $9,598.17 |

| 49507 | $9,598.11 |

| 49705 | $9,596.95 |

| 49799 | $9,596.83 |

| 49765 | $9,594.98 |

| 49035 | $9,587.40 |

| 49668 | $9,587.21 |

| 49792 | $9,584.02 |

| 48652 | $9,583.91 |

| 48131 | $9,583.50 |

| 49402 | $9,579.92 |

| 48770 | $9,576.64 |

| 48732 | $9,569.73 |

| 49345 | $9,569.11 |

| 49411 | $9,566.68 |

| 49622 | $9,564.41 |

| 48845 | $9,562.17 |

| 49795 | $9,559.64 |

| 49638 | $9,558.12 |

| 48763 | $9,555.39 |

| 49749 | $9,552.11 |

| 49645 | $9,543.77 |

| 49791 | $9,543.68 |

| 48635 | $9,539.86 |

| 49615 | $9,539.44 |

| 49706 | $9,538.08 |

| 49618 | $9,537.77 |

| 49058 | $9,533.09 |

| 49259 | $9,531.40 |

| 49415 | $9,531.34 |

| 49648 | $9,526.98 |

| 48353 | $9,514.86 |

| 48457 | $9,511.83 |

| 49454 | $9,511.51 |

| 48811 | $9,510.91 |

| 48622 | $9,507.37 |

| 49690 | $9,507.18 |

| 49629 | $9,504.20 |

| 48730 | $9,504.02 |

| 49458 | $9,503.56 |

| 49349 | $9,499.33 |

| 49782 | $9,497.41 |

| 48632 | $9,496.59 |

| 49735 | $9,491.33 |

| 49326 | $9,491.29 |

| 49738 | $9,491.13 |

| 49713 | $9,488.54 |

| 49727 | $9,486.56 |

| 49639 | $9,482.25 |

| 49796 | $9,479.93 |

| 48757 | $9,479.86 |

| 49405 | $9,478.88 |

| 48855 | $9,476.69 |

| 49679 | $9,476.49 |

| 48625 | $9,475.98 |

| 48933 | $9,473.05 |

| 49651 | $9,466.01 |

| 49721 | $9,464.90 |

| 49764 | $9,463.53 |

| 49440 | $9,458.80 |

| 49769 | $9,458.29 |

| 49431 | $9,457.65 |

| 48891 | $9,453.47 |

| 49730 | $9,452.96 |

| 49305 | $9,451.62 |

| 49701 | $9,451.10 |

| 49451 | $9,450.70 |

| 49755 | $9,448.53 |

| 49623 | $9,440.39 |

| 49729 | $9,436.59 |

| 49416 | $9,434.49 |

| 48860 | $9,433.60 |

| 49317 | $9,426.27 |

| 49442 | $9,426.10 |

| 49045 | $9,423.10 |

| 49720 | $9,422.85 |

| 49046 | $9,421.92 |

| 49285 | $9,419.85 |

| 49272 | $9,417.60 |

| 49503 | $9,417.17 |

| 49878 | $9,415.28 |

| 49896 | $9,414.98 |

| 48633 | $9,410.94 |

| 49267 | $9,407.10 |

| 48617 | $9,406.57 |

| 49740 | $9,405.96 |

| 48882 | $9,405.75 |

| 49812 | $9,400.09 |

| 48160 | $9,398.45 |

| 48634 | $9,397.80 |

| 48612 | $9,396.64 |

| 48143 | $9,396.50 |

| 48846 | $9,395.35 |

| 48604 | $9,393.47 |

| 49303 | $9,389.42 |

| 49718 | $9,387.92 |

| 49712 | $9,387.69 |

| 48631 | $9,387.54 |

| 49770 | $9,384.84 |

| 48169 | $9,381.19 |

| 49064 | $9,380.96 |

| 49818 | $9,379.61 |

| 49284 | $9,378.70 |

| 49716 | $9,375.76 |

| 49445 | $9,372.29 |

| 49302 | $9,370.78 |

| 49240 | $9,369.96 |

| 49234 | $9,368.50 |

| 49246 | $9,367.94 |

| 49874 | $9,365.01 |

| 49821 | $9,361.71 |

| 49807 | $9,360.62 |

| 49436 | $9,360.11 |

| 48912 | $9,358.48 |

| 49631 | $9,357.21 |

| 49325 | $9,356.34 |

| 48158 | $9,348.70 |

| 49504 | $9,346.86 |

| 49241 | $9,344.18 |

| 49444 | $9,334.82 |

| 49344 | $9,334.82 |

| 49065 | $9,334.46 |

| 49421 | $9,325.28 |

| 49331 | $9,323.91 |

| 48724 | $9,320.83 |

| 49419 | $9,312.95 |

| 49311 | $9,311.03 |

| 49449 | $9,308.51 |

| 49837 | $9,304.61 |

| 49338 | $9,303.17 |

| 49420 | $9,300.38 |

| 49269 | $9,295.00 |

| 49277 | $9,287.96 |

| 49230 | $9,287.64 |

| 49333 | $9,279.26 |

| 49696 | $9,277.32 |

| 48649 | $9,275.63 |

| 49441 | $9,272.81 |

| 49408 | $9,270.99 |

| 49665 | $9,268.58 |

| 49887 | $9,268.20 |

| 49070 | $9,267.63 |

| 49829 | $9,265.43 |

| 48130 | $9,264.62 |

| 48809 | $9,264.29 |

| 49237 | $9,256.66 |

| 49848 | $9,253.87 |

| 48429 | $9,250.65 |

| 49886 | $9,249.66 |

| 49726 | $9,248.97 |

| 48872 | $9,248.84 |

| 49452 | $9,248.65 |

| 49601 | $9,247.84 |

| 48851 | $9,246.72 |

| 49318 | $9,246.48 |

| 49880 | $9,243.95 |

| 49892 | $9,241.91 |

| 48747 | $9,240.23 |

| 48655 | $9,239.11 |

| 48476 | $9,238.77 |

| 49847 | $9,234.23 |

| 48892 | $9,232.68 |

| 49446 | $9,232.58 |

| 48849 | $9,230.72 |

| 49852 | $9,230.08 |

| 49873 | $9,229.95 |

| 49863 | $9,229.80 |

| 48815 | $9,226.62 |

| 49320 | $9,222.99 |

| 49894 | $9,221.24 |

| 49872 | $9,220.44 |

| 48881 | $9,220.09 |

| 49067 | $9,219.55 |

| 48836 | $9,219.15 |

| 49950 | $9,216.77 |

| 49685 | $9,215.44 |

| 49112 | $9,212.55 |

| 49680 | $9,211.74 |

| 49007 | $9,211.21 |

| 48857 | $9,210.18 |

| 49090 | $9,209.02 |

| 49619 | $9,206.45 |

| 48911 | $9,205.81 |

| 49835 | $9,205.15 |

| 49276 | $9,198.33 |

| 49455 | $9,193.55 |

| 48414 | $9,190.25 |

| 49893 | $9,188.00 |

| 49013 | $9,184.98 |

| 48114 | $9,183.25 |

| 48710 | $9,179.35 |

| 48650 | $9,176.33 |

| 49348 | $9,175.96 |

| 49675 | $9,168.59 |

| 48893 | $9,167.03 |

| 48762 | $9,161.38 |

| 48734 | $9,159.03 |

| 49060 | $9,158.68 |

| 49063 | $9,158.55 |

| 49043 | $9,157.51 |

| 49725 | $9,156.43 |

| 49955 | $9,155.46 |

| 49958 | $9,153.39 |

| 48740 | $9,153.28 |

| 49858 | $9,149.83 |

| 49918 | $9,145.61 |

| 48460 | $9,145.61 |

| 49620 | $9,141.51 |

| 49912 | $9,141.22 |

| 48651 | $9,141.10 |

| 48627 | $9,139.81 |

| 48761 | $9,139.28 |

| 49901 | $9,132.99 |

| 49021 | $9,131.99 |

| 48629 | $9,131.39 |

| 49917 | $9,130.84 |

| 49616 | $9,128.93 |

| 48638 | $9,127.62 |

| 49613 | $9,125.84 |

| 49948 | $9,125.60 |

| 48738 | $9,124.67 |

| 48706 | $9,122.72 |

| 49921 | $9,122.66 |

| 49056 | $9,119.38 |

| 49251 | $9,117.24 |

| 49508 | $9,114.74 |

| 48745 | $9,112.66 |

| 49314 | $9,112.65 |

| 49050 | $9,112.45 |

| 49031 | $9,111.87 |

| 49643 | $9,109.89 |

| 49660 | $9,109.62 |

| 49017 | $9,109.11 |

| 49934 | $9,108.42 |

| 49908 | $9,107.76 |

| 49747 | $9,105.45 |

| 49635 | $9,105.16 |

| 48825 | $9,102.42 |

| 48817 | $9,100.89 |

| 49089 | $9,100.47 |

| 49071 | $9,099.79 |

| 49827 | $9,094.83 |

| 49203 | $9,094.82 |

| 49838 | $9,094.69 |

| 49614 | $9,093.70 |

| 49965 | $9,091.98 |

| 49512 | $9,091.58 |

| 49340 | $9,090.84 |

| 49201 | $9,089.52 |

| 49202 | $9,088.91 |

| 49963 | $9,086.77 |

| 49525 | $9,083.82 |

| 49636 | $9,082.89 |

| 49020 | $9,082.23 |

| 49881 | $9,082.02 |

| 49805 | $9,081.89 |

| 48742 | $9,081.40 |

| 48873 | $9,079.08 |

| 48721 | $9,078.17 |

| 49640 | $9,077.24 |

| 49027 | $9,077.20 |

| 49766 | $9,075.59 |

| 48118 | $9,071.27 |

| 49920 | $9,065.87 |

| 49788 | $9,065.65 |

| 49902 | $9,065.45 |

| 49916 | $9,065.30 |

| 49938 | $9,064.69 |

| 49922 | $9,064.19 |

| 49650 | $9,063.75 |

| 49820 | $9,063.71 |

| 49238 | $9,063.01 |

| 49962 | $9,062.88 |

| 48830 | $9,062.47 |

| 49853 | $9,061.98 |

| 49903 | $9,061.90 |

| 49862 | $9,061.87 |

| 49945 | $9,061.75 |

| 48841 | $9,061.61 |

| 49753 | $9,057.47 |

| 48656 | $9,056.88 |

| 49911 | $9,056.42 |

| 48116 | $9,056.33 |

| 49228 | $9,055.53 |

| 49915 | $9,051.18 |

| 48906 | $9,050.97 |

| 49946 | $9,049.94 |

| 49960 | $9,049.87 |

| 49664 | $9,049.06 |

| 49913 | $9,044.73 |

| 49870 | $9,043.18 |

| 49774 | $9,042.55 |

| 49653 | $9,040.86 |

| 49746 | $9,040.72 |

| 49649 | $9,040.25 |

| 49968 | $9,038.78 |

| 49509 | $9,036.86 |

| 49868 | $9,035.91 |

| 49752 | $9,035.65 |

| 49630 | $9,034.20 |

| 49323 | $9,033.51 |

| 48819 | $9,033.36 |

| 49130 | $9,030.27 |

| 49724 | $9,028.40 |

| 49335 | $9,028.13 |

| 49905 | $9,027.64 |

| 49403 | $9,027.62 |

| 49762 | $9,027.51 |

| 49775 | $9,026.93 |

| 48737 | $9,024.58 |

| 49637 | $9,024.40 |

| 48867 | $9,024.02 |

| 48705 | $9,022.53 |

| 49780 | $9,022.32 |

| 49925 | $9,021.62 |

| 49412 | $9,019.44 |

| 49953 | $9,019.29 |

| 49736 | $9,019.08 |

| 49876 | $9,017.29 |

| 49001 | $9,016.21 |

| 49519 | $9,014.53 |

| 48866 | $9,014.46 |

| 49621 | $9,013.65 |

| 49715 | $9,011.50 |

| 49793 | $9,009.45 |

| 49450 | $9,007.86 |

| 49709 | $9,007.71 |

| 49831 | $9,006.03 |

| 48750 | $9,005.12 |

| 49080 | $9,002.16 |

| 49971 | $9,001.80 |

| 49745 | $9,000.81 |

| 49768 | $9,000.63 |

| 49026 | $9,000.60 |

| 49931 | $9,000.16 |

| 49815 | $8,998.68 |

| 49229 | $8,998.40 |

| 49055 | $8,994.67 |

| 48653 | $8,993.43 |

| 49959 | $8,992.78 |

| 48843 | $8,991.44 |

| 49961 | $8,990.97 |

| 49006 | $8,990.50 |

| 49098 | $8,989.45 |

| 49670 | $8,989.39 |

| 49728 | $8,988.25 |

| 49935 | $8,988.15 |

| 49710 | $8,985.77 |

| 48848 | $8,984.86 |

| 48636 | $8,984.57 |

| 48619 | $8,984.27 |

| 49748 | $8,983.75 |

| 49236 | $8,982.89 |

| 49744 | $8,982.18 |

| 49072 | $8,980.89 |

| 49952 | $8,979.66 |

| 48910 | $8,979.46 |

| 49264 | $8,976.03 |

| 49654 | $8,975.99 |

| 49967 | $8,975.43 |

| 49096 | $8,975.35 |

| 49667 | $8,975.29 |

| 49088 | $8,974.44 |

| 49306 | $8,972.48 |

| 49947 | $8,971.63 |

| 49839 | $8,970.09 |

| 49014 | $8,969.35 |

| 49779 | $8,968.29 |

| 49425 | $8,967.50 |

| 48621 | $8,966.80 |

| 49719 | $8,965.62 |

| 49930 | $8,965.61 |

| 49919 | $8,965.32 |

| 48647 | $8,965.28 |

| 48890 | $8,964.12 |

| 49239 | $8,963.67 |

| 49783 | $8,961.38 |

| 49034 | $8,960.34 |

| 48176 | $8,959.63 |

| 49927 | $8,958.23 |

| 49970 | $8,957.77 |

| 48859 | $8,957.53 |

| 49321 | $8,954.90 |

| 49834 | $8,953.34 |

| 49801 | $8,952.62 |

| 49776 | $8,952.46 |

| 49287 | $8,950.77 |

| 48603 | $8,950.72 |

| 49092 | $8,949.94 |

| 49099 | $8,949.11 |

| 49632 | $8,949.01 |

| 49682 | $8,948.62 |

| 49969 | $8,946.41 |

| 49686 | $8,945.07 |

| 49010 | $8,942.44 |

| 48417 | $8,940.29 |

| 49802 | $8,938.80 |

| 49316 | $8,937.25 |

| 48824 | $8,937.10 |

| 49249 | $8,934.01 |

| 49663 | $8,932.64 |

| 49095 | $8,931.48 |

| 49052 | $8,931.39 |

| 49008 | $8,930.90 |

| 49756 | $8,927.80 |

| 48896 | $8,927.75 |

| 48728 | $8,927.28 |

| 48831 | $8,927.18 |

| 49891 | $8,927.15 |

| 48189 | $8,924.45 |

| 49506 | $8,924.35 |

| 49895 | $8,922.03 |

| 49743 | $8,917.44 |

| 49816 | $8,917.13 |

| 49009 | $8,917.03 |

| 49457 | $8,916.07 |

| 49328 | $8,910.53 |

| 48861 | $8,908.86 |

| 49066 | $8,908.16 |

| 49684 | $8,906.74 |

| 48897 | $8,906.73 |

| 49062 | $8,903.04 |

| 48877 | $8,901.50 |

| 49884 | $8,895.76 |

| 49505 | $8,893.78 |

| 48878 | $8,886.90 |

| 49061 | $8,884.85 |

| 49047 | $8,881.82 |

| 49437 | $8,881.53 |

| 49301 | $8,880.98 |

| 49534 | $8,880.73 |

| 49245 | $8,879.90 |

| 49286 | $8,879.76 |

| 49707 | $8,877.85 |

| 49255 | $8,877.45 |

| 49224 | $8,877.42 |

| 49051 | $8,876.09 |

| 48743 | $8,875.89 |

| 49777 | $8,875.56 |

| 48835 | $8,873.46 |

| 49817 | $8,873.24 |

| 49836 | $8,872.42 |

| 49258 | $8,872.01 |

| 49283 | $8,868.32 |

| 49048 | $8,868.00 |

| 49232 | $8,865.76 |

| 49036 | $8,861.62 |

| 49004 | $8,858.62 |

| 49840 | $8,857.05 |

| 49910 | $8,854.31 |

| 49657 | $8,850.24 |

| 49341 | $8,849.59 |

| 49038 | $8,846.81 |

| 49854 | $8,846.62 |

| 49254 | $8,845.97 |

| 49883 | $8,843.05 |

| 49093 | $8,839.64 |

| 49461 | $8,833.07 |

| 49282 | $8,831.54 |

| 49042 | $8,826.00 |

| 48858 | $8,819.79 |

| 48895 | $8,819.67 |

| 49129 | $8,817.69 |

| 48614 | $8,815.45 |

| 49781 | $8,814.29 |

| 49079 | $8,814.10 |

| 49076 | $8,813.75 |

| 49289 | $8,810.80 |

| 49760 | $8,807.63 |

| 49253 | $8,805.22 |

| 49757 | $8,801.31 |

| 49028 | $8,799.59 |

| 49268 | $8,796.07 |

| 49022 | $8,795.92 |

| 48637 | $8,789.15 |

| 49011 | $8,788.71 |

| 49120 | $8,787.00 |

| 48662 | $8,786.36 |

| 49091 | $8,780.54 |

| 48832 | $8,779.23 |

| 49274 | $8,777.73 |

| 49029 | $8,776.51 |

| 49265 | $8,773.22 |

| 49040 | $8,768.13 |

| 49242 | $8,765.59 |

| 49104 | $8,763.97 |

| 49030 | $8,762.94 |

| 49073 | $8,758.12 |

| 49057 | $8,757.48 |

| 49113 | $8,756.48 |

| 49128 | $8,753.94 |

| 49806 | $8,751.66 |

| 49266 | $8,748.83 |

| 48626 | $8,748.68 |

| 49233 | $8,748.34 |

| 49227 | $8,740.62 |

| 49546 | $8,735.83 |

| 48847 | $8,735.17 |

| 49078 | $8,734.57 |

| 49406 | $8,730.23 |

| 49262 | $8,729.73 |

| 49116 | $8,729.56 |

| 49103 | $8,726.30 |

| 49053 | $8,724.99 |

| 49125 | $8,724.87 |

| 48807 | $8,722.75 |

| 49127 | $8,719.44 |

| 49271 | $8,719.38 |

| 49434 | $8,719.23 |

| 49032 | $8,713.35 |

| 48917 | $8,705.38 |

| 49822 | $8,703.21 |

| 49252 | $8,699.49 |

| 49279 | $8,683.92 |

| 48853 | $8,683.53 |

| 49288 | $8,682.78 |

| 48827 | $8,677.43 |

| 48875 | $8,677.20 |

| 48616 | $8,676.74 |

| 49548 | $8,676.43 |

| 49430 | $8,675.81 |

| 48801 | $8,675.30 |

| 49083 | $8,675.08 |

| 49094 | $8,674.80 |

| 49024 | $8,671.46 |

| 49082 | $8,669.34 |

| 49819 | $8,667.75 |

| 49453 | $8,667.13 |

| 49404 | $8,666.54 |

| 48871 | $8,666.40 |

| 49247 | $8,666.18 |

| 49248 | $8,664.88 |

| 49119 | $8,661.71 |

| 49250 | $8,660.74 |

| 49033 | $8,656.52 |

| 49256 | $8,650.41 |

| 49111 | $8,647.06 |

| 49448 | $8,645.62 |

| 48840 | $8,643.19 |

| 49115 | $8,636.23 |

| 49220 | $8,624.26 |

| 49002 | $8,617.68 |

| 48889 | $8,613.92 |

| 48105 | $8,612.05 |

| 49068 | $8,610.94 |

| 49126 | $8,604.98 |

| 49015 | $8,604.20 |

| 49097 | $8,600.65 |

| 49424 | $8,599.12 |

| 48856 | $8,596.48 |

| 49423 | $8,595.55 |

| 49221 | $8,593.80 |

| 49826 | $8,593.51 |

| 48879 | $8,592.86 |

| 48823 | $8,580.38 |

| 48806 | $8,575.48 |

| 49102 | $8,573.83 |

| 49235 | $8,570.88 |

| 49825 | $8,568.16 |

| 49315 | $8,566.46 |

| 49085 | $8,563.53 |

| 48864 | $8,561.97 |

| 49117 | $8,558.59 |

| 49012 | $8,545.11 |

| 48876 | $8,535.46 |

| 49885 | $8,522.41 |

| 49106 | $8,517.12 |

| 49871 | $8,517.02 |

| 49808 | $8,515.99 |

| 49101 | $8,489.80 |

| 48108 | $8,478.89 |

| 49544 | $8,477.07 |

| 49107 | $8,458.78 |

| 49861 | $8,450.31 |

| 49841 | $8,444.79 |

| 49833 | $8,432.92 |

| 49435 | $8,431.87 |

| 49428 | $8,421.66 |

| 49814 | $8,419.02 |

| 49087 | $8,416.82 |

| 49855 | $8,415.67 |

| 49849 | $8,405.97 |

| 49866 | $8,404.66 |

| 49879 | $8,404.27 |

| 49418 | $8,372.81 |

| 48854 | $8,368.95 |

| 49456 | $8,368.35 |

| 49460 | $8,364.85 |

| 48842 | $8,360.88 |

| 48103 | $8,357.87 |

| 49417 | $8,327.06 |

| 48628 | $8,315.01 |

| 48808 | $8,310.66 |

| 48618 | $8,309.23 |

| 48109 | $8,302.99 |

| 49426 | $8,302.44 |

| 48813 | $8,295.51 |

| 48820 | $8,285.75 |

| 48623 | $8,279.45 |

| 49464 | $8,271.79 |

| 49401 | $8,267.02 |

| 48821 | $8,262.31 |

| 48615 | $8,248.57 |

| 48611 | $8,242.98 |

| 48657 | $8,231.24 |

| 48822 | $8,229.45 |

| 48104 | $8,224.45 |

| 48837 | $8,153.32 |

| 48640 | $8,134.85 |

| 48642 | $8,127.78 |

| 48894 | $8,036.93 |

| 48883 | $7,958.69 |

| 48880 | $7,916.29 |

Overall, the cheapest zip codes in Michigan are in Gratiot County. The 48880 zip code, or the Saint Louis area, has an average rate of $7,916.29 annually.

Cheapest Rates By City

| City | Annual Average |

|---|---|

| SAINT LOUIS | $7,916.29 |

| SHEPHERD | $7,958.69 |

| WESTPHALIA | $8,036.93 |

| MIDLAND | $8,131.32 |

| GRAND LEDGE | $8,153.32 |

| EAGLE | $8,229.45 |

| SANFORD | $8,231.24 |

| AUBURN | $8,242.98 |

| BRECKENRIDGE | $8,248.57 |

| DIMONDALE | $8,262.30 |

| ALLENDALE | $8,267.02 |

| ZEELAND | $8,271.79 |

| FREELAND | $8,279.45 |

| DEWITT | $8,285.75 |

| CHARLOTTE | $8,295.51 |

| HUDSONVILLE | $8,302.44 |

| COLEMAN | $8,309.23 |

| BATH | $8,310.66 |

| HOPE | $8,315.01 |

| GRAND HAVEN | $8,327.06 |

| HOLT | $8,360.88 |

| WEST OLIVE | $8,364.85 |

| SPRING LAKE | $8,368.35 |

| MASON | $8,368.95 |

| GRANDVILLE | $8,372.81 |

| ANN ARBOR | $8,395.25 |

| REPUBLIC | $8,404.27 |

| NEGAUNEE | $8,404.66 |

| ISHPEMING | $8,405.97 |

| MARQUETTE | $8,415.67 |

| SCHOOLCRAFT | $8,416.81 |

| CHAMPION | $8,419.02 |

| JENISON | $8,421.66 |

| MARNE | $8,431.87 |

| LITTLE LAKE | $8,432.92 |

| GWINN | $8,444.79 |

| MICHIGAMME | $8,450.31 |

| BUCHANAN | $8,458.78 |

| BARODA | $8,489.80 |

| BIG BAY | $8,515.99 |

| PALMER | $8,517.02 |

| BRIDGMAN | $8,517.12 |

| SKANDIA | $8,522.42 |

| POTTERVILLE | $8,535.46 |

| AUGUSTA | $8,545.11 |

| NEW BUFFALO | $8,558.59 |

| OKEMOS | $8,561.97 |

| SAINT JOSEPH | $8,563.53 |

| BYRON CENTER | $8,566.46 |

| EBEN JUNCTION | $8,568.16 |

| CLAYTON | $8,570.88 |

| BERRIEN CENTER | $8,573.83 |

| ASHLEY | $8,575.48 |

| SAINT JOHNS | $8,592.86 |

| RUMELY | $8,593.51 |

| ADRIAN | $8,593.80 |

| MIDDLETON | $8,596.48 |

| HOLLAND | $8,597.34 |

| VICKSBURG | $8,600.65 |

| SODUS | $8,604.98 |

| MARSHALL | $8,610.94 |

| SUMNER | $8,613.92 |

| ADDISON | $8,624.26 |

| HARBERT | $8,636.23 |

| HASLETT | $8,643.19 |

| PORTAGE | $8,644.57 |

| NUNICA | $8,645.62 |

| EAU CLAIRE | $8,647.06 |

| MORENCI | $8,650.41 |

| CERESCO | $8,656.52 |

| JONESVILLE | $8,660.74 |

| NEW TROY | $8,661.71 |

| JASPER | $8,664.88 |

| HUDSON | $8,666.18 |

| PERRINTON | $8,666.40 |

| COOPERSVILLE | $8,666.54 |

| SAUGATUCK | $8,667.13 |

| ARNOLD | $8,667.75 |

| QUINCY | $8,669.34 |

| UNION CITY | $8,674.80 |

| RICHLAND | $8,675.08 |

| ALMA | $8,675.30 |

| LAMONT | $8,675.81 |

| CHESANING | $8,676.74 |

| PORTLAND | $8,677.20 |

| EATON RAPIDS | $8,677.43 |

| WALDRON | $8,682.78 |

| MAPLE RAPIDS | $8,683.53 |

| SAND CREEK | $8,683.92 |

| LITCHFIELD | $8,699.49 |

| DEERTON | $8,703.21 |

| CENTREVILLE | $8,713.35 |

| MACATAWA | $8,719.23 |

| PITTSFORD | $8,719.38 |

| STEVENSVILLE | $8,719.44 |

| BANNISTER | $8,722.75 |

| SAWYER | $8,724.87 |

| GALESBURG | $8,724.99 |

| LAKESIDE | $8,729.56 |

| NORTH ADAMS | $8,729.72 |

| DOUGLAS | $8,730.23 |

| OTSEGO | $8,734.57 |

| ITHACA | $8,735.17 |

| ALLEN | $8,740.62 |

| BERRIEN SPRINGS | $8,745.14 |

| CEMENT CITY | $8,748.34 |

| HEMLOCK | $8,748.68 |

| OSSEO | $8,748.83 |

| AU TRAIN | $8,751.66 |

| THREE OAKS | $8,753.94 |

| GALIEN | $8,756.48 |

| HARTFORD | $8,757.48 |

| NASHVILLE | $8,758.12 |

| BURR OAK | $8,762.94 |

| HILLSDALE | $8,765.59 |

| COLON | $8,768.13 |

| ONSTED | $8,773.22 |

| BURLINGTON | $8,776.51 |

| READING | $8,777.73 |

| ELWELL | $8,779.23 |

| STURGIS | $8,780.55 |

| WHEELER | $8,786.36 |

| NILES | $8,787.00 |

| ATHENS | $8,788.71 |

| MERRILL | $8,789.15 |

| BENTON HARBOR | $8,795.91 |

| PALMYRA | $8,796.07 |

| BRONSON | $8,799.59 |

| MACKINAC ISLAND | $8,801.31 |

| MANITOU BEACH | $8,805.22 |

| MORAN | $8,807.63 |

| WESTON | $8,810.80 |

| OLIVET | $8,813.75 |

| PAW PAW | $8,814.10 |

| SAINT IGNACE | $8,814.29 |

| BRANT | $8,815.45 |

| UNION PIER | $8,817.69 |

| WILLIAMSTON | $8,819.67 |

| CONSTANTINE | $8,826.00 |

| SOMERSET CENTER | $8,831.54 |

| WHITEHALL | $8,833.07 |

| THREE RIVERS | $8,839.64 |

| SENEY | $8,843.05 |

| MICHIGAN CENTER | $8,845.97 |

| MANISTIQUE | $8,846.62 |

| COLOMA | $8,846.81 |

| ROCKFORD | $8,849.59 |

| MC BAIN | $8,850.24 |

| BERGLAND | $8,854.31 |

| GULLIVER | $8,857.05 |

| COLDWATER | $8,861.62 |

| CAMDEN | $8,865.76 |

| SPRING ARBOR | $8,868.32 |

| MOSHERVILLE | $8,872.01 |

| GERMFASK | $8,872.42 |

| COOKS | $8,873.24 |

| EAST LANSING | $8,873.30 |

| FOWLER | $8,873.46 |

| PRESQUE ISLE | $8,875.56 |

| LONG LAKE | $8,875.89 |

| EAST LEROY | $8,876.09 |

| ALBION | $8,877.42 |

| MONTGOMERY | $8,877.45 |

| ALPENA | $8,877.85 |

| TECUMSEH | $8,879.76 |

| HOMER | $8,879.90 |

| ADA | $8,880.98 |

| MONTAGUE | $8,881.53 |

| DOWAGIAC | $8,881.82 |

| JONES | $8,884.85 |

| ROSEBUSH | $8,886.90 |

| MOUNT PLEASANT | $8,888.66 |

| SHINGLETON | $8,895.76 |

| RIVERDALE | $8,901.50 |

| KENDALL | $8,903.04 |

| WOODLAND | $8,906.73 |

| LEONIDAS | $8,908.16 |

| MULLIKEN | $8,908.86 |

| HOPKINS | $8,910.53 |

| TWIN LAKE | $8,916.07 |

| CHATHAM | $8,917.14 |

| HAWKS | $8,917.44 |

| WETMORE | $8,922.03 |

| WHITMORE LAKE | $8,924.45 |

| TRENARY | $8,927.15 |

| ELSIE | $8,927.18 |

| CURRAN | $8,927.27 |

| WINN | $8,927.75 |

| LEWISTON | $8,927.80 |

| FULTON | $8,931.39 |

| VANDALIA | $8,931.48 |

| MANTON | $8,932.64 |

| JEROME | $8,934.01 |

| CALEDONIA | $8,937.25 |

| KINGSFORD | $8,938.80 |

| BURT | $8,940.29 |

| ALLEGAN | $8,942.44 |

| WATERSMEET | $8,946.41 |

| SUTTONS BAY | $8,948.62 |

| FALMOUTH | $8,949.01 |

| WHITE PIGEON | $8,949.12 |

| TEKONSHA | $8,949.95 |

| TIPTON | $8,950.77 |

| POSEN | $8,952.46 |

| IRON MOUNTAIN | $8,952.62 |

| FOSTER CITY | $8,953.34 |

| COMSTOCK PARK | $8,954.90 |

| WATTON | $8,957.77 |

| GAASTRA | $8,958.23 |

| SALINE | $8,959.63 |

| CLIMAX | $8,960.34 |

| SAULT SAINTE MARIE | $8,961.38 |

| FRONTIER | $8,963.67 |

| SUNFIELD | $8,964.12 |

| MIO | $8,965.28 |

| COVINGTON | $8,965.32 |

| HANCOCK | $8,965.61 |

| CEDARVILLE | $8,965.62 |

| FAIRVIEW | $8,966.80 |

| HOLTON | $8,967.50 |

| ROGERS CITY | $8,968.29 |

| GRAND MARAIS | $8,970.09 |

| KALAMAZOO | $8,970.35 |

| MARENISCO | $8,971.63 |

| BELMONT | $8,972.48 |

| SCOTTS | $8,974.45 |

| MERRITT | $8,975.29 |

| VERMONTVILLE | $8,975.35 |

| TROUT CREEK | $8,975.43 |

| LELAND | $8,975.99 |

| ONONDAGA | $8,976.03 |

| NISULA | $8,979.66 |

| MENDON | $8,980.89 |

| HERRON | $8,982.18 |

| CLINTON | $8,982.89 |

| HULBERT | $8,983.75 |

| COMINS | $8,984.27 |

| LUZERNE | $8,984.57 |

| LAINGSBURG | $8,984.86 |

| BARBEAU | $8,985.77 |

| IRON RIVER | $8,988.15 |

| ECKERMAN | $8,988.25 |

| NORTHPORT | $8,989.39 |

| WATERVLIET | $8,989.45 |

| SIDNAW | $8,990.97 |

| RAMSAY | $8,992.78 |

| ROSCOMMON | $8,993.43 |

| GOBLES | $8,994.67 |

| BRITTON | $8,998.40 |

| CHANNING | $8,998.68 |

| HOUGHTON | $9,000.16 |

| BLOOMINGDALE | $9,000.60 |

| PARADISE | $9,000.63 |

| HESSEL | $9,000.81 |

| WHITE PINE | $9,001.80 |

| PLAINWELL | $9,002.17 |

| OSCODA | $9,005.12 |

| FELCH | $9,006.03 |

| ATLANTA | $9,007.71 |

| PULLMAN | $9,007.86 |

| TROUT LAKE | $9,009.45 |

| BRIMLEY | $9,011.49 |

| CEDAR | $9,013.65 |

| OVID | $9,014.46 |

| QUINNESEC | $9,017.29 |

| GOETZVILLE | $9,019.08 |

| ONTONAGON | $9,019.29 |

| FREMONT | $9,019.44 |

| GRAND RAPIDS | $9,020.04 |

| EWEN | $9,021.62 |

| RUDYARD | $9,022.32 |

| BARTON CITY | $9,022.53 |

| OWOSSO | $9,024.02 |

| GRAWN | $9,024.40 |

| GLENNIE | $9,024.58 |

| WYOMING | $9,025.70 |

| POINTE AUX PINS | $9,026.93 |

| NAUBINWAY | $9,027.51 |

| CONKLIN | $9,027.62 |

| ATLANTIC MINE | $9,027.64 |

| MOLINE | $9,028.13 |

| DAFTER | $9,028.40 |

| UNION | $9,030.27 |

| DANSVILLE | $9,033.37 |

| DORR | $9,033.51 |

| EMPIRE | $9,034.20 |

| KINROSS | $9,035.65 |

| NEWBERRY | $9,035.91 |

| WAKEFIELD | $9,038.78 |

| KINGSLEY | $9,040.25 |

| HILLMAN | $9,040.71 |

| LAKE LEELANAU | $9,040.86 |

| PICKFORD | $9,042.55 |

| NORWAY | $9,043.18 |

| CALUMET | $9,044.73 |

| MAPLE CITY | $9,049.06 |

| ROCKLAND | $9,049.87 |

| LANSE | $9,049.94 |

| CASPIAN | $9,051.18 |

| BLISSFIELD | $9,055.54 |

| BESSEMER | $9,056.42 |

| SAINT HELEN | $9,056.88 |

| LACHINE | $9,057.47 |

| HENDERSON | $9,061.61 |

| LAKE LINDEN | $9,061.75 |

| MUNISING | $9,061.87 |

| AMASA | $9,061.90 |

| MC MILLAN | $9,061.98 |

| ELM HALL | $9,062.48 |

| SKANEE | $9,062.88 |

| DEERFIELD | $9,063.01 |

| CURTIS | $9,063.71 |

| LAKE ANN | $9,063.75 |

| DOLLAR BAY | $9,064.19 |

| IRONWOOD | $9,064.69 |

| CHASSELL | $9,065.30 |

| ALPHA | $9,065.44 |

| KINCHELOE | $9,065.64 |

| CRYSTAL FALLS | $9,065.87 |

| CHELSEA | $9,071.27 |

| OSSINEKE | $9,075.59 |

| BREEDSVILLE | $9,077.20 |

| HONOR | $9,077.24 |

| BLACK RIVER | $9,078.17 |

| PEWAMO | $9,079.08 |

| LINCOLN | $9,081.40 |

| ALLOUEZ | $9,081.89 |

| SAGOLA | $9,082.02 |

| BEDFORD | $9,082.23 |

| GLEN ARBOR | $9,082.89 |

| TRAVERSE CITY | $9,086.14 |

| SOUTH RANGE | $9,086.77 |

| REMUS | $9,090.84 |

| JACKSON | $9,091.08 |

| TOIVOLA | $9,091.98 |

| BEAR LAKE | $9,093.70 |

| GOULD CITY | $9,094.69 |

| ENGADINE | $9,094.83 |

| MATTAWAN | $9,099.79 |

| SHERWOOD | $9,100.48 |

| CORUNNA | $9,100.89 |

| FRANKFORT | $9,105.16 |

| HUBBARD LAKE | $9,105.45 |

| BARAGA | $9,107.76 |

| HUBBELL | $9,108.42 |

| MANISTEE | $9,109.62 |

| INTERLOCHEN | $9,109.89 |

| CASSOPOLIS | $9,111.87 |

| DOWLING | $9,112.45 |

| BURNIPS | $9,112.65 |

| MIKADO | $9,112.66 |

| LESLIE | $9,117.24 |

| GRAND JUNCTION | $9,119.38 |

| BRIGHTON | $9,119.79 |

| BATTLE CREEK | $9,120.93 |

| DODGEVILLE | $9,122.66 |

| GREENBUSH | $9,124.67 |

| MASS CITY | $9,125.60 |

| ARCADIA | $9,125.84 |

| BENZONIA | $9,128.93 |

| COPPER CITY | $9,130.84 |

| HOUGHTON LAKE | $9,131.39 |

| BELLEVUE | $9,131.99 |

| AHMEEK | $9,132.99 |

| SOUTH BRANCH | $9,139.28 |

| HIGGINS LAKE | $9,139.81 |

| PRUDENVILLE | $9,141.10 |

| BRUCE CROSSING | $9,141.22 |

| BUCKLEY | $9,141.51 |

| COPPER HARBOR | $9,145.61 |

| NEW LOTHROP | $9,145.61 |

| MENOMINEE | $9,149.83 |

| HARRISVILLE | $9,153.28 |

| PELKIE | $9,153.39 |

| PAINESDALE | $9,155.46 |

| DE TOUR VILLAGE | $9,156.43 |

| COVERT | $9,157.51 |

| LACOTA | $9,158.55 |

| HICKORY CORNERS | $9,158.68 |

| FRANKENMUTH | $9,159.03 |

| SPRUCE | $9,161.38 |

| WEIDMAN | $9,167.03 |

| ONEKAMA | $9,168.59 |

| WAYLAND | $9,175.96 |

| PINCONNING | $9,176.33 |

| UNIVERSITY CENTER | $9,179.35 |

| BANGOR | $9,184.98 |

| WALLACE | $9,188.00 |

| BANCROFT | $9,190.25 |

| SHELBY | $9,193.55 |

| RIGA | $9,198.33 |

| GARDEN | $9,205.15 |

| BRETHREN | $9,206.45 |

| SOUTH HAVEN | $9,209.02 |

| MORRICE | $9,210.18 |

| SOUTH BOARDMAN | $9,211.74 |

| EDWARDSBURG | $9,212.55 |

| MOHAWK | $9,216.77 |

| FOWLERVILLE | $9,219.15 |

| MARCELLUS | $9,219.55 |

| SARANAC | $9,220.09 |

| PERKINS | $9,220.44 |

| WELLS | $9,221.24 |

| CHIPPEWA LAKE | $9,222.99 |

| CLARKSVILLE | $9,226.62 |

| NADEAU | $9,229.80 |

| PERRONVILLE | $9,229.95 |

| LORETTO | $9,230.08 |

| LAKE ODESSA | $9,230.72 |

| NEW ERA | $9,232.58 |

| WEBBERVILLE | $9,232.68 |

| HOWELL | $9,234.07 |

| HERMANSVILLE | $9,234.23 |

| VERNON | $9,238.77 |

| SAINT CHARLES | $9,239.11 |

| MUNGER | $9,240.23 |

| VULCAN | $9,241.91 |

| ROCK | $9,243.95 |

| CASNOVIA | $9,246.48 |

| LYONS | $9,246.72 |

| CADILLAC | $9,247.84 |

| ROTHBURY | $9,248.65 |

| PERRY | $9,248.84 |

| DRUMMOND ISLAND | $9,248.97 |

| SPALDING | $9,249.66 |

| DURAND | $9,250.65 |

| INGALLS | $9,253.87 |

| CONCORD | $9,256.66 |

| BELDING | $9,264.29 |

| DEXTER | $9,264.62 |

| ESCANABA | $9,265.43 |

| MARTIN | $9,267.63 |

| STEPHENSON | $9,268.20 |

| MARION | $9,268.58 |

| FENNVILLE | $9,270.99 |

| LANSING | $9,273.92 |

| OAKLEY | $9,275.62 |

| MIDDLEVILLE | $9,279.26 |

| BROOKLYN | $9,287.64 |

| RIVES JUNCTION | $9,287.96 |

| PARMA | $9,295.00 |

| HART | $9,300.38 |

| PARIS | $9,303.17 |

| GLADSTONE | $9,304.61 |

| PENTWATER | $9,308.51 |

| BRADLEY | $9,311.03 |

| HAMILTON | $9,312.95 |

| CARROLLTON | $9,320.83 |

| LOWELL | $9,323.91 |

| HESPERIA | $9,325.28 |

| LAWTON | $9,334.46 |

| SHELBYVILLE | $9,334.82 |

| HANOVER | $9,344.19 |

| MANCHESTER | $9,348.70 |

| FREEPORT | $9,356.34 |

| EVART | $9,357.21 |

| MEARS | $9,360.11 |

| BARK RIVER | $9,360.62 |

| DAGGETT | $9,361.71 |

| POWERS | $9,365.01 |

| HORTON | $9,367.94 |

| CLARKLAKE | $9,368.50 |

| BAY CITY | $9,369.07 |

| GRASS LAKE | $9,369.96 |

| ALTO | $9,370.78 |

| MUSKEGON | $9,372.96 |

| BRUTUS | $9,375.76 |

| SPRINGPORT | $9,378.70 |

| CORNELL | $9,379.61 |

| LAWRENCE | $9,380.96 |

| PINCKNEY | $9,381.19 |

| PETOSKEY | $9,384.84 |

| KAWKAWLIN | $9,387.54 |

| BOYNE CITY | $9,387.69 |

| CARP LAKE | $9,387.92 |

| BAILEY | $9,389.42 |

| IONIA | $9,395.35 |

| LAKELAND | $9,396.50 |

| BEAVERTON | $9,396.64 |

| LINWOOD | $9,397.80 |

| MILAN | $9,398.45 |

| CARNEY | $9,400.09 |

| SHAFTSBURG | $9,405.75 |

| HARBOR SPRINGS | $9,405.96 |

| CLARE | $9,406.57 |

| OTTAWA LAKE | $9,407.10 |

| LAKE GEORGE | $9,410.94 |

| WILSON | $9,414.98 |

| RAPID RIVER | $9,415.28 |

| PLEASANT LAKE | $9,417.60 |

| STOCKBRIDGE | $9,419.85 |

| DELTON | $9,421.92 |

| CHARLEVOIX | $9,422.85 |

| DECATUR | $9,423.10 |

| CANNONSBURG | $9,426.27 |

| MUIR | $9,433.60 |

| GLENN | $9,434.49 |

| ELLSWORTH | $9,436.59 |

| CHASE | $9,440.39 |

| LEVERING | $9,448.53 |

| RAVENNA | $9,450.70 |

| MACKINAW CITY | $9,451.10 |

| BARRYTON | $9,451.62 |

| ELMIRA | $9,452.96 |

| VESTABURG | $9,453.47 |

| LUDINGTON | $9,457.65 |

| PELLSTON | $9,458.29 |

| ODEN | $9,463.53 |

| CHEBOYGAN | $9,464.90 |

| LAKE CITY | $9,466.01 |

| HARRISON | $9,475.98 |

| SEARS | $9,476.49 |

| CUSTER | $9,478.88 |

| REESE | $9,479.86 |

| WALLOON LAKE | $9,479.93 |

| HERSEY | $9,482.25 |

| EAST JORDAN | $9,486.56 |

| BOYNE FALLS | $9,488.54 |

| GRAYLING | $9,491.13 |

| GOWEN | $9,491.29 |

| GAYLORD | $9,491.33 |

| LAKE | $9,496.59 |

| BEAVER ISLAND | $9,497.41 |

| WHITE CLOUD | $9,499.33 |

| WALHALLA | $9,503.56 |

| EAST TAWAS | $9,504.02 |

| ELK RAPIDS | $9,504.20 |

| WILLIAMSBURG | $9,507.18 |

| FARWELL | $9,507.37 |

| CARSON CITY | $9,510.91 |

| SCOTTVILLE | $9,511.51 |

| MONTROSE | $9,511.83 |

| HARTLAND | $9,514.86 |

| KEWADIN | $9,526.98 |

| FRUITPORT | $9,531.34 |

| MUNITH | $9,531.40 |

| HASTINGS | $9,533.09 |

| BOON | $9,537.77 |

| ALANSON | $9,538.08 |

| BELLAIRE | $9,539.44 |

| LUPTON | $9,539.86 |

| TOPINABEE | $9,543.68 |

| KALEVA | $9,543.77 |

| INDIAN RIVER | $9,552.11 |

| TAWAS CITY | $9,555.39 |

| HARRIETTA | $9,558.12 |

| VANDERBILT | $9,559.64 |

| HUBBARDSTON | $9,562.17 |

| CENTRAL LAKE | $9,564.41 |

| FREE SOIL | $9,566.68 |

| SPARTA | $9,569.11 |

| ESSEXVILLE | $9,569.73 |

| WHITTEMORE | $9,576.64 |

| BRANCH | $9,579.92 |

| DUNDEE | $9,583.50 |

| RHODES | $9,583.90 |

| TOWER | $9,584.02 |

| MESICK | $9,587.21 |

| CLOVERDALE | $9,587.40 |

| ONAWAY | $9,594.98 |

| WOLVERINE | $9,596.83 |

| AFTON | $9,596.95 |

| BEULAH | $9,598.17 |

| BURT LAKE | $9,598.33 |

| JOHANNESBURG | $9,600.27 |

| FIFE LAKE | $9,602.81 |

| MANCELONA | $9,603.78 |

| NATIONAL CITY | $9,604.14 |

| PRESCOTT | $9,606.33 |

| BENTLEY | $9,611.53 |

| EASTPORT | $9,614.13 |

| EDMORE | $9,615.96 |

| BLANCHARD | $9,618.28 |

| MCBRIDES | $9,624.54 |

| THOMPSONVILLE | $9,628.87 |

| FREDERIC | $9,629.81 |

| CEDAR LAKE | $9,630.39 |

| FOUNTAIN | $9,635.51 |

| HALE | $9,643.86 |

| ELBERTA | $9,648.44 |

| NATIONAL MINE | $9,650.79 |

| WEST BRANCH | $9,655.31 |

| CRYSTAL | $9,668.99 |

| COPEMISH | $9,671.56 |

| MULLETT LAKE | $9,673.87 |

| OMENA | $9,681.65 |

| ORLEANS | $9,697.20 |

| EASTLAKE | $9,700.51 |

| ROSE CITY | $9,704.40 |

| PALO | $9,709.71 |

| ALDEN | $9,709.76 |

| WELLSTON | $9,710.64 |

| NAZARETH | $9,713.93 |

| WATERS | $9,722.04 |

| POMPEII | $9,722.74 |

| CEDAR SPRINGS | $9,727.77 |

| FENWICK | $9,732.66 |

| ACME | $9,734.96 |

| SIDNEY | $9,737.45 |

| MILLERSBURG | $9,741.61 |

| HAGAR SHORES | $9,744.22 |

| STANWOOD | $9,753.71 |

| RODNEY | $9,760.78 |

| LENNON | $9,760.79 |

| RAPID CITY | $9,770.14 |

| FENTON | $9,773.75 |

| KALKASKA | $9,794.66 |

| STANTON | $9,803.73 |

| SIX LAKES | $9,806.76 |

| MAYBEE | $9,812.51 |

| SHERIDAN | $9,816.19 |

| AU GRES | $9,822.89 |

| KENT CITY | $9,824.89 |

| GREENVILLE | $9,828.02 |

| DAVISON | $9,834.80 |

| GREGORY | $9,837.19 |

| TURNER | $9,846.46 |

| BAD AXE | $9,855.26 |

| NEWAYGO | $9,855.81 |

| SYLVAN BEACH | $9,863.66 |

| BIG RAPIDS | $9,867.55 |

| MORLEY | $9,870.12 |

| BROHMAN | $9,872.49 |

| GAGETOWN | $9,877.99 |

| TRUFANT | $9,884.04 |

| CORAL | $9,886.56 |

| SAND LAKE | $9,891.00 |

| STANDISH | $9,892.35 |

| OMER | $9,895.30 |

| GLADWIN | $9,899.46 |

| STERLING | $9,902.46 |

| SEBEWAING | $9,912.04 |

| HARBOR BEACH | $9,912.62 |

| GRANT | $9,913.77 |

| PIGEON | $9,914.89 |

| KINDE | $9,914.92 |

| TWINING | $9,919.63 |

| MECOSTA | $9,921.44 |

| ELKTON | $9,924.33 |

| OWENDALE | $9,927.01 |

| FAIRGROVE | $9,927.93 |

| PIERSON | $9,936.26 |

| BAY PORT | $9,936.93 |

| UBLY | $9,941.22 |

| WALKERVILLE | $9,942.95 |

| VASSAR | $9,950.51 |

| PORT AUSTIN | $9,952.35 |

| CASEVILLE | $9,952.61 |

| RUTH | $9,955.19 |

| CARO | $9,955.61 |

| SWARTZ CREEK | $9,956.53 |

| CASS CITY | $9,957.81 |

| AKRON | $9,961.52 |

| HOWARD CITY | $9,962.00 |

| PORT HOPE | $9,966.45 |

| KINGSTON | $9,970.84 |

| SNOVER | $9,975.31 |

| MINDEN CITY | $9,976.69 |

| IDA | $9,978.87 |

| FILION | $9,981.73 |

| PLYMOUTH | $9,986.14 |

| UNIONVILLE | $9,988.75 |

| LAKEVIEW | $9,991.19 |

| PALMS | $10,000.31 |

| REED CITY | $10,001.36 |

| DEFORD | $10,005.99 |

| DECKER | $10,007.32 |

| DECKERVILLE | $10,008.40 |

| SANDUSKY | $10,010.92 |

| TUSTIN | $10,023.48 |

| BITELY | $10,029.06 |

| ALGER | $10,030.90 |

| FORESTVILLE | $10,031.41 |

| LEROY | $10,035.30 |

| BIRCH RUN | $10,042.53 |

| MAYVILLE | $10,047.02 |

| RICHVILLE | $10,047.16 |

| TEMPERANCE | $10,059.71 |

| LUTHER | $10,065.49 |

| PETERSBURG | $10,078.61 |

| CARLETON | $10,080.78 |

| MARLETTE | $10,090.39 |

| HOUGHTON LAKE HEIGHTS | $10,100.91 |

| NEWPORT | $10,102.22 |

| AZALIA | $10,108.55 |

| CLARKSTON | $10,114.89 |

| IRONS | $10,116.14 |

| LAMBERTVILLE | $10,129.46 |

| LAKE ORION | $10,131.64 |

| SOUTH LYON | $10,139.79 |

| IDLEWILD | $10,141.13 |

| DAVISBURG | $10,164.44 |

| MARYSVILLE | $10,167.04 |

| KEARSARGE | $10,169.21 |

| OAKLAND | $10,173.42 |

| SMYRNA | $10,181.74 |

| MILLINGTON | $10,193.35 |

| BALDWIN | $10,194.24 |

| LUNA PIER | $10,207.25 |

| LAPEER | $10,211.71 |

| BYRON | $10,212.55 |

| GOODRICH | $10,284.84 |

| MELVIN | $10,287.16 |

| SAINT CLAIR | $10,291.39 |

| HIGHLAND | $10,294.72 |

| PORT HURON | $10,296.16 |

| LINDEN | $10,303.86 |

| CLIFFORD | $10,326.56 |

| METAMORA | $10,347.17 |

| EAST CHINA | $10,355.23 |

| OXFORD | $10,355.84 |

| COLUMBIAVILLE | $10,356.33 |

| SILVERWOOD | $10,385.71 |

| FOSTORIA | $10,403.76 |

| MILFORD | $10,414.60 |

| NORTHVILLE | $10,425.97 |

| $10,426.77 | |

| CARSONVILLE | $10,433.11 |

| PECK | $10,442.76 |

| COLUMBUS | $10,446.94 |

| SOUTH ROCKWOOD | $10,447.80 |

| ATTICA | $10,449.65 |

| PORT SANILAC | $10,459.71 |

| NEW HUDSON | $10,463.25 |

| CROSS VILLAGE | $10,466.63 |

| SALEM | $10,481.91 |

| GOOD HART | $10,485.93 |

| BROWN CITY | $10,487.91 |

| NORTH BRANCH | $10,489.29 |

| BIRMINGHAM | $10,491.26 |

| MEMPHIS | $10,493.02 |

| ALMONT | $10,506.04 |

| IMLAY CITY | $10,508.66 |

| BAY SHORE | $10,511.20 |

| NORVELL | $10,521.16 |

| APPLEGATE | $10,522.87 |

| FORT GRATIOT | $10,534.36 |

| SAGINAW | $10,535.01 |

| CROSWELL | $10,535.59 |

| OTTER LAKE | $10,563.29 |

| ALBA | $10,565.41 |

| DRYDEN | $10,573.67 |

| SMITHS CREEK | $10,581.74 |

| SAMARIA | $10,589.21 |

| CAPAC | $10,591.64 |

| WIXOM | $10,595.09 |

| GAINES | $10,599.59 |

| OLD MISSION | $10,636.17 |

| FILER CITY | $10,640.77 |

| ALLENTON | $10,647.76 |

| OTISVILLE | $10,658.57 |

| LEXINGTON | $10,659.66 |

| MARINE CITY | $10,660.22 |

| LAKEVILLE | $10,667.69 |

| LEONARD | $10,670.95 |

| LA SALLE | $10,714.39 |

| RICHMOND | $10,714.39 |

| MONROE | $10,725.18 |

| CANTON | $10,725.27 |

| FLUSHING | $10,735.55 |

| ALGONAC | $10,745.87 |

| GRAND BLANC | $10,750.59 |

| HARSENS ISLAND | $10,755.83 |

| WHITE LAKE | $10,810.40 |

| ANCHORVILLE | $10,810.91 |

| CASCO | $10,832.68 |

| BRIDGEPORT | $10,868.44 |

| JEDDO | $10,872.94 |

| NORTH STREET | $10,884.68 |

| WALLED LAKE | $10,907.94 |

| YPSILANTI | $10,911.62 |

| CLAWSON | $10,915.79 |

| AVOCA | $10,925.79 |

| ROCKWOOD | $10,961.24 |

| GOODELLS | $10,965.72 |

| WHITTAKER | $10,982.92 |

| COMMERCE TOWNSHIP | $11,009.11 |

| ARMADA | $11,011.50 |

| CLIO | $11,011.74 |

| HOLLY | $11,027.98 |

| ROCHESTER | $11,028.01 |

| RALPH | $11,042.30 |

| UNION LAKE | $11,046.10 |

| ERIE | $11,061.48 |

| ROMEO | $11,129.87 |

| BERKLEY | $11,136.60 |

| YALE | $11,147.62 |

| EMMETT | $11,157.42 |

| FRANKLIN | $11,197.34 |

| ORTONVILLE | $11,206.96 |

| FAIR HAVEN | $11,250.47 |

| LIVONIA | $11,256.51 |

| NEW HAVEN | $11,278.58 |

| WATERFORD | $11,306.34 |

| ROYAL OAK | $11,364.97 |

| WASHINGTON | $11,368.09 |

| WILLIS | $11,498.56 |

| NOVI | $11,533.36 |

| RAY | $11,542.38 |

| AUBURN HILLS | $11,641.07 |

| MACOMB | $11,722.47 |

| FARMINGTON | $11,722.84 |

| KEEGO HARBOR | $11,751.62 |

| DRAYTON PLAINS | $11,784.51 |

| TROY | $11,806.87 |

| UTICA | $12,101.89 |

| BLOOMFIELD HILLS | $12,238.82 |

| PLEASANT RIDGE | $12,322.59 |

| FLAT ROCK | $12,355.30 |

| NEW BALTIMORE | $12,397.74 |

| MADISON HEIGHTS | $12,475.72 |

| TRENTON | $12,535.40 |

| WEST BLOOMFIELD | $12,537.69 |

| BURTON | $12,544.01 |

| BELLEVILLE | $12,605.17 |

| SAINT CLAIR SHORES | $13,120.82 |

| WESTLAND | $13,178.90 |

| CLINTON TOWNSHIP | $13,214.76 |

| HARRISON TOWNSHIP | $13,262.93 |

| FRASER | $13,284.36 |

| STERLING HEIGHTS | $13,315.84 |

| GROSSE ILE | $13,348.84 |

| WAYNE | $13,349.33 |

| NEW BOSTON | $13,393.48 |

| GARDEN CITY | $13,518.13 |

| MOUNT CLEMENS | $13,565.07 |

| HUNTINGTON WOODS | $13,700.16 |

| FERNDALE | $13,868.27 |

| TAYLOR | $13,914.92 |

| ROSEVILLE | $13,991.39 |

| WYANDOTTE | $14,043.40 |

| SOUTHGATE | $14,149.43 |

| ROMULUS | $14,173.50 |

| LINCOLN PARK | $14,234.31 |

| GENESEE | $14,524.70 |

| ALLEN PARK | $14,529.34 |

| RIVERVIEW | $14,530.95 |

| GROSSE POINTE | $14,811.54 |

| HAZEL PARK | $14,956.77 |

| WARREN | $15,080.65 |

| MOUNT MORRIS | $15,267.00 |

| EASTPOINTE | $15,452.65 |

| REDFORD | $15,713.38 |

| CENTER LINE | $15,998.68 |

| PONTIAC | $16,275.04 |

| FLINT | $16,343.93 |

| DEARBORN HEIGHTS | $16,487.42 |

| MELVINDALE | $16,544.22 |

| INKSTER | $16,984.97 |

| SOUTHFIELD | $17,516.86 |

| ECORSE | $18,154.01 |

| OAK PARK | $18,716.04 |

| HARPER WOODS | $19,225.22 |

| RIVER ROUGE | $19,405.58 |

| DEARBORN | $20,920.85 |

| HIGHLAND PARK | $26,923.65 |

| HAMTRAMCK | $26,925.66 |

| DETROIT | $26,966.81 |

Again, the cheapest city in Michigan when it comes to auto insurance in Saint Louis. This could mean Saint Louis has a high rate of crime or poverty. Just because it is the cheapest doesn’t mean it’s the best place to live. Be careful when choosing the right area for you.

The most expensive city is Detroit at an average annual rate of just under $27,000.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

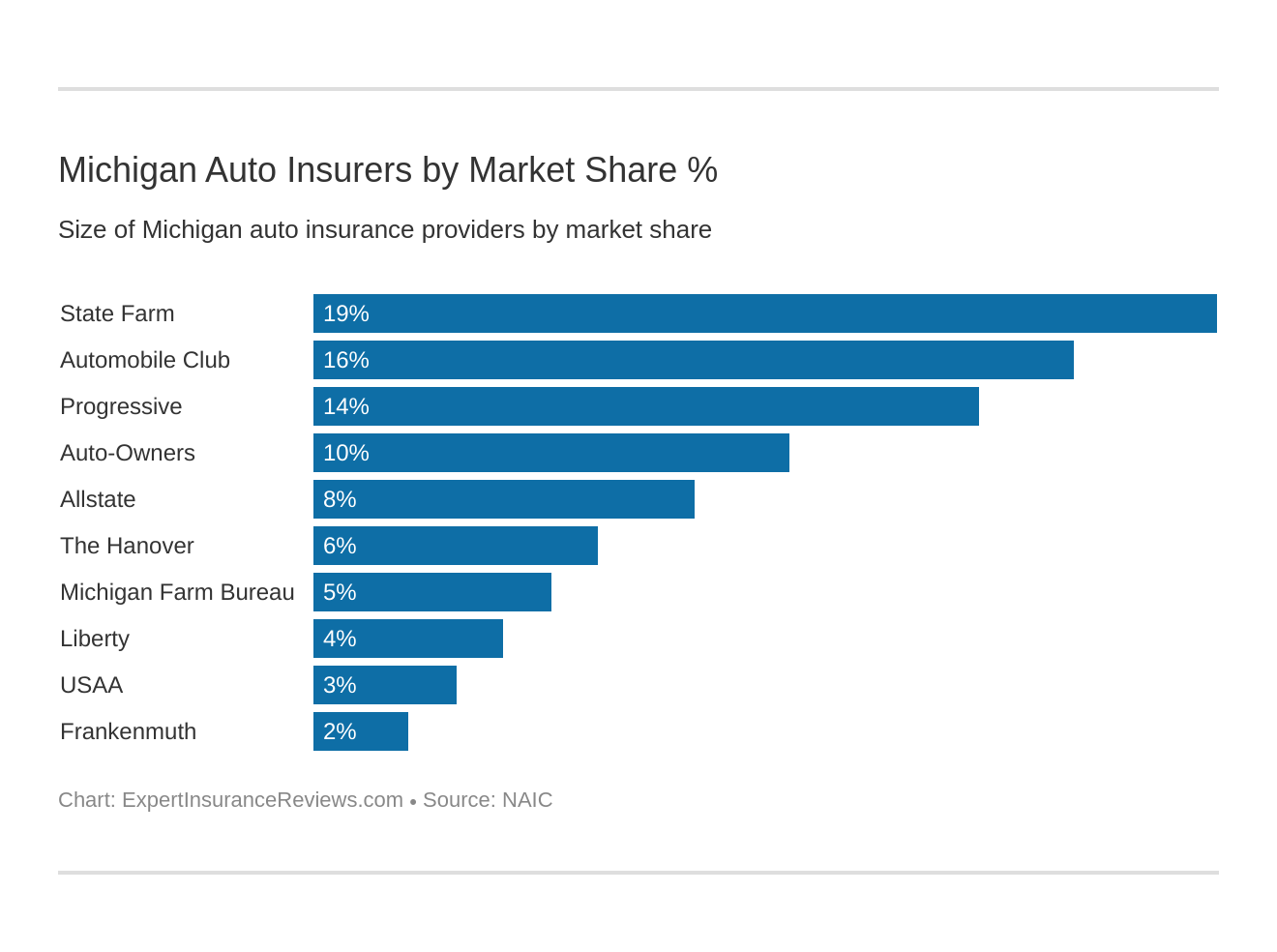

Best Car Insurance Companies in Michigan

There are a million different car insurance companies in Michigan and the United States. Choosing which is the best can be a struggle. Sometimes the cheapest rate isn’t the best coverage, but then again you don’t want to overpay for anything. Saving money is always a good thing.

The commercials you see on TV are more often than not, the top insurance companies in the world. They advertise so well you may be blinded to the reality of who they are. Every company will tell you that they have the best rates and the best coverages for you.

In this section, we’ll break down the top companies in Michigan and you can decide for yourself which is best for you. Instead of searching for hours on the internet you can find all your data in one place.

We’ll cover ratings from the most trusted sources, customer reviews of companies, and we’ll also look at rates to create a complete picture of how the top companies are performing.

The Largest Companies’ Financial Rating

Every year AM Best comes out with a financial rating for top companies in insurance. This gives a grade to every company to help you understand which companies are the best.

Companies with the best financial ratings have the ability to pay claims, even in the case of a major accident.

| COMPANY | A.M. BEST RATING: |

|---|---|

| Geico | A++ |

| State Farm | A++ |

| USAA | A++ |

| Allstate | A+ |

| Progressive | A+ |

| Farmers | A |

| Liberty Mutual | A |

| Travelers Group | A |

Companies With The Best Ratings

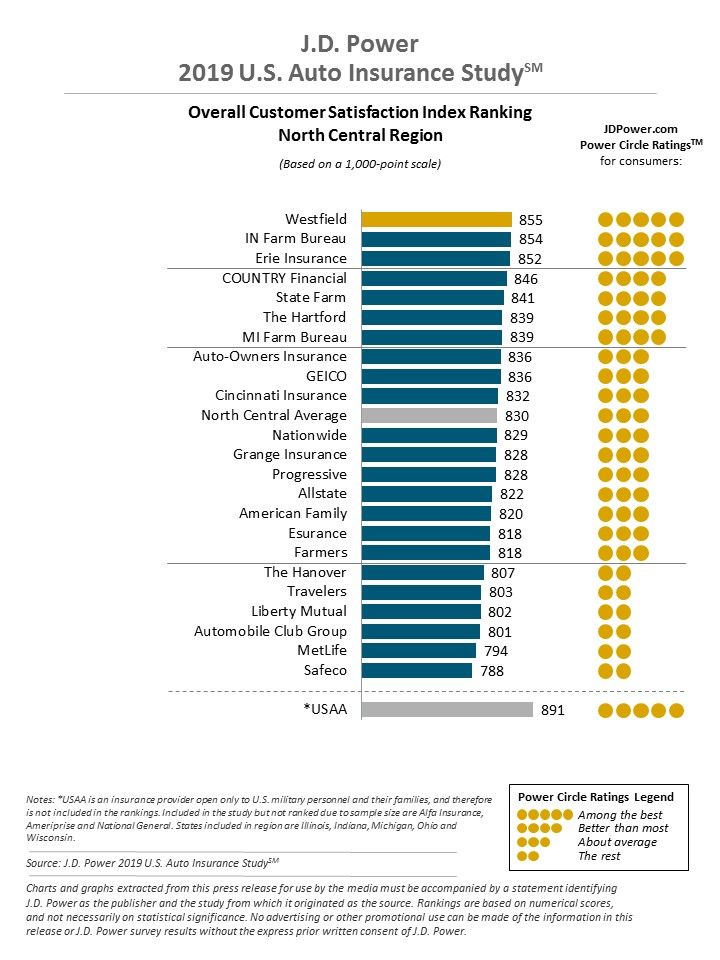

JD Power is the most trusted name in insurance ratings and many other fields. They release awards yearly to the top companies in each state and the entire nation.

In the entire north-central region of the U.S. Westfield Insurance has the best JD Power ratings. USAA sets the standard, but this is because it is only available to the military, so it is not included in the graph.

Within Michigan, State Farm and Michigan Farm Bureau are the top two companies according to the ratings.

Companies With the Most Complaints in Michigan

Complaints are a great statistic to look at when it comes to insurance companies. If a complaint ratio is high that the company may be having issues with customers.

| Company | 2013 Complaint Ratio | 2013 Premiums Written | Rank |

|---|---|---|---|

| Fremont Insurance | 0.02 | $59,273,366 | 1 |

| USAA | 0.04 | 155,907,111 | 2 |

| Wolverine Mutual | 0.04 | 23,071,674 | 3 |

| Westfield Insurance | 0.05 | 39,885,127 | 4 |

| Progressive | 0.06 | 627,359,749 | 5 |

| Michigan Millers | 0.06 | 47,370,514 | 6 |

| State Farm | 0.07 | 1,385,322,336 | 7 |

| Frankenmuth | 0.08 | 177,396,742 | 8 |

| MEEMIC | 0.08 | 199,074,699 | 9 |

| GEICO | 0.09 | 193,080,067 | 10 |

Read more: Westfield Insurance Review & Complaints: Auto, Home & Business Insurance

As you can see in the table Fremont Insurance, USAA, and Wolverine Mutual have the best complaint rates in the state. Careful though, some companies are so small it’s hard to find things to complain about. Huge companies that serve consumers across the nation may have more complaints, but they also insure a lot more people.

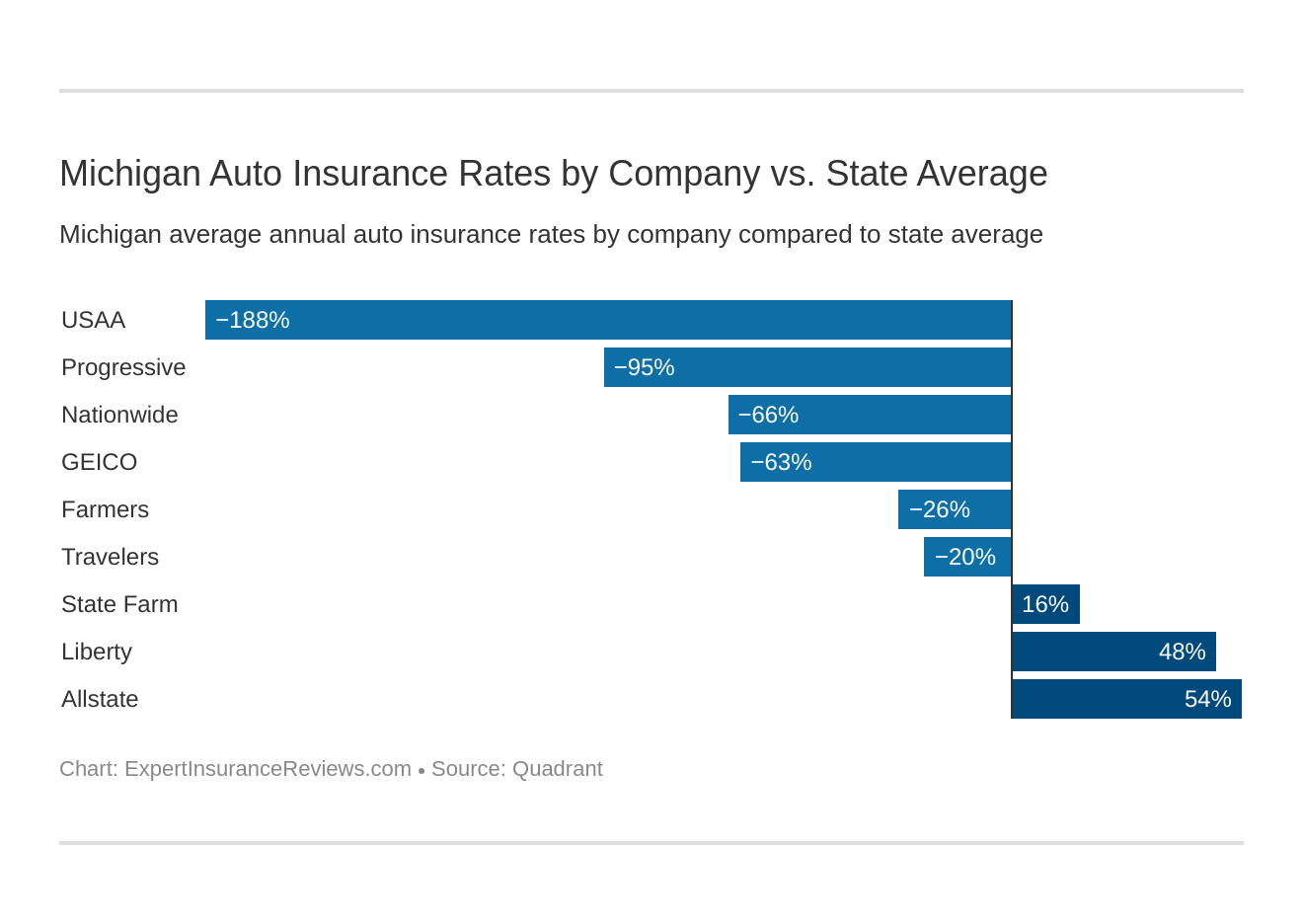

Cheapest Companies in Michigan

Rates are probably the most essential part of car insurance. Knowing the best rates and what companies in Michigan has them can be your best friend.

In the following sections, we will break down the rates by different factors, including commute, coverage levels, and driving records.

This should help you decide which company is best for you.

Commute Rates By Company

Car insurance companies can sometimes get aggressive with rates when you have a longer commute. The rule of thumb to use is, the more you are on the road, the more accidents, tickets, or other insurance-related situations can happen.

Knowing this, some companies try to protect themselves from heavy commuters by raising rates. Depending on where you live in Michigan, traffic varies so you may not have to worry about a long commute at all. But if you do have an extensive commute, this data could help you assure you aren’t overpaying.

| Group | Commute_And_Annual_Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $22,821.42 |

| Allstate | 25 miles commute. 12000 annual mileage. | $22,821.42 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $20,602.33 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $19,223.85 |

| State Farm | 25 miles commute. 12000 annual mileage. | $12,821.40 |

| State Farm | 10 miles commute. 6000 annual mileage. | $12,142.23 |

| Travelers | 25 miles commute. 12000 annual mileage. | $8,757.05 |

| Travelers | 10 miles commute. 6000 annual mileage. | $8,657.15 |

| Farmers | 10 miles commute. 6000 annual mileage. | $8,275.23 |

| Farmers | 25 miles commute. 12000 annual mileage. | $8,275.23 |

| GEICO | 25 miles commute. 12000 annual mileage. | $6,529.03 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $6,287.43 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $6,287.43 |

| GEICO | 10 miles commute. 6000 annual mileage. | $6,236.05 |

| Progressive | 10 miles commute. 6000 annual mileage. | $5,354.18 |

| Progressive | 25 miles commute. 12000 annual mileage. | $5,354.18 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,659.52 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,576.60 |

As you can see in the table, Allstate has the most expensive rates but if you have a long commute the rates don’t change. Unlike State Farm, which has affordable rates but raises their rates for commutes by over $800 annually.

Coverage Level Rates By Company

Car insurance has three different types of coverage level; low, medium, and high. Each company will cover different things within those levels, but it is generally similar. From company to company the rates for each coverage range as well.

Some companies may charge the same for low and medium coverage.

| Group | Coverage_Type | Annual Average |

|---|---|---|

| Allstate | High | $23,352.73 |

| Allstate | Medium | $22,873.48 |

| Allstate | Low | $22,238.06 |

| Liberty Mutual | High | $20,418.71 |

| Liberty Mutual | Medium | $19,868.02 |

| Liberty Mutual | Low | $19,452.55 |

| State Farm | High | $13,040.02 |

| State Farm | Medium | $12,560.38 |

| State Farm | Low | $11,845.05 |

| Travelers | High | $8,788.45 |

| Travelers | Medium | $8,716.50 |

| Travelers | Low | $8,616.35 |

| Farmers | High | $8,523.10 |

| Farmers | Medium | $8,253.96 |

| Farmers | Low | $8,048.64 |

| GEICO | High | $6,832.27 |

| Nationwide | Low | $6,579.61 |

| GEICO | Medium | $6,327.85 |

| Nationwide | Medium | $6,181.29 |

| Nationwide | High | $6,101.40 |

| GEICO | Low | $5,987.51 |

| Progressive | High | $5,512.79 |

| Progressive | Medium | $5,360.96 |

| Progressive | Low | $5,188.80 |

| USAA | High | $3,716.05 |

| USAA | Medium | $3,626.86 |

| USAA | Low | $3,511.28 |

Allstate is consistently the most expensive in Michigan all around. However, from low to high coverage, Allstate’s rates don’t change all that much.

Other companies will make you pay thousands more a year for high coverage. When high coverage is worth it is if you get a good rate on it. Then you may be saving a lot of money if you were to get in an accident.

Choose carefully which level is best for you. If you have a long history of great driving, then low coverage may be all you need.

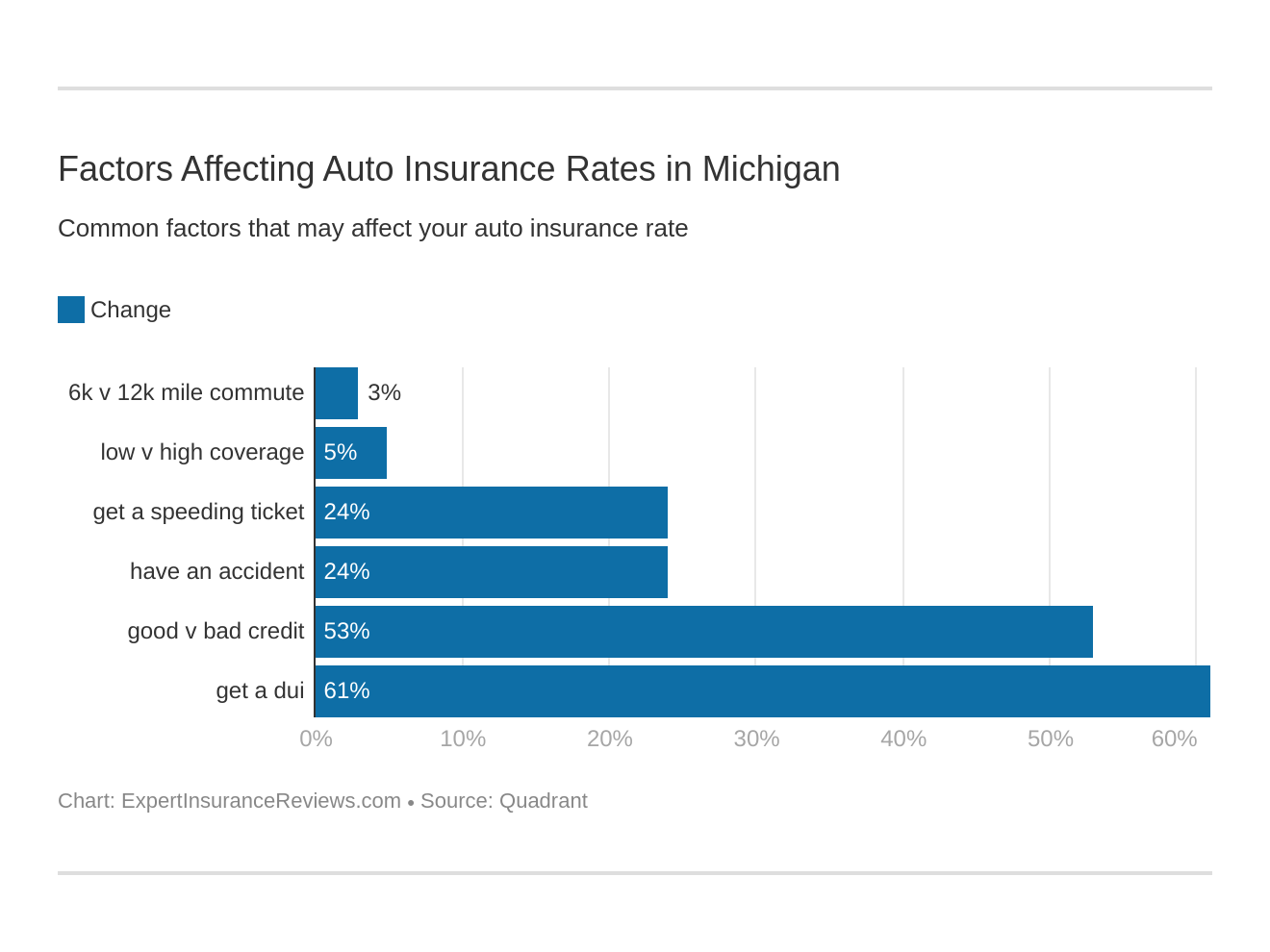

Credit History Rates By Company

In some states changing insurance rates by credit history is illegalized, but not in Michigan. Michigan is consistently the worst state at overcharging for bad credit.

Each person’s credit history follows them everywhere they go. From buying a car to a home, to even layaway at WalMart.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $34,695.69 |

| Liberty Mutual | Poor | $31,503.82 |

| State Farm | Poor | $20,256.29 |

| Allstate | Fair | $19,170.49 |

| Liberty Mutual | Fair | $18,192.56 |

| Allstate | Good | $14,598.09 |

| Farmers | Poor | $11,579.33 |

| State Farm | Fair | $10,240.44 |

| Liberty Mutual | Good | $10,042.90 |