10 Most Expensive Medicare Part D Drugs (2025 Results)

Medicare Part D is a valuable add-on that covers prescription drugs not covered by Medicare Parts A and B. The most expensive drug Medicare Part D covers is Gattex, with an average sales price per dose of $40,190. Overall, insurers spent a total of over one billion on the most expensive Medicare drugs in a year.

Free Medicare Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Medicare Part D is an optional, add-on coverage for Medicare cardholders that covers a variety of expensive medicines

- The average sales price per dose for the 10 most expensive Medicare Part D medicines is $28,302

- The average sales price per dose for the 10 most commonly used Medicare Part D drugs is only $0.19

Prescription drugs can be expensive, which is why it’s so important to have good health insurance that covers part of or all of a prescription drug’s cost. Medicare Part D is an optional prescription medicine coverage that customers can add to their Medicare plan. Of course, if customers pay to add this coverage, they can rightfully expect it to cover their drug costs, no matter how expensive the drug might be.

In this study, we took a look at the most expensive drugs that Medicare Part D covers. In addition to looking at the most expensive Medicare drugs (Part D), we look at which expensive drugs are most commonly used and the most commonly used drugs overall covered by Medicare Part D.

We collected expert advice on Medicare Part D drugs, including how to find savings on prescriptions and determine whether Medicare Part D is right for you. We will also answer the most commonly asked questions about Medicare Part D and prescription drugs.

Most Expensive Medicare Part D Drugs

Our team of researchers looked into the latest data on prescription drug pricing and payments released from the Centers for Medicare and Medicaid Services (CMS) in order to rank the drugs. Pulling all of the data, our researchers ranked the Medicare Part D drugs by most expensive and most commonly used using the relevant data columns.

The combined total per dose for the most expensive Medicare Part D drugs is $1,182,521,591, with the cheapest drug in the top 10 costing more than $19,000 and the most expensive costing more than $40,000.

Take a look at the complete list of the 10 most expensive drugs covered by Medicare Part D below.

Gattex, a drug used to treat short bowel syndrome, is the most expensive drug on the list. Its average sales price per dosage unit comes to $40,190. The cheapest drug on the list is Somatuline Depot, with an average sales price per dose of $19,418. Somatuline Depot is used to treat growth hormone disorders and certain types of tumors.

The average Medicare Part D spent per dose on the top 10 most expensive drugs for patients was $28,302. However, Medicare Part D may not cover all drugs or may only cover medications under certain conditions, which is why it’s important to review your plan every year.

For example, Medicare recently announced it would cover an expensive Alzheimer’s drug, but only for patients participating in pre-approved trials.

It’s important to keep in mind that Medicare is provided through independent insurers, so it’s still important to pick the best overall Medicare company to get the best coverage for your prescription drugs.

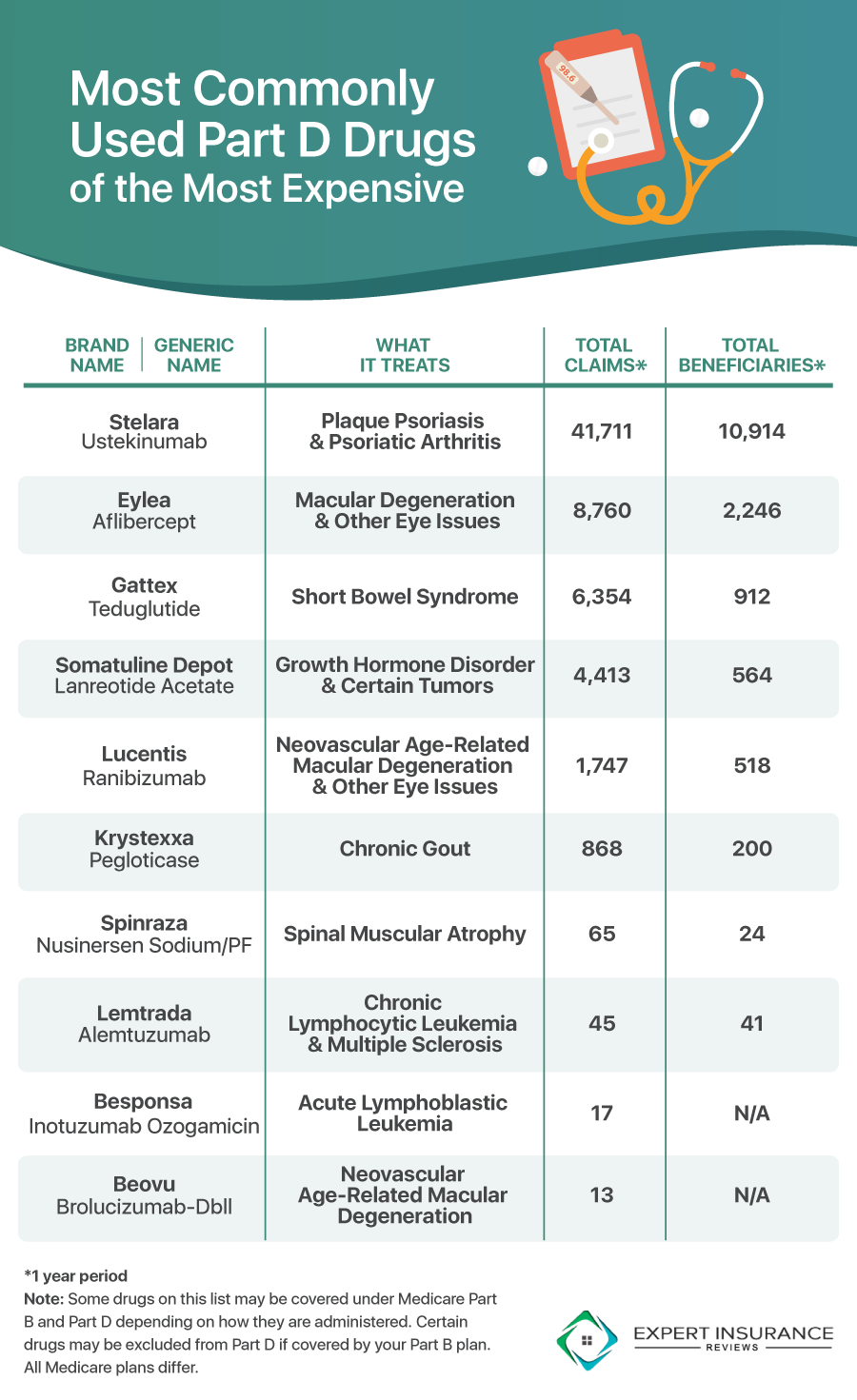

Most Commonly Used of the Most Expensive Medicare Part D Drugs

To find which of the 10 most expensive drugs are the most commonly used, our researchers ranked them by total claims. Take a look at the graphic below to see which had the most claims.

Stelara, an immunosuppressive drug for arthritis, was the most commonly used drug with 41,711 claims. In comparison, Beovu, an injection used to treat macular degeneration and help prevent vision loss, only had a total of 13 claims.

Since arthritis is a much more common condition than macular degeneration, it makes sense that Medicare Part D would handle more claims for Stelara than Beovu.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Most Commonly Used Medicare Part D Drugs Overall

While we’ve covered the most expensive drugs and which had the most claims, we also want to see what drugs are the most commonly used out of all the drugs covered by Medicare Part D. The graphic below shows which drugs had the most claims over one year.

Atorvastatin Calcium, a drug used to treat high cholesterol, was the most commonly used drug with 54,672,688 claims. In comparison, Metoprolol Succinate, a common beta-blocker, only had a total of 23,669,154 claims. A number of the drugs on this list are used to treat high blood pressure, which is a common condition that can lead to a number of serious issues, such as a heart attack or kidney disease.

The average sales price per dose for the most commonly claimed drugs is only $0.19. This is significantly less than the average sales price per dose for the most expensive drugs, which came in at $28,302.

Medicare Tips and Tricks

If you are looking for advice on whether Medicare Part D is right for you and how to save on prescription drugs, we’ve collected tips from the experts. From advice from pharmacists and physicians to insurance experts and Medicare holders, scroll through the great Medicare advice below.

“In terms of your actions regarding Medicare Part D, it is very important to enroll when you are eligible for it, usually at 65. If not, you will pay the penalty when you enroll later. Most Advantage plans have Part D, and if you have a supplement instead, you can buy a very cheap plan for only $10-20/month.

The best way to save on prescription medications is with a combination of Medicare Part D and a free prescription drug card like Glic RX. Both of these options together will save you the most money. And as a bonus, these plans do not make you pay more when they overlap.

Everyone should be in Medicare Part D if you do not have other prescription qualifying coverage, such as TRICARE for the military. While Medicare Part D is not required, you will have to pay the penalty later on for getting into a plan. Other qualifying coverage like TRICARE will waive the penalty since a similar prescription plan is offered through them.

Medicare Part D is very comprehensive and will ‘pay first’ before your other insurance plans if you have any. This makes it so that you will pretty much pay nothing for prescriptions if you happen to have both types of insurance.

Overall, Medicare Part D plans make sense for almost anyone who is eligible. It is important to work with an independent advisor or broker to make sure you are enrolling in the right plan and saving the most money.”

Kelly Maxwell is the CEO of SeniorsMutual.com.

Seniors Mutual is an online insurance agency for seniors.

“For nearly five years, I helped Medicare patients refill medications for Wellmed. Insulins were the most expensive medications that were difficult to cover. What helped those in Texas was a medication assistance program that covered much of the cost of the medication. Eligibility was based on the federal poverty levels.

Newer diabetes medications (like Jardiance, Steglatro, Bydureon, etc.) also are expensive. When I worked at Walmart, I remember a customer complaining about a state alternative: Praluent (alirocumab) or Repatha (evolocumab) in the new class of PCSK9 inhibitors.

Inhalers are also quite expensive. I don’t care what your age is, but especially if you are not yet a retiree, please stop smoking now so that your pocketbook will thank you. It is well-documented that your lung function will improve after you stop smoking.

The main advantage of Medicare Part D is that it helps retirees somewhat with prescription coverage. If you need medicine when you are on Medicare, you should probably enroll.

Try to take generic medications consistently. If you have taken all the generic medicines your plan offers, it will help your doctor persuade your health plan to approve the expensive medications.

I have worked on the insurance end approving them. My bosses always told me that was how the system worked for approvals. You try and fail cheap old medications. Then you get to use new medications.

Those RX coupons for new medications are not to be used when you are on Medicare. It is in the fine print. People often forget that. So if you want to use a drug maker’s coupon card, get out of retirement and get on a commercial plan.

Also, realize that the food you eat and the liquids (soda, alcohol) also contribute to getting sticky fat-filled blood (dyslipidemia), which means your heart has to work harder to pump (due to high blood pressure). Eventually, your pancreas won’t absorb all the sugar you eat, so it makes you go to the restroom to urinate it out, and you’re hungry constantly (diabetes).

Both commercial and governmental insurance programs have to pay high prices for new medications. However, the government is the largest purchaser of drugs because commercial plans tend to have younger and presumably healthier patients.”

Board-certified pharmacist Dr. Benjamin Gibson educates on disease prevention.

He’s a published author and podcast host who has given over 30 clinical presentations.

“I signed up for Medicare when I turned 65. Because I was not collecting Social Security, Medicare bills me quarterly for my Part B coverage.

I chose to enroll in a Medicare Advantage plan which includes Part D prescription drug coverage. Medicare requires recipients to have Part D drug coverage; otherwise, they are penalized when they do sign up for coverage for every month that they could have had prescription drug coverage and chose not to.

For example, if you sign up one year late, your penalty is approximately $1.20 per month times 12 months. This penalty is ongoing; it does not go away.

As far as prescriptions and costs, Medicare plans must cover at least one prescription in every category. However, the costs of the prescriptions in the drug plans can be very high. I usually recommend to my clients that they do a little shopping around. For example, good RX often offers lower prices on drugs than Part D prescription drug plans do.

The other issue that people on Medicare have to deal with in regards to prescription drug costs is the coverage gap. Once you reach the coverage gap, you are responsible for 25% of the cost of your drugs. And the retail cost can be very high.

One way to avoid getting into the gap is to self pay for less expensive drugs and not put them through your plan at all. This is not against the law; it is one way of avoiding the coverage gap.”

Roseann Birch is a Medicare recipient with MedicarePlans.com.

Their site advises consumers on Medicare plans and enrollments.

What are the advantages and disadvantages of Medicare Part D?

“Medicare Part D can help you manage the costs of more expensive prescription drugs. Generally, they have affordable premiums and can complement your Medicare Parts A and B plans.

However, it does require you to be able to anticipate your prescription drug costs for the year so that you can choose the plan that adequately covers your needs. Part D plans offered by different insurers can also be different, so you have to read through the different options and compare them carefully. Also, not all prescription drugs are offered under Part D.”

Who should get Medicare Part D for drug coverage? Who shouldn’t?

“Consider getting Medicare Part D if prescription drugs are a significant portion of your yearly healthcare expenses and if the drugs you need are covered under the plan. Carefully evaluate whether the coverage limits are sufficient for you and whether there is extra coverage for any expensive drugs.

Medicare coverage also generally doesn’t extend to dependents. If you anticipate that you would also need to meet the prescription drug needs of dependents, you might consider a private health plan.”

How does Medicare Part D’s coverage of drugs compare to non-medicare insurance programs?

“If you have ‘creditable’ prescription drug coverage, where the coverage is equal to or better than Part D, you will not have to enroll, and you can enjoy better benefits. Examples include if you are on TRICARE or have Federal employee health benefits.

Medicare Part D with prescription drug coverage is a component that is not included in basic Medicare. However, there are private health insurance plans that include prescription drug coverage, which would remove your need to get Medicare Part D.”

Shawn Plummer is the CEO of AnnuityExpertAdvice.com.

He is also the Director of Advanced Annuity and Insurance Sales.

“Medicare Part D is a government-sponsored health insurance program that provides coverage for prescription drugs. Medicare Part D has a variety of different plan options that can vary in terms of monthly premiums, out-of-pocket costs, and coverage for specific medications.”

What are the most expensive Medicare Part D Drugs?

“The most expensive Medicare Part D drugs can be found in the Part D Prescription Drug Listing. This is a database that contains information on the most expensive prescription drugs.”

How can I find out if a prescription drug is on the most expensive Medicare Part D Drugs listing?

“You can search for a particular prescription drug on the Most Expensive Medicare Part D Drugs Listing. You can also use the Drug Database to find the most expensive prescription drugs.”

What are the out-of-pocket costs that I will encounter if I take a prescription drug that is on the most expensive Medicare Part D Drugs listing?

“If you are taking a prescription drug that is on the Most Expensive Medicare Part D Drugs Listing, you will need to pay the full cost of the prescription drug. You will also need to pay any out-of-pocket costs that may apply.”

What are the coverage requirements for prescription drugs that are on the most expensive Medicare Part D Drugs listing?

“If a prescription drug is on the Most Expensive Medicare Part D Drugs Listing, you will need to have Medicare Part D coverage. You will also need to have a prescription from a doctor who is registered in the Medicare Part D program.”

What are the benefits of Medicare Part D?

“Medicare Part D is a program that provides prescription drug coverage for individuals who are enrolled in Medicare. The program is available to those who are 65 years of age or older and have been covered by Medicare since before January 1, 2007.

The benefits of Medicare Part D include:

- Prescription drugs are covered at no cost to the beneficiary.

- The beneficiary only pays for the Part D drug costs, not the entire cost of the prescription.

- There is no annual deductible or co-payments.

- Drug coverage is continuous until death or disability occurs.

- Beneficiaries have access to a wide variety of drugs, including generics and specialty medications, through this program.

The most expensive Medicare Part D drugs can be found in the Part D Prescription Drug Listing. You can use the Drug Database to find the most expensive prescription drugs. Out-of-pocket costs can be high if you are taking a prescription drug that is on the Most Expensive Medicare Part D Drugs Listing.

You will need to have Medicare Part D coverage and a prescription from a doctor registered in the Medicare Part D program to take the drug.”

Shawna Haider is the founder of Lola Collective.

Her company provides skincare products and wellness advice.

“I don’t have Medicare since I’m not yet old enough to qualify. I was a practicing physician until a few months ago (I retired last year), so I’ve had quite a bit of experience in dealing with the Part D plans my patients had. Here’s what I’ve learned from that experience, as well as years of research I’ve done on prescription drug pricing:

Part D plans won’t really help you in purchasing generic prescription medications. Nearly 90% of all prescriptions filled in the U.S. are for generic medications, and most of these medications cost very little. Pharmacies usually pay only a few pennies per dose for these medications.

If you have a Part D plan that you’re paying for yourself, the cost of the plan plus the cost of your copays and deductibles will almost always exceed the total cost of whichever generic medications you might need.

Put another way, if all of your prescription medications are generic, you’ll most likely save money by foregoing a Part D plan and paying cash for your prescriptions as long as you use a discount program like Goodrx.com.

Using a discount prescription drug program (which should be free) is also very important since the list prices for generic prescription medications at some pharmacies can be many times that of their discount prices.

Brand-name prescription medications are very expensive — usually about 100 times the price of generic prescription medications. Since brand-name medications are so expensive, it’s almost always better to have a prescription drug plan to cover the cost of these medications if you need them. Choosing the right Part D plan does require some homework, though.

The difference in copays and deductibles for the same medication can vary greatly for different Part D plans. You might have to pay several hundred dollars a month for a medication with one plan, whereas that exact same medication might only cost you $30 a month if you have a different plan.

The good news is that you can go online and check what prescription drugs each Part D plan in your area covers and how much each drug will cost you.

In order to assess your total cost for a medication, you need to add the cost of your monthly copays, deductible, and the total monthly premiums for the year. Then, choose the plan that covers your medication at the lowest combined total price. All of this requires a bit of math, but it’s the only sure way to save money with these plans.

There’s usually no way to know whether you would ever need a brand-name medication and whether your current plan would cover that medication at a reasonable cost. However, if you don’t currently need a brand-name prescription medication, a Part D plan won’t save you money.

The fine for not buying a Part D plan right away (as soon as you qualify for Medicare) is about $4 a month for each year you delay.

I should add that the inexpensive Part D plans I’ve encountered through my patients (those costing less than $20 a month in premiums) rarely provide any real prescription drug coverage beyond what you can get for free using a prescription drug discount program like Goodrx.com (mentioned above).

In virtually every case where a patient of mine used such a program, they were simply paying premiums for discounts they could have easily gotten for free just by looking.”

Dr. David Belk is an experienced physician with True Cost of Healthcare.

His site provides healthcare cost information from an inside perspective.

Who should get Medicare Part D for drug coverage? Who shouldn’t?

“You are eligible for the Medicare drug benefit (Part D) if you are a Medicare beneficiary. To enroll in Part D, you must be enrolled in Medicare Part A and/or Part B.

Private plans are the only way to get Medicare drug coverage. You should enroll in a Part D plan if you have Medicare Part A and/or Part B and no other medication coverage (creditable coverage).

Even if you don’t use any prescription medications, this is true. If you put off enrolling in Part D for whatever reason and later need drug coverage, you will be charged a premium penalty.

The real issue with Medicare Part D plans is that they were not designed with seniors in mind. They were created with pharmacies, insurance companies, and pharmaceutical firms in consideration.”

Do you have any practical tips for saving on prescription medications?

“Request a larger supply: Instead of getting a 30-day prescription and paying an insurance charge each time, request a 90-day supply and pay only one copay every three months. This method works for long-term drugs.

Shop around: The cost of medication varies depending on where you get it. Some pharmacies buy directly from drug manufacturers, while others use an intermediary, raising prices.

To compare pricing, call pharmacies in your neighborhood or use a computer or a smartphone app like WeRx or GoodRx. Your state’s attorney general’s office may also have a website with similar information.

Make the Most of Your Insurance Policy: take advantage of your health insurance, which you have paid for. A formulary is a list of pharmaceuticals that each insurance company covers and does not cover. But don’t waste your time trying to make sense of it. It’s considerably easier to phone your insurance company and inquire about the medications you’re taking.

And if you get to the drugstore and discover that a drug is too expensive or not covered, I suggest calling the pharmacist. Something along the lines of, ‘When I went to get this filled, my pharmacist informed me that it was not covered. Is there another option?’ Your insurance may cover a similar medicine.”

Justin Nabity is the CEO of PhysiciansThrive.com.

His advisory group provides legal counsel to physicians.

What is the most expensive Medicare part D drugs?

“Medicare part D is a prescription drug program for people eligible for Medicare. It covers most of the cost of prescription drugs. However, there are some expensive parts of Medicare part D.

Medicare Part D is a government-run health insurance program that provides coverage for medications used by seniors and people with disabilities.

The program has two parts: Part A covers hospital services, while Part B covers prescription drugs. There are a variety of Medicare Part D drugs to choose from, and each one can cost a different amount. Here are a few of the most expensive Medicare Part D Drugs.

- Crestor (rosuvastatin) – Crestor is the most expensive Medicare Part D drug, costing an average of $236 per month. It is also one of the most popular medications on the list, with more than 2 million prescriptions written each year.

- Lipitor (atorvastatin) – Lipitor is second on the list, costing an average of $215 per month. It has been around for many years and is often recommended as an option for people who want to lower their risk for heart disease.

- Plavix (clopidogrel) – Plavix is third on the list, costing an average of $200 per month. It helps to prevent blood clots in the legs and lungs.

As you can see, the cost of these drugs can add up, especially for those who depend on them the most.”

How do they compare to other Medicare part D drugs?

“When it comes to Medicare Part D drugs, the most expensive drugs tend to be those that treat chronic conditions. This is because these medications often have a long list of side effects and require regular monitoring.

However, some expensive medicare part d drugs are used for short-term treatments. For example, medications used to treat high blood pressure or cholesterol levels can be quite costly. Medicare part D is an expensive prescription drug program.

However, there are some expensive parts of Medicare part D. These are the top 10 most expensive Medicare part D drugs. Patients can reduce their costs by using generics or by shopping for discounts.”

Melanie Cohen is the co-founder of BrandList.com.

Their company provides information about prescription drugs.

What is the most affordable Medicare Part D Drug that you can find?

“You are most likely aware of the Medicare Part D drug coverage program if you’re reading this. This program was created in 2006 under the Bush administration to help with the costs of prescription medicine for Americans over 65 years old or with disabilities.

However, you might not know that this program is starting to get more expensive, and many people are left without affordable options for their prescription medications.”

What is Medicare Part D?

“Medicare Part D is a prescription drug benefit that helps cover the cost of prescription drugs. A variety of Medicare Part D plans are available, each with its list of covered drugs and costs.

Some plans may offer coverage for generic drugs, while others may only cover brand-name drugs. You can compare Medicare Part D plans to find the most affordable option for your needs.”

Types of Medicare Part D Plans

“There are a few different types of Medicare Part D plans, and the most affordable option for you will depend on your specific needs. The four main types of plans are:

- Basic Plans – These plans have a limited number of covered drugs and may not cover all classes of drugs. They typically have lower monthly premiums and deductibles than other plans.

- Enhanced Plans – These plans offer more comprehensive coverage than basic plans and may cover all classes of drugs. They typically have higher monthly premiums and deductibles than basic plans.

- Premium Plans – These plans offer the most comprehensive coverage of all the Medicare Part D plan types. They typically have the highest monthly premiums and deductibles.

- Catastrophic Plans – These plans have low monthly premiums and deductibles but only cover a limited number of drugs. They are only available to people who meet certain criteria, such as having a high deductible health plan or enrolling in a qualifying low-income subsidy program.

Before deciding which Part D Plan is for you, it is important to understand your unique situation and consult with a medical professional.”

Mohamed Hasnaoui is the CEO of Mosaik.Care.

His app helps people overcome depression and anxiety.

What are the most expensive Medicare Part D Drugs?

“According to a recent report, the most expensive Medicare Part D drugs are those used to treat cancer, multiple sclerosis, and HIV/AIDS. The report found that the average cost of these drugs is over $3,000 per month, significantly higher than other Medicare Part D drugs. These findings highlight the need for patients with these conditions to be aware of the potential costs of their treatment.

Patients can visit the Centers for Medicare and Medicaid Services’ website to determine if a prescription drug is on the most expensive Medicare Part D Drugs listing. The website provides information on the average cost of each drug and the number of prescriptions that have been filled for each drug. Patients can also use the website to compare the prices of different medications.”

What are the coverage requirements for prescription drugs that are on the most expensive Medicare Part D Drugs listing?

“In order to receive coverage for these drugs, patients must meet a number of requirements, including a yearly deductible, coinsurance, and copayments. These requirements can be challenging to meet for patients with limited incomes.”

What are the benefits of Medicare Part D?

“There are a number of benefits to Medicare Part D, including the fact that it can help patients save money on their prescription drugs. This coverage can help patients save money on their medical costs.

Make sure you are taking advantage of any discount programs your pharmacy offers. Many pharmacies offer discounts for seniors, military personnel, and people with certain medical conditions.

Ask your doctor if any generic or over–the-counter options could work for you. Generic drugs are often much cheaper than brand-name drugs and work just as well. Try to purchase your medications in bulk.

Many pharmacies offer discounts when you buy multiple months’ worth of drugs at once. This can be a great way to save if you take several different medications. Consider using mail-order pharmacies; these pharmacies usually charge lower prices for medicines than brick–and–mortar pharmacies.

Don’t be afraid to ask for help from your doctor or pharmacist. They can offer additional tips on saving money on your prescription medications.”

Jaqueline Miranda is a research assistant for Practical Psychology.

This company provides guides and resources for psychology and mental illness.

“You are required, upon turning 65, to have creditable drug coverage. This can come from an Employer’s Group Health Insurance plan (yours or a spouse’s) or from a Medicare plan. If you do not have Part D coverage, you will be penalized for not having it when you eventually enroll.”

Part D is a standalone product for those with Supplements. Low-income beneficiaries who qualify will be automatically enrolled in a Part D plan at no cost. Advantage plans typically have the Part D coverage rolled in.

Any prescription drug that is advertised on TV will be pricey. Always use your plan’s preferred pharmacy. It is amazing how many people overpay when the preferred pharmacy is next door. Check GoodRx and other coupon sites. Medicare isn’t always the least expensive option. If your state offers drug assistance for middle-income beneficiaries, check to see if you qualify.

The biggest advantage of getting Medicare Part D is that you get low or zero-cost prescriptions. The biggest disadvantage is that you are stuck in the plan for a year and, with few exceptions, cannot change your plan outside of the Annual Enrollment period.

That means that everyone should check their plans in the Fall because they will be stuck, and plans change, and people’s prescriptions change throughout the year.

Everyone who thinks that at some point they will be on a medication that they will want help paying for should get on Medicare Part D for drug coverage. There are lifetime penalties for not having a plan. The least expensive plan is around $8/mo. If it is bundled in an Advantage plan, it is free.

Someone with coverage from the VA may not want the extra expense if they are confident that they will never require a source of medications outside of the VA system. Also, anyone with creditable coverage from their own or their spouse’s employer does not need a drug plan.

Medicare Part D’s coverage of drugs is different from non-Medicare insurance programs. A Standalone Part D plan is unique in that it is unbundled drug coverage separate from medical insurance. You pick a plan based upon where you live, your medications, and the pharmacy you want to use.”

Scott Maibor is a licensed medical advisor with MedicarePlans.com.

He is also the Managing Director at Senior Benefits Boston.

Do you have any practical tips for saving on prescription medications?

“The first choice is to figure out which Medicare Part D plan will offer you the lowest out-of-pocket expenses. If you are eligible, you can sign up for Extra Help with Social Security. If you are still having issues with the cost, you can consider switching to a lower-cost prescription drug.

You can also call your local pharmacist, and they might be able to provide you with some assistance in checking the prices for different medications.

Another thing to keep in mind is that you can always ask for generics.

The Pharmaceutical Assistance Program (PAP) or State Pharmaceutical Assistance Program (SPAP) can provide you with assistance.

You can contact your Medicare Part D insurance provider for assistance. They may conduct the study for you or submit an organization determination to reduce the cost.”

What are the advantages and disadvantages of Medicare Part D?

“The first advantage is that it allows seniors to get prescriptions. Previously, many Medicare beneficiaries had difficulty affording their prescriptions. There are several insurance companies to select from, each with its own distinct set of plans. Each plan formulary is different.

Assistance programs coordinate with Medicare Part D. Medicare Part D coordinates with other insurance.

One disadvantage of Medicare Part D is that there is no formulary that covers every prescription drug that the FDA has authorized. You must locate the one that covers all of your medications.

Another disadvantage is that you must reevaluate the plan every year for the Annual Enrollment Period. Each year, formularies are adjusted. Prescriptions change levels and prices, and sometimes they aren’t covered.

If you were eligible for Medicare and didn’t have a creditable drug plan, there’s a late enrollment penalty for having a gap in coverage. That penalty lasts a lifetime and applies when you have Medicare Part D coverage.

Medicare Part D has a coverage gap period as well. In the coverage gap phase, Medicare Beneficiaries pay a percentage of their medications’ costs. It varies each year, but it’s set to 25% in 2022.”

Who should get Medicare Part D for drug coverage?

“Everyone who would not have a creditable drug plan after starting Medicare Part A or Part B, even if they don’t take any prescriptions, should have Medicare Part D. The penalty continues to add up for each uncovered month. You can save money by avoiding the late enrollment penalty.”

Who shouldn’t? How does Medicare Part D’s coverage of drugs compare to non-Medicare insurance programs?

“People who have Tricare or people on the Federal Employee Health Benefits Program shouldn’t switch. However, you may always compare prices, but be aware of the drawbacks listed above. Medicare Part D works in conjunction with Tricare and FEHB. However, it is often a hassle.

If you have creditable drug coverage outside of Tricare and FEHB, just compare it. A lot of times, if a person has a costly prescription drug, other creditable coverage may be superior because Medicare Part D has the coverage gap phase.”

John Ramsey is the president of Eternal Insurance Agency.

His company provides health, annuity, and life insurance.

Methodology: Ranking Medicare Part D Drug Prices

In order to find what the most expensive drugs that are covered by Medicare Part D, our researchers looked at the latest report on Medicare Part D drugs released by the CMS. Pulling all relevant data of hundreds of medications, our researchers determined the most relevant categories to rank them.

For most expensive overall, drugs were ranked by the average sales price rather than total spending. This more accurately represented the individual cost of each drug. Our researchers then ranked the most expensive drugs by total claims to see which drugs were most commonly used. The same process was used on the complete list of drugs to see the most commonly used out of all Medicare Part D drugs.

For both the most expensive and most common drugs, each drug’s purpose was researched. This can help those debating whether to buy Medicare Part D decide if the most expensive or most common drugs are something they may need covered with Medicare Part D.

Regardless of whether you have a Medicare Part D plan or not, using price comparison tools for different pharmacies and looking for coupons can help you save on your prescription medications.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Case Studies: Medicare Part D Drugs

Case Study 1: Gattex – Addressing a Rare Condition

John Smith, a 55-year-old individual, is diagnosed with Short Bowel Syndrome, a rare condition that hampers his ability to absorb nutrients. To manage his condition effectively, John’s doctor prescribes Gattex, a medication specifically designed for this purpose.

However, the cost of Gattex poses a significant financial burden for John, as the average sales price per dose is a staggering $40,190. Thankfully, with the inclusion of Medicare Part D coverage, John can access this life-saving medication and experience an improved quality of life.

Case Study 2: Humira – Managing Chronic Inflammation

Sarah Johnson, aged 42, lives with the daily challenges of Rheumatoid Arthritis, a chronic condition causing inflammation and joint pain. To alleviate her symptoms and improve her quality of life, Sarah’s healthcare provider prescribes Humira, a widely used medication for rheumatoid arthritis.

However, the average sales price per dose of Humira stands at $5,710, making it a costly treatment option. Through the support of Medicare Part D coverage, Sarah can afford the ongoing treatment she needs, enabling her to maintain an active lifestyle and manage her condition effectively.

Case Study 3: Revlimid – Battling Multiple Myeloma

David Thompson, a 60-year-old individual, receives a devastating diagnosis of Multiple Myeloma, a form of blood cancer. His oncologist recommends Revlimid, a medication that aids in slowing down the progression of the disease. However, the financial burden associated with Revlimid is substantial, with an average sales price per dose of $13,025.

Thanks to the coverage provided by Medicare Part D, David can access this crucial medication and continue his courageous fight against cancer.

Frequently Asked Questions

What is Medicare Part D?

Medicare Part D is a voluntary prescription drug coverage program available to eligible individuals who are enrolled in Medicare. It was introduced by the federal government in 2006 as a way to help beneficiaries pay for the cost of their prescription drugs.

Can I change my Medicare Part D plan if I’m not satisfied with it?

You can enroll in Medicare Part D by contacting a private insurance company that offers Medicare-approved drug plans, or by using the Medicare Plan Finder tool on the Medicare website.

Is there a penalty for not enrolling in Medicare Part D?

Yes, there may be a penalty for not enrolling in Medicare Part D when you are first eligible or if you go without creditable prescription drug coverage for a period of time. The penalty is calculated based on the number of months without coverage and can be added to your monthly premium for as long as you have Medicare Part D coverage.

Can I use my Medicare Part D coverage to purchase medications from an online pharmacy?

Yes, you can use your Medicare Part D coverage to purchase medications from an online pharmacy that is in the United States and that is licensed by Medicare.

Can I switch between Medicare Advantage and Medicare Part D plans?

Yes, you can switch between Medicare Advantage and Medicare Part D plans during the Annual Enrollment Period or during a Special Enrollment Period if certain qualifying events occur.

Does Medicare Part D cover all prescription drugs?

No, Medicare Part D does not cover all prescription drugs. Each plan has a formulary, or list of covered drugs, which may vary from plan to plan.

Can I switch between Medicare Advantage and Medicare Part D plans?

Yes, you can switch between Medicare Advantage and Medicare Part D plans during the Annual Enrollment Period or during a Special Enrollment Period if certain qualifying events occur.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.