Best Ohio Car Insurance (2025)

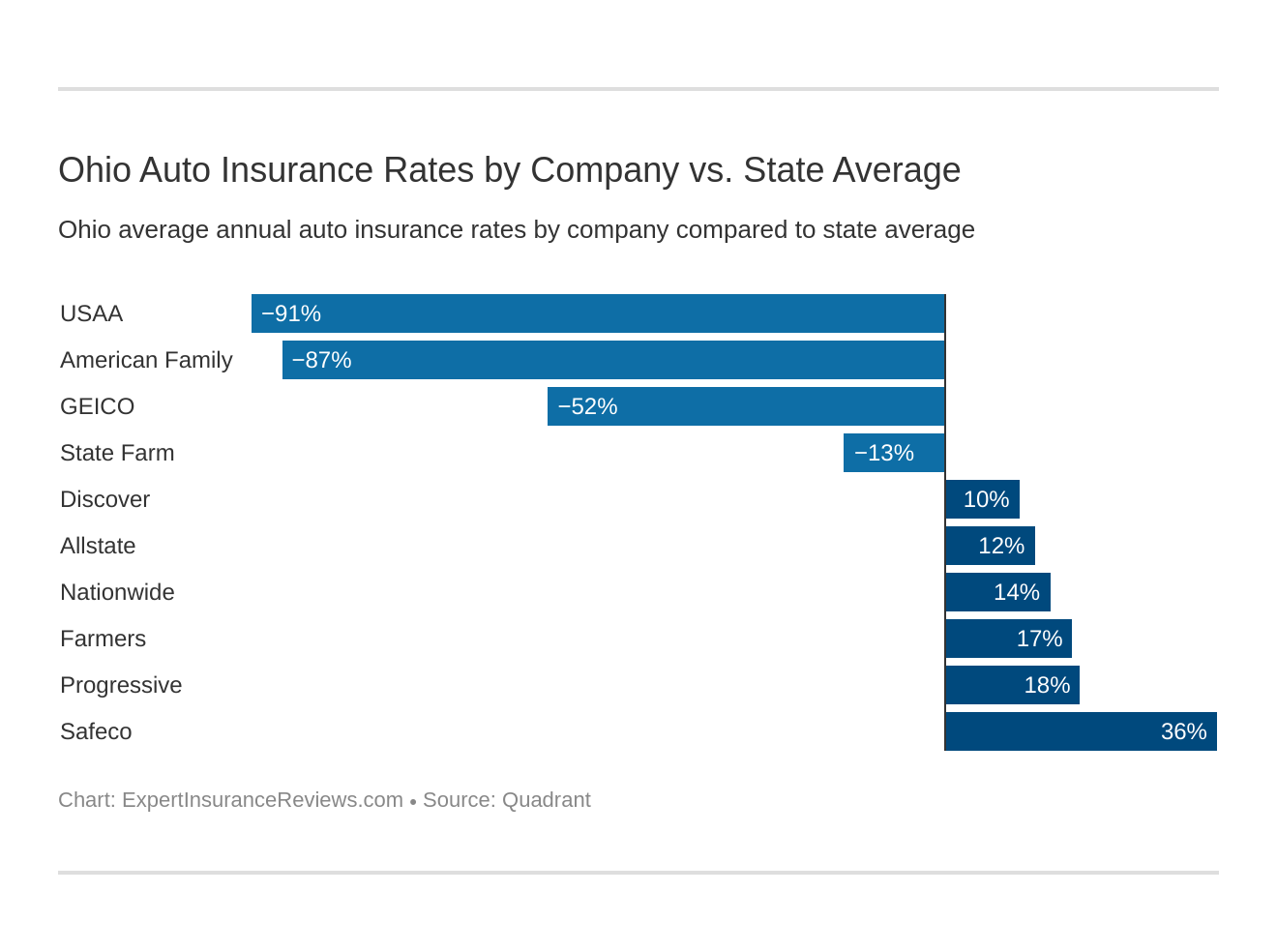

Ohio minimum car insurance requirements are 25/50/25 for bodily injury and property damage while Ohio auto insurance rates average $66 per month. USAA and American Family are some of the cheapest auto insurance companies in Ohio. If you haven’t chosen an insurance company, make sure to ask them about discounts to save on your Ohio car insurance quotes.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

UPDATED: Mar 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Ohio minimum car insurance requirements are 25/50/25 for bodily injury and property damage

- Ohio auto insurance rates average $66 per month

- USAA is the cheapest car insurance company in Ohio

| OHIO STATISTICS SUMMARY | DETAILS |

|---|---|

| Miles of Roadway | 122,926 |

| Vehicles Registered in State | 10,152,367 |

| State Population | 11,689,442 |

| Most Popular Vehicle | Honda Civic |

| Uninsured Motorists | 12.40% |

| - | State Rank: 22 |

| Driving Fatalities in 2018 | Speeding: 290 |

| - | DUI: 294 |

| - | Total: 4,530 |

| Annual Insurance Costs | Liability: $397.11 |

| - | Collision: $269.84 |

| - | Comprehensive: $121.61 |

| - | Full Coverage: $788.56 |

| Cheapest Provider | USAA |

If you are passing through the beautiful Ohio state, there’s one thing the majority of residents seem to have agreed upon — Honda Civics. So it’s easy to say Ohioans are an environmentally conscious bunch.

But what about Ohio car insurance coverage and rates? What’s the consensus on that? And how does one sift through all the available information and make a well-informed decision for their families?

No need to be overwhelmed any further — we’ve got you covered. In this article, we’ll be looking at some of the most affordable rates and best companies for the Ohio region, as well as state coverages, laws, and more.

Ohio Car Insurance Coverage & Rates

Before we dive into which factors affect your rates and which companies are best, let’s examine a few basics.

Ohio Minimum Coverage

| INSURANCE REQUIRED | LIMITS |

|---|---|

| Bodily Injury Coverage | $25,000 per person $50,000 per accident |

| Property Damage Coverage | $25,000 |

Liability car insurance covers any damage attributed to the driver in the event of an accident. Bodily injury insurance typically pays for the other person’s medical expenses, while property damage typically pays for repairs for another person’s vehicle.

Thus, the minimum insurance coverage Ohio requires from its residents to be on the road is

- $25,000 – insures injury/death of one person

- $50,000 – insures injuries or death of persons

- $25,000 – insures property damage

Keep in mind that this is simply the minimum. The Insurance Information Institute recommends a minimum of at least $100,000 of liability insurance per person and a total of $300,000 liability insurance per accident.

[Ohio’s] coverage is about average compared to other states’ requirements, but it’s always wise to buy more than the minimum — especially in an at-fault state like Ohio.

Furthermore, Ohio is considered an “at-fault” car accident state. This means simply that the person responsible for causing the accident becomes responsible for compensation to the other party that incurred harm as a result of the crash.

You break it, you buy it.

Don’t worry, we’ll be comparing companies and rates below to get you insured in no time.

Thus, it’s always wise to purchase more than the minimum, especially since Ohio is an at-fault state and if one damages a luxury vehicle, for instance, they would be paying the remainder of the money out of pocket.

Let’s look at the forms required by the state that references the driver’s ability to pay for damages in the event of an accident.

Forms of Financial Responsibility

Under Ohio law, drivers are obligated to carry car insurance or additional proof of financial responsibility to be considered insured in the state.

Ohio requires drivers to show financial responsibility for any potential car accident by purchasing a bond, posting collateral, or buying liability car insurance.

The state requires some sort of financial responsibility for registered drivers.

- An auto liability insurance policy.

- A surety bond of $30,000 issued by an authorized surety or insurance company.

- A certificate issued by the Ohio Bureau of Motor Vehicles (BMV) indicating that money or government bonds of $30,000 is on deposit with the Treasurer of the State

- A certificate issued by the BMV showing a bond secured by real estate having equity of at least $60,000.

- A certificate of self-insurance issued by the BMV that is available to those with more than 25 vehicles registered in their or a company’s name.

But while proof of auto insurance is mandated, this does not stop individuals from driving without insurance.

Failure to provide the necessary documentation for your insurance could result in the following in the state of Ohio:

- Suspension of driver’s license (for up to 90 days and up to a full year for a repeat offense)

- Impoundment of your vehicle

- Reinstatement fees ($75 to get your driver’s license back, up to $500 for a repeat offense)

- The requirement to show proof of compliance with insurance/financial responsibility laws

So be sure to always carry proof of insurance, deposit, or bond while operating your vehicle. And for those who are tech-savvy, Ohio is one of the states, as of April 2018, allowing drivers to use an electronic copy of their insurance card in the event they are stopped on the road.

Premiums as a Percentage of Income

An individual’s income per capita is the money they have left over to save or spend post taxes. In 2014, the annual per capita for an individual in Ohio was $37,490.

Since Ohio drivers pay roughly $766.66 on average, that means that roughly 2.04 percent is spent on car insurance of their annual income.

It seems pretty affordable, right?

A tad bit more than its neighbor Indiana; however, residents nearby in Pennsylvania, New York, and West Virginia spend hundreds of dollars more on car insurance each year.

Average Monthly Car Insurance Rates in OH (Liability, Collision, Comprehensive)

| Coverage Types | Annual Cost (2015) |

|---|---|

| Liability | $397.11 |

| Collision | $269.84 |

| Comprehensive | $121.61 |

| Combined | $788.56 |

This data provided by the National Association of Insurance Commissioners displays the average rate for each type of coverage in the state of Ohio.

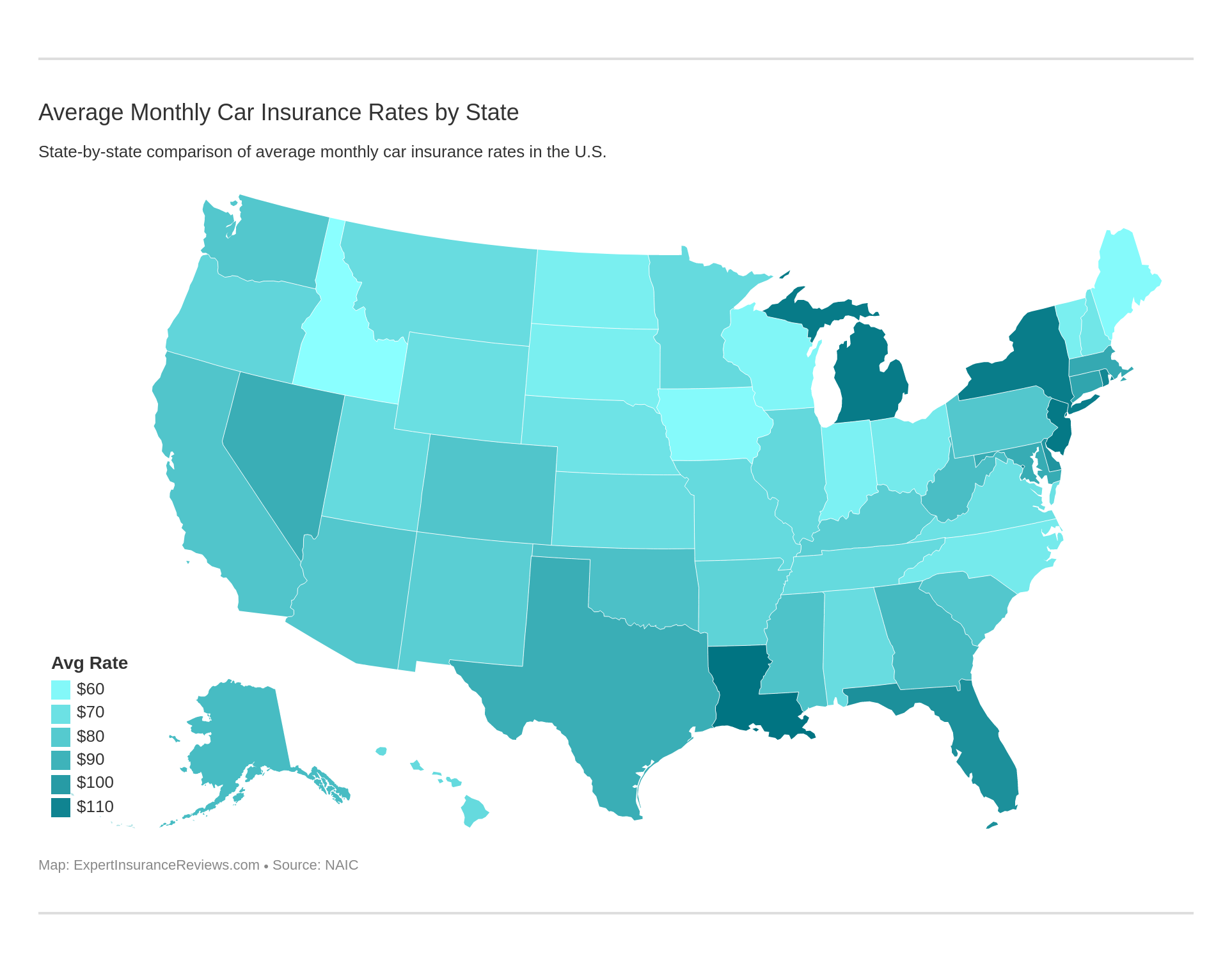

According to the National Association of Insurance Commissioners’s most recent auto insurance reporting, the U.S. average premium cost was $1,009 in 2015 — whereas Ohioans paid around $200 cheaper at $789.

Since then, the national average of premiums has increased.

The good news is Ohio drivers pay much less than most other drivers around the nation. On average, Americans pay $1,311 per year for their auto insurance, while Ohio drivers pay on average about $843 per year.

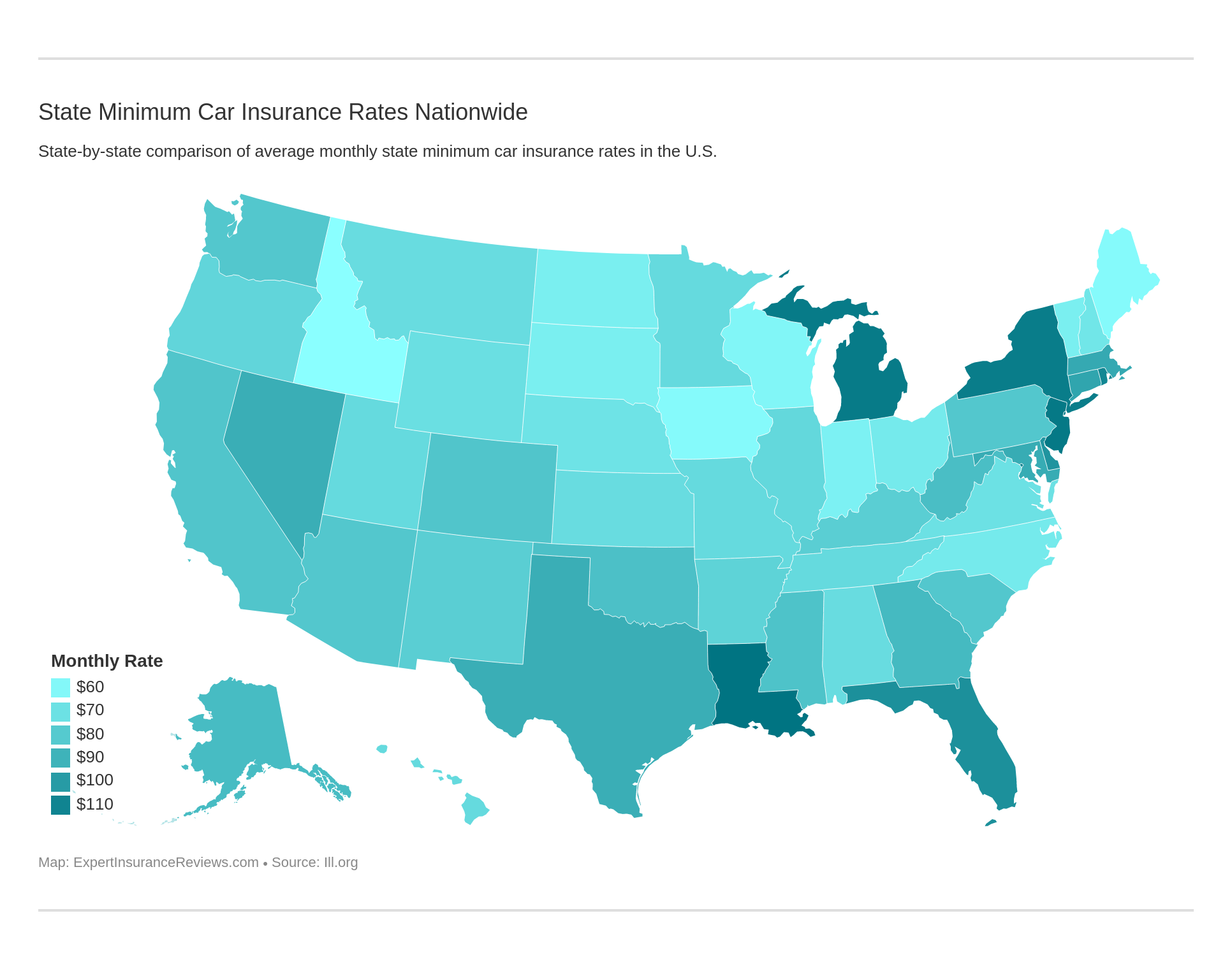

The average rate for car insurance in Ohio is $843, the second-lowest on a national average.

Pretty sweet right? Especially compared to its neighbor Michigan, which pays almost three times as much for car insurance. Thus, living in the state of Ohio has its perks when it comes to car insurance (in case you were thinking about relocating to the Northcentral region).

And seeing that this is simply an average, there might even be lower rates for your family in the Buckeye state — keep reading to learn more.

Additional Liability

When you are involved in a car or truck accident, you are likely to fare better if you stick with a company that has a higher pay loss ratio.

A loss ratio shows how much a company spends on the types of claims to how much money they take in on premiums.

Let’s look at an example.

Say we have a loss ratio of 60. Sixty percent indicates the company spent $60 on claims out of every $100 earned in premiums. The closer the ratio is to 100, the more claims that are paid. So a 60 – 70 loss ratio is considered to be in the safe zone.

Now let’s take a look at the graph below for the state of Ohio.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 81.76% | 78.69% | 78.67% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 58.91% | 56.67% | 54.71% |

MedPay and uninsured/underinsured car insurance are two more insurance add-ons that anyone can purchase to bulk up their policy. While the loss ratio numbers for Ohio’s uninsured/underinsured coverage is a little on the lower side, it is still within a safe range.

That’s why a higher loss ratio is important when looking for a new provider, so be sure to add this to your list of must-haves when looking for new providers.

Add-Ons, Endorsements, & Riders

Since we’ve started, we’ve discussed insurance and several add-ons like MedPay and uninsured motorist coverage. There are still other options and we want to make sure you’re informed as much as possible when making your decision.

With that in mind, here are some other types of insurance that might be helpful for you and your family. Click on the links below to see if any additional coverage appeals to you.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

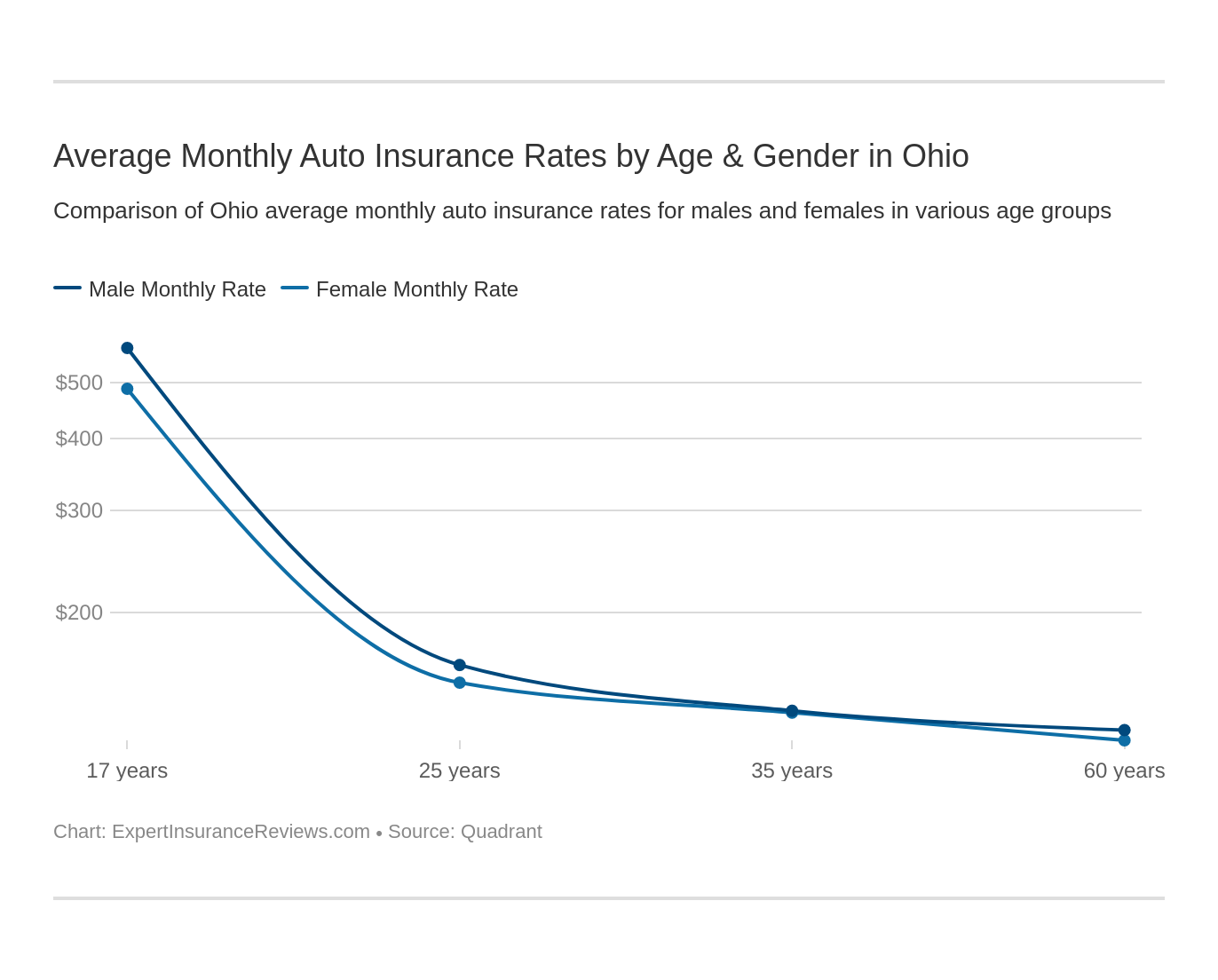

Average Car Insurance Rates by Age & Gender in OH

While many factors go into calculating your rate, your age, gender, and marital status are among some of the top factors.

Statistically, women tend to get into fewer accidents, have fewer driver-under-the-influence accidents (DUIs) and — most importantly — have less serious accidents than men. So all other things being equal, women often pay less for auto insurance than their male counterparts.

But are females in Ohio paying less than their male counterparts? Let’s take a second and look at the chart below (feel free to sort the data for your particular circumstance).

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allied P&C | $1,379.41 | $1,410.32 | $1,282.59 | $1,334.83 | $3,703.82 | $4,511.88 | $1,642.80 | $1,773.07 |

| Allstate | $2,076.46 | $2,054.07 | $1,919.38 | $2,011.85 | $7,306.88 | $8,456.50 | $2,206.95 | $2,292.07 |

| American Family Mutual | $1,958.34 | $1,958.34 | $1,787.39 | $1,787.39 | $7,444.49 | $10,177.95 | $1,958.34 | $2,631.93 |

| Farmers | $2,106.20 | $2,160.58 | $1,928.90 | $2,179.61 | $4,781.38 | $5,126.04 | $2,651.77 | $2,761.52 |

| First Nat'l | $1,781.98 | $1,950.41 | $1,596.99 | $1,871.63 | $9,875.56 | $10,891.02 | $1,909.10 | $2,081.18 |

| GEICO | $1,741.67 | $1,773.53 | $1,636.13 | $1,636.13 | $3,760.90 | $4,926.25 | $2,930.56 | $2,144.04 |

| Progressive | $1,528.34 | $1,427.27 | $1,374.92 | $1,392.37 | $7,688.90 | $8,614.41 | $1,828.39 | $1,821.58 |

| State Farm | $1,565.66 | $1,565.66 | $1,407.45 | $1,407.45 | $4,512.95 | $5,714.10 | $1,779.29 | $2,045.65 |

| USAA | $1,133.34 | $1,118.30 | $1,090.31 | $1,091.29 | $4,883.26 | $5,777.50 | $1,433.41 | $1,569.85 |

Men do pay more than women in the state of Ohio for car insurance, sometimes as near as a thousand dollars.

Read more:

Keep in mind when looking at this chart that this data is based on actual purchased coverage by the state population and includes rates for high-risk drivers and those who choose to purchase more than the state minimum as well (such as those not required, like uninsured/underinsured motorist, PIP, and MedPay).

But don’t worry, we’ll be getting to some cheap alternatives in your state in no time.

Here’s a helpful video explaining how one individual found discounts that helped him save money on his car insurance every month. Why don’t you check it out?

And just to reiterate, there are numerous amounts of discounts one may be eligible, for similar to the video, that would be sure to save you some cash. Every little bit helps, right? If you haven’t selected an insurance company already, be sure to remind yourself to ask them what discounts you are indeed eligible for.

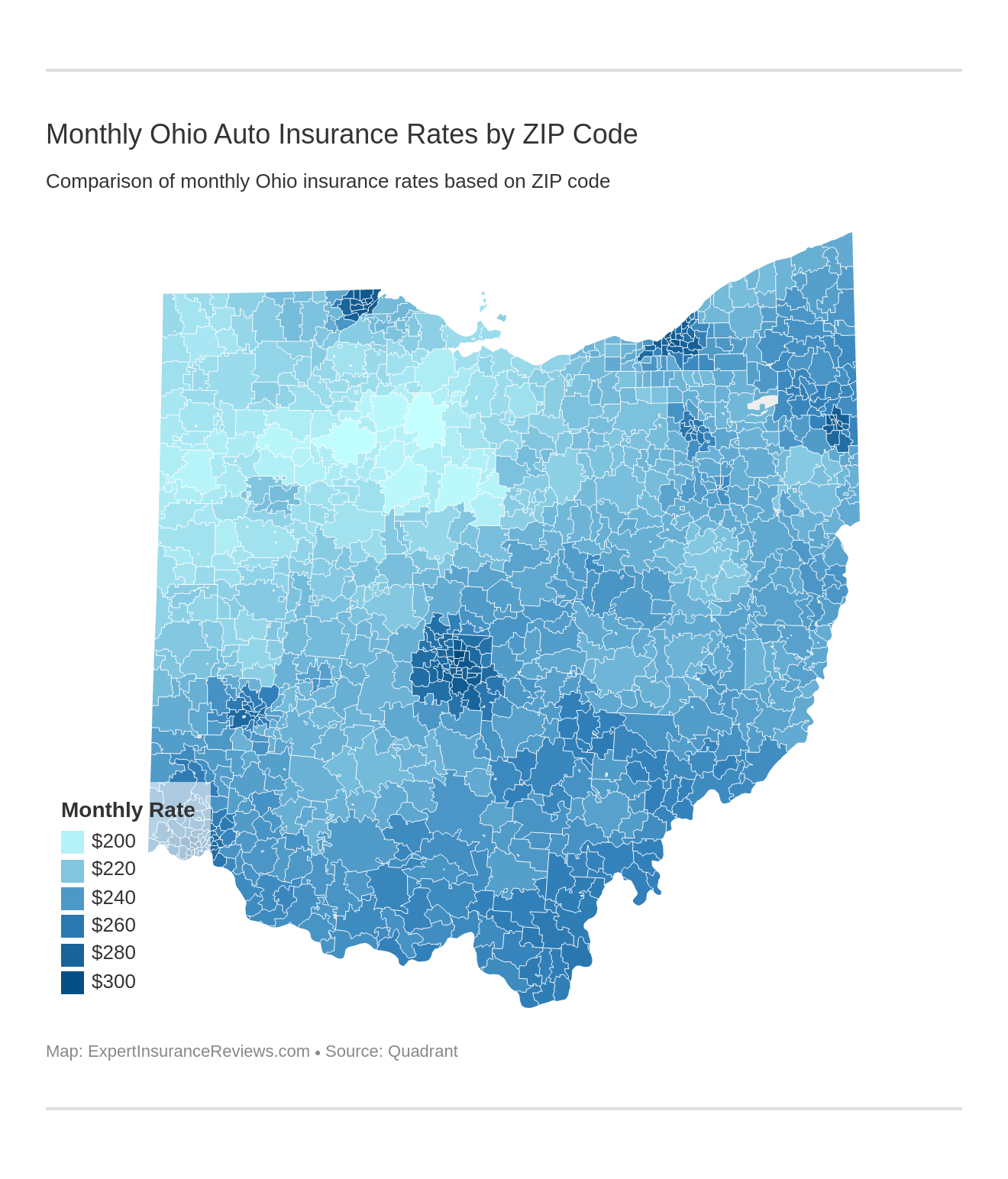

You don’t want to miss this. Next, we’ll be taking a look at the cheapest rates by zip codes as you could discover cheap rates located near you!

Cheapest Rates by City

We’ve broken down the cheapest rates by city.

Drivers in rural areas generally pay less than drivers in urban areas. Rural areas have fewer cars on the road, so costs for insurers are lower because there are fewer accidents, claims, and thefts.

It isn’t a surprise that rural cities like Benton Ridge and Old Fort pop up in the top five cities with the cheapest rates, as they both have a population of fewer than 300 persons. And as mentioned before, drivers in rural areas generally pay less than those in urban areas.

As far as the most expensive rates go, both Toledo and Youngstown appear on the list; understandably so as both fall in the top ten most populated cities in Ohio, where rates are most likely higher. Graveport is also among the top expensive cities by rate and it only has a population close to 6,000 persons–it’s highly likely that neighboring Rickenbacker airport has an affect on its higher rates.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Ohio

Finding the right car insurance company is hard. And some may not have been successful in their first or even second attempt. We’re here to help.

We’ve heard from the experts on the matter. In the following sections, we’ll take a look at ratings for insurance companies, including your opinions, the cheapest companies (we know you’ll love this), as well as other rates as affected by various factors like driving record, credit history, and more.

The Largest Companies’ Financial Rating

Measuring a company’s financial rating is significant in that it proves how great a company’s financial strength is. Let’s look at the chart below.

| COMPANY | AM BEST RATING | DIRECT PREMIUMS WRITTEN | MARKET SHARE |

|---|---|---|---|

| Allstate | A+ | $687,527 | 10.29% |

| American | A | $176,153 | 2.64% |

| Erie | A+ | $222,863 | 3.33% |

| Geico | A++ | $466,535 | 6.98% |

| Grange Mutual | A | $344,399 | 5.15% |

| Liberty Mutual | A | $315,308 | 4.72% |

| Nationwide | A+ | $536,768 | 8.03% |

| Progressive | A+ | $903,179 | 13.51% |

| State Farm | A++ | $1,316,297 | 19.69% |

| USAA | A++ | $198,016 | 2.96% |

State Farm emerges as the top insurer with 19.69 percent of the market share. Progressive and Allstate also had large market shares, 13.5 percent and 10.29 percent, respectively.

In general, financial ratings prove the good standing of a company. This would also help assess if they were on a verge of a bankruptcy, which is why you’d want to make sure you’d consider this.

Here comes the moment you’ve probably have been wondering — what other’s experiences with the insurance companies in your state were. Because while data and other factors generate reports, your voice matters and is considered a valuable variable, as well.

Companies with Best Ratings

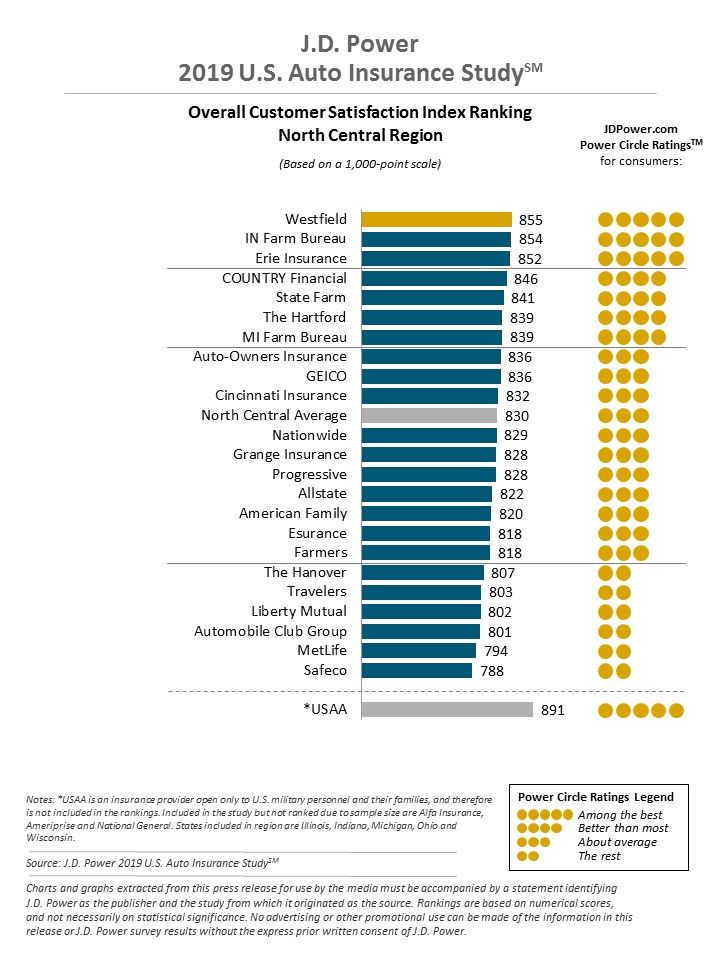

According to J.D. Power, customer sanctification plays a huge role in determining the best insurance companies. Here’s what you said about the insurance companies for the NorthCentral region last year.

Auto-Owners Insurance was ranked highest across five states including Ohio, except for USAA, who only serves military members and their families and was thus not considered in the rankings.

And in case you aren’t familiar with them, check them out here.

Companies with Most Complaints in Ohio

There are always complaints out there, but whenever you have the good, the bad should also be considered, as well. This isn’t to say a company is known for its complaints — but how they handle those complaints, that’s what matters most.

Check out the data below — these companies are the top companies in the state with the most complaints.

| Top Providers of Car Insurance (Ohio) | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints (2017) |

|---|---|---|---|

| Allstate | 1 | 0.5 | 163 |

| American | 1 | 0.79 | 73 |

| Erie | 1 | 0.7 | 22 |

| Geico | N/A | 0.007 | 6 |

| Grange Mutual | 1 | 0.62 | 10 |

| Liberty Mutual | N/A | 0.007 | 6 |

| Nationwide | 1 | 0.28 | 25 |

| Progressive | 1 | 0.75 | 120 |

| State Farm | 1 | 0.44 | 1482 |

| USAA | N/A | 0 | 2 |

You may be wondering what a complaint index is. A company with a complaint index of one has an average number of complaints. Anything higher indicates a company has more complaints than average. An index of 0.0 (zero) states no complaints were received for the company — always better than average.

Customers seemed to have less to say about companies like USAA, Geico, and Liberty, who had complaint ratios near zero, while companies like American and Progressive led with a higher amount of complaints despite their acute loss ratios.

Keep in mind that this is just in 2017 — some of these companies could have improved their complaint index since them.

Feel free to sort the table to see what your counterparts had to say about these companies.

Cheapest Car Insurance Companies in Ohio

Here are the cheapest companies in Ohio. Check out the chart below.

While everyone likes to save money, sometimes buying cheap car insurance may not be the wisest option for many drivers.

Commute Rates by Companies

Did you know that your commute time can also affect your rates? Curious to see how? Check out this chart below.

| Company | 10 Miles Commute, 6000 Annual Mileage | 25 Miles Commute, 12000 Annual Mileage |

|---|---|---|

| Allstate | $3,197.22 | $3,197.22 |

| American | $1,496.84 | $1,533.50 |

| Farmers | $3,423.01 | $3,423.01 |

| Geico | $1,834.42 | $1,899.95 |

| Liberty Mutual | $4,429.74 | $4,429.74 |

| Nationwide | $3,300.89 | $3,300.89 |

| Progressive | $3,436.96 | $3,436.96 |

| State Farm | $2,445.81 | $2,569.94 |

| Travelers | $3,135.16 | $3,135.16 |

| USAA | $1,422.09 | $1,534.83 |

Most companies, like Allstate and Traders, seem to give their drivers a break when it comes to commute rates, whereas companies like American and State Farm seem to be on the stricter side.

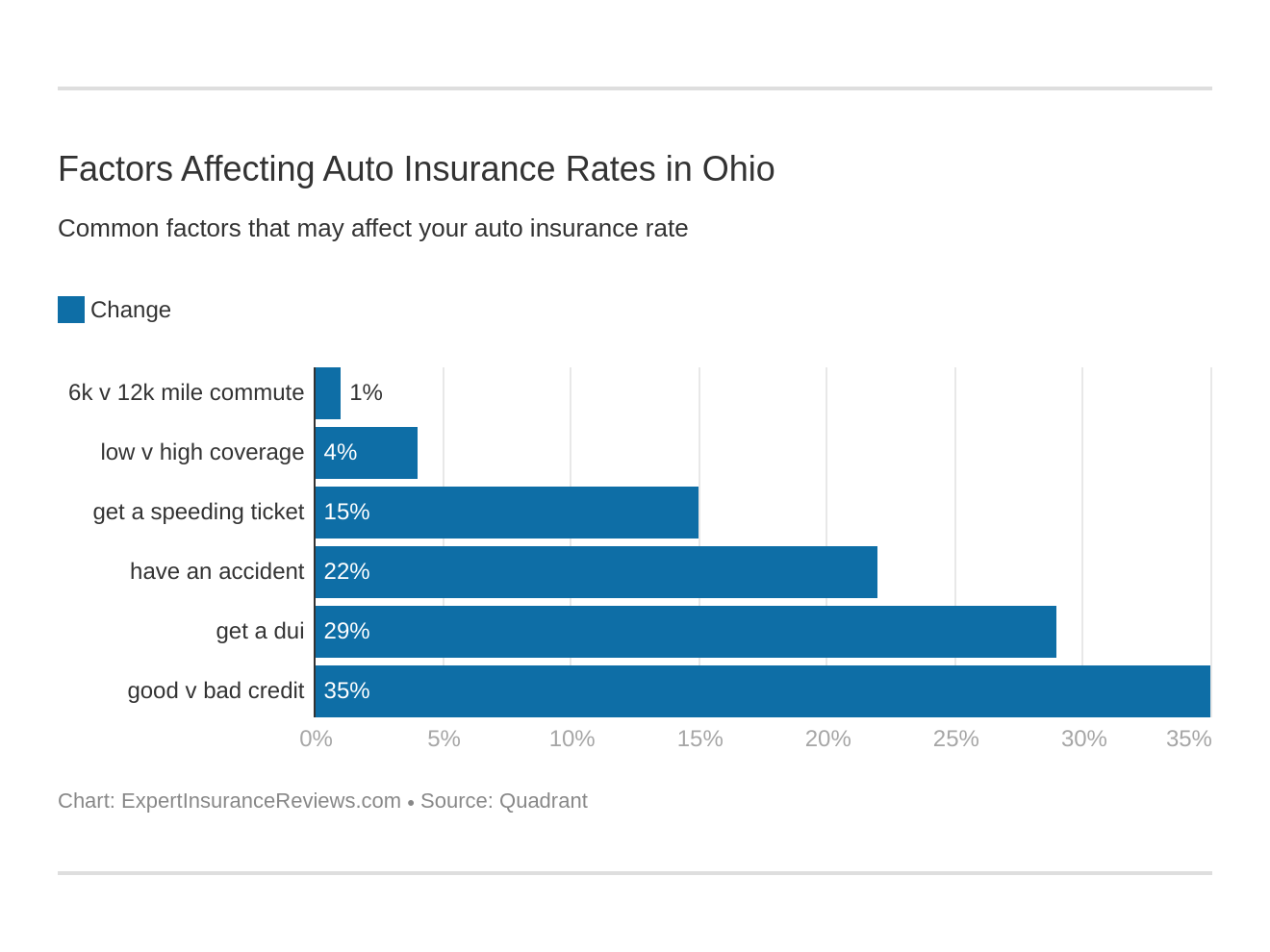

With that in mind, commute distance does not affect your rates as much as some other factors.

Coverage Level Rates by Companies

Everyone loves lower coverage. Who doesn’t? Keep in mind, however, that in the event of a serious accident, higher coverage is a better route to take.

| Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $3,092.59 | $3,190.74 | $3,308.32 |

| American | $1,488.65 | $1,526.68 | $1,530.18 |

| Farmers | $3,243.37 | $3,370.12 | $3,655.55 |

| Geico | $1,807.66 | $1,858.73 | $1,935.16 |

| Liberty Mutual | $4,264.14 | $4,451.75 | $4,573.32 |

| Nationwide | $3,647.54 | $3,199.58 | $3,055.56 |

| Progressive | $3,305.47 | $3,408.32 | $3,597.09 |

| State Farm | $2,384.79 | $2,515.42 | $2,623.40 |

| Travelers | $3,050.20 | $3,176.78 | $3,178.51 |

| USAA | $1,413.38 | $1,477.00 | $1,544.99 |

While companies like State Farm and USAA offer a low rate for low coverage, they are among the leading companies when it comes to penalizing users for extending that coverage. If you go with Progressive, not only will you have a low rate, but it’ll also benefit you to extend your coverage.

Credit History Rates by Companies

Your credit score is like the doorway that opens up new opportunities for cars, homes, loans, and more. It is also a factor insurance companies determine when charging you a premium.

| Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| Allstate | $2,494.19 | $2,987.92 | $4,109.54 |

| American | $1,162.34 | $1,372.30 | $2,010.87 |

| Farmers | $3,117.43 | $3,273.78 | $3,877.82 |

| Geico | $1,495.27 | $1,867.18 | $2,239.10 |

| Liberty Mutual | $3,049.35 | $3,890.18 | $6,349.68 |

| Nationwide | $2,709.43 | $3,209.33 | $3,983.93 |

| Progressive | $3,115.60 | $3,335.09 | $3,860.18 |

| State Farm | $1,741.35 | $2,208.94 | $3,573.32 |

| Travelers | $2,849.59 | $3,050.60 | $3,505.29 |

| USAA | $1,157.84 | $1,358.48 | $1,919.04 |

Companies like Travelers, Progressive, and Farmers rarely penalize their customers for having bad credit, while companies like Liberty Mutual and State charge nearly double.

Driving Record Rates by Companies

Insurance rates are determined by many factors, and driving behavior is just one – but it’s one you control the most. Drivers with squeaky-clean records get some of the lowest rates, so shoot for those good-driver discounts.

If you are a safe driver and avoid penalties like a ticket or DUI, your car insurance could be relatively cheaper than other residents in the state.

Here’s a chart that shows driving record rates by companies.

| Company | Clean Record | 1 Speeding Violation | 1 Accident | 1 DUI |

|---|---|---|---|---|

| Allstate | $2,689.12 | $3,040.34 | $3,250.76 | $3,808.65 |

| American Family | $1,451.77 | $1,536.30 | $1,536.30 | $1,536.30 |

| Farmers | $2,823.36 | $3,688.92 | $3,634.83 | $3,544.94 |

| Geico | $1,269.11 | $1,725.85 | $1,828.67 | $2,645.09 |

| Liberty Mutual | $3,722.47 | $4,341.01 | $4,775.12 | $4,880.34 |

| Nationwide | $2,644.52 | $2,924.39 | $3,364.88 | $4,269.79 |

| Progressive | $2,963.60 | $3,599.93 | $4,028.09 | $3,156.21 |

| State Farm | $2,285.04 | $2,507.87 | $2,730.70 | $2,507.87 |

| Travelers | $2,308.77 | $2,683.62 | $3,009.00 | $4,539.26 |

| USAA | $1,135.07 | $1,257.56 | $1,521.70 | $1,999.49 |

According to the data, companies like Travelers and Geico nearly double your rate if you develop a bad record, while companies like American and Progressive do not.

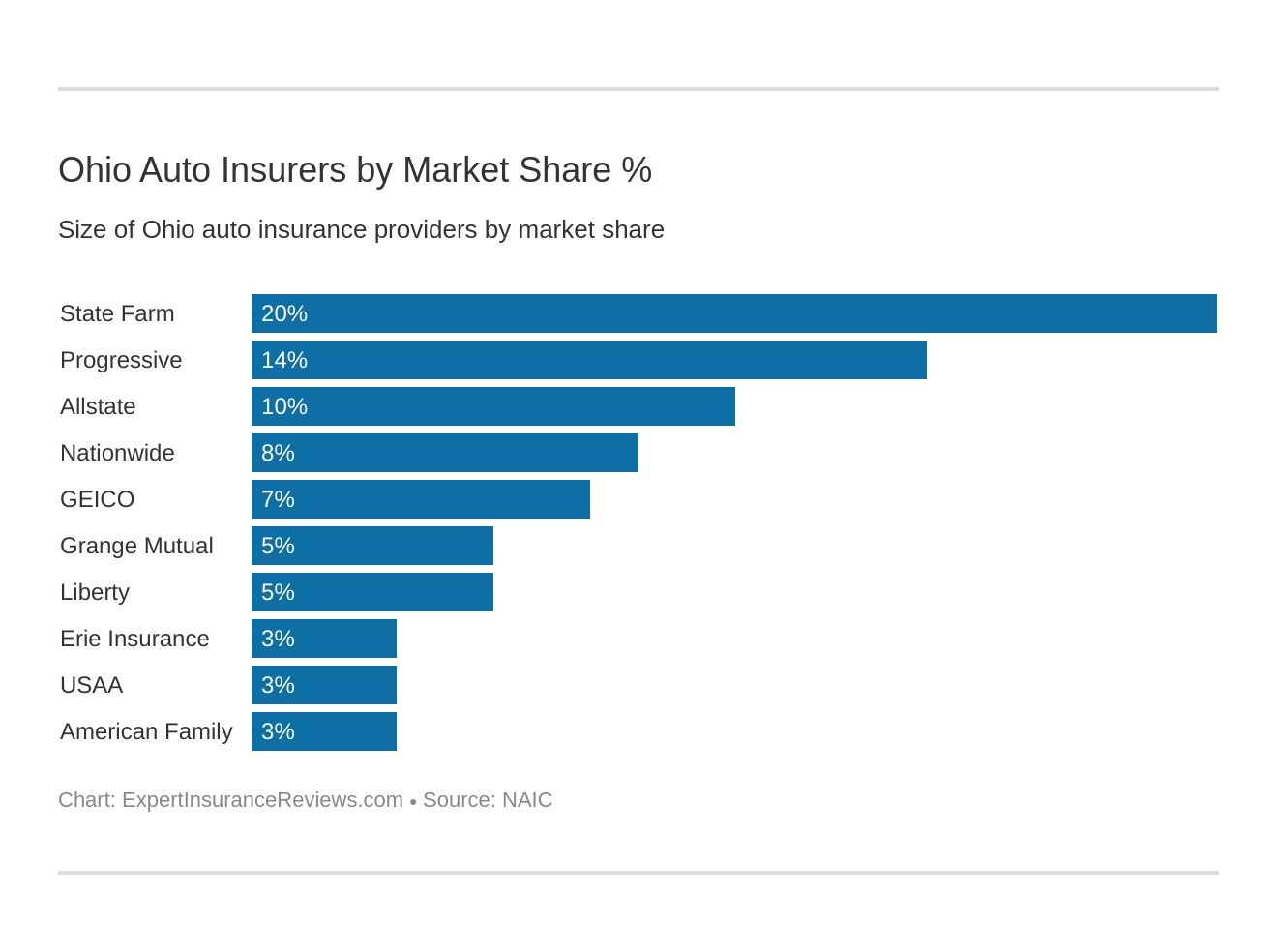

Largest Car Insurance Companies in Ohio

Here are the 10 largest car insurance companies in Ohio.

| Company | Direct Premiums Written | Market Shares |

|---|---|---|

| State Farm | $1,316,297 | 19.69% |

| Progressive | $903,179 | 13.51% |

| Allstate | $687,527 | 10.29% |

| Nationwide | $536,768 | 8.03% |

| GEICO | $466,535 | 6.98% |

| Grange | $344,399 | 5.15% |

| Liberty Mutual | $315,308 | 4.72% |

| Erie Insurance | $222,863 | 3.33% |

| USAA | $198,016 | 2.96% |

| American | $176,153 | 2.64% |

| TOTAL | $6,684,674 | 100.00% |

Again, we see State Farm as the top insurer in Ohio, while Progressive and Allstate also had large market shares.

Number of Insurers in Ohio

Domestic insurance is formed under state laws while foreign insurance is formed under laws that apply to every state in the U.S. In the state of Ohio, there are 138 domestic insurers and 851 foreign insurers, totaling nearly 1,000 insurers.

Ohio Laws

Laws vary from state to state and it’s beneficial to know which laws are in your state to ensure you drive to your safest ability. Let’s take a look at laws particular to Ohio to keep you well informed and educated about the state.

Ohio Car Insurance Laws

As we’ve covered in previous sections, one must have the minimum liability coverage (25/50/25) for your car. We’ve also previously covered several penalties as a result of the failure to provide such. (For more information, read our “Ohio Car Insurance Laws“).

In Ohio, it is illegal to drive any motor vehicle without insurance, and it is illegal for a vehicle owner to allow anyone else to drive his or her motor vehicle without insurance.

So not only is it illegal not to have car insurance, but it’s also illegal to not have forms of financial responsibility present as an alternative to the minimum liability coverage.

Let’s dive deeper.

How State Laws for Insurance are Determined

Each state has laws to ensure the safety of all individuals on the road.

All states require a demonstration of financial responsibility to operate a vehicle. Most states require this to be in the form of liability insurance purchased from an insurer. The required limits vary by state.

Windshield Coverage

You would think with how cold Ohio gets that there would be some coverage regarding cracked windshields. However, at the moment there are none and drivers are responsible for repairing these damages on their own, unless they are covered under comprehensive car insurance.

Do a quick search or ask your insurer if they offer options for windshield coverage.

High-Risk Insurance

High-risk insurance is categorized for individuals with a bad driving record or poor credit, for example, who have a hard time obtaining insurance through more commercial parties.

High-risk drivers in the Buckeye State who can’t find an insurer to cover them in the standard voluntary market can seek an alternative like the Ohio Automobile Insurance Plan (OAIP) that will provide them with auto insurance.

Keep in mind that if you have high-risk insurance your premium may be higher — however, that’s still better than having no insurance. Some companies won’t cover you if you are a high-risk driver.

You might also be required to get SR-22 insurance, which we’ve mentioned before as a financial form of responsibility. SR-22 insurance is considered high-risk insurance that you must carry in Ohio for a minimum of three years.

Low-Cost Insurance

Currently, Ohio does not have a low-income insurance plan. Only California, Hawaii, and New Jersey help low-income families pay their car insurance.

However, as stated earlier, you may be eligible for certain discounts by law if you are a veteran or a student, for example.

Here’s a video below outlining discounts for teens and the proper documentation required for that particular circumstance. See any commonalities?

Automobile Insurance Fraud in Ohio

Insurance fraud is where individuals provide falsified information on their applications to obtain lower rates or even present false claims to be compensated for an “incident.”

In Ohio, any fraudulent insurance claim with a value of over $1,000 will be prosecuted as a felony.

If one is prosecuted, penalties range from thousands of dollars in fines, the loss of a business license, and even worse, up to five years incarcerated if found guilty.

There are so many affordable rates and companies out there that are willing to help you find the lowest rate. If you enter your zip code in the box below, you can start today.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Statute of Limitations

The statute of limitations is used to set the maximum time after an event in which legal proceedings may be initiated.

You can read the statute of limitations in Revised Code Section 2305.10. Under this section, any lawsuit based on personal bodily injury, product liability, or damage to personal property must be brought within two years from the date the cause of action accrues.

So in the event of the accident, be sure to begin your filing process, as cases are often prolonged for turn-arounds depending on the office of the company who is handling your case.

Vehicle Licensing Laws

Let’s find out about Ohio’s licensing requirements for various populations.

REAL ID

REAL ID is a coordinated effort by the states and the Federal Government to enhance both the reality and accuracy of state-issued identification documents. Ultimately, this should inhibit terrorists’ ability to avoid detection by utilizing fraudulent identification.

Ohio is compliant with the REAL ID Act. Federal agencies can accept driver’s licenses and identification cards from Ohio at Federal facilities and nuclear power plants.

If you are wondering how the REAL ID will impact you, the Department of Homeland Security has tons of information to get you squared away.

Penalties for Driving Without Insurance

You cannot separate laws from their consequences; they go hand in hand, which is why this section will be of extreme importance to you. We’ve mentioned penalties for driving without your insurance, but just to refresh your memory, we’ll outline those again.

- License/plates/registration suspension until requirements are met and $100 reinstatement fee is paid; maintain special high-risk coverage on file with the BMV for three to five years; if involved in accident without insurance: all above penalties and a security suspension for two-plus years and an indefinite judgment suspension (until all damages are satisfied)

- License/plates/registration suspension for one year; $300 reinstatement fee; maintain special high-risk coverage on file with the BMV for three or five years; if involved in an accident without insurance: all above penalties and a security suspension for two-plus years and an indefinite judgment suspension (until all damages are satisfied)

So as you can see, it’s better to always have proof of your insurance and to drive insured. But with so many available options, there are plenty of options to choose from.

Teen Driver Laws

Teens must follow all driving laws, as they have the potential to save lives.

Between 2103 – 2017, 1,932 drivers aged 15 – 17 years old were killed in crashing involving teen drivers.

Ohio uses a multi-stage licensing process for teens. This system allows teens to gradually gain exposure to complex driving situations, easing them into driving over an extended period of time.

Let’s take a good look at these stages.

- Temporary instruction permit

- Probationary license

- Full license

If a probationary license holder under age 17 is convicted of a moving violation that occurred during the first six months of license issuance, they will only be allowed to drive with a parent or guardian for the next six months or until age 17, whichever comes first.

A temporary instruction permit or probationary license can be suspended for up to one year if the teen is convicted of multiple moving violations or any alcohol-related offense.

Ohio’s underage consumption law makes it illegal for a driver under age 21 to drive with a blood alcohol content level of .02 or greater.

Older Driver License Renewal Procedures

Each state has its own renewal process.

[In Ohio] a driver license that is current or expired less than six months can be renewed at any deputy registrar license agency at any time before the expiration date.

Let’s expound upon this.

- Renewed more than 90 days before expiration, the license will expire in three years.

- Renewed within 90 days of expiration, the license will expire in four years.

- Drivers turning 21 cannot renew more than 30 days before their birthday.

Be sure to take care of that, because if your driver’s license is expired more than 60 days in Ohio, you would have to start the entire process of obtaining a permit and all the necessary testing over before you can be on the road again.

New Residents

But what about new residents? Within 30 days of establishing residency, you will need an Ohio driver’s license for yourself, and an Ohio title and license plates for your vehicle.

Here are the necessary documents needed:

- Full legal name

- Date of birth

- Social security number (if assigned)

- Ohio residency

- Citizenship or legal presence

Don’t forget to contact your insurer and remind them you are in a different state and need Ohio insurance so you can be properly covered.

License Renewal Procedures

Here’s a quick video showing you the procedure from start to finish in getting your license renewed. Take a look.

Notice how the forms must be completed in-office, contrary to some states that have electronic ways for applying.

Negligent Operator Treatment System (NOTS)

States like California have a point system for individuals who recklessly drive without regard to another individual or individuals. But what about Ohio? How do they keep track of individuals who are a willful danger on the road?

In Ohio, a person can be convicted of “reckless operation” (also called “reckless driving”) for operating a vehicle “in willful or wanton disregard of the safety of persons or property.”

This displays the state’s intent to keep you and your family safe from others on the road. Here are the penalties in Ohio for reckless driving according to Driving Laws by NOLO:

- No prior traffic convictions. When a motorist has had no prior motor vehicle or traffic convictions within the past year, reckless operation is a minor misdemeanor. The maximum punishment for a minor misdemeanor is a $100 fine — jail time isn’t a possibility.

- One prior traffic conviction. Reckless driving is a fourth-degree misdemeanor if the driver has been convicted of one motor vehicle or traffic offense within the past year. A fourth-degree misdemeanor carries up to 30 days in jail and/or a maximum of $250 in fines.

- Two prior traffic convictions. If a driver has been convicted of two or more motor vehicle or traffic offenses within the past year, reckless driving is a third-degree misdemeanor. Convicted motorists face up to 60 days in jail and/or a maximum of $500 in fines.

Furthermore, a judge can suspend a license between three months to six years for reckless driving.

A few other offenses exist within the state of Ohio regarding reckless driving:

- Operation without reasonable control. Similar to reckless driving with less-severe penalties (convicted motorists don’t face the possibility of license suspension, for example).

- Vehicular assault. When a driver causes “serious physical harm” to another while operating a vehicle in a reckless manner. This offense is typically a fourth-degree felony and penalties involve six to 18 months jail time, near $5,000 in fines, and a one- to five-year license suspension.

Be careful and encourage others to do the same whenever operating a vehicle.

Rules of the Road

Overwhelmed? Don’t be. That’s what we’re here for, to digest a lot of this information for you so you can make the best-informed decision and walk away feeling confident as ever.

Every state differs when it comes to rules on the road. This particular section will cover important information on speed limits, car seat laws, and more.

Fault vs. No-Fault

As stated before, Ohio is a “fault” state. A driver is responsible for damages incurred by the opposing party in the event of a crash — this differs from a “no-fault” state where drivers have insurance to cover their own injuries and damages.

States like Michigan, New York, Kentucky, and Kansas are all “no-fault” states.

Let’s move on.

Seat Belt & Car Seat Laws

In Ohio, you will be fined for not being properly secured in your seat belt when the vehicle is in operation.

Ohio’s child passenger safety law is defined in Ohio Revised Code 4511.81.

And as of October 7, 2009, children in Ohio are required to use belt-positioning booster seats once they outgrow their child safety seats until they are 8 years old, unless they are at least 4 feet, 9 inches or 57 inches tall.

Here’s a chart below that will break this down even further:

| Child's Age | Law Requirement |

|---|---|

| Children less than 4 years old or 40 pounds | Must use a child safety seat meeting federal motor vehicle safety standards. |

| Children less than 8 years old (unless they are at least 4 feet, 9 inches tall) | Must use a booster seat. |

| Children 8-15 years | Must use a child safety seat or safety belt. |

And fines range from $25 – $75, so be sure to get a booster seat for your little one.

Keep Right & Move Over Laws

Ohio laws state that one must be in the right lane if driving slower, as the left lane is permissible only for faster drivers. Watch this video below to get a better idea of these Ohio designated laws. Enjoy.

Speed Limits

NOLO helps us understand ways to honor the speeding laws in Ohio. Here are the three speeding laws:

- Basic speeding law – Motorists are required to drive at a safe speed on the road and alter that speed in alternative conditions, like on a snowy or rainy day, where one would most likely slow down to be safe from oil and black ice on the road.

- Absolute speeding law – This law will be violated if you go faster than the suggested speed limit by the state of Ohio (75 mph on rural freeways, 65 mph on rural expressways and urban freeways, and 55 mph on most other roadways).

- Prima Facie speeding law – Sometimes called “presumed limits,” these are speeds you can argue in court in case you were, for instance, going 25 – 30 mph in a school zone (instead of the suggested 20) if the school was indeed out and the coast was clear.

Don’t think these laws are simply out to get you. Recently, laws changed to accommodate drivers regarding speeding and gave regulators a tap on the wrist. Take a look at this.

Ridesharing

Ridesharing refers to companies like Lyft and Uber providing transportation services. The technical term for those companies is Transportation Network Companies (TNCs).

These TNCs are now subject to new laws in Ohio because lawmakers recognized there was a gap in coverage when ridesharers had their app turned off. Specifics for TNCs in Ohio are outlined in chapter 3942 of Ohio’s revised code.

TNCs are required to be insured during this “gap” period just as they would be if they were driving for their personal use. Their insurance requirements differ, however, from the state’s minimum. Here are the requirements:

- $50,000 for bodily injury or death of a person,

- $100,000 for bodily injury or death of two or more persons

- $25,000 for property damage.

And along with this, drivers are also required to maintain a minimum coverage of $1 million for bodily injury or death of one or more persons and property damage.

The driver is insured when he accepts the ride to the point where the last rider left his vehicle, making up for the gap we talked about earlier. And as long as the driver is insured or the TNC itself, or both, there will be no penalties.

Automation on the Road

Automation is considered the use of a machine or technology utilized to administer a task previously carried out by a human. Driving-wise, this comes down to aspects such as cameras and sensors.

Ohio currently does not have automation laws, but they recently won a $17.8 million grant that would enable them to do more automation testing on rural roadways.

The lessons we learn in Ohio can have enormous benefits for the state and nationwide as we work to make our transportation system safer.

And if you’re in these counties, don’t worry, they’ll be a human driver in the car at all times unless otherwise noted. You’ll be notified by officials beforehand regarding testing regions.

Safety Laws

If you’re just catching up, we’ve talked about some standard laws of the past as well as some futuristic ones including ridesharing and automation. But here are a few laws that commonly affect us and often threaten our safety — DUI laws, marijuana-impaired driving laws, and distracted driving laws.

However, thousands of people every year get penalized as a result of not obeying these laws. Let’s take a look together.

DUI Laws

Here are a few basics regarding DUIs in Ohio.

| DUI LAW IN OHIO | DETAILS |

|---|---|

| Name for the Offense | Operating a Vehicle Under the Influence (OVI) |

| BAC Limit | 0.8 |

| High BAC Limit | 0.17 |

| Criminal Status by Offense | 1st-2nd first degree misdemeanors, 3rd misdemeanor, 4th in 6 years fourth degree felony, + in any time period third degree felony |

| Look Back Period | 10 years |

But what happens if you break these laws? Here’s are a list of penalties for operating a vehicle under the influence.

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 6 months minimum, but up to 3 years; 15 days before eligible for restricted driving privileges with IID | 3 days jail or 3 days DIP - 6 months(If court grants unrestricted driving privilege with IID, mandatory jail time suspended.) | $250-$1075; license reinstatement fee $475 | 6 points on driving record; up to 5 years probation, optional treatment order, optional restricted plates |

| 2nd Offense | 1-7 years; no driving privileges for 45 days | 10 days jail or 5 days jail and 18 days house arrest with monitoring -6 months incarceration | $350-$1625 +license reinstatement fee of $475 | up to 5 years probation, restricted plates required, mandatory assessment and treatment, IID required, 90 day vehicle immobilization for those registered to offender, 6 points on license |

| 3rd Offense | 1-12 years; no driving privileges for 180 days | 30 days jail OR 15 days jail and 55 days house arrest with monitoring - 1 year incarceration | $350-$2750 +$475 license reinstatement fee | up to 5 years probation, mandatory addiction program, restricted plates required, IID required, possible forfeiture of vehicle registered to offender, 6 points on license |

| 4th Offense | Felony charges |

Drunk driving is a serious crime. Just in 2017, Ohio had 333 deaths associated with drunk driving, making up 3 percent of the nation’s average. Having fun is not a crime, but being drunk behind the wheel is.

This leads to our next point — being impaired with marijuana has consequences, as well. Let’s take a look.

Marijuana-Impaired Driving Laws

Alcohol isn’t the only substance that can impair your driving. Marijuana also has adverse side effects and can impair one’s ability to focus and function while operating a vehicle. More than two nanograms of THC per se in your system could get you in some serious trouble.

In fact, any substance that impairs your driving can subject you to a penalty–something extremely important to keep in mind.

Distracted Driving Laws

Distracted driving is more than texting, although that ranks among the most prevalent of them all. In fact, in Ohio, there is a texting ban for all drivers.

In Ohio, distracted driving is “engaging in any activity that is not necessary to the operation of a vehicle and impairs, or reasonably would be expected to impair, the ability of the operator to drive the vehicle safely.”

Last October of 2018, a new law went into place giving officers the authority to issue tickets for any distracted driving — not just texting.

Driving Safely in Ohio

We’ve covered almost everything from rates and coverage to state and safety laws. But have you ever wondered how safe it is to drive in Ohio?

In this section, we’ll be covering vehicle theft, road risks, weather, commute time, and more. These are aspects that are good to know if one is driving on a road or highway in Ohio, especially daily.

Let’s take a look at vehicle theft.

Vehicle Theft in Ohio

Some vehicles are more popular than others when it comes to thieves. Below is a chart from 2017 which shows the top stolen cars in Ohio — take a look.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Impala | 2007 | 441 |

| Chevrolet Malibu | 2015 | 343 |

| Chevrolet Pickup (Full Size) | 1999 | 579 |

| Dodge Caravan | 2003 | 679 |

| Dodge Pickup (Full Size) | 2005 | 297 |

| Ford Pickup (Full Size) | 2004 | 540 |

| Honda Accord | 1997 | 437 |

| Honda Civic | 2000 | 325 |

| Jeep Cherokee/Grand Cherokee | 2000 | 467 |

| Toyota Camry | 2014 | 308 |

The Dodge Caravan, Chevrolet Pickup, and the Ford Pickup were among the most valuable cars.

And here’s a list via city as well. Feel free to search for your city.

| CITY | MOTOR VEHICLE THEFT |

|---|---|

| Ada | 1 |

| Addyston | 1 |

| Akron | 755 |

| Albany | 0 |

| Alliance | 41 |

| Amberley Village | 0 |

| Amelia | 3 |

| American Township | 11 |

| Amherst | 3 |

| Archbold | 1 |

| Ashland | 5 |

| Ashville | 4 |

| Athens | 19 |

| Aurora | 2 |

| Austintown | 21 |

| Avon Lake | 6 |

| Bainbridge Township | 0 |

| Baltimore | 1 |

| Barberton | 41 |

| Barnesville | 1 |

| Batavia | 4 |

| Bath Township, Summit County | 2 |

| Bazetta Township | 0 |

| Beavercreek | 49 |

| Beaver Township | 5 |

| Bedford | 32 |

| Bedford Heights3 | 50 |

| Bellaire | 0 |

| Bellbrook | 0 |

| Bellefontaine | 5 |

| Bellville | 1 |

| Belpre | 5 |

| Berea | 8 |

| Bethel | 2 |

| Bexley | 15 |

| Blanchester | 5 |

| Blue Ash | 7 |

| Bluffton | 1 |

| Bowling Green | 15 |

| Brecksville | 1 |

| Bridgeport | 5 |

| Brimfield Township | 9 |

| Broadview Heights | 5 |

| Brooklyn3 | 34 |

| Brookville3 | 5 |

| Brunswick | 11 |

| Brunswick Hills Township | 2 |

| Bucyrus | 6 |

| Butler Township | 24 |

| Byesville | 3 |

| Cambridge3 | 6 |

| Campbell | 6 |

| Canal Fulton | 2 |

| Canfield | 0 |

| Canton | 246 |

| Cardington | 0 |

| Carey | 0 |

| Carlisle | 0 |

| Carroll Township | 0 |

| Centerville | 16 |

| Chagrin Falls | 0 |

| Chardon3 | 1 |

| Chester Township | 0 |

| Cheviot | 21 |

| Chillicothe | 52 |

| Cincinnati | 1,485 |

| Circleville | 28 |

| Clayton | 9 |

| Clay Township, Montgomery County | 1 |

| Clearcreek Township | 3 |

| Cleveland | 3,395 |

| Cleveland Heights | 99 |

| Clyde | 3 |

| Coitsville Township | 4 |

| Coldwater | 0 |

| Colerain Township | 85 |

| Columbiana | 0 |

| Columbus | 4,176 |

| Commercial Point | 1 |

| Copley Township | 6 |

| Cortland | 1 |

| Covington | 0 |

| Crestline | 5 |

| Creston | 2 |

| Cuyahoga Falls | 39 |

| Dayton | 616 |

| Deer Park | 3 |

| Defiance | 20 |

| Delaware | 22 |

| Delhi Township | 26 |

| Delphos3 | 1 |

| Dennison | 1 |

| Dover | 5 |

| Dublin | 20 |

| East Cleveland | 150 |

| Eastlake | 10 |

| East Palestine | 2 |

| Elyria | 56 |

| Englewood | 12 |

| Euclid | 131 |

| Evendale | 7 |

| Fairborn | 53 |

| Fairfax | 2 |

| Fairfield | 51 |

| Fairfield Township | 8 |

| Fairview Park | 7 |

| Felicity | 1 |

| Findlay | 38 |

| Forest Park | 20 |

| Frazeysburg | 0 |

| Fredericktown | 0 |

| Fremont3 | 16 |

| Gahanna | 27 |

| Galion | 5 |

| Gallipolis | 9 |

| Gates Mills | 2 |

| Georgetown | 3 |

| Germantown | 4 |

| German Township, Montgomery County | 2 |

| Glouster | 1 |

| Goshen Township, Clermont County | 15 |

| Goshen Township, Mahoning County | 5 |

| Grafton4 | 0 |

| Granville | 2 |

| Greenfield | 21 |

| Greenhills | 1 |

| Green Township | 56 |

| Greenville | 21 |

| Grove City | 56 |

| Groveport | 12 |

| Hamilton | 2 |

| Harrison | 9 |

| Hartville | 0 |

| Heath | 28 |

| Highland Heights3 | 4 |

| Hilliard | 36 |

| Hillsboro | 11 |

| Hinckley Township | 1 |

| Holland | 4 |

| Howland Township | 20 |

| Hubbard | 1 |

| Hubbard Township | 7 |

| Huber Heights | 52 |

| Hudson | 2 |

| Huron | 0 |

| Independence | 2 |

| Indian Hill | 3 |

| Ironton | 15 |

| Jackson | 3 |

| Jackson Township, Mahoning County | 0 |

| Jackson Township, Stark County | 18 |

| Jamestown | 4 |

| Johnstown | 3 |

| Kent | 17 |

| Kenton | 13 |

| Kettering | 52 |

| Kirtland | 0 |

| Kirtland Hills3 | 0 |

| Lakewood | 78 |

| Lancaster | 88 |

| Lawrence Township | 6 |

| Lexington | 0 |

| Liberty Township | 14 |

| Lima | 79 |

| Lisbon | 1 |

| Lithopolis | 0 |

| Lockland | 19 |

| Logan | 14 |

| London | 13 |

| Lorain | 94 |

| Lordstown | 3 |

| Loudonville | 1 |

| Louisville | 3 |

| Loveland | 7 |

| Lyndhurst | 11 |

| Macedonia | 3 |

| Madison Township, Franklin County | 7 |

| Madison Township, Lake County | 2 |

| Magnolia | 1 |

| Mansfield | 78 |

| Mariemont3 | 2 |

| Marietta | 16 |

| Marion | 30 |

| Martins Ferry | 6 |

| Mason | 5 |

| Maumee | 9 |

| Mayfield Heights | 6 |

| McArthur | 3 |

| McConnelsville | 2 |

| Mechanicsburg | 1 |

| Medina | 0 |

| Medina Township | 5 |

| Mentor | 23 |

| Mentor-on-the-Lake | 6 |

| Miamisburg | 7 |

| Miami Township, Clermont County | 19 |

| Miami Township, Montgomery County | 43 |

| Middlefield3 | 0 |

| Middleport | 1 |

| Middletown | 180 |

| Milford | 11 |

| Millersburg | 1 |

| Milton Township | 2 |

| Minerva | 3 |

| Mogadore3 | 1 |

| Monroe | 7 |

| Montgomery | 5 |

| Montpelier | 6 |

| Montville Township | 0 |

| Moreland Hills | 0 |

| Mount Healthy | 23 |

| Mount Orab | 8 |

| Mount Vernon | 7 |

| Munroe Falls | 0 |

| Napoleon | 3 |

| Navarre | 1 |

| Nelsonville | 6 |

| New Albany | 4 |

| New Boston | 11 |

| Newcomerstown3 | 6 |

| New Concord | 0 |

| New Franklin | 4 |

| New Lebanon | 3 |

| New Lexington | 8 |

| New Middletown | 2 |

| New Philadelphia | 4 |

| New Richmond | 3 |

| Newton Falls | 6 |

| Newtown | 0 |

| New Vienna | 3 |

| North Baltimore | 1 |

| North Canton | 8 |

| North College Hill | 26 |

| Northfield | 3 |

| North Olmsted | 32 |

| North Ridgeville | 4 |

| Norton | 11 |

| Norwood | 56 |

| Oak Harbor | 0 |

| Oak Hill | 0 |

| Oberlin | 2 |

| Olmsted Falls | 3 |

| Olmsted Township | 2 |

| Ontario | 1 |

| Oregon | 22 |

| Orrville | 6 |

| Ottawa | 1 |

| Ottawa Hills | 4 |

| Owensville | 1 |

| Oxford4 | 6 |

| Oxford Township | 5 |

| Parma | 74 |

| Peninsula | 1 |

| Pepper Pike | 0 |

| Perrysburg | 1 |

| Perrysburg Township | 7 |

| Perry Township, Columbiana County | 0 |

| Perry Township, Franklin County | 2 |

| Pickerington | 16 |

| Pierce Township | 5 |

| Pioneer | 2 |

| Piqua | 18 |

| Poland Township | 0 |

| Poland Village | 2 |

| Port Clinton | 13 |

| Portsmouth | 69 |

| Powell | 1 |

| Reading | 7 |

| Reminderville | 1 |

| Reynoldsburg | 35 |

| Richmond Heights | 23 |

| Ripley | 3 |

| Rittman | 8 |

| Roseville | 4 |

| Ross Township | 3 |

| Russells Point | 0 |

| Russell Township | 0 |

| Sabina | 0 |

| Sagamore Hills | 1 |

| Salem | 4 |

| Salineville | 0 |

| Sandusky | 39 |

| Sebring | 5 |

| Seven Hills | 3 |

| Sharon Township | 1 |

| Shawnee Township | 3 |

| Sheffield Lake | 8 |

| Shelby | 3 |

| Sidney | 19 |

| Solon | 11 |

| South Bloomfield | 3 |

| South Charleston | 4 |

| South Euclid | 35 |

| South Point3 | 3 |

| South Russell | 0 |

| South Zanesville | 1 |

| Springboro | 2 |

| Springfield | 293 |

| Springfield Township, Hamilton County | 48 |

| Springfield Township, Mahoning County | 4 |

| Springfield Township, Summit County | 28 |

| St. Clairsville | 0 |

| St. Clair Township | 0 |

| Steubenville | 22 |

| St. Marys | 6 |

| Stow | 4 |

| Strasburg | 0 |

| Streetsboro | 10 |

| Strongsville | 25 |

| Struthers | 10 |

| Sugarcreek Township | 5 |

| Swanton | 4 |

| Sylvania | 7 |

| Sylvania Township | 38 |

| Tallmadge3 | 12 |

| Tiffin3 | 4 |

| Tipp City | 10 |

| Toledo4, 5, 6 | 745 |

| Toronto | 1 |

| Trotwood | 145 |

| Troy | 8 |

| Twinsburg | 3 |

| Uhrichsville | 11 |

| Uniontown | 6 |

| Union Township, Clermont County | 16 |

| University Heights | 15 |

| Upper Arlington | 7 |

| Upper Sandusky | 3 |

| Urbana | 13 |

| Utica | 1 |

| Valley View, Cuyahoga County3 | 6 |

| Vandalia | 25 |

| Van Wert | 6 |

| Vermilion | 1 |

| Village of Leesburg | 2 |

| Wadsworth | 4 |

| Waite Hill | 0 |

| Walton Hills3 | 1 |

| Wapakoneta | 2 |

| Warren | 106 |

| Warren Township | 14 |

| Washington Court House | 10 |

| Waterville | 0 |

| Wauseon | 4 |

| Waverly | 1 |

| Wellston | 5 |

| West Carrollton | 21 |

| West Chester Township | 44 |

| Westerville | 17 |

| West Jefferson | 2 |

| West Lafayette | 0 |

| Westlake | 15 |

| West Union | 5 |

| Whitehall | 81 |

| Wickliffe | 8 |

| Willard | 11 |

| Williamsburg | 2 |

| Willoughby | 18 |

| Wilmington | 11 |

| Windham | 2 |

| Wintersville | 2 |

| Woodlawn | 5 |

| Woodmere Village | 5 |

| Wooster | 37 |

| Worthington | 13 |

| Wyoming | 2 |

| Xenia | 34 |

| Yellow Springs | 5 |

| Youngstown | 232 |

| Zanesville | 57 |

Is it such a surprise that the most popular cities in Ohio — Columbus, Cleveland, Cincinnati — have the highest auto theft?

Road Fatalities in Ohio

Nobody likes to hear about road fatalities, but the fact of the matter is that they do happen. We have data that will be showing you factors that cause them, as well as places they happen most, and even which type of people are in them.

This data could be helpful to have at the forefront anytime you get in the vehicle.

Most Fatal Highway in Ohio

According to Geotab, the most dangerous highway in Ohio is highway I-71. This highway has an average of 18 fatal crashes per year and has been under construction since 1999.

Fatal Crashes by Weather Condition & Light Condition

Weather conditions can be the cause of fatal crashes, as well. Take a look at the chart below.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 507 | 172 | 237 | 42 | 1 | 959 |

| Rain | 36 | 21 | 28 | 4 | 1 | 90 |

| Snow/Sleet | 12 | 4 | 12 | 1 | 0 | 29 |

| Other | 1 | 1 | 7 | 2 | 0 | 11 |

| Unknown | 0 | 0 | 3 | 0 | 2 | 5 |

| TOTAL | 556 | 198 | 287 | 49 | 4 | 1,094 |

According to the data, most weather-related instances in Ohio occurred under normal conditions (throughout the day) and during the rain (in both day and nighttime). It is interesting that winter conditions are extreme in Ohio; however, snow and sleet conditions had the lowest effect on fatal car crashes.

Fatalities (All Crashes) by County

The National Highway Traffic Safety Administration displays data regarding all fatal crashes by county. We’ve input them in a chart below. Feel free to search your county here, as well.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100k Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adams County | 2 | 5 | 5 | 5 | 4 | 7.12 | 17.82 | 17.91 | 17.96 | 14.43 |

| Allen County | 7 | 9 | 8 | 14 | 11 | 6.67 | 8.58 | 7.69 | 13.51 | 10.66 |

| Ashland County | 5 | 8 | 5 | 6 | 9 | 9.41 | 15.06 | 9.39 | 11.23 | 16.78 |

| Ashtabula County | 20 | 9 | 18 | 16 | 17 | 20.06 | 9.09 | 18.29 | 16.3 | 17.38 |

| Athens County | 7 | 13 | 5 | 6 | 1 | 10.86 | 20.11 | 7.6 | 9.05 | 1.5 |

| Auglaize County | 10 | 7 | 8 | 4 | 4 | 21.83 | 15.3 | 17.49 | 8.73 | 8.74 |

| Belmont County | 11 | 6 | 10 | 4 | 10 | 15.81 | 8.65 | 14.5 | 5.83 | 14.7 |

| Brown County | 7 | 5 | 5 | 5 | 7 | 15.86 | 11.38 | 11.44 | 11.46 | 16.06 |

| Butler County | 19 | 29 | 29 | 23 | 31 | 5.12 | 7.77 | 7.72 | 6.09 | 8.14 |

| Carroll County | 4 | 5 | 3 | 4 | 5 | 14.16 | 17.77 | 10.82 | 14.47 | 18.26 |

| Champaign County | 6 | 1 | 5 | 11 | 6 | 15.21 | 2.56 | 12.84 | 28.4 | 15.45 |

| Clark County | 14 | 16 | 24 | 12 | 17 | 10.25 | 11.74 | 17.7 | 8.91 | 12.63 |

| Clermont County | 21 | 26 | 16 | 19 | 11 | 10.48 | 12.91 | 7.93 | 9.36 | 5.39 |

| Clinton County | 4 | 12 | 3 | 3 | 10 | 9.56 | 28.72 | 7.17 | 7.16 | 23.8 |

| Columbiana County | 11 | 20 | 8 | 8 | 5 | 10.39 | 18.95 | 7.65 | 7.71 | 4.85 |

| Coshocton County | 2 | 7 | 7 | 11 | 6 | 5.45 | 19.16 | 19.14 | 30.02 | 16.42 |

| Crawford County | 6 | 7 | 5 | 1 | 3 | 14.05 | 16.51 | 11.83 | 2.38 | 7.19 |

| Cuyahoga County | 56 | 46 | 75 | 82 | 95 | 4.43 | 3.64 | 5.96 | 6.54 | 7.61 |

| Darke County | 6 | 7 | 13 | 7 | 4 | 11.47 | 13.42 | 25.02 | 13.56 | 7.76 |

| Defiance County | 4 | 8 | 7 | 6 | 9 | 10.38 | 20.79 | 18.29 | 15.74 | 23.59 |

| Delaware County | 10 | 12 | 13 | 23 | 14 | 5.4 | 6.34 | 6.73 | 11.69 | 6.98 |

| Erie County | 10 | 5 | 11 | 11 | 8 | 13.16 | 6.6 | 14.61 | 14.68 | 10.69 |

| Fairfield County | 9 | 16 | 14 | 12 | 14 | 6.05 | 10.64 | 9.26 | 7.86 | 9.05 |

| Fayette County | 8 | 7 | 9 | 9 | 7 | 27.91 | 24.45 | 31.49 | 31.4 | 24.35 |

| Franklin County | 76 | 74 | 85 | 94 | 88 | 6.25 | 5.99 | 6.78 | 7.4 | 6.81 |

| Fulton County | 12 | 11 | 11 | 11 | 9 | 28.45 | 25.94 | 26.02 | 25.99 | 21.28 |

| Gallia County | 4 | 1 | 6 | 2 | 6 | 13.07 | 3.3 | 19.94 | 6.67 | 20.02 |

| Geauga County | 10 | 14 | 10 | 16 | 11 | 10.66 | 14.9 | 10.65 | 17.05 | 11.71 |

| Greene County | 4 | 5 | 8 | 11 | 22 | 2.44 | 3.04 | 4.88 | 6.66 | 13.19 |

| Guernsey County | 9 | 7 | 1 | 9 | 10 | 22.67 | 17.64 | 2.54 | 22.96 | 25.58 |

| Hamilton County | 38 | 49 | 54 | 62 | 58 | 4.72 | 6.07 | 6.68 | 7.65 | 7.13 |

| Hancock County | 6 | 8 | 10 | 18 | 4 | 7.95 | 10.64 | 13.25 | 23.81 | 5.28 |

| Hardin County | 9 | 3 | 6 | 4 | 6 | 28.36 | 9.44 | 18.98 | 12.74 | 19.13 |

| Harrison County | 4 | 6 | 3 | 5 | 4 | 25.64 | 38.66 | 19.49 | 32.77 | 26.29 |

| Henry County | 2 | 2 | 10 | 5 | 10 | 7.19 | 7.25 | 36.4 | 18.34 | 36.78 |

| Highland County | 5 | 3 | 7 | 9 | 4 | 11.58 | 6.96 | 16.3 | 20.93 | 9.31 |

| Hocking County | 6 | 1 | 4 | 4 | 6 | 20.94 | 3.48 | 14.04 | 14.09 | 21.07 |

| Holmes County | 6 | 3 | 4 | 4 | 5 | 13.76 | 6.85 | 9.12 | 9.13 | 11.37 |

| Huron County | 9 | 6 | 10 | 9 | 6 | 15.32 | 10.25 | 17.16 | 15.41 | 10.26 |

| Jackson County | 7 | 3 | 5 | 7 | 10 | 21.34 | 9.15 | 15.35 | 21.52 | 30.82 |

| Jefferson County | 3 | 6 | 11 | 1 | 4 | 4.4 | 8.84 | 16.3 | 1.49 | 6.03 |

| Knox County | 3 | 6 | 6 | 8 | 6 | 4.94 | 9.85 | 9.85 | 13.15 | 9.79 |

| Lake County | 14 | 10 | 14 | 11 | 9 | 6.09 | 4.35 | 6.1 | 4.8 | 3.91 |

| Lawrence County | 7 | 4 | 5 | 3 | 4 | 11.32 | 6.5 | 8.21 | 4.94 | 6.64 |

| Licking County | 14 | 19 | 23 | 20 | 30 | 8.31 | 11.22 | 13.5 | 11.64 | 17.3 |

| Logan County | 6 | 8 | 9 | 3 | 9 | 13.22 | 17.59 | 19.89 | 6.64 | 19.86 |

| Lorain County | 14 | 10 | 34 | 38 | 33 | 4.62 | 3.29 | 11.14 | 12.39 | 10.72 |

| Lucas County | 34 | 41 | 34 | 35 | 49 | 7.8 | 9.44 | 7.85 | 8.09 | 11.37 |

| Madison County | 4 | 9 | 8 | 5 | 10 | 9.25 | 20.48 | 18.14 | 11.53 | 22.71 |

| Mahoning County | 25 | 18 | 22 | 21 | 19 | 10.67 | 7.72 | 9.49 | 9.12 | 8.27 |

| Marion County | 11 | 13 | 5 | 8 | 12 | 16.68 | 19.76 | 7.65 | 12.24 | 18.47 |

| Medina County | 2 | 15 | 11 | 8 | 18 | 1.15 | 8.53 | 6.25 | 4.52 | 10.09 |

| Meigs County | 5 | 3 | 6 | 5 | 4 | 21.33 | 12.89 | 25.88 | 21.57 | 17.33 |

| Mercer County | 7 | 4 | 5 | 4 | 7 | 17.24 | 9.82 | 12.28 | 9.83 | 17.13 |

| Miami County | 9 | 10 | 11 | 14 | 13 | 8.72 | 9.64 | 10.58 | 13.41 | 12.37 |

| Monroe County | 3 | 4 | 2 | 3 | 3 | 20.67 | 27.84 | 14.02 | 21.28 | 21.51 |

| Montgomery County | 55 | 42 | 56 | 60 | 49 | 10.31 | 7.89 | 10.54 | 11.29 | 9.22 |

| Morgan County | 4 | 0 | 6 | 6 | 4 | 26.84 | 0 | 40.69 | 40.64 | 27.19 |

| Morrow County | 11 | 5 | 12 | 10 | 12 | 31.57 | 14.31 | 34.33 | 28.61 | 34.29 |

| Muskingum County | 9 | 13 | 10 | 6 | 9 | 10.51 | 15.14 | 11.61 | 6.98 | 10.45 |

| Noble County | 3 | 5 | 4 | 2 | 0 | 20.46 | 34.44 | 27.67 | 13.85 | 0 |

| Ottawa County | 9 | 7 | 4 | 6 | 6 | 21.93 | 17.11 | 9.81 | 14.82 | 14.76 |

| Paulding County | 6 | 3 | 4 | 6 | 2 | 31.34 | 15.81 | 21.1 | 31.85 | 10.61 |

| Perry County | 3 | 4 | 4 | 5 | 2 | 8.33 | 11.14 | 11.12 | 13.88 | 5.55 |

| Pickaway County | 14 | 13 | 5 | 13 | 10 | 24.85 | 22.93 | 8.78 | 22.6 | 17.29 |

| Pike County | 8 | 11 | 3 | 3 | 8 | 28.17 | 38.86 | 10.62 | 10.62 | 28.3 |

| Portage County | 12 | 8 | 21 | 14 | 9 | 7.43 | 4.93 | 12.94 | 8.63 | 5.55 |

| Preble County | 6 | 5 | 10 | 8 | 16 | 14.4 | 12.05 | 24.23 | 19.46 | 38.91 |

| Putnam County | 0 | 5 | 3 | 3 | 3 | 0 | 14.63 | 8.82 | 8.82 | 8.86 |

| Richland County | 9 | 12 | 17 | 6 | 10 | 7.36 | 9.84 | 13.98 | 4.95 | 8.29 |

| Ross County | 10 | 9 | 7 | 20 | 7 | 12.94 | 11.68 | 9.08 | 26 | 9.05 |

| Sandusky County | 10 | 11 | 10 | 12 | 11 | 16.66 | 18.39 | 16.82 | 20.24 | 18.58 |

| Scioto County | 10 | 9 | 13 | 11 | 8 | 12.8 | 11.65 | 16.93 | 14.43 | 10.54 |

| Seneca County | 14 | 3 | 4 | 3 | 11 | 25.08 | 5.38 | 7.2 | 5.42 | 19.91 |

| Shelby County | 6 | 8 | 5 | 8 | 11 | 12.21 | 16.35 | 10.21 | 16.42 | 22.56 |

| Stark County | 26 | 44 | 19 | 32 | 33 | 6.93 | 11.72 | 5.07 | 8.57 | 8.86 |

| Summit County | 29 | 32 | 25 | 41 | 47 | 5.35 | 5.9 | 4.62 | 7.59 | 8.68 |

| Trumbull County | 21 | 12 | 18 | 14 | 12 | 10.18 | 5.85 | 8.85 | 6.94 | 5.99 |

| Tuscarawas County | 8 | 8 | 7 | 6 | 20 | 8.64 | 8.64 | 7.55 | 6.49 | 21.67 |

| Union County | 8 | 6 | 9 | 6 | 4 | 15 | 11.18 | 16.59 | 10.82 | 7.05 |

| Van Wert County | 7 | 4 | 3 | 5 | 4 | 24.71 | 14.13 | 10.6 | 17.75 | 14.18 |

| Vinton County | 3 | 7 | 7 | 6 | 3 | 22.55 | 52.99 | 53.51 | 46.08 | 22.91 |

| Warren County | 17 | 10 | 15 | 16 | 15 | 7.76 | 4.52 | 6.7 | 7.06 | 6.55 |

| Washington County | 9 | 6 | 6 | 7 | 13 | 14.67 | 9.82 | 9.84 | 11.56 | 21.52 |

| Wayne County | 11 | 18 | 14 | 13 | 20 | 9.54 | 15.55 | 12.06 | 11.17 | 17.24 |

| Williams County | 4 | 6 | 9 | 10 | 4 | 10.69 | 16.14 | 24.33 | 27.08 | 10.87 |

| Wood County | 19 | 15 | 30 | 13 | 16 | 14.74 | 11.61 | 23.22 | 10.02 | 12.26 |

| Wyandot County | 1 | 3 | 4 | 2 | 3 | 4.45 | 13.47 | 18.05 | 9.07 | 13.62 |

Fatal crashes do not have any discrimination between large cities like Cuyahoga and smaller cities like Franklin, which ranked the top deadliest counties, along with Hamilton and Montgomery.

Traffic Fatalities

Here are traffic fatalities.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 762 | 660 | 713 | 661 | 640 | 513 | 496 | 492 | 508 | 552 |

| Urban | 429 | 362 | 366 | 356 | 481 | 471 | 506 | 610 | 614 | 620 |

| Unknown | 0 | 0 | 1 | 0 | 0 | 5 | 4 | 8 | 10 | 7 |

| Total | 1,191 | 1,022 | 1,080 | 1,017 | 1,121 | 989 | 1,006 | 1,110 | 1,132 | 1,179 |

Traffic fatalities in rural areas were nearly twice that of those in urban areas between 2008 – 2012, but have decreased in the last several years.

Fatalities by Person Type

| - | Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 427 | 469 | 449 | 471 | 545 |

| - | Light Truck - Pickup | 105 | 89 | 104 | 99 | 92 |

| - | Light Truck - Utility | 121 | 130 | 130 | 135 | 145 |

| - | Light Truck - Van | 46 | 42 | 58 | 40 | 43 |

| - | Large Truck | 27 | 14 | 28 | 14 | 18 |

| - | Other/Unknown Occupants | 18 | 18 | 20 | 10 | 8 |

| - | Total Occupants | 744 | 764 | 793 | 773 | 851 |

| - | Light Truck - Other | 0 | 2 | 4 | 4 | 0 |

| Motorcyclists | Total Motorcyclists | 132 | 136 | 168 | 199 | 157 |

| Nonoccupants | Pedestrian | 85 | 87 | 116 | 134 | 142 |

| - | Bicyclist and Other Cyclist | 19 | 11 | 25 | 18 | 19 |

| - | Other/Unknown Nonoccupants | 9 | 8 | 8 | 8 | 10 |

| - | Total Nonoccupants | 113 | 106 | 149 | 160 | 171 |

| Total | Total | 989 | 1,006 | 1,110 | 1,132 | 1,179 |

Fatalities by Crash Type

The crash type displays fatalities caused by the type of accident. Knowing this information would be good to see which trends are occurring in your state.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 989 | 1,006 | 1,110 | 1,132 | 1,179 |

| (1) Single Vehicle | 560 | 540 | 593 | 593 | 641 |

| (2) Involving a Large Truck | 131 | 130 | 167 | 123 | 164 |

| (3) Involving Speeding | 273 | 274 | 207 | 257 | 252 |

| (4) Involving a Rollover | 232 | 253 | 231 | 241 | 254 |

| (5) Involving a Roadway Departure | 590 | 625 | 658 | 670 | 670 |

| (6) Involving an Intersection (or Intersection Related) | 217 | 256 | 295 | 320 | 327 |

Five-Year Trend For the Top 10 Counties

Next, we have a five-year trend for the top 10 countries.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Butler County | 19 | 29 | 29 | 23 | 31 |

| Cuyahoga County | 56 | 46 | 75 | 82 | 95 |

| Franklin County | 76 | 74 | 85 | 94 | 88 |

| Hamilton County | 38 | 49 | 54 | 62 | 58 |

| Licking County | 14 | 19 | 23 | 20 | 30 |

| Lorain County | 14 | 10 | 34 | 38 | 33 |

| Lucas County | 34 | 41 | 34 | 35 | 49 |

| Montgomery County | 55 | 42 | 56 | 60 | 49 |

| Stark County | 26 | 44 | 19 | 32 | 33 |

| Summit County | 29 | 32 | 25 | 41 | 47 |

Fatalities Involving Speeding by County

Here we have counties that are more liable to have fatalities regarding speeding.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100k Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adams County | 1 | 1 | 0 | 2 | 0 | 3.56 | 3.56 | 0 | 7.19 | 0 |

| Allen County | 2 | 1 | 1 | 2 | 2 | 1.9 | 0.95 | 0.96 | 1.93 | 1.94 |

| Ashland County | 3 | 2 | 1 | 2 | 2 | 5.65 | 3.77 | 1.88 | 3.74 | 3.73 |

| Ashtabula County | 6 | 2 | 1 | 4 | 6 | 6.02 | 2.02 | 1.02 | 4.07 | 6.13 |

| Athens County | 2 | 3 | 1 | 0 | 1 | 3.1 | 4.64 | 1.52 | 0 | 1.5 |

| Auglaize County | 3 | 1 | 3 | 0 | 0 | 6.55 | 2.19 | 6.56 | 0 | 0 |

| Belmont County | 4 | 3 | 2 | 3 | 2 | 5.75 | 4.33 | 2.9 | 4.38 | 2.94 |

| Brown County | 0 | 2 | 2 | 0 | 0 | 0 | 4.55 | 4.58 | 0 | 0 |

| Butler County | 7 | 9 | 6 | 4 | 5 | 1.89 | 2.41 | 1.6 | 1.06 | 1.31 |

| Carroll County | 2 | 0 | 0 | 0 | 0 | 7.08 | 0 | 0 | 0 | 0 |

| Champaign County | 2 | 0 | 1 | 2 | 1 | 5.07 | 0 | 2.57 | 5.16 | 2.57 |

| Clark County | 4 | 6 | 4 | 2 | 1 | 2.93 | 4.4 | 2.95 | 1.49 | 0.74 |

| Clermont County | 5 | 15 | 6 | 3 | 1 | 2.5 | 7.45 | 2.97 | 1.48 | 0.49 |

| Clinton County | 3 | 4 | 2 | 0 | 1 | 7.17 | 9.57 | 4.78 | 0 | 2.38 |

| Columbiana County | 4 | 8 | 0 | 3 | 0 | 3.78 | 7.58 | 0 | 2.89 | 0 |

| Coshocton County | 2 | 2 | 0 | 4 | 1 | 5.45 | 5.48 | 0 | 10.92 | 2.74 |

| Crawford County | 0 | 3 | 2 | 0 | 1 | 0 | 7.08 | 4.73 | 0 | 2.4 |

| Cuyahoga County | 26 | 18 | 31 | 34 | 34 | 2.06 | 1.43 | 2.46 | 2.71 | 2.72 |

| Darke County | 1 | 0 | 0 | 0 | 0 | 1.91 | 0 | 0 | 0 | 0 |

| Defiance County | 0 | 3 | 3 | 0 | 2 | 0 | 7.8 | 7.84 | 0 | 5.24 |

| Delaware County | 6 | 2 | 4 | 4 | 0 | 3.24 | 1.06 | 2.07 | 2.03 | 0 |

| Erie County | 2 | 1 | 2 | 5 | 2 | 2.63 | 1.32 | 2.66 | 6.67 | 2.67 |

| Fairfield County | 2 | 2 | 1 | 0 | 0 | 1.34 | 1.33 | 0.66 | 0 | 0 |

| Fayette County | 1 | 3 | 4 | 1 | 3 | 3.49 | 10.48 | 13.99 | 3.49 | 10.43 |

| Franklin County | 10 | 16 | 9 | 15 | 8 | 0.82 | 1.29 | 0.72 | 1.18 | 0.62 |

| Fulton County | 1 | 1 | 0 | 0 | 0 | 2.37 | 2.36 | 0 | 0 | 0 |

| Gallia County | 1 | 0 | 1 | 0 | 2 | 3.27 | 0 | 3.32 | 0 | 6.67 |

| Geauga County | 2 | 5 | 1 | 3 | 1 | 2.13 | 5.32 | 1.07 | 3.2 | 1.06 |

| Greene County | 0 | 1 | 3 | 1 | 2 | 0 | 0.61 | 1.83 | 0.61 | 1.2 |

| Guernsey County | 2 | 2 | 0 | 4 | 4 | 5.04 | 5.04 | 0 | 10.2 | 10.23 |

| Hamilton County | 12 | 13 | 5 | 16 | 17 | 1.49 | 1.61 | 0.62 | 1.98 | 2.09 |

| Hancock County | 0 | 2 | 1 | 1 | 2 | 0 | 2.66 | 1.32 | 1.32 | 2.64 |

| Hardin County | 0 | 1 | 0 | 1 | 1 | 0 | 3.15 | 0 | 3.18 | 3.19 |

| Harrison County | 1 | 3 | 1 | 2 | 1 | 6.41 | 19.33 | 6.5 | 13.11 | 6.57 |

| Henry County | 1 | 0 | 2 | 2 | 1 | 3.6 | 0 | 7.28 | 7.33 | 3.68 |

| Highland County | 1 | 0 | 3 | 2 | 1 | 2.32 | 0 | 6.99 | 4.65 | 2.33 |

| Hocking County | 3 | 1 | 2 | 2 | 1 | 10.47 | 3.48 | 7.02 | 7.05 | 3.51 |

| Holmes County | 2 | 2 | 0 | 0 | 1 | 4.59 | 4.57 | 0 | 0 | 2.27 |

| Huron County | 1 | 1 | 1 | 4 | 1 | 1.7 | 1.71 | 1.72 | 6.85 | 1.71 |

| Jackson County | 1 | 1 | 1 | 1 | 2 | 3.05 | 3.05 | 3.07 | 3.07 | 6.16 |

| Jefferson County | 2 | 1 | 3 | 0 | 3 | 2.93 | 1.47 | 4.45 | 0 | 4.52 |

| Knox County | 2 | 2 | 1 | 0 | 2 | 3.29 | 3.28 | 1.64 | 0 | 3.26 |

| Lake County | 5 | 3 | 4 | 0 | 2 | 2.18 | 1.31 | 1.74 | 0 | 0.87 |

| Lawrence County | 3 | 0 | 2 | 0 | 2 | 4.85 | 0 | 3.28 | 0 | 3.32 |

| Licking County | 5 | 6 | 1 | 4 | 9 | 2.97 | 3.54 | 0.59 | 2.33 | 5.19 |

| Logan County | 1 | 2 | 1 | 0 | 1 | 2.2 | 4.4 | 2.21 | 0 | 2.21 |

| Lorain County | 4 | 2 | 4 | 11 | 8 | 1.32 | 0.66 | 1.31 | 3.59 | 2.6 |

| Lucas County | 10 | 13 | 6 | 5 | 7 | 2.29 | 2.99 | 1.38 | 1.16 | 1.62 |

| Madison County | 1 | 1 | 4 | 2 | 3 | 2.31 | 2.28 | 9.07 | 4.61 | 6.81 |

| Mahoning County | 8 | 3 | 2 | 6 | 5 | 3.41 | 1.29 | 0.86 | 2.61 | 2.18 |

| Marion County | 1 | 1 | 0 | 0 | 0 | 1.52 | 1.52 | 0 | 0 | 0 |

| Medina County | 1 | 3 | 4 | 2 | 5 | 0.57 | 1.71 | 2.27 | 1.13 | 2.8 |

| Meigs County | 0 | 0 | 1 | 2 | 1 | 0 | 0 | 4.31 | 8.63 | 4.33 |

| Mercer County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 2.45 |

| Miami County | 3 | 0 | 0 | 2 | 3 | 2.91 | 0 | 0 | 1.92 | 2.85 |

| Monroe County | 0 | 1 | 0 | 1 | 1 | 0 | 6.96 | 0 | 7.09 | 7.17 |

| Montgomery County | 19 | 9 | 15 | 16 | 13 | 3.56 | 1.69 | 2.82 | 3.01 | 2.45 |

| Morgan County | 2 | 0 | 1 | 1 | 2 | 13.42 | 0 | 6.78 | 6.77 | 13.6 |

| Morrow County | 2 | 1 | 2 | 2 | 2 | 5.74 | 2.86 | 5.72 | 5.72 | 5.72 |

| Muskingum County | 4 | 5 | 0 | 3 | 4 | 4.67 | 5.82 | 0 | 3.49 | 4.64 |

| Noble County | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 6.92 | 13.85 | 0 |

| Ottawa County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 2.45 | 2.47 | 0 |

| Paulding County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 5.28 | 0 | 0 |

| Perry County | 2 | 1 | 0 | 0 | 1 | 5.56 | 2.78 | 0 | 0 | 2.78 |

| Pickaway County | 3 | 5 | 0 | 1 | 2 | 5.32 | 8.82 | 0 | 1.74 | 3.46 |

| Pike County | 1 | 3 | 0 | 1 | 3 | 3.52 | 10.6 | 0 | 3.54 | 10.61 |

| Portage County | 4 | 1 | 5 | 1 | 2 | 2.48 | 0.62 | 3.08 | 0.62 | 1.23 |

| Preble County | 1 | 1 | 1 | 2 | 5 | 2.4 | 2.41 | 2.42 | 4.87 | 12.16 |

| Putnam County | 0 | 1 | 1 | 1 | 2 | 0 | 2.93 | 2.94 | 2.94 | 5.9 |

| Richland County | 1 | 5 | 7 | 2 | 3 | 0.82 | 4.1 | 5.75 | 1.65 | 2.49 |

| Ross County | 3 | 3 | 0 | 9 | 0 | 3.88 | 3.89 | 0 | 11.7 | 0 |

| Sandusky County | 5 | 6 | 2 | 2 | 1 | 8.33 | 10.03 | 3.36 | 3.37 | 1.69 |

| Scioto County | 2 | 2 | 3 | 3 | 0 | 2.56 | 2.59 | 3.91 | 3.93 | 0 |

| Seneca County | 2 | 0 | 0 | 0 | 0 | 3.58 | 0 | 0 | 0 | 0 |

| Shelby County | 2 | 2 | 1 | 2 | 3 | 4.07 | 4.09 | 2.04 | 4.1 | 6.15 |

| Stark County | 5 | 13 | 3 | 9 | 10 | 1.33 | 3.46 | 0.8 | 2.41 | 2.68 |

| Summit County | 14 | 11 | 2 | 12 | 10 | 2.58 | 2.03 | 0.37 | 2.22 | 1.85 |

| Trumbull County | 8 | 4 | 4 | 3 | 2 | 3.88 | 1.95 | 1.97 | 1.49 | 1 |

| Tuscarawas County | 2 | 3 | 3 | 2 | 10 | 2.16 | 3.24 | 3.24 | 2.16 | 10.83 |

| Union County | 5 | 1 | 1 | 2 | 0 | 9.37 | 1.86 | 1.84 | 3.61 | 0 |

| Van Wert County | 1 | 2 | 0 | 1 | 0 | 3.53 | 7.07 | 0 | 3.55 | 0 |

| Vinton County | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 7.64 | 7.68 | 7.64 |

| Warren County | 4 | 3 | 4 | 3 | 2 | 1.83 | 1.36 | 1.79 | 1.32 | 0.87 |

| Washington County | 1 | 3 | 4 | 4 | 5 | 1.63 | 4.91 | 6.56 | 6.61 | 8.28 |

| Wayne County | 2 | 3 | 2 | 4 | 3 | 1.73 | 2.59 | 1.72 | 3.44 | 2.59 |

| Williams County | 1 | 3 | 0 | 2 | 1 | 2.67 | 8.07 | 0 | 5.42 | 2.72 |

| Wood County | 5 | 3 | 2 | 1 | 2 | 3.88 | 2.32 | 1.55 | 0.77 | 1.53 |

| Wyandot County | 0 | 2 | 0 | 0 | 0 | 0 | 8.98 | 0 | 0 | 0 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

And next, fatalities in crashes involving an alcohol-impaired driver, (BAC = .08+)

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100k Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adams County | 1 | 1 | 2 | 2 | 0 | 3.56 | 3.56 | 7.16 | 7.19 | 0 |

| Allen County | 2 | 2 | 2 | 4 | 5 | 1.9 | 1.91 | 1.92 | 3.86 | 4.85 |

| Ashland County | 1 | 2 | 1 | 2 | 2 | 1.88 | 3.77 | 1.88 | 3.74 | 3.73 |

| Ashtabula County | 7 | 4 | 7 | 7 | 5 | 7.02 | 4.04 | 7.11 | 7.13 | 5.11 |

| Athens County | 2 | 3 | 1 | 0 | 0 | 3.1 | 4.64 | 1.52 | 0 | 0 |

| Auglaize County | 1 | 3 | 0 | 1 | 0 | 2.18 | 6.56 | 0 | 2.18 | 0 |

| Belmont County | 3 | 1 | 3 | 1 | 2 | 4.31 | 1.44 | 4.35 | 1.46 | 2.94 |

| Brown County | 1 | 3 | 1 | 0 | 0 | 2.27 | 6.83 | 2.29 | 0 | 0 |

| Butler County | 6 | 11 | 7 | 8 | 9 | 1.62 | 2.95 | 1.86 | 2.12 | 2.36 |

| Carroll County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 3.61 | 0 | 3.65 |

| Champaign County | 0 | 0 | 2 | 3 | 2 | 0 | 0 | 5.14 | 7.74 | 5.15 |

| Clark County | 8 | 9 | 7 | 2 | 2 | 5.86 | 6.61 | 5.16 | 1.49 | 1.49 |

| Clermont County | 2 | 6 | 7 | 6 | 2 | 1 | 2.98 | 3.47 | 2.96 | 0.98 |

| Clinton County | 2 | 2 | 1 | 0 | 1 | 4.78 | 4.79 | 2.39 | 0 | 2.38 |

| Columbiana County | 2 | 7 | 1 | 5 | 3 | 1.89 | 6.63 | 0.96 | 4.82 | 2.91 |

| Coshocton County | 0 | 2 | 2 | 4 | 1 | 0 | 5.48 | 5.47 | 10.92 | 2.74 |

| Crawford County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 2.37 | 0 | 2.4 |

| Cuyahoga County | 19 | 25 | 29 | 34 | 32 | 1.5 | 1.98 | 2.31 | 2.71 | 2.56 |

| Darke County | 1 | 2 | 5 | 2 | 2 | 1.91 | 3.83 | 9.62 | 3.87 | 3.88 |

| Defiance County | 1 | 4 | 2 | 2 | 3 | 2.6 | 10.39 | 5.23 | 5.25 | 7.86 |

| Delaware County | 2 | 2 | 6 | 4 | 3 | 1.08 | 1.06 | 3.11 | 2.03 | 1.5 |

| Erie County | 0 | 0 | 3 | 4 | 1 | 0 | 0 | 3.98 | 5.34 | 1.34 |

| Fairfield County | 4 | 2 | 4 | 5 | 4 | 2.69 | 1.33 | 2.65 | 3.27 | 2.59 |

| Fayette County | 2 | 1 | 1 | 1 | 3 | 6.98 | 3.49 | 3.5 | 3.49 | 10.43 |

| Franklin County | 20 | 27 | 25 | 34 | 27 | 1.64 | 2.19 | 1.99 | 2.68 | 2.09 |

| Fulton County | 3 | 0 | 4 | 2 | 1 | 7.11 | 0 | 9.46 | 4.73 | 2.36 |