Best Oklahoma Car Insurance (2025)

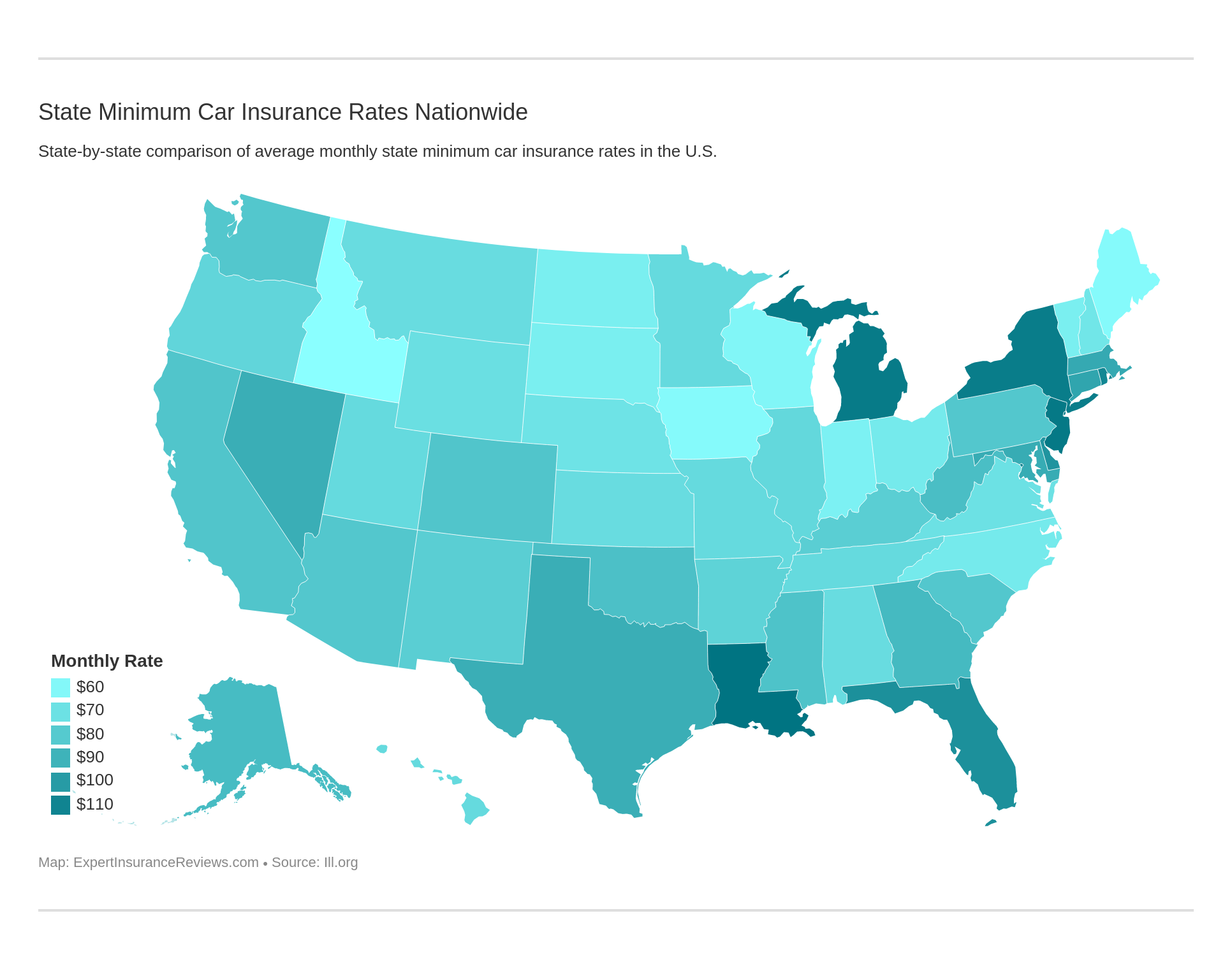

Drivers looking for the best Oklahoma car insurance should compare coverages and rates. Oklahoma drivers must carry 25/50/25 of bodily injury and property damage liability coverage, which is an average of $40/mo. However, full coverage in Oklahoma offers better protection at an average of $137/mo.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Oklahoma drivers need 25/50/25 of bodily injury and property damage minimum liability coverage

- Minimum liability car insurance in Oklahoma is an average of $40 per month

- Full coverage car insurance in Oklahoma is an average of $137 per month

If the process of getting the best Oklahoma car insurance seems daunting, don’t worry. Our Oklahoma auto insurance review goes over everything you need to know about Oklahoma auto insurance, from Oklahoma car insurance laws to the best car insurance companies for affordable Oklahoma auto insurance policies.

Do you want to find the cheapest Oklahoma car insurance today? Check out our FREE car insurance quote tool to get free Oklahoma car insurance quotes.

Oklahoma Car Insurance Coverage & Rates

It can be hard to know if you’re getting the best Oklahoma car insurance rates without spending hours getting quotes. It’s also difficult to determine exactly how much coverage you need on your vehicle.

To make things simpler, we are going to go through Oklahoma’s coverages and rates so you know what you need and how much you should be paying.

All our rate data is from our partnership with Quadrant, so we can bring you the most accurate data possible on car insurance in Oklahoma.

Let’s jump right in.

What is Oklahoma’s state minimum car insurance?

You’ve purchased your new Oklahoma pickup and are now ready to drive across Oklahoma’s terrain, but what coverages do you need before you go on Oklahoma’s roads (or off them)? Does Oklahoma require car insurance?

In Oklahoma, state law requires drivers to have the following minimum coverage amounts:

| Insurance Required | Minimum Limits: 25/50/25 |

|---|---|

| Body Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

You should have more coverage than the state minimums if possible. Oklahoma’s requirements are the bare minimum of coverage and won’t completely cover you in the majority of accidents.

Forms of Financial Responsibility

You now have your pickup and minimum insurance coverage, but how do you show law enforcement you’ve followed Oklahoma’s law?

All drivers must have a form of financial responsibility on them at all times when driving, as it proves they have insurance. Acceptable forms of proof of insurance are as follows:

- An electronic Insurance ID card

- Physical (paper) Insurance ID Card

- Letter from insurance company verifying insurance (must be on official letterhead)

Oklahoma is one of the states allowing electronic ID cards, which means you can download an electronic version on your smartphone. We still recommend carrying a paper copy in case your smartphone dies.

So when do you need to pull up an ID card on your smartphone?

- At traffic stops

- After accidents

- When registering a vehicle

If you don’t provide proof of insurance (there is a short grace period to provide proof) or don’t have insurance, you face fines and license suspension.

Premiums as a Percentage of Income

Do you know what percentage of your income goes to car insurance? Let’s take a look at Oklahoma’s average percentages to see what you might be paying after a move to Oklahoma.

| Oklahoma Car Insurance as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Full Coverage Average Annual Cost | $902.90 | $931.41 | $985.58 |

| Disposable Income (amount left after taxes) | $37,298.00 | $38,623.00 | $40,879.00 |

| Insurance as Percentage of Income | 2.42% | 2.41% | 2.41% |

The percentage of income going to car insurance has remained the same over the years, as car insurance price increases were matched with income increases.

Also, Oklahoma’s percentage of income as car insurance is almost exactly the same as the countrywide average. For example, the countrywide percentage in 2014 was 2.40 percent, while Oklahoma’s 2014 percentage was 2.41 percent.

This is good, as it means Oklahoma’s car insurance costs and incomes are average compared to the rest of the U.S. So if you move to Oklahoma, what you pay for car insurance won’t be astronomical.

If you want to calculate your exact percentage of income going to car insurance, try out our free calculator below.

CalculatorPro

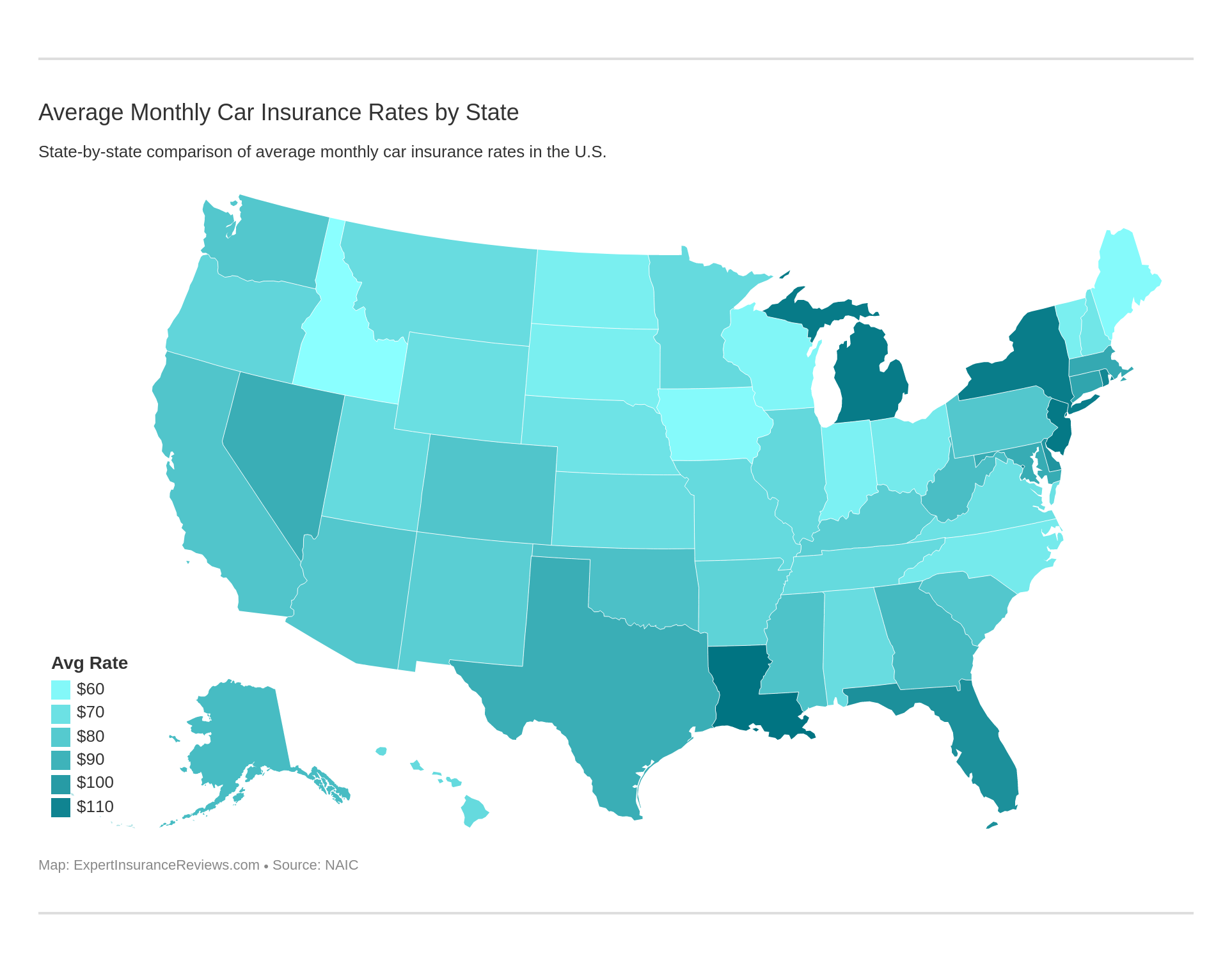

Average Monthly Car Insurance Rates in OK (Liability, Collision, Comprehensive)

Let’s take a look at the average cost of core coverages in Oklahoma. Below is the National Association of Insurance Commissioner’s (NAIC) data on Oklahoma’s averages.

| Coverage Type | Annual Average |

|---|---|

| Liability | $441.57 |

| Collision | $298.21 |

| Comprehensive | $201.56 |

| Combined | $941.34 |

Oklahoma’s overall average cost of $941 is slightly less than the countrywide overall average cost of $954. While $13 isn’t a huge difference, at least it’s still less than the average.

We also want to point out that the NAIC’s data is based on Oklahoma’s state minimum. It doesn’t cover people who purchase more than the state minimum or have add-on coverages.

So if you purchase more than minimum coverage (which we highly recommend), your rates will be higher than the NAIC’s data above.

Additional Liability

There are more liability coverages than just the state’s minimums.

- Medical Payments (MedPay): Provides coverage for medical treatment bills after an accident. It covers both the insured driver and passengers.

- Uninsured/Underinsured Motorist Coverage: Provides coverage for drivers in case of accidents with poorly insured (or uninsured) drivers who can’t cover the accident bills.

Uninsured coverage is important to have in Oklahoma, as 10.5 percent of motorists are uninsured. This percentage gives Oklahoma the rank of 31st in the list of worst U.S. states for uninsured drivers.

The main thing we want to look at for these coverages is their loss ratios. Why loss ratios?

A loss ratio tells us the liklihood of claim payouts. A company with a high loss ratio (over 100 percent) is risking bankruptcy, while a company with a low loss ratio is risking losing customers.

Below is the NAIC’s data on additional liability coverages’ loss ratios.

| Loss Ratio (Total Business) | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 63.27% | 65.97% | 68.09% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 65.40% | 62.69% | 63.31% |

The loss ratios for both coverages look decent. MedPay’s loss ratio has increased over the years, from 63 percent to 68 percent. Uninsured/underinsured’s loss ratio also looks good, as it hasn’t dropped below 60 percent.

Based on these loss ratios, there a good chance of your claim will be paid.

Add-Ons, Endorsements, & Riders

There are more additional coverages than the ones we’ve covered. While Oklahoma doesn’t require any of the following coverages, they are useful for filling out a policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Add any of these coverages to your basic policy for a well-rounded plan.

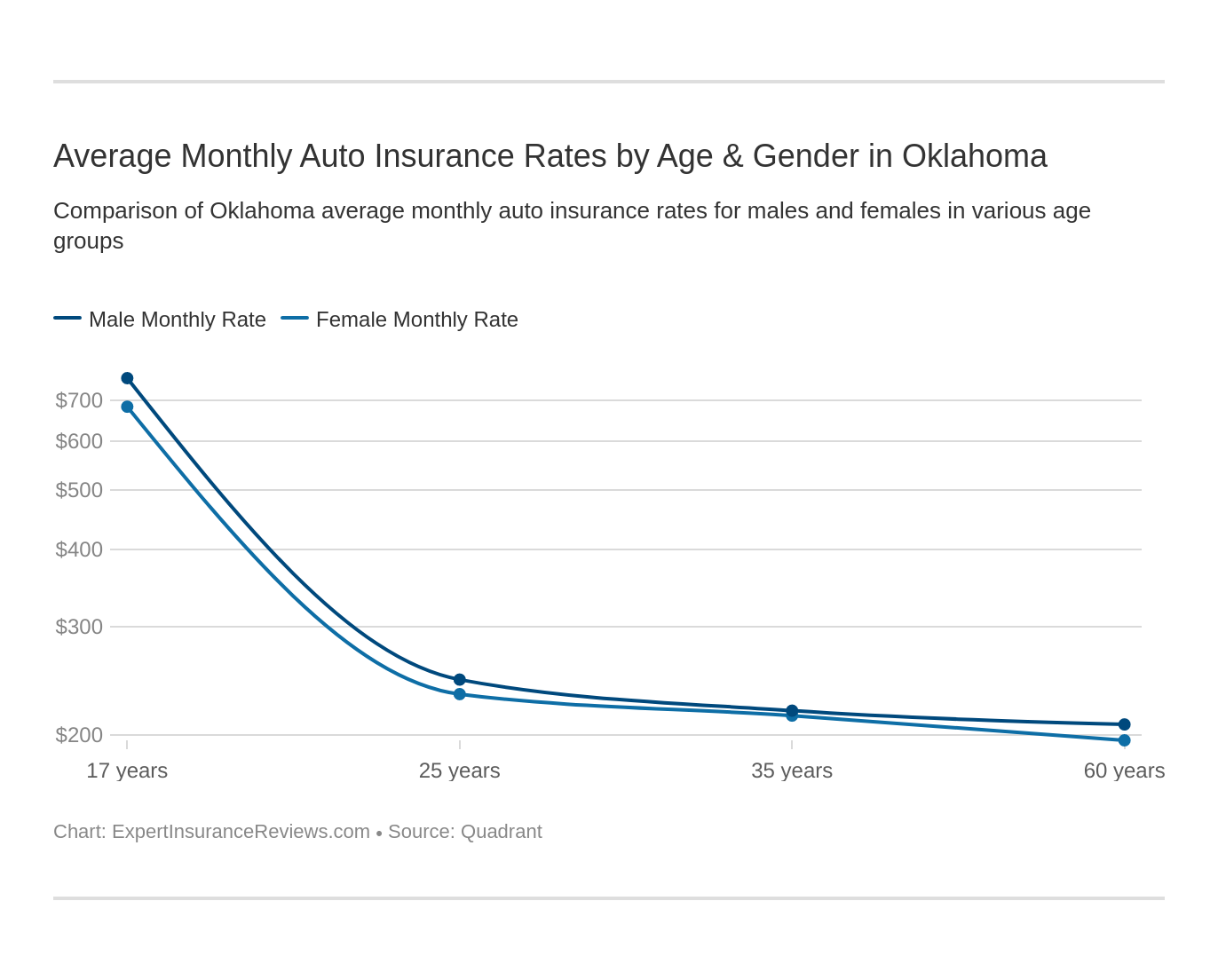

Average Monthly Car Insurance Rates by Age & Gender in OK

When you select the F or M on a car insurance application, insurers automatically change your rates. Insurers’ rationale is the same as for price differences based on age — one gender is more dangerous on the road.

Just like teens, male drivers may find themselves paying more for car insurance. While this gender price gap isn’t always set in stone, most insurers believe males to be riskier drivers.

California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan have passed laws banning insurers from using gender as a factor in rate determination.

In areas that do allow rate increases, though, we want to see what insurers generally charge.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $7,139.27 | $8,374.22 | $2,516.93 | $2,659.13 | $2,328.59 | $2,340.04 | $2,141.58 | $2,249.20 |

| Farmers Ins Co | $9,093.76 | $9,327.58 | $2,709.31 | $2,835.43 | $2,388.47 | $2,371.89 | $2,146.04 | $2,266.74 |

| Geico Cas | $6,619.94 | $7,073.30 | $1,975.53 | $2,001.68 | $2,253.30 | $2,465.41 | $2,404.73 | $2,704.77 |

| SAFECO Ins Co of America | $12,935.67 | $14,212.79 | $4,819.54 | $4,995.32 | $4,632.47 | $4,896.08 | $4,069.22 | $4,435.89 |

| Progressive Northern | $10,613.86 | $11,900.02 | $3,126.90 | $3,279.31 | $2,671.48 | $2,540.84 | $2,198.84 | $2,327.53 |

| State Farm Mutual Auto | $4,875.91 | $6,153.78 | $2,017.34 | $2,264.81 | $1,920.57 | $1,920.57 | $1,690.71 | $1,690.71 |

| USAA | $6,095.05 | $6,803.79 | $2,425.69 | $2,663.55 | $1,883.69 | $1,887.12 | $1,807.32 | $1,826.96 |

In all the age groups, males tend to pay slightly more than females for car insurance. Below, we’ve rearranged the data so you can see which companies have the best or worst rates based on demographics.

| Company | Demographic | Average Annual Rates |

|---|---|---|

| SAFECO Ins Co of America | Single 17-year old male | $14,212.79 |

| SAFECO Ins Co of America | Single 17-year old female | $12,935.67 |

| Progressive Northern | Single 17-year old male | $11,900.02 |

| Progressive Northern | Single 17-year old female | $10,613.86 |

| Farmers Ins Co | Single 17-year old male | $9,327.58 |

| Farmers Ins Co | Single 17-year old female | $9,093.76 |

| Allstate F&C | Single 17-year old male | $8,374.22 |

| Allstate F&C | Single 17-year old female | $7,139.27 |

| GEICO Cas | Single 17-year old male | $7,073.30 |

| USAA | Single 17-year old male | $6,803.79 |

| GEICO Cas | Single 17-year old female | $6,619.94 |

| State Farm Mutual Auto | Single 17-year old male | $6,153.78 |

| USAA | Single 17-year old female | $6,095.05 |

| SAFECO Ins Co of America | Single 25-year old male | $4,995.32 |

| SAFECO Ins Co of America | Married 35-year old male | $4,896.08 |

| State Farm Mutual Auto | Single 17-year old female | $4,875.91 |

| SAFECO Ins Co of America | Single 25-year old female | $4,819.54 |

| SAFECO Ins Co of America | Married 35-year old female | $4,632.47 |

| SAFECO Ins Co of America | Married 60-year old male | $4,435.89 |

| SAFECO Ins Co of America | Married 60-year old female | $4,069.22 |

| Progressive Northern | Single 25-year old male | $3,279.31 |

| Progressive Northern | Single 25-year old female | $3,126.90 |

| Farmers Ins Co | Single 25-year old male | $2,835.43 |

| Farmers Ins Co | Single 25-year old female | $2,709.31 |

| GEICO Cas | Married 60-year old male | $2,704.77 |

| Progressive Northern | Married 35-year old female | $2,671.48 |

| USAA | Single 25-year old male | $2,663.55 |

| Allstate F&C | Single 25-year old male | $2,659.13 |

| Progressive Northern | Married 35-year old male | $2,540.84 |

| Allstate F&C | Single 25-year old female | $2,516.93 |

| GEICO Cas | Married 35-year old male | $2,465.41 |

| USAA | Single 25-year old female | $2,425.69 |

| GEICO Cas | Married 60-year old female | $2,404.73 |

| Farmers Ins Co | Married 35-year old female | $2,388.47 |

| Farmers Ins Co | Married 35-year old male | $2,371.89 |

| Allstate F&C | Married 35-year old male | $2,340.04 |

| Allstate F&C | Married 35-year old female | $2,328.59 |

| Progressive Northern | Married 60-year old male | $2,327.53 |

| Farmers Ins Co | Married 60-year old male | $2,266.74 |

| State Farm Mutual Auto | Single 25-year old male | $2,264.81 |

| GEICO Cas | Married 35-year old female | $2,253.30 |

| Allstate F&C | Married 60-year old male | $2,249.20 |

| Progressive Northern | Married 60-year old female | $2,198.84 |

| Farmers Ins Co | Married 60-year old female | $2,146.04 |

| Allstate F&C | Married 60-year old female | $2,141.58 |

| State Farm Mutual Auto | Single 25-year old female | $2,017.34 |

| GEICO Cas | Single 25-year old male | $2,001.68 |

| GEICO Cas | Single 25-year old female | $1,975.53 |

| State Farm Mutual Auto | Married 35-year old female | $1,920.57 |

| State Farm Mutual Auto | Married 35-year old male | $1,920.57 |

| USAA | Married 35-year old male | $1,887.12 |

| USAA | Married 35-year old female | $1,883.69 |

| USAA | Married 60-year old male | $1,826.96 |

| USAA | Married 60-year old female | $1,807.32 |

| State Farm Mutual Auto | Married 60-year old female | $1,690.71 |

| State Farm Mutual Auto | Married 60-year old male | $1,690.71 |

Safeco has the highest rate out of all the companies, charging over $14,000 for a teenage male. On the other hand, the cheapest rate is for a 60-year-old male at State Farm.

Depending on what your demographic is, shop around at car insurance providers to find cheap auto insurance rates.

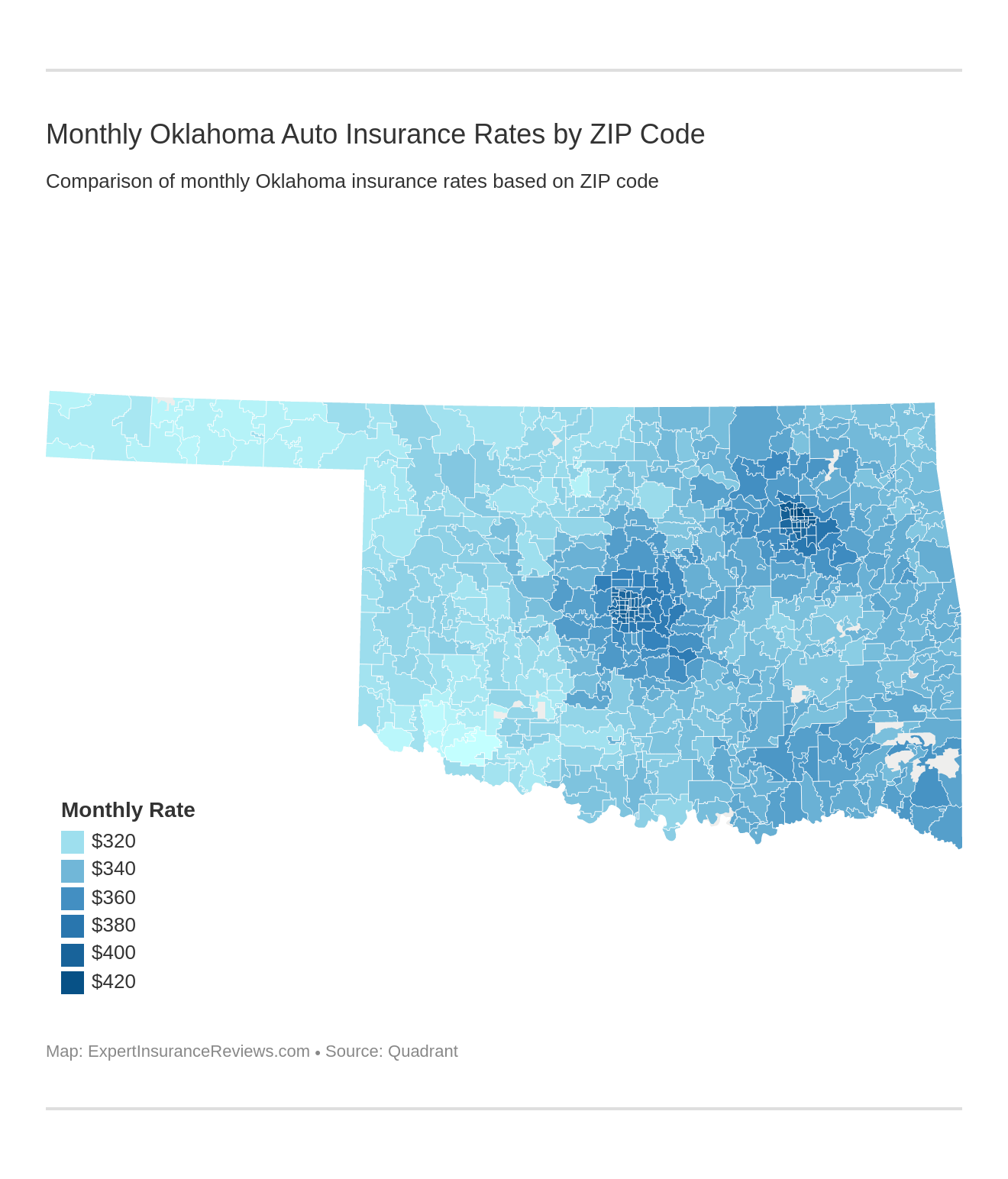

Cheapest Rates by Zip Code

Have you ever moved and found, to your dismay, that your car insurance costs rose? Insurers do base rates on customers’ zip codes, as area is an important factor.

This may seem odd, but varients like theft, crashes, and natural disasters can make insuring a car in a certain area more expensive. The difference between the cheapest and most expensive zip code isn’t that drastic, though, as it is less than $2,000.

In states like New York, the zip code prices can range over $5,000 in differences. So if you move around Oklahoma, your car insurance rates shouldn’t drastically increase.

Cheapest Rates by City

The most expensive city in Oklahoma is Tulsa ($4,883). Tusla is also the second-most populated city in Oklahoma, smaller than only Oklahoma City (which is the second-most expensive city on the list).

The cheapest city in Oklahoma is Manitou ($3,646), costing about $1,200 less than Tulsa’s average car insurance rate.

Once again, this price gap isn’t bad at all when compared to other states’ price increases by city.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Oklahoma Car Insurance Companies

The last thing you want is to be scammed out of your hard-earned money, but it can sometimes be hard to know if a company is reputable and follows through on its promises.

If you are having trouble finding a new car insurance company, look no further. We are going to cover Oklahoma companies’ financial and customer satisfaction ratings, as well as covering companies’ prices.

So keep reading to find the right insurance company for you.

The Largest Companies’ Financial Ratings

Financial ratings show us a companies’ creditworthiness, as well as the ability to pay claims. To see what the largest companies’ financial ratings are, we are going to look at A.M. Best’s ratings.

A.M. Best rates companies on their ability to meet financial obligations, so companies with a low rating from A.M. Best have poor credit.

| Providers | AM Rating |

|---|---|

| State Farm Group | A |

| Farmer's Insurance Group | A |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Geico | A++ |

| Liberty Mutual Group | A |

| USAA Group | A++ |

| Oklahoma Farm Bureau Group | B+ |

| CSAA Insurance Group | A |

| Shelter Insurance Group | A |

All of the companies, except for Oklahoma Farm Bureau Group, have ratings above an A.

Geico and USAA have the highest ratings possible, each receiving an A++ from A.M. Best. This means Geico and USAA have very low credit risk and are excellent at paying back short-term financial obligations (such as claims).

Companies with Best Ratings

Now that we’ve looked at financial ratings, let’s see what customers think of the top companies in Oklahoma.

Below are the results from J.D. Power’s 2019 study that surveyed over 42,700 customers.

| Insurer | Points (out of 1,000) | JD Power Circle Rating |

|---|---|---|

| USAA (only for military members and their families) | 907 | 5-Among the best |

| Shelter | 858 | 5-Among the best |

| Auto-Owners Insurance | 856 | 5-Among the best |

| Allstate | 844 | 4-Better than most |

| GEICO | 838 | 4-Better than most |

| Auto Club of Southern California Insurance Group | 837 | 3-About average |

| Travelers | 832 | 3-About average |

| Central Average | 832 | 3-About average |

| State Farm | 828 | 3-About average |

| American Family | 823 | 3-About average |

| Progressive | 823 | 3-About average |

| Farm Bureau Mutual | 822 | 3-About average |

| Safeco | 819 | 2-The Rest |

| Farmers | 817 | 2-The Rest |

| Liberty Mutual | 811 | 2-The Rest |

| Nationwide | 807 | 2-The Rest |

USAA auto insurance has the highest rating possible, but it is only for military personnel and their families. For regular customers, Shelter is the best option for customer satisfaction, followed by Auto-Owners Insurance.

Companies with Most Complaints in Oklahoma

We’ve covered customer satisfaction levels, so now let’s look at how many customers are unhappy. The NAIC has complaint ratios for major companies. A complaint ratio simply compares the number of complaints to the number of total customers.

Let’s take a look.

| Providers | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| State Farm Group | 0.44 | 1,482 |

| Liberty Mutual Group | 5.95 | 222 |

| Allstate Insurance Group | 0.5 | 163 |

| Progressive Group | 0.75 | 120 |

| Shelter Insurance Group | 0.61 | 47 |

| CSAA Insurance Group | 3.97 | 6 |

| Geico | 0 | 2 |

| USSA Group | 0 | 2 |

| Oklahoma Farm Bureau Group | 0.21 | 2 |

| Farmers Insurance Group | 0 | 0 |

State Farm has the highest number of complaints, but it has a low complaint ratio because it’s one of the largest companies in the U.S. This means that almost 15,000 customers complaining is only a small percentage of State Farm’s overall customers.

On the other hand, CSAA Insurance Group is a small company. So while it only has six complaints, it has a complaint ratio of almost four.

Who has the cheapest car insurance in Oklahoma?

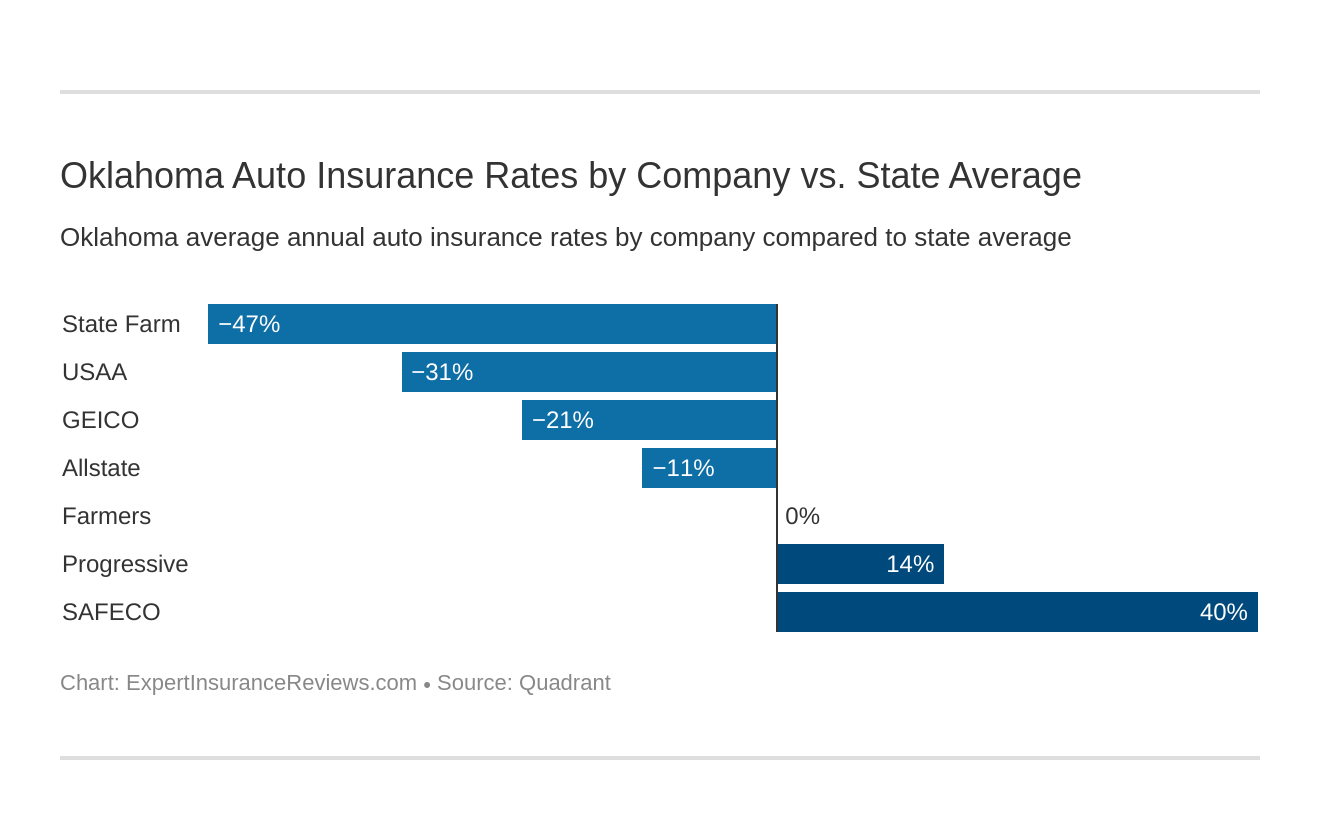

Who has the cheapest car insurance? It’s the question we know you’re asking. Before we dive in-depth into rates, let’s see which companies generally have the cheapest rates in Oklahoma.

| Company | Company Annual Average | Percentage Compared to State Annual Average |

|---|---|---|

| SAFECO Insurance Co of America | $6,874.62 | 39.74% |

| Progressive Northern | $4,832.35 | 14.28% |

| Farmers Insurance Co | $4,142.40 | 0.0% |

| Allstate F&C | $3,718.62 | -11.39% |

| Geico | $3,437.33 | -20.51% |

| USAA | $3,174.15 | -30.50% |

| State Farm Mutual Auto | $2,816.80 | -47.06% |

In Oklahoma, Safeco and Progressive have the highest overall rates. State Farm is the cheapest provider, costing 47 percent less than the Oklahoma state average.

As you can see, your choice of provider is important in saving money. However, make sure you also consider financial and customer satisfaction ratings.

Commute Rates by Companies

The first set of rate data we want to look at is commute distance rates.

| Company | 10 Miles Commute. 6,000 Annual Mileage | 25 Miles Commute. 6,000 Annual Mileage |

|---|---|---|

| Liberty Mutual | $6,874.62 | $6,874.62 |

| Progressive | $4,832.35 | $4,832.35 |

| Farmers | $4,142.40 | $4,142.40 |

| Allstate | $3,718.62 | $3,718.62 |

| Geico | $3,371.88 | $3,502.79 |

| USAA | $3,135.87 | $3,212.43 |

| State Farm | $2,768.69 | $2,864.91 |

Four providers don’t charge for commutes: Liberty Mutual, Progressive, Farmers, and Allstate. However, if you look at the other companies’ price increases for a longer commute, their final rate is still cheaper than the companies who don’t charge for commute distance.

So rather than worrying about how much insurers add on for a long commute, see what the final rate is.

Coverage Level Rates by Companies

Since high coverage is always the best option, we want to see which companies charge the least for it.

| Group | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Liberty Mutual | $6,520.08 | $6,849.85 | $7,253.93 |

| Progressive | $4,481.18 | $4,801.19 | $5,214.67 |

| Farmers | $3,962.59 | $4,095.52 | $4,369.10 |

| Allstate | $3,493.21 | $3,703.87 | $3,958.78 |

| Geico | $3,198.14 | $3,442.87 | $3,670.99 |

| USAA | $3,048.34 | $3,165.21 | $3,308.89 |

| State Farm | $2,645.97 | $2,796.58 | $3,007.85 |

Remember, it’s not just the price increase differences that matter. While Liberty Mutual and Progressive both charge about $730 to upgrade from low to high coverage, Liberty Mutual costs about $2,000 more than Progressive.

So pick a company that has a more affordable rate for high coverage, instead of looking at how much it costs to upgrade.

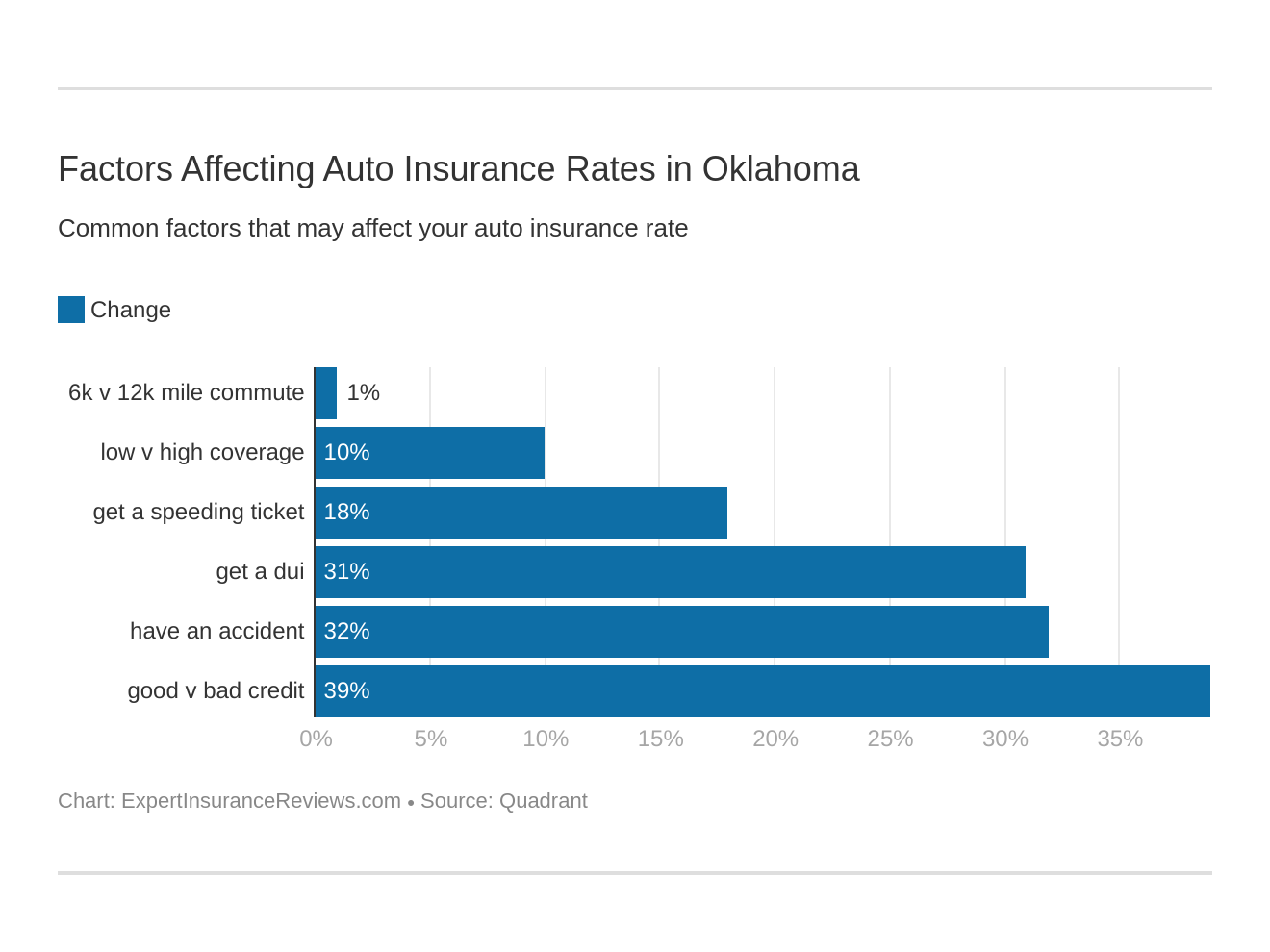

Credit History Rates by Companies

Another set of rate changes we want to look at is credit history rates. When you apply for car insurance, companies look at your credit score to determine rates.

The average credit score in Oklahoma is 656. The average credit score in the U.S. is 675.

Unfortunately, Oklahoma is one of the top 10 states with the lowest credit scores. This means most residents will probably have car insurance rates that are higher than normal.

| Group | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| Liberty Mutual | $4,724.45 | $6,024.91 | $9,874.49 |

| Progressive | $4,340.94 | $4,669.23 | $5,486.87 |

| Farmers | $3,735.69 | $3,927.60 | $4,763.91 |

| USAA | $2,139.63 | $2,681.79 | $4,701.02 |

| Allstate | $3,073.21 | $3,484.29 | $4,598.37 |

| Geico | $2,732.76 | $3,437.33 | $4,141.91 |

| State Farm | $2,020.90 | $2,510.32 | $3,919.18 |

Once again, Liberty Mutual has the highest rate for poor credit. Liberty Mutual’s rate is $6,000 more than State Farm’s rate for poor credit, showing how important it is to shop around for insurance if you have credit problems.

After all, that $6,000 saved by switching could be used to pay off bills and build better credit.

Driving Record Rates by Companies

Finally, the last important rate changes we want to look at is how your driving record impacts rates.

| Company | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,198.39 | $3,597.46 | $3,749.51 | $4,329.11 |

| Farmers | $3,497.47 | $4,199.60 | $4,490.66 | $4,381.87 |

| Geico | $2,504.07 | $3,153.48 | $3,835.75 | $4,256.03 |

| Liberty Mutual | $4,623.23 | $6,369.71 | $7,744.42 | $8,761.12 |

| Progressive | $3,763.08 | $4,419.80 | $6,992.38 | $4,154.13 |

| State Farm | $2,616.01 | $2,816.80 | $3,017.59 | $2,816.80 |

| USAA | $2,341.22 | $2,880.43 | $3,362.41 | $4,112.53 |

Unlike credit history, companies vary in what offense they charge the most for. For example, Progressive charges more for an at-fault accident than for a DUI, whereas other companies on the list tend to charge the most for a DUI.

So rates depend on what offenses you have on your record, as not every insurer will charge the same for a DUI or an at-fault accident.

As well, the rates we showed are for first offenses. If you have multiple offenses, it’s even more important to shop around at providers.

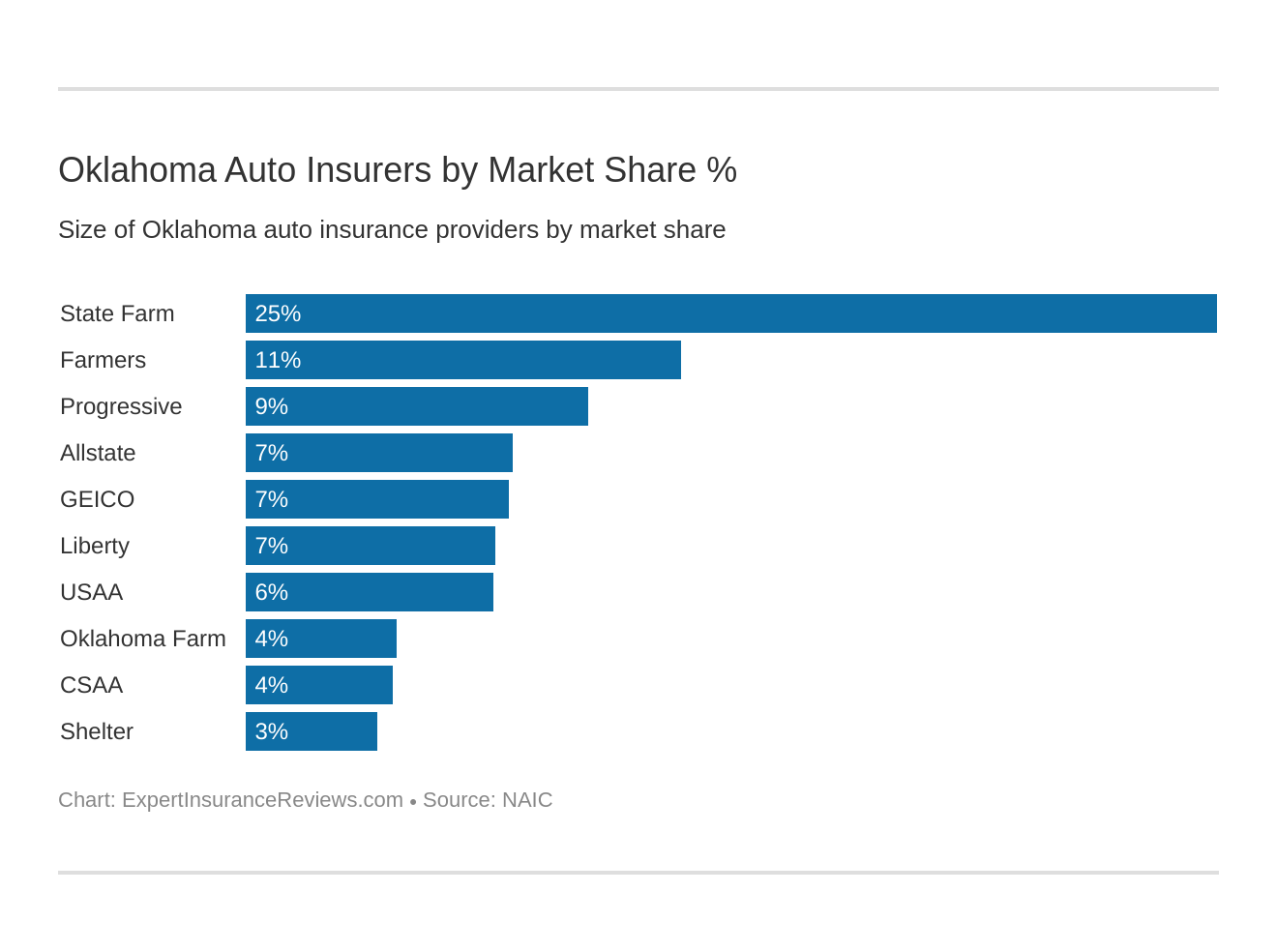

Largest Car Insurance Companies in Oklahoma

So which companies dominate the market in Oklahoma? Let’s take a look at the largest companies’ market shares, loss ratios, and written premiums.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $677,192 | 57.03% | 25.41% |

| Farmers Insurance Group | $303,207 | 51.38% | 11.38% |

| Progressive Group | $238,951 | 55.51% | 8.96% |

| Allstate Insurance Group | $186,448 | 48.05% | 7.00% |

| GEICO | $184,196 | 66.79% | 6.91% |

| Liberty Mutual Group | $174,654 | 57.68% | 6.55% |

| USAA Group | $172,914 | 69.06% | 6.49% |

| Oklahoma Farm Bureau Group | $105,712 | 55.16% | 3.97% |

| CSAA Insurance Group | $103,378 | 50.54% | 3.88% |

| Shelter Insurance Group | $92,167 | 61.81% | 3.46% |

State Farm is the largest insurer in Oklahoma, dominating over 25 percent of the insurance market. It also has a decent loss ratio of 57 percent.

However, a few of the companies have lower loss ratios than we’d like — Allstate’s is less than 50 percent.

The good news, though, is that none of the companies’ rates are dangerously low. The majority are paying out at least $50 in claims for every $100 in earned premiums.

Number of Insurers in Oklahoma

Let’s take a look a the total number of insurers in Oklahoma.

| Domestic Companies | Foreign Companies | Total Number of Licensed Insurers |

|---|---|---|

| 31 | 873 | 904 |

There are many more options than just the top 10 options in Oklahoma. If you’re wondering what the difference between domestic and foreign providers is, domestic providers are in-state, local providers.

On the other hand, foreign providers are out-of-state and serve multiple states.

This means that bigger insurance giants always outnumber local, domestic providers.

Oklahoma State Laws

Following state laws is important, but it can be hard to familiarize yourself with important ones, especially if you just moved to a new state. If you aren’t aware of Oklahoma’s state laws, you risk earning a ticket or losing the right to drive. Luckily, we have you covered.

So keep reading to learn about must-know laws in Oklahoma, so you don’t end up breaking the law by accident.

Car Insurance Laws

The first set of laws we want to cover are important car insurance laws. We’ve already covered that Oklahoma requires car insurance, but there a few laws beyond that.

In this section, we will cover car insurance laws from windshield coverage to insurance fraud.

How Oklahoma State Laws for Insurance are Determined

The state regulates car insurance rates to make sure insurers don’t inflate them. Otherwise, it would impossible for some people to get Oklahoma’s minimum coverage without bankrupting themselves.

According to the NAIC, rates in Oklahoma are regulated by the Oklahoma Insurance Commissioner.

Insurers must file their rates with the Oklahoma Insurance Commissioner before they can use them.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Windshield Coverage

Have a cracked windshield? It is illegal to drive with a cracked windshield if the crack meets any of the four requirements below.

- Larger than three inches in diameter

- Longer than 12 inches in windshield wiper area

- Can be felt when touched

- Lets air through

As well, the law prohibits anything that blocks or obstructs the driver’s view of the road. So if your crack is impeding your vision, you need to get it repaired or risk a ticket.

However, the state doesn’t require insurers to cover windshield repairs. Unless you have comprehensive coverage, you might get stuck paying for repairs yourself.

If your insurer does cover windshield repairs, the law allows your insurer to use aftermarket parts and chose the repair vendor.

High-Risk Insurance

Remember when we covered rates for driving records? Well, insurers also have the right to refuse coverage to drivers with bad records.

According to the State of Oklahoma’s website, drivers who are having trouble finding coverage should contact the Oklahoma Automobile Insurance Plan. The OK AIP will help drivers find car insurance, so ask them for help if you are having trouble finding insurance.

While Oklahoma doesn’t require drivers to file for SR-22 insurance, also known as high-risk insurance, drivers will still have to pay higher rates.

Low-Cost Insurance

Unfortunately, Oklahoma doesn’t have a low-cost insurance program.

Only three states (California, Hawaii, and New Jersey) have government-sponsored programs that help low-income families get car insurance.

To help reduce car insurance costs, make sure to use the tips below.

- Keep as clean a driving record as possible

- Shop around for insurance and get quotes

- Take advantage of discounts

If you take the time to look through providers and compare rates, you can lower your annual premium to an affordable level.

Automobile Insurance Fraud in Oklahoma

Fraud is a common occurrence, costing insurers billions every year. According to the Insurance Information Institute (III), automobile insurance fraud can be any of the following offenses:

- Adding Onto Claims: adding false charges onto a legitimate claim.

- Falsifying Accidents: staging an accident or filing a claim for an accident that never happened.

- Ignoring Claims: insurers may ignore claims — think of a door-to-door salesperson scamming customers.

- Rate Evasion: using false facts on applications, such as using a fake SSN or lying about a driving record.

- Title Fraud: sellers selling flood-damaged (salvage-only) cars without telling customers.

Read more: Best Car Insurance Company That Accepts Salvage Titles

It’s not just customers who commit insurance fraud — insurers and car stores can also commit fraud. To help put a stop to this illegal activity, Oklahoma has a fraud bureau dedicated to finding and stopping fraudulent activity.

If you want to report a case of possible fraud, you must fill out a report form and contact the Oklahoma Insurance Department.

- Phone: 1-800-522-0071

- Email: fraudstoppers@oid.ok.gov

- Mail: send to one of the following addresses:

- OKC Office at Five Corporate Plaza Bldg. / 3625 NW 56th St. Suite 100 / Oklahoma City, OK 73112

- Tusla Office at Triad II Bldg. / 7645 E. 63rd St. Suite 102 / Tusla, OK 74133

The Oklahoma Insurance Department doesn’t have an online form you can automatically submit, so you must send it in through email or mail.

You can also contact the Oklahoma Insurance Department by phone if you have questions about the fraud report process.

Statute of Limitations

Filing a claim is probably the first thing on your mind after a minor accident. If you don’t file in time, though, insurers will reject your claim.

So let’s take a look at Oklahoma’s statute of limitations law to see how long insurers must accept your claim for.

- Personal Injury: two years

- Property Damage: two years

The two-year timer starts the day of your accident, so don’t wait to file. As well, the sooner you file the quicker your insurer will step in to help out with bills and repairs.

State-Specific Laws

The state of Oklahoma has an Unfair Claims Settlement Practices Act to make sure insurers are ethical in their dealings with customers.

Under the act, insurers must fully disclose all policy and coverage information to customers, as well as reply promptly to claims and handle them in a fair manner.

In other words, insurers can’t “forget” your benefits to cheat you, and they can’t ignore your claim or deny it without just cause.

Still, laws can only do so much. To make sure your insurer is following this law, be aware of what’s on your policy.

Vehicle Licensing Laws

Part of the hassle of moving to a new state is getting a new driver’s license. License renewal procedures and laws with also be different, which can lead to confusion.

To help you navigate Oklahoma’s licensing laws, we are going to go through everything from Real IDs to new resident requirements.

Let’s get started.

REAL ID

Starting October 1, 2020, all Oklahoma residents must have a form of REAL ID to fly domestically or enter federal buildings.

One acceptable form of REAL ID is a passport, while the other acceptable form is a REAL ID driver’s license. The cost of a REAL ID license is $5, and you must bring forms of identification and residency to apply for a REAL ID.

Since you need a REAL ID in every state of the U.S. to fly or enter federal buildings, you must get one before October 202o if you need to do either of those things.

You do not need a REAL ID to vote or drive, so you can elect to just get a regular driver’s license if you have a passport. If you don’t like carrying a passport, though, it’s easier to simply have a REAL ID driver’s license.

Penalties for Driving Without Insurance

You already know driving without insurance is illegal and law enforcement will check for proof of insurance after an accident or at a traffic stop.

As a reminder, the following are acceptable forms of proof of insurance:

- An electronic Insurance ID card

- Physical (paper) Insurance ID Card

- Letter from insurance company verifying insurance (must be on official letterhead)

You must provide proof of insurance within Oklahoma’s short grace period (usually 30 days). Immediately contact your insurance provider to provide proof.

If you don’t provide the requested documentation before time’s up, you’ll face the following possible penalties:

- $250 fine

- Up to 30 days of jail time

- Seizure of car and license tags

- A reinstatement fee of $125 once insurance has been proved

Oklahoma will send you an intent to suspend registration letter if you don’t provide proof. If you don’t turn in your license plates and registration by the date on the letter, you’ll face strict penalties.

So make sure to always have proof of insurance on you while driving to avoid the hassle of providing documentation and facing fines and loss of driving rights.

Teen Driver Laws

According to the Insurance Institute for Highway Safety (IIHS), teens must be at least 15 years and six months old to get a learner’s permit. Once teens have a learner’s permit, they must obey the following restrictions before they can test for an intermediate license.

| Learner Permit Restrictions | Details |

|---|---|

| Mandatory holding period | 6 months |

| Minimum amount of supervised driving | 50 hours, 10 of which must be at night |

| Intermediate license minimum age | 16 years |

Once teens have the required hours and pass the driving test, they will have intermediate licenses. Like permit holders, teens with intermediate licenses have to follow a special set of driving restrictions.

| Oklahoma Intermediate License Restrictions | Details |

|---|---|

| Nighttime restrictions | 10 p.m. to 5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | No more than 1 passenger |

| When Restrictions can be Lifted | Details |

| Nighttime restrictions | 6 months with driver education, 12 months without or until age 18 (minimum age: 16 years and 6 months) |

| Passenger restrictions | 6 months with driver education, 12 months without or until age 18 (minimum age: 16 years and 6 months) |

Teens need to follow intermediate driving restrictions until they have adult licenses. Oklahoma created these restrictions to keep new, less-experienced drivers safe.

Older Driver License Renewal Procedures

Below are the license renewal procedures for older drivers.

| License Renewal Cycle | Proof of Adequate Vision Required at Renewal? | Mail or Online Renewal Permitted? |

|---|---|---|

| 4 years | No | No |

Older drivers have the same renewal procedure as the general population. They must make an in-person visit to a local DMV to renew their license, as Oklahoma doesn’t allow mail and online renewals.

However, proof of adequate vision isn’t required at renewal.

New Residents

Recently moved to Oklahoma? You’ll need to get over to a DMV and get an Oklahoma driver’s license. If you already have a driver’s license from another state, you’ll need to bring the following to a DMV:

- Primary ID form, such as birth certificate

- Secondary ID form, such as an SSN

- An out-of-state license (must be unexpired or expired less than 6 months)

- Social Security Number

- Proof of name change (if applicable)

You will also have to pay a small fee to get your new license printed.

In addition to getting a new Oklahoma driver’s license, you need to contact your current insurance provider to update your coverage (to match Oklahoma’s insurance law) and issue a new insurance ID card.

If your insurance provider doesn’t cover Oklahoma, then you need to find a new insurer as fast as possible or face a lapse in coverage.

So don’t wait until after you move to worry about insurance and contacting your provider. Taking care of your insurance provider before moving will save you the headache of possible insurance lapses and increases in rates.

License Renewal Procedures

You may recall that the older population had the same renewal procedure as the general population. In case you’ve forgotten, though, we will reiterate them here.

| License Renewal Cycle | Proof of Adequate Vision Required at Renewal? | Mail or Online Renewal Permitted? |

|---|---|---|

| 4 years | No | No |

Unlike other states, Oklahoma doesn’t permit online or mail renewals. So make sure to make your visit to the DMV every four years to get an updated license.

Negligent Operator Treatment System

Oklahoma’s Negligent Operator Treatment System (NOTS) is a law prohibiting reckless driving.

Reckless driving is whenever a driver disregards others’ safety and property by driving in a careless manner.

To discourage reckless driving, Oklahoma has the following penalties in place.

| Reckless Driving Offense | Classification | Fines | Jail Time | Points |

|---|---|---|---|---|

| First Offense | Misdemeanor | $100 to $500 plus $155 for penalty assessment | 5 to 90 days | 8 |

| Second and Subsequent Offenses | Misdemeanor | $150 to $1,000 plus $155 for penalty assessment | 10 days to six months | 8 |

If drivers accumulate too many points, they will lose their licenses.

One last thing we wanted to discuss while on the subject of reckless driving is a “wet reckless.” If a driver has a DUI, they can sometimes plea bargain the charge down to a reckless driving charge.

A wet reckless has less serious penalties than a DUI charge, although drivers will still face the penalties above.

Rules of the Road

We’ve covered insurance and license laws, so now let’s dive into the laws that are enforced on the road. If you don’t familiarize yourself with Oklahoma’s rules of the road, you will probably end up with a ticket.

So to avoid an expensive penalty, keep reading to learn about Oklahoma’s important road laws.

Fault vs. No-Fault

If you cause a car accident in Oklahoma, you are liable for the other driver’s injury and property damage costs. This is because Oklahoma is an at-fault car insurance state, so whoever caused the accident is liable.

If the fault isn’t 100 percent one person’s, then each driver will be responsible for costs.

For example, if a driver is 40 percent responsible for an accident, then they will have to cover 40 percent of their costs while the other driver covers the remaining 60 percent.

If you are in an accident, you have three ways to deal with it.

You can file a claim with your own insurance company, file a claim with the at-fault driver’s insurance company, or file a personal injury lawsuit against the at-fault driver.

A lawsuit should be a last resort option, as it comes with fees and court time. However, if you are the one being sued, umbrella insurance is incredibly valuable.

Umbrella insurance provides extra liability coverage, which means it will help you with court fees and lawyer bills if another driver sues you.

Seat Belt & Car Seat Laws

Seat belts are installed in every car for a reason. Oklahoma law requires all drivers and passengers to buckle up. Below is the IIHS’s information on Oklahoma’s seat belt law.

| Initial Effective Date | Primary Enforcement? | Who is Covered? In What Seats? | Maximum base fine for 1st offense, additional fees may apply |

|---|---|---|---|

| 02/01/87 | Yes, effective since 11/01/97 | 9+ years in front seat | $20 |

Oklahoma’s enforcement is primary, meaning officers can pull over and ticket anyone they see not wearing a seat belt.

As for car seat laws, Oklahoma has the following laws in place.

| Type of Car Seat Required | Age |

|---|---|

| Rear-Facing Child Safety Seat | Younger than 2 years (or until a child outgrows the manufacturer's top height or weight recommendations) |

| Child Restraint System | Younger than four years old |

| Child Restraint or Booster Seat | Four to seven years old (can't be taller than 4'9") |

| Adult Belt Permissible | Over eight years old (or taller than 4'9") |

| Maximum base fine for a 1st offense, additional fees may apply | $50 |

Always check manufacturers’ weight and height requirements to make sure your child is in the proper car seat.

One last safety restraint law we want to cover is riding in the cargo areas of pickup trucks. While Oklahoma doesn’t have a state law regulating this, it is important to practice proper safety protocol.

Make sure nobody is standing, lessening the chance of being thrown out of the cargo area, and drive carefully.

Keep Right & Move Over Laws

In Oklahoma, you should never get stuck behind a slow driver. According to Oklahoma’s keep right law, drivers are prohibited from driving in the left lane if they are driving slower than the speed limit.

As for Oklahoma’s move over law, drivers must move over a lane for the following parked vehicles on the side of a road:

- Stationary emergency vehicle with flashing lights

- Wrecker vehicle with flashing lights

- Road maintenance vehicle with flashing lights

- Any stationary vehicle with flashing hazard lights

If you see one of these vehicles and can’t move over, you need to reduce your speed and be prepared to stop. If you don’t obey the move-over law, you could hit someone walking around their vehicle.

In fact, states created the move over law to combat the number of deaths every year from people failing to move over. So next time you see a parked vehicle with flashing lights, remember the law is there for a purpose.

Speed Limits

Have you ever taught a teen to drive? If you have, there have probably been times you’ve had a death grip on the door handle and barked at them to slow down.

Because most drivers incline to speed, especially when late for something, Oklahoma has the following speed limits in place.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph (80 mph on specified segments of road) |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

These are the maximum speed limits that can be put on posted speed limit signs. You won’t see any speed limits higher than these in Oklahoma.

Ridesharing

Thinking of becoming a rideshare driver to pick up some extra cash on the weekends? Before you can join up with Uber or Lyft, you need rideshare insurance (it’s the law).

The following insurance providers have rideshare insurance in Oklahoma:

- Allstate

- Farmers

- Geico

- Mercury

- State Farm

- USAA

Oklahoma has a decent amount of providers to choose from. If you are already insured at one of these companies, it is even easier to sign up for rideshare insurance.

Automation on the Road

With self-driving cars becoming more and more of a reality, some states are passing laws regulating the use of self-driving vehicles.

However, Oklahoma doesn’t currently have any automated vehicle laws. As these vehicles improve and become more common, though, Oklahoma will probably follow the route of other states and regulate them.

Safety Laws

Safety laws are important in keeping drunk, impaired, or distracted drivers off the road. Every state has different regulations, though, which is why we are going to go through Oklahoma’s laws.

So keep reading to learn when you need to put the phone down in the car.

DUI Laws

Drunk driving takes hundreds of lives every year.

In 2017, there were 165 alcohol-impaired driving fatalities in the state of Oklahoma.

Oklahoma’s percentage of alcohol-impaired driving fatalities per 100,000 population is 4.2, which is higher than the U.S. percentage (3.4).

Since Oklahoma’s number of deaths is higher than the U.S. average, we want to look at Oklahoma’s DUI law.

| Formal Name for Offense | Blood Alcohol Content (BAC) Limit | High Blood Alcohol Content (BAC) Limit | Criminal Status | Look Back Period |

|---|---|---|---|---|

| Driving While Intoxicated (DWI) | 0.08 | 0.15 | 1st misdemeanor, 2nd+ in 10 years felony | 10 years |

Oklahoma’s DUI is normal, as it has a standard BAC limit and lookback period (time offense stays on record). What we want to delve into, though, is Oklahoma’s penalities.

| Offense | License Revocation | Fines | Jail Time | Other |

|---|---|---|---|---|

| First | 1 to 6 months | no minimum but up to $1,000 | 5 days to 1 year | IID required for 18 months if BAC is 0.15+ |

| Second | 6 months minimum | no minimum, but up to $2,500 | 1 to 5 years | IID required for 5 years |

| Third | 1 to 3 years | no minimum, but up to $5,000 | 1 to 10 years | IID 5 years after DL revocation |

Oklahoma does have fewer penalties than other states. For example, while Oklahoma requires an IID device, it doesn’t require AAA, community service, or treatment programs.

Still, a DUI in Oklahoma will result in fines, jail time, license revocation, and an IID lock, which is a steep price to pay for having one more drink.

Marijuana-Impaired Driving Laws

Oklahoma has a zero-tolerance policy for marijuana-impaired driving. So any drivers with THC or other metabolites in their system will be charged with driving under the influence.

This means that drivers will face the same penalties as a DUI: license revocation, fines, and possible jail time.

While medical marijuana has recently been legalized in Oklahoma, this doesn’t mean medical marijuana cardholders can drive while high — Oklahoma will still charge them with a DUI.

Distracted Driving Laws

Oklahoma has laws on smartphone use in cars to reduce distracted driving.

| Laws on Cellphones while Driving in Oklahoma | Who it Affects |

|---|---|

| Hand-held ban | Learner's permit and intermediate license holders |

| Text ban | All drivers |

| Enforcement | Primary |

Drivers with learner’s and intermediate licenses can’t use handheld devices in Oklahoma. As well, the state prohibits all drivers from texting.

Enforcement of these laws is primary, so put that phone down in the car to avoid a ticket (or worse, an accident).

Driving in Oklahoma

Do you know what to watch out for on Oklahoma’s roads? Every state has different risks.

For example, Oklahoma has a lot of wildlife on the roads. The Oklahoma Department of Wildlife Conservation warns drivers about the frequency of deer collisions in the state.

Knowing when deer are most active (dusk and dawn) and what months are the worst for deer crossings (November) can help you avoid an accident.

Read more: Does my car insurance cover damage caused by a deer or other wildlife?

So stick with us as we go through what to watch out for on Oklahoma’s roads, from vehicle theft to traffic congestion.

Let’s begin.

Vehicle Theft in Oklahoma

Remember when we mentioned pickups are the most popular vehicles in Oklahoma? Well, they also tend to be the most stolen vehicles. Below is one year’s data on stolen vehicles in Oklahoma.

| Car Model and Make | Most Popular Year of Vehicle Stolen | Total Number of Vehicles Stolen |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1994 | 1143 |

| Ford Pickup (Full Size) | 2004 | 780 |

| Dodge Pickup (Full Size) | 2001 | 419 |

| GMC Pickup (Full Size) | 1994 | 304 |

| Honda Civic | 1998 | 292 |

| Honda Accord | 1996 | 269 |

| Chevrolet Impala | 2005 | 181 |

| Chevrolet Pickup (Small Size) | 1998 | 127 |

| Ford Explorer | 2002 | 123 |

| Chevrolet Malibu | 2009 | 119 |

A full-size Chevrolet Pickup was the most popular stolen vehicle. In one year, 1,143 Chevrolet Pickups were stolen. Out of those 1,143 stolen pickups, the model from the year 1994 was stolen the most.

So if you own a pickup, double-click the lock button. Otherwise, someone may easily climb in, hotwire your car, and take off with it.

Now that we know what types of vehicles thieves like to prey on. let’s see what areas are the worst for vehicle theft. Below is the FBI’s 2017 report on crimes in Oklahoma (we’ve only included vehicle theft crimes).

| City | Population | Stolen Vehicles |

|---|---|---|

| Achille | 521 | 0 |

| Ada | 17,455 | 41 |

| Allen | 935 | 2 |

| Altus | 19,054 | 41 |

| Alva | 5,149 | 6 |

| Amber | 460 | 1 |

| Anadarko | 6,756 | 15 |

| Antlers | 2,306 | 3 |

| Apache | 1,439 | 4 |

| Ardmore | 25,211 | 63 |

| Arkoma | 1,914 | 7 |

| Atoka | 3,056 | 8 |

| Barnsdall | 1,197 | 2 |

| Bartlesville | 36,788 | 101 |

| Beaver | 1,429 | 0 |

| Beggs | 1,244 | 0 |

| Bethany | 19,620 | 72 |

| Big Cabin | 257 | 1 |

| Bixby | 26,131 | 66 |

| Blackwell | 6,765 | 8 |

| Blanchard | 8,649 | 12 |

| Boise City | 1,074 | 0 |

| Bokoshe | 493 | 0 |

| Boley | 1,183 | 0 |

| Bristow | 4,251 | 18 |

| Broken Arrow | 108,823 | 229 |

| Broken Bow | 4,100 | 22 |

| Cache | 2,857 | 3 |

| Caddo | 1,070 | 4 |

| Calera | 2,295 | 4 |

| Caney | 197 | 1 |

| Carnegie | 1,711 | 2 |

| Carney | 664 | 2 |

| Cashion | 860 | 0 |

| Catoosa | 7,129 | 68 |

| Cement | 499 | 0 |

| Chandler | 3,194 | 3 |

| Chattanooga | 441 | 0 |

| Checotah | 3,207 | 15 |

| Chelsea | 1,972 | 1 |

| Cherokee | 1,553 | 1 |

| Chickasha | 16,489 | 33 |

| Choctaw | 12,556 | 12 |

| Chouteau | 2,088 | 2 |

| Claremore | 19,147 | 30 |

| Clayton | 780 | 6 |

| Cleveland | 3,217 | 3 |

| Clinton | 9,455 | 19 |

| Coalgate | 1,850 | 1 |

| Colbert | 1,207 | 1 |

| Colcord | 814 | 2 |

| Collinsville | 6,836 | 4 |

| Comanche | 1,595 | 3 |

| Cordell | 2,852 | 4 |

| Covington | 547 | 0 |

| Coweta | 9,718 | 37 |

| Crescent | 1,564 | 1 |

| Cushing | 7,790 | 15 |

| Cyril | 1,053 | 0 |

| Davenport | 826 | 1 |

| Davis | 2,822 | 5 |

| Del City | 22,046 | 105 |

| Depew | 482 | 0 |

| Dewar | 865 | 1 |

| Dewey | 3,513 | 6 |

| Dibble | 846 | 0 |

| Dickson | 1,253 | 0 |

| Drumright | 2,870 | 5 |

| Duncan | 22,909 | 47 |

| Durant | 17,871 | 52 |

| Earlsboro | 644 | 5 |

| Edmond | 92,876 | 66 |

| Elgin | 3,164 | 1 |

| Elk City | 12,057 | 17 |

| Elmore City | 708 | 0 |

| El Reno | 19,133 | 25 |

| Enid | 51,257 | 92 |

| Erick | 1,034 | 1 |

| Eufaula | 2,971 | 17 |

| Fairfax | 1,335 | 2 |

| Fairview | 2,672 | 4 |

| Fletcher | 1,138 | 0 |

| Forest Park | 1,082 | 1 |

| Fort Gibson | 4,045 | 5 |

| Frederick | 3,621 | 4 |

| Geary | 1,286 | 7 |

| Glenpool | 13,954 | 18 |

| Goodwell | 1,311 | 0 |

| Gore | 939 | 1 |

| Grandfield | 955 | 0 |

| Granite | 2,008 | 0 |

| Grove | 6,868 | 23 |

| Guthrie | 11,713 | 21 |

| Guymon | 11,733 | 10 |

| Haileyville | 762 | 0 |

| Harrah | 6,215 | 6 |

| Hartshorne | 1,966 | 6 |

| Haskell | 1,960 | 0 |

| Healdton | 2,757 | 2 |

| Heavener | 3,328 | 3 |

| Hennessey | 2,219 | 2 |

| Henryetta | 5,737 | 18 |

| Hinton | 3,273 | 6 |

| Hobart | 3,567 | 0 |

| Holdenville | 5,663 | 10 |

| Hollis | 1,886 | 2 |

| Hominy | 3,485 | 7 |

| Hooker | 1,959 | 1 |

| Howe | 789 | 0 |

| Hulbert | 607 | 0 |

| Hydro | 959 | 1 |

| Idabel | 6,940 | 14 |

| Jay | 2,520 | 4 |

| Jenks | 22,693 | 32 |

| Jennings | 359 | 2 |

| Jones | 3,067 | 7 |

| Kellyville | 1,147 | 2 |

| Kiefer | 1,968 | 4 |

| Kingfisher | 4,931 | 6 |

| Kingston | 1,634 | 1 |

| Konawa | 1,267 | 4 |

| Krebs | 1,928 | 9 |

| Lahoma | 645 | 0 |

| Lamont | 402 | 0 |

| Langley | 819 | 7 |

| Langston | 1,857 | 0 |

| Lawton | 94,134 | 314 |

| Lexington | 2,169 | 7 |

| Lindsay | 2,827 | 6 |

| Locust Grove | 1,401 | 3 |

| Lone Grove | 5,252 | 3 |

| Luther | 1,675 | 1 |

| Madill | 3,937 | 7 |

| Mangum | 2,848 | 6 |

| Mannford | 3,150 | 3 |

| Marietta | 2,782 | 6 |

| Marlow | 4,520 | 7 |

| Maud | 1,077 | 2 |

| Maysville | 1,233 | 0 |

| McAlester | 18,181 | 48 |

| McCurtain | 510 | 1 |

| McLoud | 4,656 | 10 |

| Medicine Park | 447 | 0 |

| Meeker | 1,179 | 0 |

| Miami | 13,470 | 13 |

| Midwest City | 57,772 | 143 |

| Minco | 1,649 | 0 |

| Moffett | 121 | 0 |

| Moore | 62,476 | 101 |

| Mooreland | 1,240 | 0 |

| Morris | 1,464 | 0 |

| Mounds | 1,200 | 0 |

| Mountain View | 759 | 1 |

| Muldrow | 3,250 | 7 |

| Muskogee | 38,199 | 110 |

| Mustang | 21,392 | 13 |

| Nash | 202 | 0 |

| Newcastle | 10,011 | 24 |

| Newkirk | 2,217 | 2 |

| Nichols Hills | 3,940 | 6 |

| Nicoma Park | 2,473 | 7 |

| Ninnekah | 1,033 | 0 |

| Noble | 6,799 | 10 |

| Norman | 124,074 | 277 |

| North Enid | 922 | 0 |

| Nowata | 3,709 | 2 |

| Oilton | 1,015 | 1 |

| Okemah | 3,239 | 10 |

| Oklahoma City | 648,260 | 2,800 |

| Okmulgee | 12,183 | 25 |

| Olustee | 576 | 0 |

| Owasso | 36,869 | 77 |

| Paoli | 616 | 0 |

| Pauls Valley | 6,225 | 16 |

| Pawhuska | 3,461 | 5 |

| Pawnee | 2,160 | 7 |

| Perkins | 2,841 | 6 |

| Perry | 5,000 | 6 |

| Piedmont | 7,738 | 1 |

| Pocola | 4,073 | 4 |

| Ponca City | 24,397 | 48 |

| Pond Creek | 854 | 0 |

| Porum | 707 | 0 |

| Poteau | 8,913 | 21 |

| Prague | 2,464 | 4 |

| Pryor Creek | 9,517 | 40 |

| Purcell | 6,483 | 22 |

| Quinton | 987 | 3 |

| Ringling | 989 | 1 |

| Roland | 3,720 | 6 |

| Rush Springs | 1,271 | 3 |

| Salina | 1,381 | 3 |

| Sallisaw | 8,548 | 8 |

| Sand Springs | 19,977 | 75 |

| Sapulpa | 21,062 | 83 |

| Savanna | 642 | 2 |

| Sawyer | 312 | 0 |

| Sayre | 4,644 | 6 |

| Seiling | 850 | 0 |

| Seminole | 7,415 | 18 |

| Shady Point | 995 | 1 |

| Shattuck | 1,333 | 1 |

| Shawnee | 31,725 | 155 |

| Skiatook | 8,018 | 21 |

| Snyder | 1,326 | 1 |

| South Coffeyville | 758 | 2 |

| Sparks | 174 | 0 |

| Spencer | 4,031 | 13 |

| Sperry | 1,292 | 10 |

| Spiro | 2,184 | 2 |

| Sportsmen Acres | 312 | 0 |

| Stigler | 2,760 | 5 |

| Stillwater | 50,159 | 60 |

| Stilwell | 4,062 | 20 |

| Stratford | 1,539 | 4 |

| Stringtown | 401 | 0 |

| Stroud | 2,792 | 9 |

| Sulphur | 5,105 | 6 |

| Tahlequah | 16,905 | 43 |

| Talala | 278 | 1 |

| Talihina | 1,094 | 1 |

| Tecumseh | 6,699 | 14 |

| Texhoma | 955 | 1 |

| Thackerville | 478 | 0 |

| The Village | 9,512 | 11 |

| Thomas | 1,235 | 1 |

| Tipton | 779 | 0 |

| Tishomingo | 3,119 | 6 |

| Tonkawa | 3,077 | 3 |

| Tryon | 505 | 1 |

| Tulsa | 404,868 | 3,460 |

| Tupelo | 313 | 1 |

| Tushka | 301 | 0 |

| Tuttle | 7,140 | 24 |

| Tyrone | 769 | 0 |

| Union City | 2,053 | 2 |

| Valley Brook | 779 | 9 |

| Valliant | 737 | 0 |

| Velma | 602 | 0 |

| Verden | 527 | 0 |

| Verdigris | 4,488 | 4 |

| Vian | 1,383 | 4 |

| Vici | 702 | 0 |

| Vinita | 5,532 | 9 |

| Wagoner | 8,931 | 10 |

| Wakita | 339 | 1 |

| Walters | 2,464 | 2 |

| Warner | 1,614 | 1 |

| Warr Acres | 10,480 | 46 |

| Washington | 655 | 0 |

| Watonga | 2,931 | 2 |

| Watts | 310 | 2 |

| Waukomis | 1,349 | 0 |

| Waynoka | 960 | 2 |

| Weatherford | 12,178 | 14 |

| Webbers Falls | 593 | 0 |

| Weleetka | 981 | 2 |

| West Siloam Springs | 839 | 14 |

| Westville | 1,561 | 8 |

| Wewoka | 3,390 | 3 |

| Wilburton | 2,633 | 4 |

| Wilson | 1,721 | 0 |

| Wister | 1,067 | 1 |

| Woodward | 12,655 | 18 |

| Wright City | 733 | 0 |

| Wyandotte | 330 | 0 |

| Wynnewood | 2,227 | 2 |

| Wynona | 440 | 0 |

| Yale | 1,207 | 5 |

| Yukon | 26,971 | 17 |

Tusla had the most vehicle thefts in 2017 (3,460 stolen vehicles). Incidentally, Tulsa also has the second-highest population.

Oklahoma City, which has the largest population, had the second-highest number of vehicle thefts (2,800 stolen vehicles).

The population has something to do with vehicle theft. Achille, with a population of just over 500 people, had zero stolen vehicles in 2017.

So if you move to a bigger city, be aware that your risk of vehicle theft will probably go up.

Road Fatalities in Oklahoma

Accidents can be out of a driver’s control. For example, weather conditions and bad drivers can cause you to get in an accident through no fault of your own.

To prepare you for what conditions you’ll be dealing with, we are going to go through dangerous highways, weather conditions, and fatality rates.

Let’s jump in.

Most Fatal Highway in Oklahoma

The most fatal highway in Oklahoma is US Route 69. In the history of the highway, there have been 132 crashes and 155 fatalities, making for a 1.1 fatal crash rate.

This highway averages 13 fatal accidents a year, so be careful when driving on US Route 69 and follow the speed limit.

Fatal Crashes by Weather Condition & Light Condition

Do you know what weather conditions to watch out for in Oklahoma? Below is a table detailing when most fatal crashes occur in Oklahoma.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 281 | 50 | 195 | 27 | 3 | 556 |

| Rain | 13 | 3 | 17 | 1 | 1 | 35 |

| Snow/Sleet | 0 | 0 | 1 | 0 | 0 | 1 |

| Other | 7 | 1 | 7 | 0 | 0 | 15 |

| Unknown | 1 | 1 | 1 | 0 | 1 | 4 |

| TOTAL | 302 | 55 | 221 | 28 | 5 | 611 |

35 fatal crashes have occurred during rainy weather, while only one fatal crash happened during snow/sleet.

As well, a large number of crashes occurred during dark conditions, when it is harder to see and react to road dangers.

Fatalities (All Crashes) by County

Now that we’ve covered weather and light conditions, we want to see which areas in Oklahoma have the most fatal crashes. Below is the National Highway Traffic Safety Administration’s (NHTSA) data on county crashes (we will also use the NHTSA’s data for every fatality section following this).

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adair | 4 | 3 | 3 | 2 | 8 |

| Alfalfa | 1 | 1 | 3 | 2 | 1 |

| Atoka | 8 | 9 | 3 | 5 | 7 |

| Beaver | 2 | 5 | 5 | 2 | 4 |

| Beckham | 4 | 6 | 9 | 8 | 5 |

| Blaine | 4 | 7 | 1 | 2 | 8 |

| Bryan | 10 | 17 | 11 | 20 | 11 |

| Caddo | 13 | 14 | 7 | 7 | 12 |

| Canadian | 12 | 14 | 12 | 17 | 24 |

| Carter | 14 | 16 | 11 | 11 | 11 |

| Cherokee | 6 | 9 | 7 | 10 | 11 |

| Choctaw | 1 | 5 | 5 | 8 | 7 |

| Cimarron | 0 | 1 | 2 | 1 | 2 |

| Cleveland | 21 | 16 | 28 | 14 | 25 |

| Coal | 2 | 1 | 0 | 1 | 0 |

| Comanche | 15 | 15 | 12 | 15 | 16 |

| Cotton | 5 | 2 | 4 | 3 | 2 |

| Craig | 8 | 7 | 0 | 6 | 2 |

| Creek | 23 | 12 | 14 | 14 | 8 |

| Custer | 5 | 5 | 6 | 5 | 7 |

| Delaware | 15 | 11 | 7 | 10 | 8 |

| Dewey | 3 | 6 | 3 | 5 | 2 |

| Ellis | 5 | 4 | 1 | 1 | 1 |

| Garfield | 10 | 7 | 4 | 10 | 5 |

| Garvin | 8 | 15 | 5 | 12 | 7 |

| Grady | 19 | 17 | 17 | 16 | 14 |

| Grant | 3 | 2 | 3 | 5 | 0 |

| Greer | 3 | 2 | 1 | 5 | 4 |

| Harmon | 0 | 0 | 1 | 0 | 1 |

| Harper | 0 | 1 | 3 | 6 | 2 |

| Haskell | 2 | 5 | 2 | 2 | 4 |

| Hughes | 2 | 2 | 2 | 2 | 3 |

| Jackson | 2 | 3 | 3 | 4 | 2 |

| Jefferson | 2 | 1 | 1 | 4 | 0 |

| Johnston | 6 | 3 | 2 | 3 | 5 |

| Kay | 12 | 2 | 15 | 6 | 4 |

| Kingfisher | 3 | 5 | 6 | 6 | 7 |

| Kiowa | 5 | 3 | 5 | 0 | 4 |

| Latimer | 3 | 1 | 4 | 3 | 4 |

| Le Flore | 7 | 10 | 14 | 18 | 16 |

| Lincoln | 14 | 11 | 9 | 11 | 11 |

| Logan | 5 | 10 | 7 | 7 | 2 |

| Love | 4 | 6 | 3 | 5 | 6 |

| Major | 7 | 2 | 7 | 5 | 3 |

| Marshall | 2 | 4 | 4 | 4 | 3 |

| Mayes | 12 | 15 | 7 | 21 | 14 |

| Mcclain | 9 | 7 | 7 | 16 | 14 |

| Mccurtain | 16 | 9 | 8 | 14 | 11 |

| Mcintosh | 6 | 3 | 5 | 7 | 3 |

| Murray | 4 | 9 | 4 | 4 | 5 |

| Muskogee | 20 | 11 | 14 | 5 | 5 |

| Noble | 9 | 3 | 1 | 4 | 7 |

| Nowata | 4 | 10 | 6 | 2 | 5 |

| Okfuskee | 4 | 4 | 1 | 4 | 5 |

| Oklahoma | 75 | 73 | 85 | 88 | 90 |

| Okmulgee | 10 | 12 | 7 | 13 | 3 |

| Osage | 7 | 5 | 8 | 8 | 11 |

| Ottawa | 8 | 4 | 11 | 7 | 14 |

| Pawnee | 3 | 2 | 3 | 6 | 4 |

| Payne | 22 | 20 | 16 | 10 | 9 |

| Pittsburg | 10 | 7 | 13 | 7 | 10 |

| Pontotoc | 7 | 9 | 8 | 14 | 9 |

| Pottawatomie | 6 | 9 | 20 | 21 | 12 |

| Pushmataha | 3 | 5 | 5 | 1 | 3 |

| Roger Mills | 3 | 3 | 0 | 3 | 0 |

| Rogers | 14 | 13 | 22 | 16 | 9 |

| Seminole | 6 | 13 | 5 | 10 | 12 |

| Sequoyah | 6 | 10 | 8 | 2 | 8 |

| Stephens | 5 | 11 | 6 | 4 | 3 |

| Texas | 0 | 3 | 8 | 3 | 7 |

| Tillman | 0 | 0 | 0 | 1 | 1 |

| Tulsa | 71 | 61 | 72 | 67 | 70 |

| Wagoner | 16 | 15 | 6 | 10 | 6 |

| Washington | 1 | 6 | 6 | 6 | 5 |

| Washita | 8 | 8 | 5 | 1 | 5 |

| Woods | 7 | 1 | 2 | 2 | 0 |

| Woodward | 6 | 10 | 4 | 7 | 6 |

Oklahoma County has the most fatal crashes in the state. Part of the reason for this is population size in a county (Oklahoma County has the largest population in the state).

Five counties in Oklahoma had zero fatalities in 2017: Coal County, Grant County, Jefferson County, Roger Mills County, and Woods County.

Incidentally, Roger Mills County and Grant County have some of the smallest populations in Oklahoma. The more people living in a county, the more fatalities you are going to see.

Traffic Fatalities

Now that we know which counties have the most fatalities, let’s see what road types are more dangerous.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 523 | 498 | 465 | 497 | 468 | 499 | 468 | 391 | 426 | 417 |

| Urban | 226 | 239 | 203 | 199 | 241 | 229 | 201 | 254 | 260 | 238 |

| Total | 750 | 737 | 668 | 696 | 709 | 678 | 669 | 645 | 687 | 655 |

Rural roads have about twice as many crashes as urban roads. This could be because Oklahoma has more rural roads than urban roads, as well as due to factors like wildlife.

Regardless, don’t let the lack of traffic on rural roads tempt you into not staying as alert. Any road type is dangerous if you aren’t paying attention or are speeding.

Fatalities by Person Type

It’s not just car occupants who are killed in crashes. Anyone walking or cycling near a roadway is at risk of being hit.

| Traffic Deaths by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 230 | 226 | 222 | 207 | 198 |

| Light Pickup Truck Occupants | 130 | 174 | 121 | 144 | 123 |

| Light Utility Truck Occupants | 92 | 82 | 78 | 88 | 86 |

| Van Occupants | 22 | 18 | 21 | 31 | 27 |

| Large Truck Occupants | 29 | 41 | 27 | 27 | 28 |

| Other/Unknown Occupants | 9 | 11 | 9 | 6 | 11 |

| Bus Occupants | 0 | 4 | 0 | 0 | 0 |

| Motorcyclists | 92 | 57 | 89 | 88 | 93 |

| Pedestrians | 58 | 50 | 70 | 88 | 78 |

| Bicyclists and Other Cyclists | 13 | 4 | 6 | 5 | 6 |

| Other/Unknown Non-occupants | 3 | 2 | 2 | 3 | 5 |

| State Total | 678 | 669 | 645 | 687 | 655 |

The number of pedestrian deaths has steadily increased over the years, totaling 78 deaths in 2017. While bicyclist deaths have decreased since the spike in 2013, they have yet to significantly drop.

So whenever you are near a roadway, pay attention to cars and wear bright, reflective clothing.

Fatalities by Crash Type

Do you know what types of crashes claim the most lives? Below is the NHTSA’s data on fatalities by the type of crash.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 351 | 335 | 351 | 376 | 357 |

| Involving a Large Truck | 112 | 134 | 106 | 126 | 133 |

| Involving Speeding | 174 | 152 | 171 | 185 | 143 |

| Involving a Rollover | 232 | 246 | 217 | 223 | 210 |

| Involving a Roadway Departure | 385 | 402 | 359 | 386 | 370 |

| Involving an Intersection (or Intersection Related) | 134 | 146 | 116 | 139 | 126 |

| Total Fatalities (All Crashes) | 678 | 669 | 645 | 687 | 655 |

In 2017, roadway departures caused 370 fatalities. Single-vehicle crashes and rollovers were also major contributors to the overall number of fatalities.

And since rollovers are often caused by speeding, it is possible speeding is a more significant cause of fatalities than the numbers listed for speeding.

Five-Year Trend for the Top 10 Counties

Now that we know what causes crashes and where they happen, let’s see which counties are the most dangerous to drive in.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Oklahoma County | 75 | 73 | 85 | 88 | 90 |

| Tulsa County | 71 | 61 | 72 | 67 | 70 |

| Cleveland County | 21 | 16 | 28 | 14 | 25 |

| Canadian County | 12 | 14 | 12 | 17 | 24 |

| Comanche County | 15 | 15 | 12 | 15 | 16 |

| Le Flore County | 7 | 10 | 14 | 18 | 16 |

| Grady County | 19 | 17 | 17 | 16 | 14 |

| McClain County | 9 | 7 | 7 | 16 | 14 |

| Mayes County | 12 | 15 | 7 | 21 | 14 |

| Ottawa County | 8 | 4 | 11 | 7 | 14 |

| Top 10 County Total | 298 | 265 | 303 | 300 | 297 |

| State Total (Includes All Counties) | 678 | 669 | 645 | 687 | 655 |

Unsurprisingly, Oklahoma County has the most fatalities every year. Tulsa County and Cleveland County also have a high number of fatalities.

Fatalities Involving Speeding by County

Speeding is dangerous. It reduces reaction time and makes it easy to skid off the road when going around turns. Below, you can see just how many lives speeding claims each year.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Adair County | 0 | 2 | 1 | 3 | 1 |

| Alfalfa County | 0 | 0 | 0 | 0 | 0 |

| Atoka County | 1 | 0 | 1 | 4 | 2 |

| Beaver County | 0 | 1 | 1 | 0 | 0 |

| Beckham County | 1 | 3 | 2 | 0 | 0 |

| Blaine County | 1 | 0 | 0 | 1 | 1 |

| Bryan County | 7 | 2 | 7 | 2 | 4 |

| Caddo County | 8 | 2 | 4 | 4 | 0 |

| Canadian County | 1 | 1 | 2 | 6 | 3 |

| Carter County | 3 | 3 | 1 | 0 | 4 |

| Cherokee County | 2 | 1 | 3 | 7 | 3 |

| Choctaw County | 0 | 0 | 2 | 2 | 1 |

| Cimarron County | 0 | 0 | 1 | 0 | 1 |

| Cleveland County | 3 | 8 | 3 | 6 | 5 |

| Coal County | 0 | 0 | 1 | 0 | 0 |

| Comanche County | 2 | 2 | 3 | 2 | 3 |

| Cotton County | 1 | 0 | 0 | 0 | 1 |

| Craig County | 3 | 0 | 0 | 1 | 0 |

| Creek County | 0 | 0 | 3 | 4 | 2 |

| Custer County | 1 | 1 | 3 | 2 | 0 |

| Delaware County | 7 | 2 | 3 | 5 | 0 |

| Dewey County | 1 | 0 | 1 | 1 | 0 |

| Ellis County | 1 | 1 | 1 | 0 | 0 |

| Garfield County | 0 | 3 | 0 | 1 | 1 |

| Garvin County | 5 | 3 | 1 | 0 | 1 |

| Grady County | 1 | 4 | 2 | 0 | 4 |

| Grant County | 0 | 1 | 1 | 0 | 0 |

| Greer County | 0 | 0 | 4 | 0 | 0 |

| Harmon County | 0 | 0 | 0 | 0 | 0 |

| Harper County | 0 | 0 | 3 | 0 | 0 |

| Haskell County | 2 | 0 | 1 | 0 | 2 |

| Hughes County | 1 | 0 | 1 | 1 | 1 |

| Jackson County | 0 | 0 | 0 | 0 | 0 |

| Jefferson County | 0 | 0 | 4 | 0 | 1 |

| Johnston County | 0 | 2 | 0 | 1 | 0 |

| Kay County | 0 | 3 | 1 | 1 | 1 |

| Kingfisher County | 1 | 1 | 1 | 0 | 1 |

| Kiowa County | 1 | 1 | 0 | 0 | 0 |

| Latimer County | 1 | 1 | 1 | 0 | 0 |

| Le Flore County | 2 | 6 | 5 | 8 | 0 |

| Lincoln County | 4 | 1 | 0 | 0 | 2 |

| Logan County | 1 | 1 | 0 | 1 | 2 |

| Love County | 3 | 0 | 1 | 1 | 0 |

| Major County | 0 | 1 | 0 | 0 | 1 |

| Marshall County | 0 | 2 | 1 | 0 | 1 |

| Mayes County | 3 | 1 | 5 | 4 | 5 |

| Mcclain County | 0 | 2 | 3 | 2 | 2 |

| Mccurtain County | 0 | 2 | 2 | 4 | 5 |

| Mcintosh County | 0 | 2 | 4 | 0 | 4 |

| Murray County | 0 | 0 | 1 | 0 | 2 |

| Muskogee County | 2 | 3 | 1 | 2 | 3 |

| Noble County | 1 | 1 | 1 | 0 | 2 |

| Nowata County | 0 | 1 | 1 | 0 | 0 |

| Okfuskee County | 0 | 0 | 1 | 0 | 1 |

| Oklahoma County | 23 | 36 | 30 | 21 | 27 |

| Okmulgee County | 1 | 3 | 4 | 0 | 4 |

| Osage County | 1 | 3 | 4 | 1 | 2 |

| Ottawa County | 0 | 3 | 0 | 1 | 1 |

| Pawnee County | 1 | 1 | 1 | 1 | 0 |

| Payne County | 5 | 1 | 4 | 2 | 1 |

| Pittsburg County | 0 | 7 | 3 | 3 | 3 |

| Pontotoc County | 2 | 1 | 1 | 2 | 2 |

| Pottawatomie County | 1 | 5 | 3 | 0 | 3 |

| Pushmataha County | 0 | 0 | 0 | 0 | 2 |

| Roger Mills County | 1 | 0 | 0 | 0 | 0 |

| Rogers County | 4 | 2 | 6 | 4 | 1 |

| Seminole County | 3 | 3 | 3 | 1 | 0 |

| Sequoyah County | 4 | 4 | 0 | 2 | 0 |

| Stephens County | 2 | 0 | 0 | 0 | 1 |

| Texas County | 1 | 1 | 1 | 3 | 0 |

| Tillman County | 0 | 0 | 0 | 0 | 0 |

| Tulsa County | 23 | 22 | 24 | 20 | 17 |

| Wagoner County | 2 | 4 | 4 | 1 | 8 |

| Washington County | 3 | 0 | 2 | 2 | 0 |

| Washita County | 1 | 1 | 1 | 0 | 1 |

| Woods County | 0 | 0 | 1 | 0 | 1 |

| Woodward County | 3 | 3 | 4 | 3 | 0 |

In 2018, Oklahoma County once again had the most speeding deaths (27).

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County

Rember when we covered all those serious charges for a DUI? Well, there’s a reason Oklahoma has those laws in place.

Below are the DUI fatalities by county.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Adair County | 1 | 1 | 0 | 3 | 0 |

| Alfalfa County | 0 | 1 | 0 | 0 | 1 |

| Atoka County | 2 | 2 | 0 | 3 | 1 |

| Beaver County | 1 | 2 | 0 | 1 | 0 |

| Beckham County | 0 | 1 | 1 | 1 | 1 |

| Blaine County | 1 | 0 | 0 | 1 | 2 |

| Bryan County | 2 | 5 | 5 | 3 | 3 |

| Caddo County | 6 | 0 | 2 | 3 | 3 |

| Canadian County | 4 | 3 | 3 | 7 | 7 |

| Carter County | 5 | 3 | 3 | 3 | 3 |

| Cherokee County | 3 | 1 | 3 | 2 | 1 |

| Choctaw County | 4 | 1 | 1 | 1 | 2 |

| Cimarron County | 0 | 0 | 0 | 0 | 1 |

| Cleveland County | 4 | 10 | 4 | 7 | 1 |

| Coal County | 0 | 0 | 0 | 0 | 1 |

| Comanche County | 7 | 1 | 4 | 3 | 2 |

| Cotton County | 1 | 2 | 2 | 0 | 1 |

| Craig County | 1 | 0 | 0 | 0 | 1 |

| Creek County | 4 | 7 | 7 | 2 | 2 |

| Custer County | 0 | 1 | 1 | 0 | 2 |

| Delaware County | 2 | 2 | 3 | 2 | 2 |

| Dewey County | 0 | 0 | 1 | 0 | 0 |

| Ellis County | 1 | 0 | 1 | 0 | 2 |

| Garfield County | 2 | 1 | 3 | 2 | 2 |

| Garvin County | 4 | 2 | 2 | 3 | 3 |

| Grady County | 4 | 5 | 4 | 2 | 2 |

| Grant County | 0 | 0 | 2 | 0 | 0 |

| Greer County | 0 | 1 | 2 | 0 | 0 |

| Harmon County | 0 | 0 | 0 | 0 | 0 |

| Harper County | 0 | 0 | 0 | 0 | 1 |

| Haskell County | 1 | 0 | 0 | 0 | 0 |

| Hughes County | 1 | 0 | 1 | 2 | 0 |

| Jackson County | 0 | 0 | 1 | 0 | 0 |

| Jefferson County | 0 | 0 | 0 | 0 | 0 |

| Johnston County | 0 | 0 | 0 | 0 | 3 |

| Kay County | 0 | 3 | 2 | 0 | 1 |

| Kingfisher County | 2 | 2 | 0 | 1 | 1 |

| Kiowa County | 0 | 2 | 0 | 2 | 0 |

| Latimer County | 1 | 1 | 1 | 2 | 0 |

| Le Flore County | 2 | 7 | 6 | 5 | 3 |

| Lincoln County | 2 | 2 | 4 | 3 | 4 |

| Logan County | 0 | 3 | 0 | 0 | 1 |

| Love County | 0 | 0 | 1 | 1 | 0 |

| Major County | 1 | 1 | 0 | 0 | 1 |

| Marshall County | 0 | 0 | 1 | 1 | 0 |

| Mayes County | 4 | 3 | 3 | 4 | 2 |

| Mcclain County | 2 | 1 | 3 | 0 | 3 |

| Mccurtain County | 0 | 3 | 6 | 4 | 5 |

| Mcintosh County | 1 | 1 | 4 | 1 | 2 |

| Murray County | 1 | 1 | 3 | 0 | 2 |

| Muskogee County | 4 | 3 | 0 | 0 | 3 |

| Noble County | 0 | 0 | 0 | 1 | 0 |

| Nowata County | 0 | 1 | 0 | 0 | 0 |

| Okfuskee County | 2 | 0 | 3 | 1 | 1 |

| Oklahoma County | 17 | 26 | 25 | 31 | 22 |

| Okmulgee County | 6 | 2 | 4 | 2 | 3 |

| Osage County | 0 | 2 | 4 | 0 | 3 |

| Ottawa County | 0 | 1 | 2 | 4 | 1 |

| Pawnee County | 0 | 0 | 2 | 1 | 1 |

| Payne County | 3 | 4 | 4 | 2 | 2 |

| Pittsburg County | 1 | 7 | 3 | 5 | 5 |

| Pontotoc County | 3 | 2 | 4 | 1 | 1 |

| Pottawatomie County | 1 | 7 | 3 | 1 | 2 |

| Pushmataha County | 0 | 1 | 0 | 0 | 2 |

| Roger Mills County | 1 | 0 | 1 | 0 | 0 |

| Rogers County | 1 | 6 | 3 | 0 | 2 |

| Seminole County | 7 | 0 | 3 | 3 | 0 |

| Sequoyah County | 4 | 3 | 0 | 1 | 0 |

| Stephens County | 2 | 0 | 0 | 0 | 0 |

| Texas County | 0 | 2 | 1 | 1 | 0 |

| Tillman County | 0 | 0 | 0 | 0 | 0 |

| Tulsa County | 16 | 18 | 24 | 25 | 16 |

| Wagoner County | 4 | 1 | 4 | 0 | 3 |

| Washington County | 1 | 1 | 0 | 1 | 1 |

| Washita County | 1 | 0 | 0 | 2 | 0 |

| Woods County | 0 | 0 | 1 | 0 | 1 |

| Woodward County | 1 | 1 | 2 | 0 | 0 |

As usual, Oklahoma County has the highest number of alcohol-impaired driving fatalities, followed closely by Tusla County.

Teen Drinking & Driving

Adults aren’t the only ones driving drunk on Oklahoma’s roads.